Sales intelligence platform ZoomInfo reported results in line with analysts' expectations in Q1 CY2024, with revenue up 3.1% year on year to $310.1 million. On the other hand, next quarter's revenue guidance of $307.5 million was less impressive, coming in 1.8% below analysts' estimates. It made a non-GAAP profit of $0.26 per share, improving from its profit of $0.24 per share in the same quarter last year.

ZoomInfo (ZI) Q1 CY2024 Highlights:

- Revenue: $310.1 million vs analyst estimates of $308.9 million (small beat)

- EPS (non-GAAP): $0.26 vs analyst estimates of $0.23 (11.1% beat)

- Revenue Guidance for Q2 CY2024 is $307.5 million at the midpoint, below analyst estimates of $313.3 million

- The company dropped its revenue guidance for the full year from $1.27 billion to $1.26 billion at the midpoint, a 0.6% decrease

- Gross Margin (GAAP): 89.1%, in line with the same quarter last year

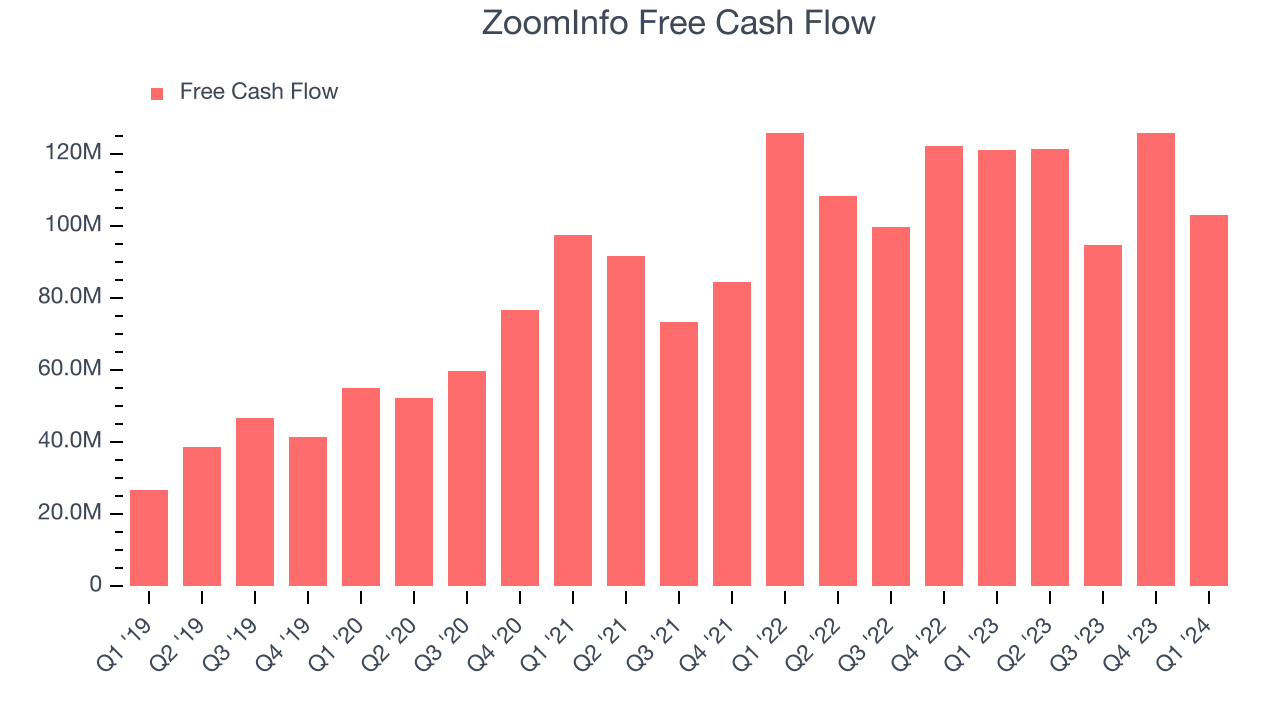

- Free Cash Flow of $103.1 million, down 18.2% from the previous quarter

- Market Capitalization: $6.28 billion

- ZoomInfo approved an additional $500 million under the share repurchase program, bringing the total aggregate authorization to $1.1 billion, of which $546.8 million remained outstanding as of quarter-end.

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

The company essentially runs a large database of professionals similar to LinkedIn, and it also maintains a repository of companies with information about their revenue, industry or number of employees. It then puts this data together to help sales teams find and identify potential customers, alerts them if new ones appear and provides them with contact details of prospective buyers. ZoomInfo scrapes the information and data from public websites, sources it from email communications of people who let the company scan their mailboxes or buys it from other companies.

Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

ZoomInfo’s main competitor is LinkedIn which is owned by Microsoft (NASDAQ:MSFT), but there are plenty of smaller competitors in this space whether public, like TechTarget (NASDAQ:TTGT), or private, like Clearbit or FullContact.

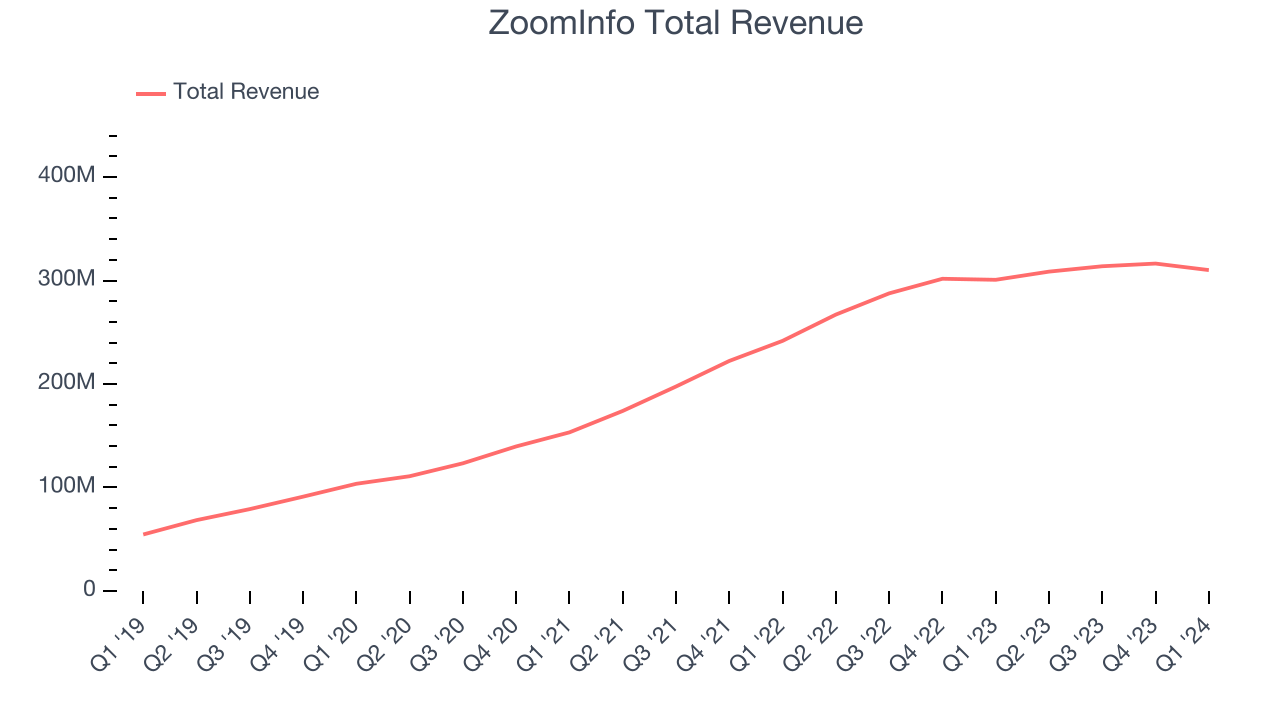

Sales Growth

As you can see below, ZoomInfo's revenue growth has been very strong over the last three years, growing from $153.3 million in Q1 2021 to $310.1 million this quarter.

ZoomInfo's quarterly revenue was only up 3.1% year on year, which might disappoint some shareholders. On top of that, the company's revenue actually decreased by $6.3 million in Q1 compared to the $2.6 million increase in Q4 CY2023. Taking a closer look we can a similar revenue decline in the same quarter last year, which could suggest that the business has seasonal elements. Regardless, this situation is worth monitoring as management is guiding for a further revenue drop in the next quarter.

Next quarter, ZoomInfo is guiding for a 0.4% year-on-year revenue decline to $307.5 million, a further deceleration from the 15.5% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 3.7% over the next 12 months before the earnings results announcement.

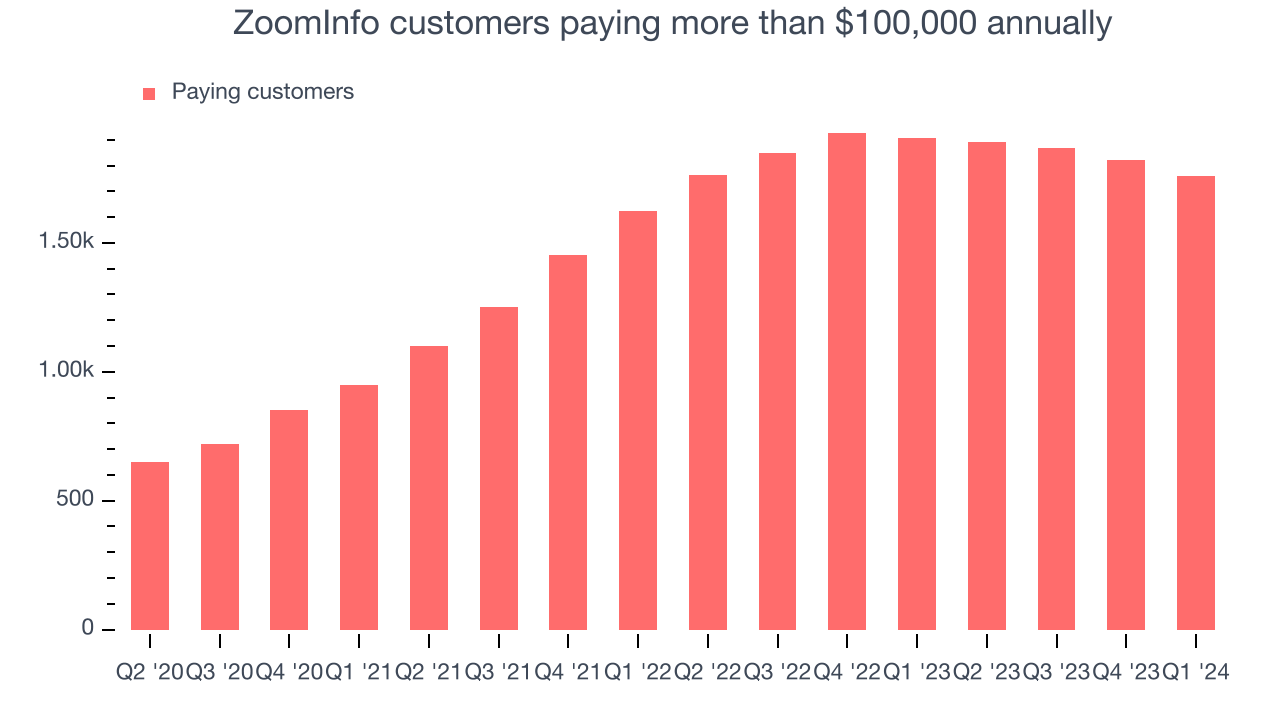

Large Customers Growth

This quarter, ZoomInfo reported 1,760 enterprise customers paying more than $100,000 annually, a decrease of 60 from the previous quarter. We've no doubt shareholders would like to see the company regain its sales momentum.

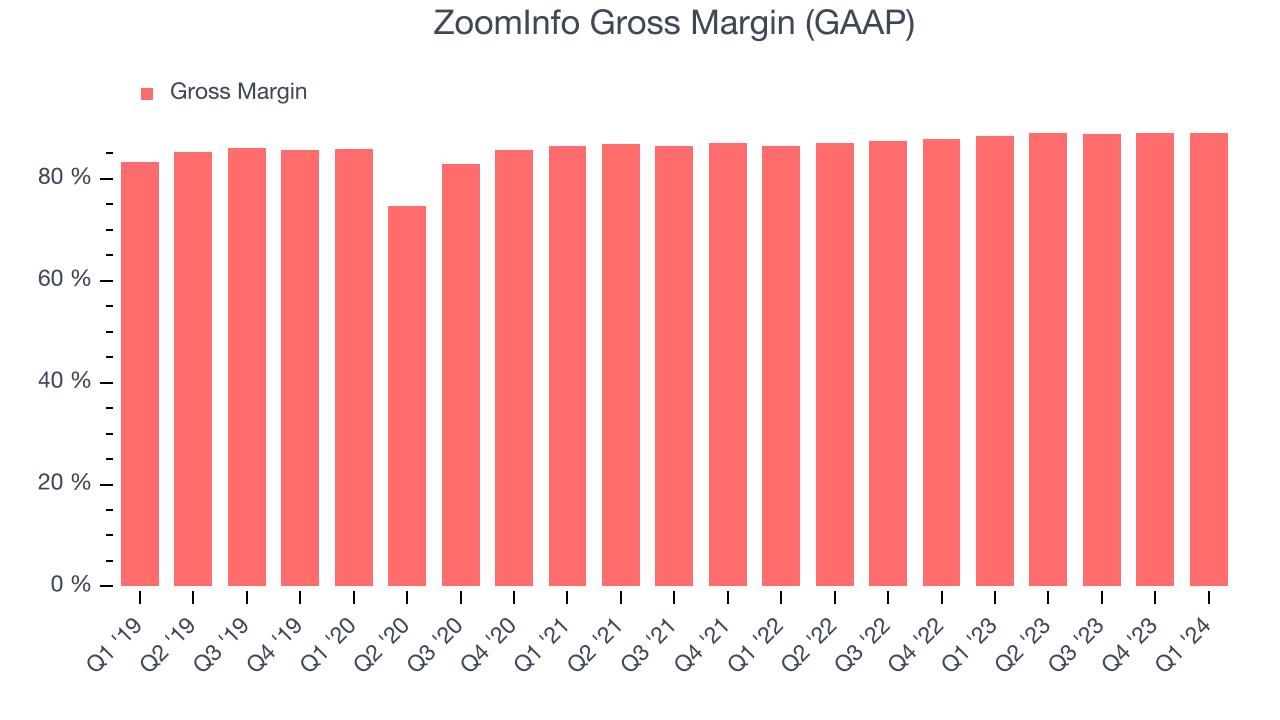

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. ZoomInfo's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 89.1% in Q1.

That means that for every $1 in revenue the company had $0.89 left to spend on developing new products, sales and marketing, and general administrative overhead. ZoomInfo's excellent gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity. It's also comforting to see its gross margin remain stable, indicating that ZoomInfo is controlling its costs and not under pressure from its competitors to lower prices.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. ZoomInfo's free cash flow came in at $103.1 million in Q1, down 14.9% year on year.

ZoomInfo has generated $445.4 million in free cash flow over the last 12 months, an eye-popping 35.7% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from ZoomInfo's Q1 Results

We struggled to find many strong positives in these results. Revenue guidance missed analysts' expectations and customer numbers are declining. Overall, this was a tough quarter for ZoomInfo. The company is down 15.9% on the results and currently trades at $13.5 per share.

Is Now The Time?

ZoomInfo may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Although we have other favorites, we understand the arguments that ZoomInfo isn't a bad business. We'd expect growth rates to moderate from here, but its revenue growth has been impressive over the last three years. And while its existing customers have been reducing their spending, which is a bit concerning, the good news is its bountiful generation of free cash flow empowers it to invest in growth initiatives.

ZoomInfo's price-to-sales ratio based on the next 12 months is 4.9x, suggesting the market is expecting more moderate growth relative to the hottest software stocks. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like ZoomInfo, it seems to be trading at a reasonable price right now.

Wall Street analysts covering the company had a one-year price target of $21.74 right before these results (compared to the current share price of $13.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.