Earnings results often indicate what direction a company will take in the months ahead. With Q4 now behind us, let’s have a look at Zoom (NASDAQ:ZM) and its peers.

Work is becoming more distributed, both across geographies and devices. In order for businesses to keep functioning efficiently, they need to be able to communicate as well as they did when the teams were co-located, which drives the demand for integrated communication platforms.

The 4 video conferencing stocks we track reported a weak Q4; on average, revenues were in line with analyst consensus estimates, while next quarter's revenue guidance was 1.9% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and video conferencing stocks have had a rough stretch, with share prices down 16.7% on average since the previous earnings results.

Best Q4: Zoom (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

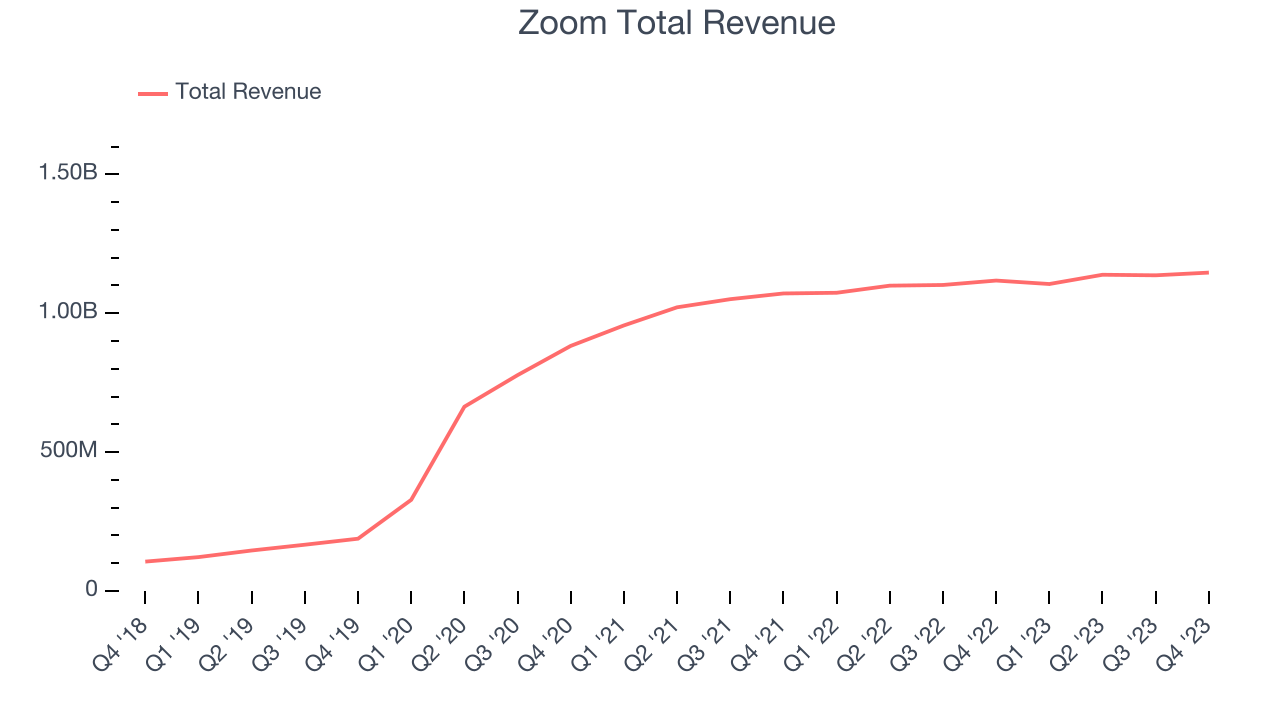

Zoom reported revenues of $1.15 billion, up 2.6% year on year, topping analyst expectations by 1.4%. It was a mixed quarter for the company, with revenue narrowly outperforming Wall Street's estimates. On the other hand, its full-year revenue guidance was below expectations and suggests a slowdown in demand.

"In FY24, we unveiled Zoom AI Companion, our generative AI digital assistant, aimed at boosting productivity, enhancing team effectiveness, and fostering skill development across the Zoom platform. We're committed to democratizing AI accessibility, offering it to all our customers regardless of business size, included at no extra charge with a paid license,” stated Eric S. Yuan, Zoom's founder and CEO.

Zoom achieved the biggest analyst estimates beat of the whole group. The company added 79 enterprise customers paying more than $100,000 annually to reach a total of 3,810. The stock is down 5.3% since the results and currently trades at $59.78.

Read our full report on Zoom here, it's free.

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

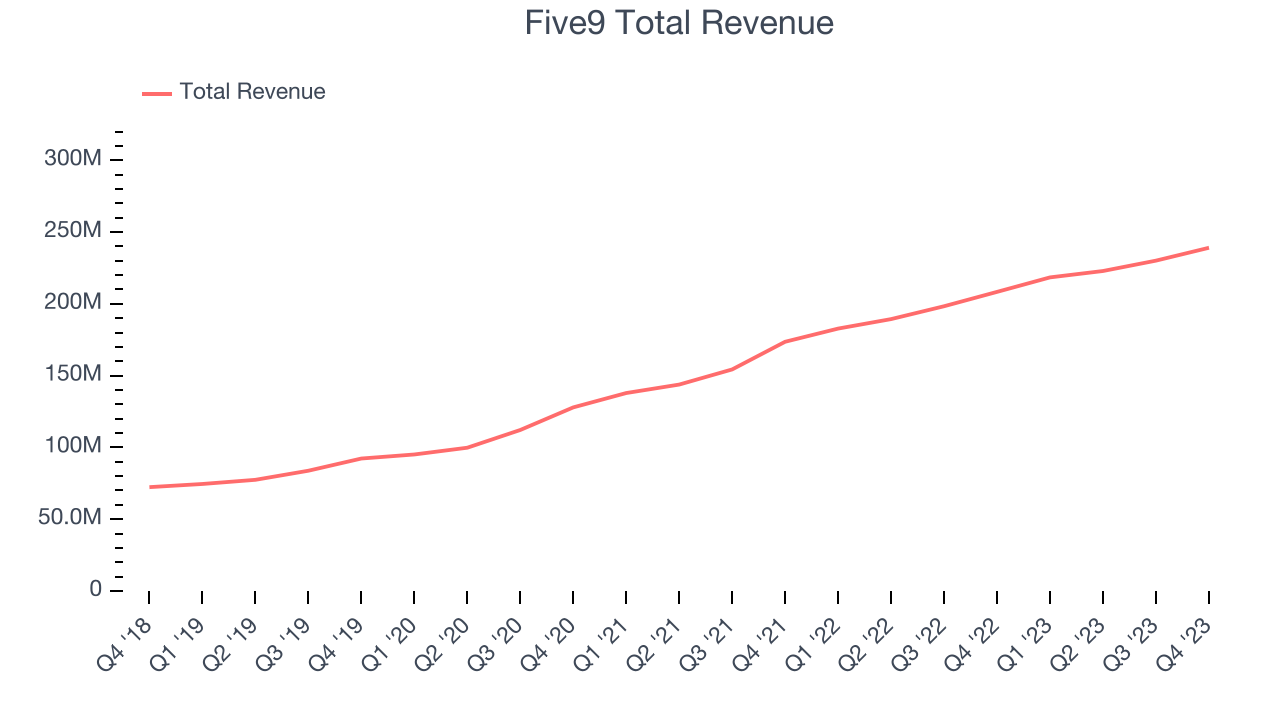

Five9 reported revenues of $239.1 million, up 14.7% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter.

Five9 pulled off the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 20.2% since the results and currently trades at $56.75.

Is now the time to buy Five9? Access our full analysis of the earnings results here, it's free.

Weakest Q4: 8x8 (NASDAQ:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $181 million, down 1.8% year on year, falling short of analyst expectations by 1.3%. It was a weak quarter for the company, with revenue guidance for the next quarter missing analysts' expectation.

8x8 had the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. The stock is down 35.7% since the results and currently trades at $2.16.

Read our full analysis of 8x8's results here.

RingCentral (NYSE:RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE:RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $571.3 million, up 8.9% year on year, in line with analyst expectations. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and full-year revenue guidance missing analysts' expectations.

The stock is down 5.7% since the results and currently trades at $29.1.

Read our full, actionable report on RingCentral here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.