Cloud security platform Zscaler (NASDAQ:ZS) announced better-than-expected results in Q2 CY2024, with revenue up 30.3% year on year to $592.9 million. The company expects next quarter’s revenue to be around $605 million, in line with analysts’ estimates. It made a non-GAAP profit of $0.88 per share, improving from its loss of $0.19 per share in the same quarter last year.

Is now the time to buy Zscaler? Find out by accessing our full research report, it’s free.

Zscaler (ZS) Q2 CY2024 Highlights:

- Revenue: $592.9 million vs analyst estimates of $567.6 million (4.4% beat)

- Adjusted Operating Income: $127.5 million vs analyst estimates of $108.5 million (17.6% beat)

- EPS (non-GAAP): $0.88 vs analyst estimates of $0.69 (26.9% beat)

- Management’s billings guidance for the upcoming financial year 2025 is $3.12 billion at the midpoint, slightly below analyst expectations of $3.13 billion

- Management’s revenue guidance for the upcoming financial year 2025 is $2.61 billion at the midpoint, in line with analyst expectations and implying 20.4% growth (vs 34.4% in FY2024)

- EPS (non-GAAP) guidance for the upcoming financial year 2025 is $2.84 at the midpoint, missing analyst estimates by 13.4%

- Gross Margin (GAAP): 78%, in line with the same quarter last year

- Free Cash Flow Margin: 23%, similar to the previous quarter

- Billings: $910.8 million at quarter end, up 26.6% year on year (5.3% beat)

- Market Capitalization: $30.23 billion

“We ended a successful Fiscal 2024 with Q4 results exceeding the high end of our guidance across all metrics,” said Jay Chaudhry, Chairman and CEO of Zscaler.

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ:ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

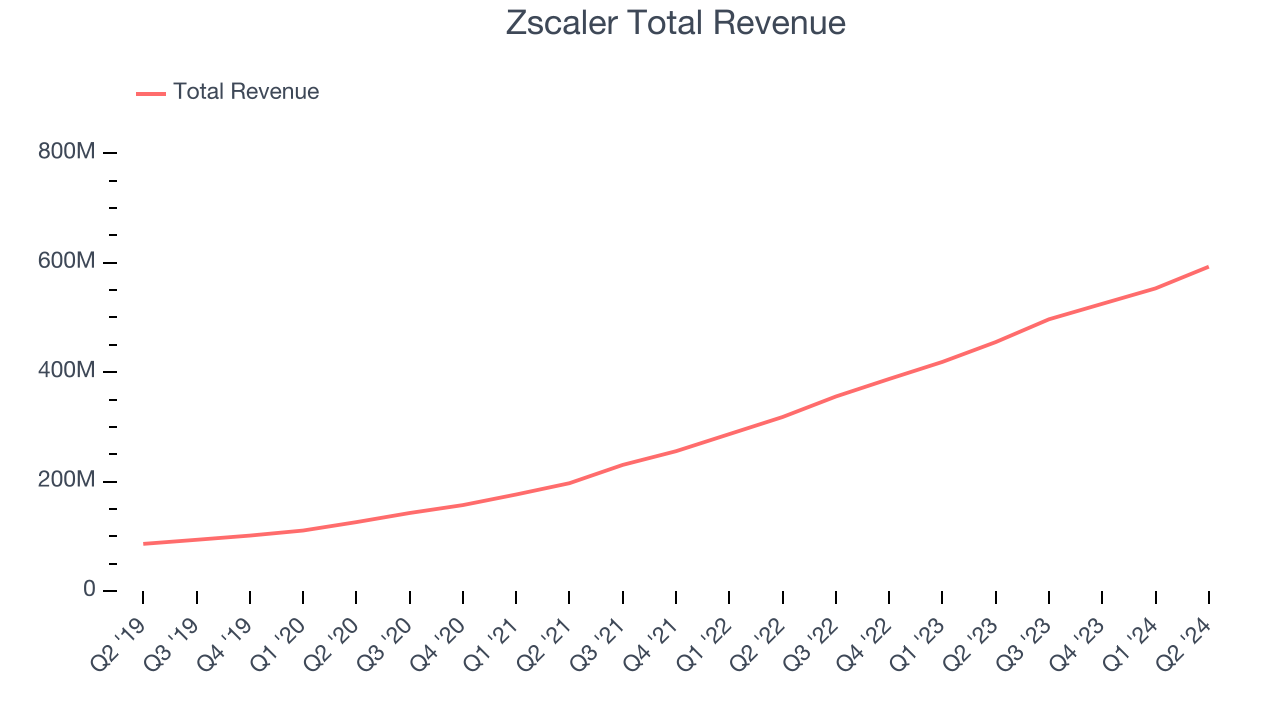

Sales Growth

As you can see below, Zscaler’s 47.7% annualized revenue growth over the last three years has been incredible, and its sales came in at $592.9 million this quarter.

Unsurprisingly, this was another great quarter for Zscaler with revenue up 30.3% year on year. On top of that, its revenue increased $39.67 million quarter on quarter, a very strong improvement from the $28.2 million increase in Q1 CY2024. This is a sign of acceleration of growth and great to see.

Next quarter’s guidance suggests that Zscaler is expecting revenue to grow 21.8% year on year to $605 million, slowing down from the 39.7% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $2.61 billion at the midpoint, growing 20.4% year on year compared to the 34.1% increase in FY2024.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

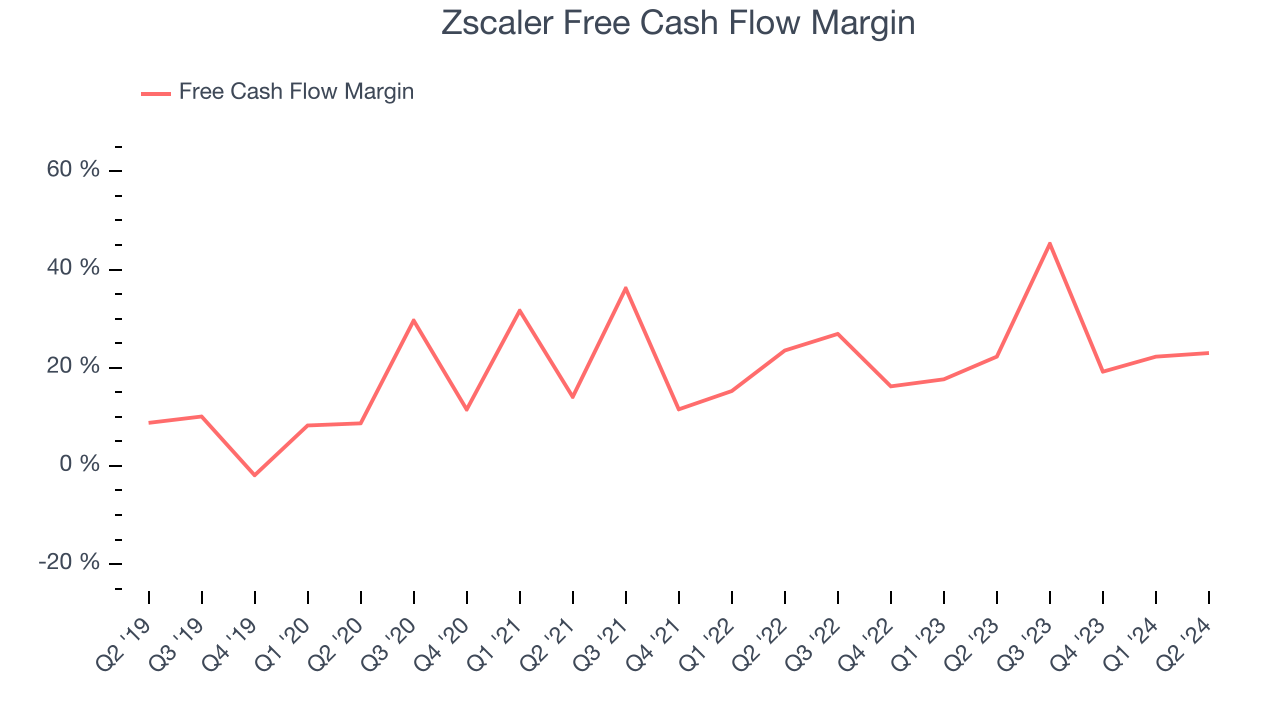

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Zscaler has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging 27% over the last year.

Zscaler’s free cash flow clocked in at $136.3 million in Q2, equivalent to a 23% margin. This quarter’s cash profitability was in line with the comparable period last year but below its one-year average. We wouldn’t read too much into it because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict Zscaler’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 27% for the last 12 months will decrease to 23.1%.

Key Takeaways from Zscaler’s Q2 Results

It was good to see Zscaler beat analysts’ revenue expectations this quarter. We were also glad its billings outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a slowdown in demand and its full-year revenue guidance slightly missed Wall Street’s estimates. Zooming out, we think this was a decent quarter featuring some areas of strength, but the outlook seems to be weighing on shares. The areas below expectations seem to be driving the stock move, and the stock traded down 6% to $181.84 immediately after reporting.

So should you invest in Zscaler right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.