Clothing and footwear retailer Zumiez (NASDAQ:ZUMZ) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 3% year on year to $177.4 million. On top of that, next quarter's revenue guidance ($201.5 million at the midpoint) was surprisingly good and 5.7% above what analysts were expecting. It made a GAAP loss of $0.86 per share, improving from its loss of $0.96 per share in the same quarter last year.

Is now the time to buy Zumiez? Find out by accessing our full research report, it's free.

Zumiez (ZUMZ) Q1 CY2024 Highlights:

- Revenue: $177.4 million vs analyst estimates of $171.5 million (3.4% beat)

- EPS: ($0.86) vs analyst estimates of ($1.13) (beat)

- Revenue Guidance for Q2 CY2024 is $201.5 million at the midpoint, above analyst estimates of $190.6 million

- EPS Guidance for Q2 CY2024 is ($0.35) at the midpoint, below analyst estimates of ($0.11) million

- Gross Margin (GAAP): 29.3%, up from 27% in the same quarter last year

- Free Cash Flow was -$21.12 million compared to -$18.32 million in the same quarter last year

- Locations: 751 at quarter end, in line with the same quarter last year

- Market Capitalization: $392.2 million

Rick Brooks, Chief Executive Officer of Zumiez Inc., stated, “Fiscal 2024 is off to an encouraging start as we once again achieved sequential improvement in our year-over-year quarterly sales trends and both top and bottom line results exceeded our initial outlook for the quarter. The results were driven by our North American region which inflected positive in the first quarter. At the same time, our focus on improving full priced selling in Europe helped expand merchandise margins, which more than offset expense deleverage and fueled enhanced operating performance versus a year ago, even as overall sales remained under pressure. We still have much work to do to return to historic levels of both sales and profitability, but I am confident that our strategies to reinvigorate growth and reduce our cost base have us on the path to deliver further progress over the remainder of this year and beyond.”

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

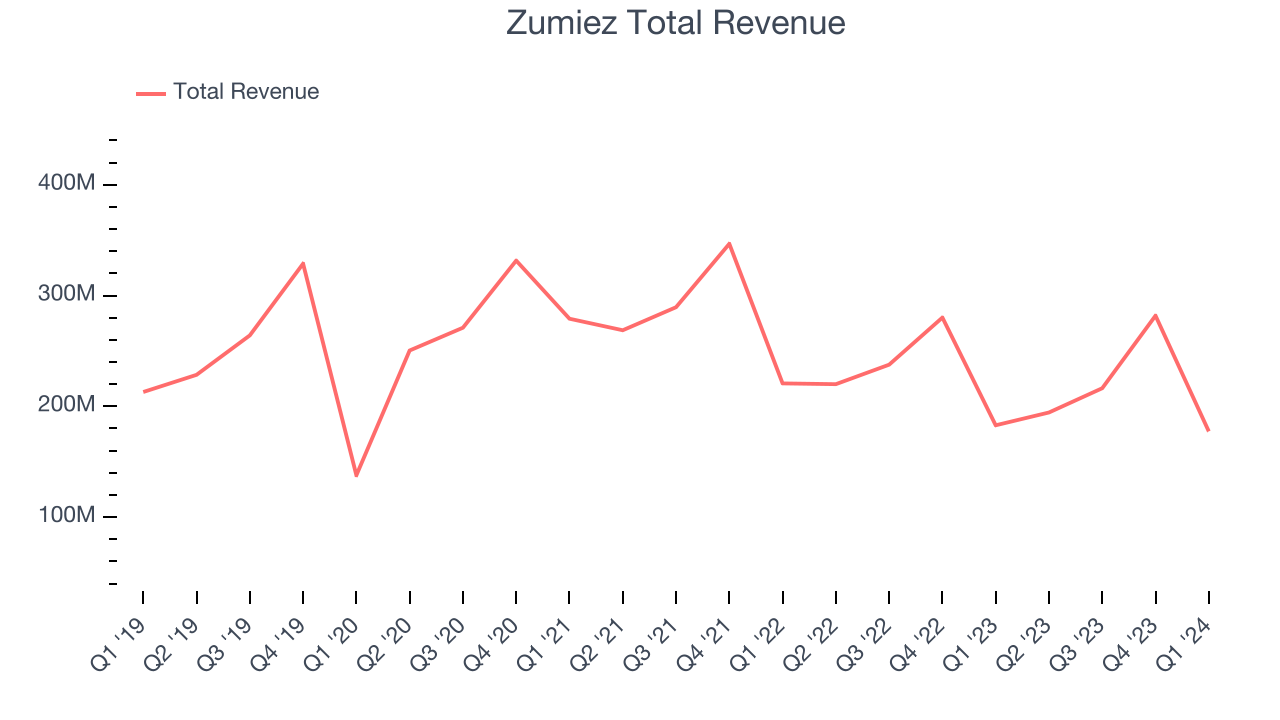

As you can see below, the company's revenue has declined over the last four years, dropping 2.5% annually as it failed to grow its store footprint meaningfully and observed lower sales at existing, established stores.

This quarter, Zumiez's revenue fell 3% year on year to $177.4 million but beat Wall Street's estimates by 3.4%. The company is guiding for revenue to rise 3.6% year on year to $201.5 million next quarter, improving from the 11.6% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

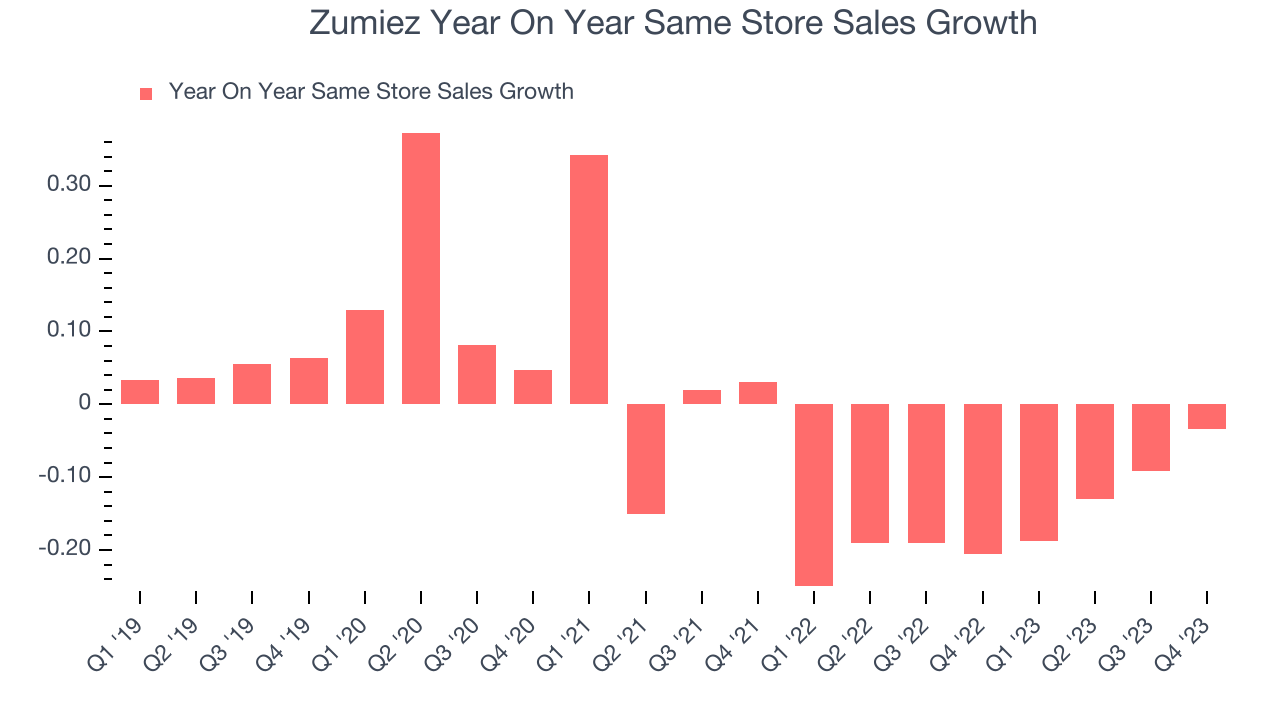

Zumiez's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 14.7% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Key Takeaways from Zumiez's Q1 Results

Zumiez's earnings forecast for next quarter missed analysts' expectations by a wide margin. This was the main negative that marred an otherwise solid quarter. The stock is down 1.9% after reporting, trading at $18.93 per share.

So should you invest in Zumiez right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.