Clothing and footwear retailer Zumiez (NASDAQ:ZUMZ) announced better-than-expected results in Q4 FY2023, with revenue flat year on year at $281.8 million. On the other hand, next quarter's revenue guidance of $169.5 million was less impressive, coming in 9% below analysts' estimates. It made a GAAP loss of $1.73 per share, down from its profit of $0.59 per share in the same quarter last year.

Zumiez (ZUMZ) Q4 FY2023 Highlights:

- Revenue: $281.8 million vs analyst estimates of $276.7 million (1.9% beat)

- EPS: -$1.73 vs analyst estimates of $0.25 (-$1.98 miss)

- Revenue Guidance for Q1 2024 is $169.5 million at the midpoint, below analyst estimates of $186.3 million

- Gross Margin (GAAP): 34.3%, in line with the same quarter last year

- Free Cash Flow of $33.54 million, up 19.2% from the same quarter last year

- Store Locations: 753 at quarter end, decreasing by 3 over the last 12 months

- Market Capitalization: $305.4 million

With store associates called “Zumiez Stash Members”, Zumiez (NASDAQ:ZUMZ) is a specialty retailer of street and skate apparel, footwear, and accessories.

Customers can also find skateboards, snowboards, and related equipment such as wheels and bindings. The core Zumiez customer is typically a teen or young adult who skates, snowboards, or surfs and wants to reflect these interests in their clothing and footwear choices. Unsurprisingly, brands focused on these subcultures such as Vans, Thrasher, Volcom, and Element are featured in Zumiez stores.

Zumiez stores tend to be small–roughly 3,000 square feet on average–and located in suburban malls and shopping centers. There are various merchandise zones dedicated to apparel, footwear, and hard goods such as skate decks. Two unique aspects of Zumiez stores are video screens or televisions featuring endless loops of action sports as well as interactive areas where customers can handle and lightly try out equipment.

In addition to its physical store footprint, Zumiez also has an e-commerce platform, which was launched in 2005. It allows the company to reach customers that may not have a physical store near them, and it allows customers with access to a store to buy online and pick up physically.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Competitors that offer street or skate apparel and footwear include Tilly’s (NYSE:TLYS), Genesco’s (NYSE:GCO) Journeys banner, Foot Locker (NYSE:FL), and private company PacSun.Sales Growth

Zumiez is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

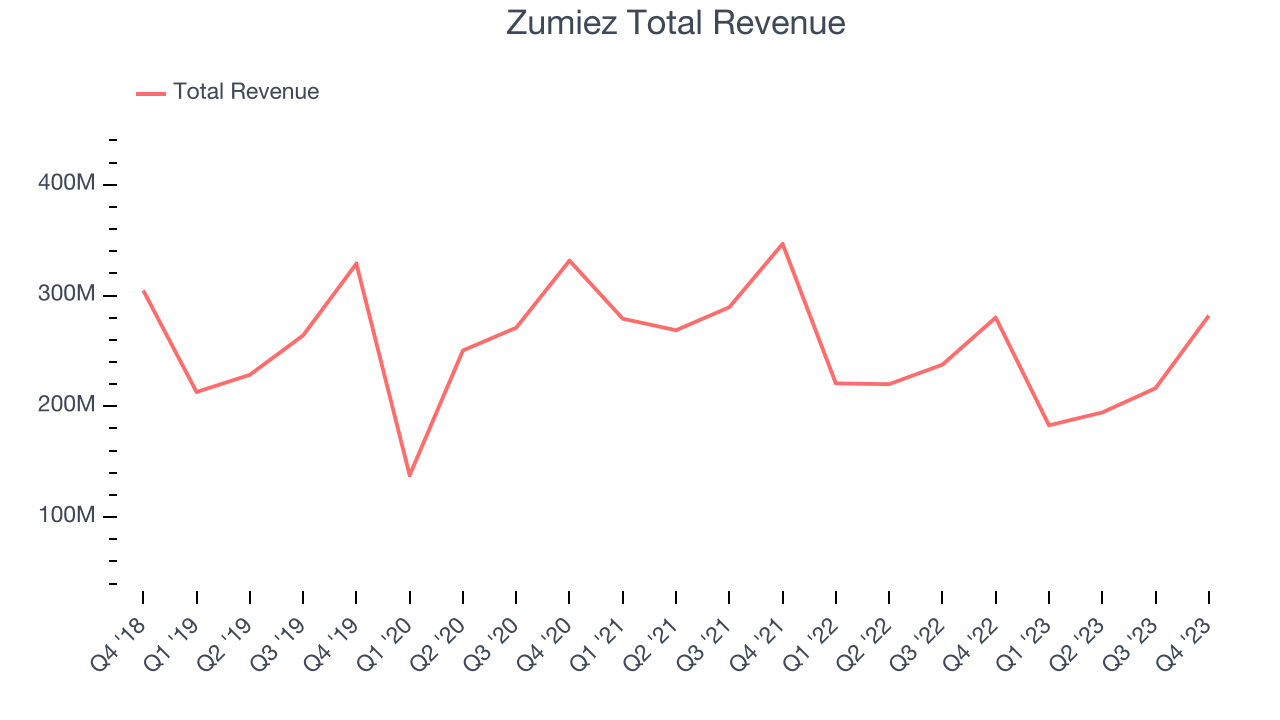

As you can see below, the company's revenue has declined over the last four years, dropping 4.1% annually despite opening new stores, indicating that its underperformance was driven by lower sales at existing, established stores.

This quarter, Zumiez reported decent year-on-year revenue growth of 0.6%, and its $281.8 million in revenue topped Wall Street's estimates by 1.9%. The company is guiding for a 7.3% year-on-year revenue decline next quarter to $169.5 million, an improvement from the 17.1% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 1.6% over the next 12 months, an acceleration from this quarter.

Number of Stores

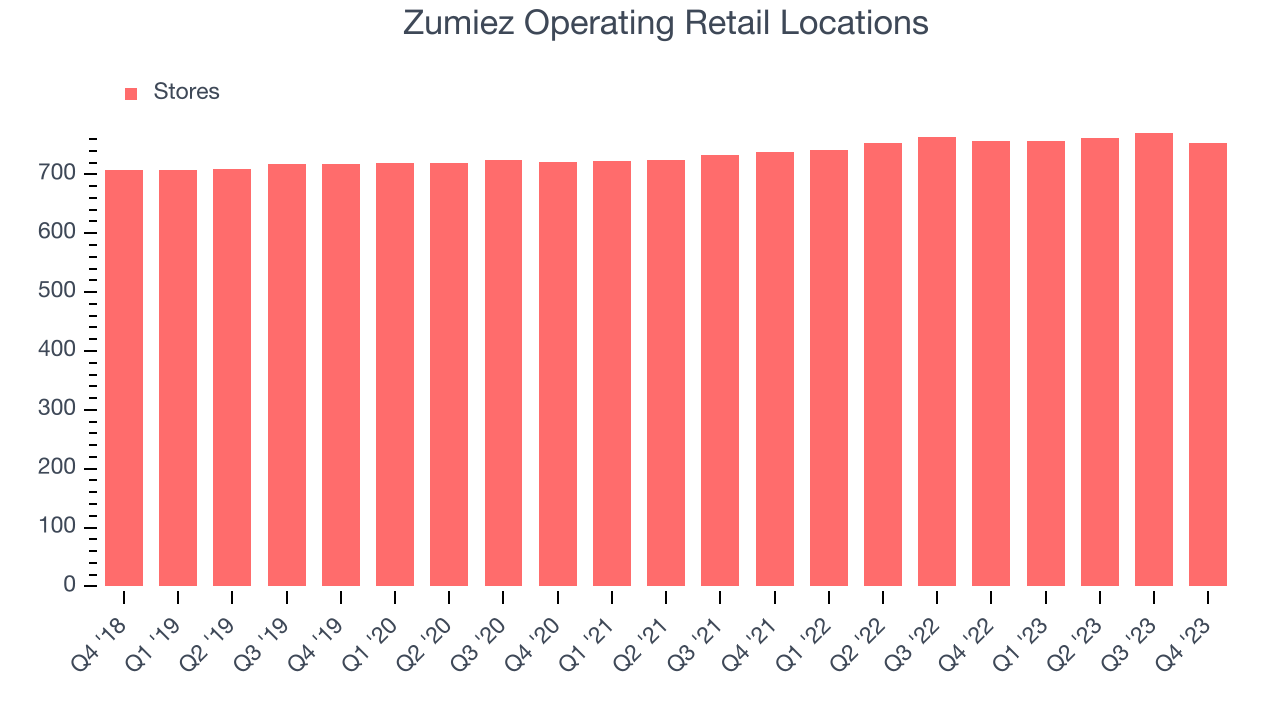

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Zumiez keeps its store footprint steady, it usually means that demand is stable and it's focused on improving operational efficiency to increase profitability. At the end of this quarter, Zumiez operated 753 total retail locations, in line with its store count 12 months ago.

Taking a step back, the company has only opened a few new stores over the last eight quarters, averaging 2.1% annual growth in new locations. Although it's expanded its presence, this sluggish store growth lags other retailers. A flat store base means that revenue growth must come from increased e-commerce sales or higher foot traffic and sales per customer at existing stores.

Same-Store Sales

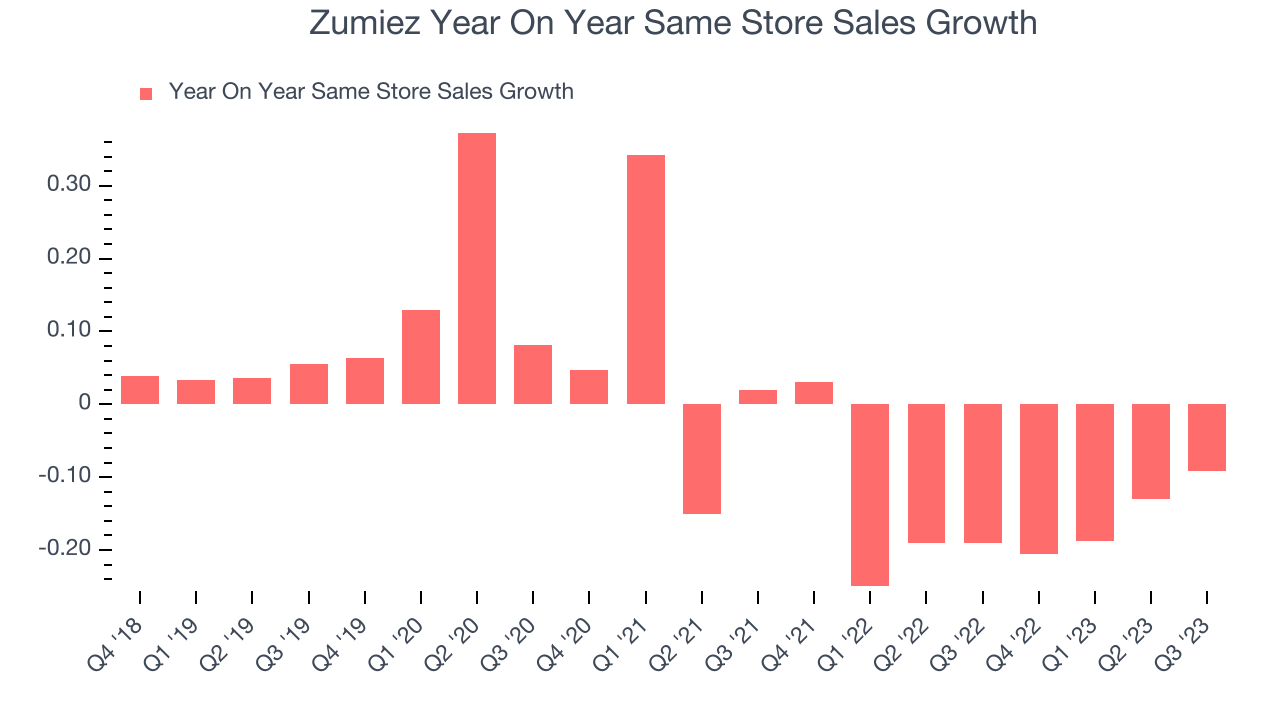

Zumiez's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 17.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer's pricing power, product differentiation, and negotiating leverage.

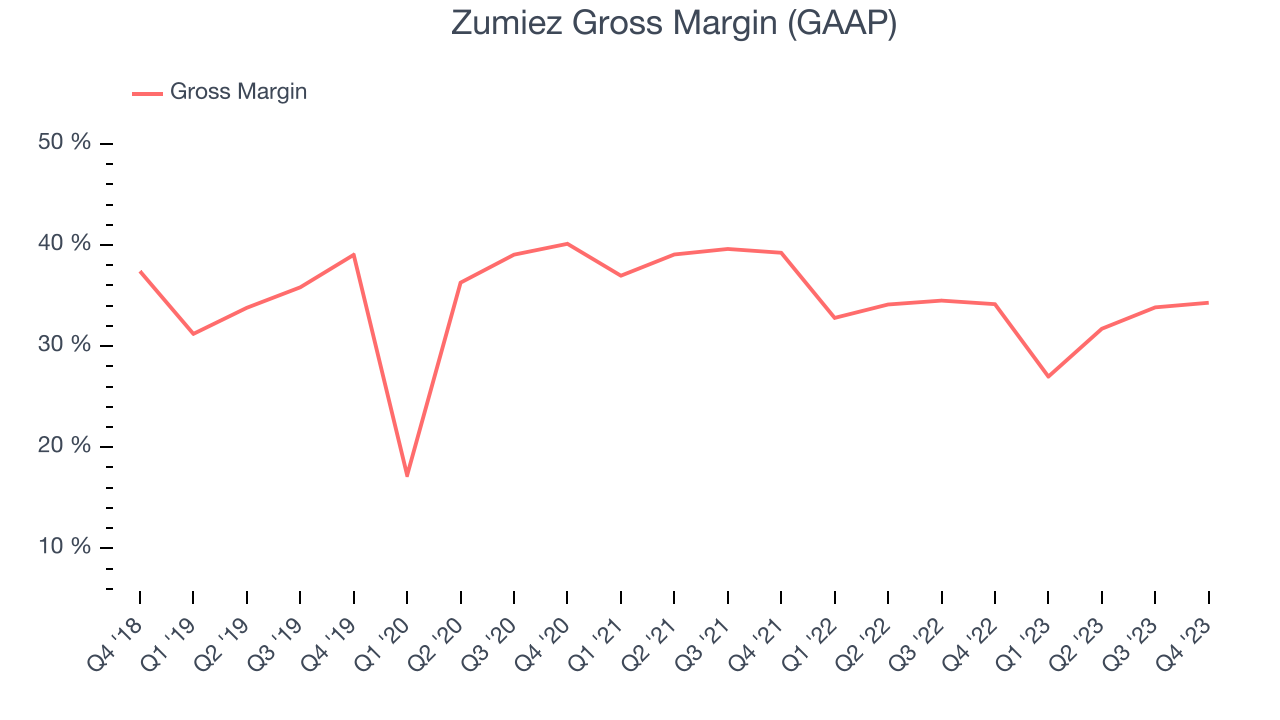

Zumiez has subpar unit economics for a retailer, making it difficult to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged a paltry 33% gross margin over the last two years. This means the company makes $0.33 for every $1 in revenue before accounting for its operating expenses.

Zumiez produced a 34.3% gross profit margin in Q4, flat with the same quarter last year. This steady margin stems from its efforts to keep prices low for consumers and signals that it has stable input costs (such as freight expenses to transport goods).

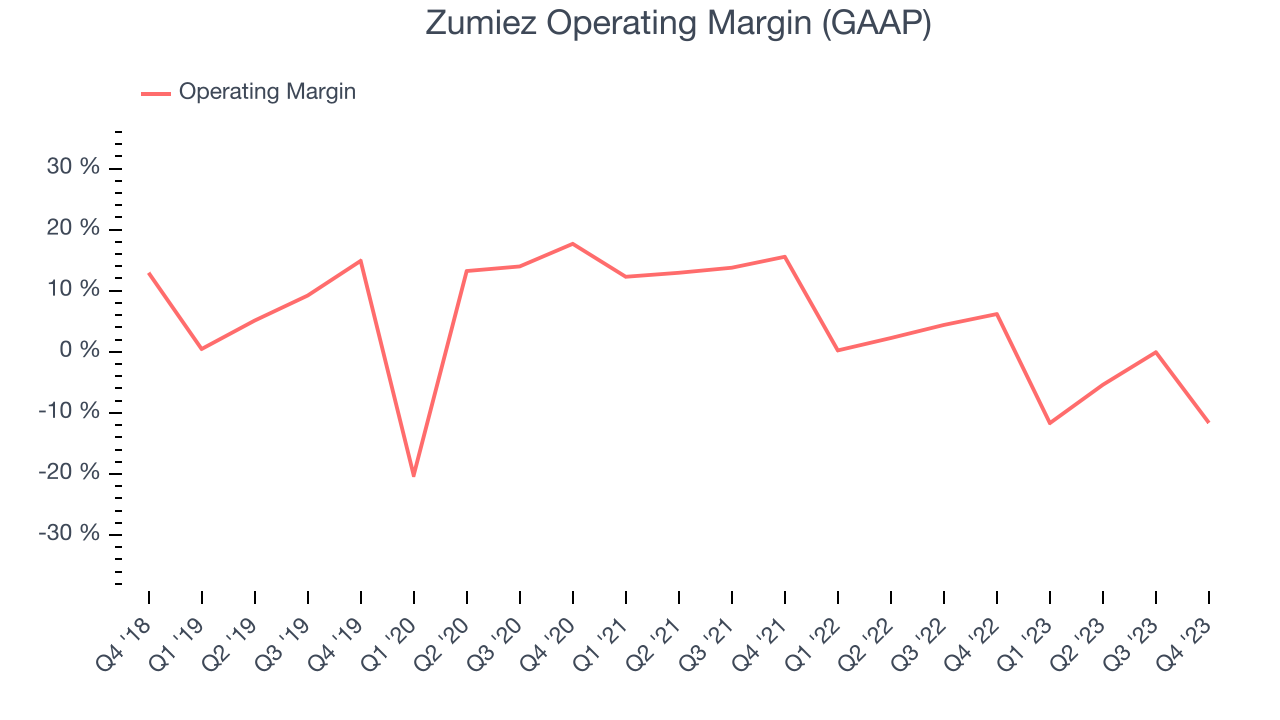

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Zumiez generated an operating profit margin of negative 11.6%, down 17.8 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by weaker cost controls or operating leverage on fixed costs.

Unprofitable publicly traded companies are few and far between in the consumer retail sector, and over the last two years, Zumiez has been one of them. Its high expenses have contributed to an average operating margin of negative 1.7%. On top of that, Zumiez's margin has declined, on average, by 10.9 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.

Unprofitable publicly traded companies are few and far between in the consumer retail sector, and over the last two years, Zumiez has been one of them. Its high expenses have contributed to an average operating margin of negative 1.7%. On top of that, Zumiez's margin has declined, on average, by 10.9 percentage points year on year. This shows the company is heading in the wrong direction, and investors were likely hoping for better results.EPS

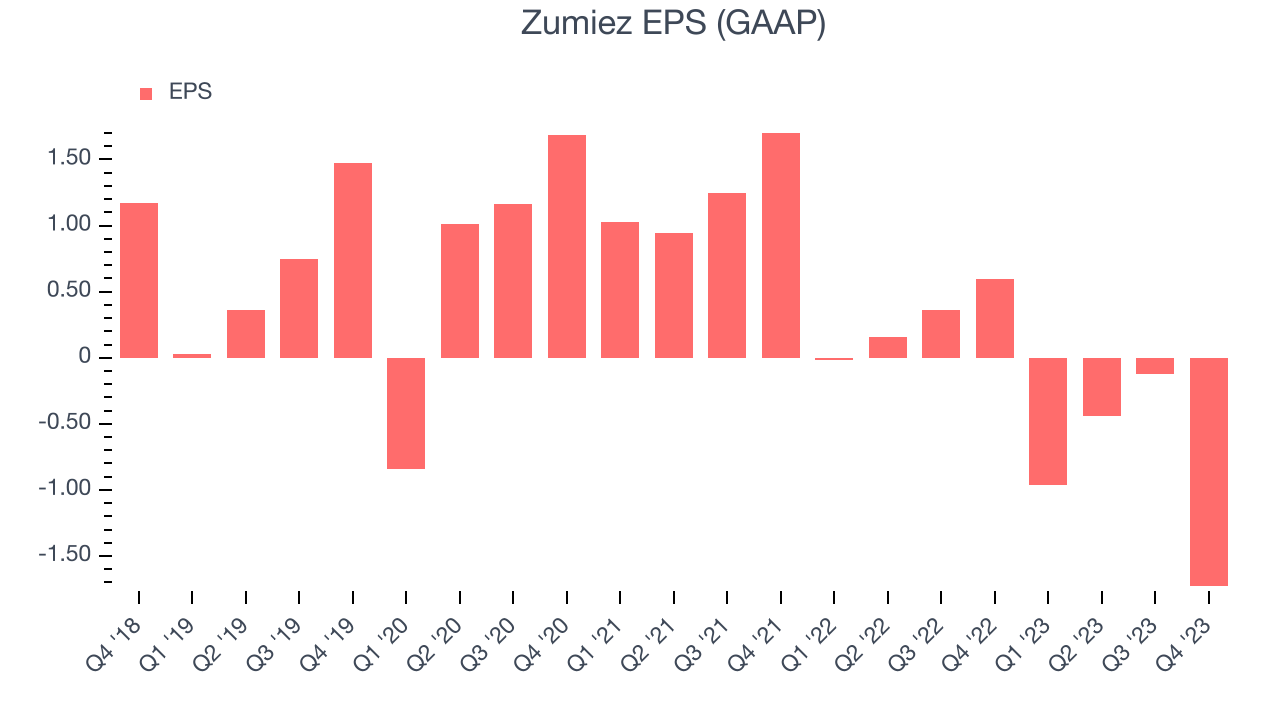

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Zumiez reported EPS at negative $1.73, down from $0.59 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Between FY2019 and FY2023, Zumiez's adjusted diluted EPS dropped 81.3%, translating into 34.2% annualized declines. In a mature sector such as consumer retail, we tend to steer our readers away from companies with falling EPS. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

On the bright side, Wall Street expects the company's earnings to grow over the next 12 months, with analysts projecting an average 124% year-on-year increase in EPS.

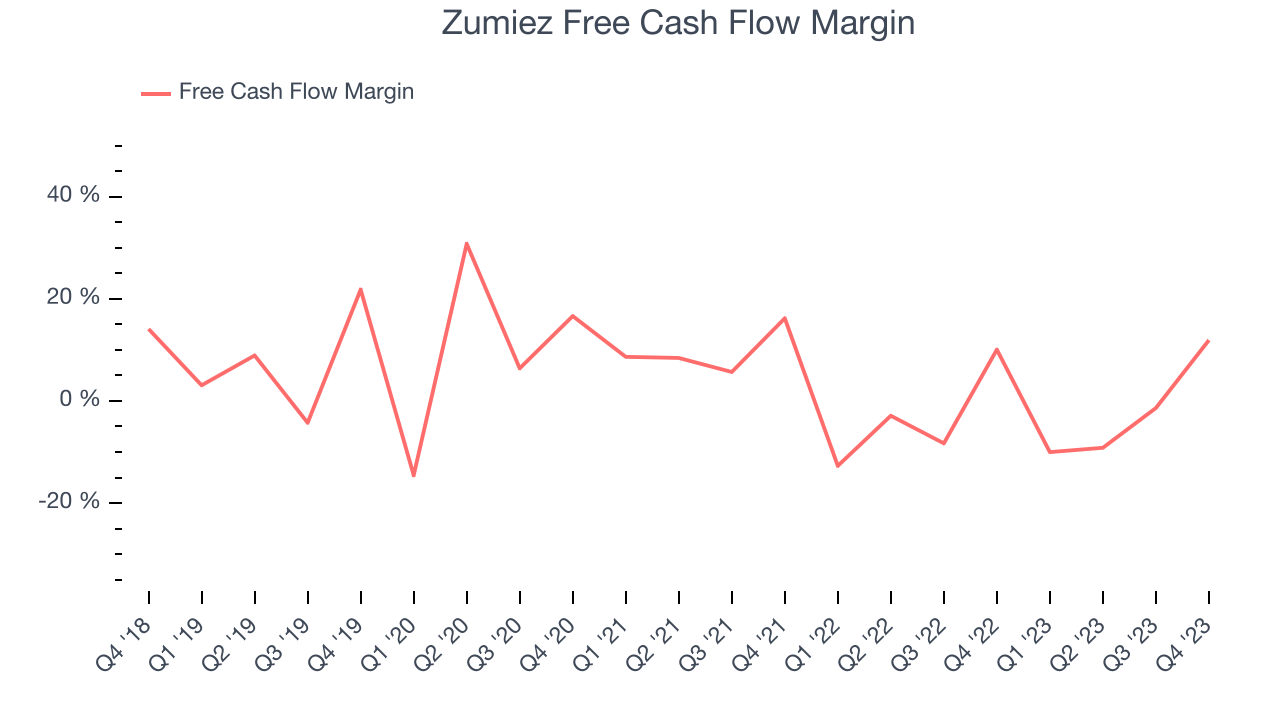

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Zumiez's free cash flow came in at $33.54 million in Q4, up 19.2% year on year. This result represents a 11.9% margin.

While Zumiez posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Zumiez's capital-intensive business model and demanding reinvestment strategy have consumed many company resources. Its free cash flow margin has averaged negative 1.7%, weak for a consumer retail business. However, its margin has averaged year-on-year increases of 2.1 percentage points, showing the company is at least improving.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Zumiez's five-year average ROIC was 10.5%, somewhat low compared to the best retail companies that consistently pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Zumiez's ROIC over the last two years averaged 22.9 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from Zumiez's Q4 Results

We enjoyed seeing Zumiez exceed analysts' revenue and gross margin expectations this quarter, driven by better-than-expected performance in its North American men's business. On the other hand, its EPS and European division underperformed, and as a result, the company expects to slow its store growth in the region (it expects to open 3 new stores in Europe in 2024). Because of the weakness, Zumiez shared Q1 2024 revenue and EPS guidance that missed analysts' expectations. Overall, this was a mixed quarter for Zumiez. The company is down 5.1% on the results and currently trades at $14 per share.

Is Now The Time?

Zumiez may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Zumiez, we'll be cheering from the sidelines. Its revenue has declined over the last four years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its brand caters to a niche market. On top of that, its declining EPS over the last four years makes it hard to trust.

Zumiez's price-to-earnings ratio based on the next 12 months is 18.6x. While we've no doubt one can find things to like about Zumiez, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $18.50 per share right before these results (compared to the current share price of $14).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.