Auto parts and accessories retailer Advance Auto Parts (NYSE:AAP) missed analysts' expectations in Q1 CY2024, with revenue flat year on year at $3.41 billion. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $11.4 billion at the midpoint. It made a GAAP profit of $0.67 per share, down from its profit of $0.81 per share in the same quarter last year.

Is now the time to buy Advance Auto Parts? Find out by accessing our full research report, it's free.

Advance Auto Parts (AAP) Q1 CY2024 Highlights:

- Revenue: $3.41 billion vs analyst estimates of $3.43 billion (small miss)

- The company reconfirmed its revenue guidance for the full year of $11.4 billion at the midpoint (above analyst estimates)

- The company reconfirmed its EPS guidance for the full year of $4.00 at the midpoint (above analyst estimates)

- Gross Margin (GAAP): 42%, down from 43% in the same quarter last year

- Free Cash Flow was -$46.27 million compared to -$472.5 million in the same quarter last year

- Locations: 5,097 at quarter end, in line with the same quarter last year

- Same-Store Sales were down (0.2%) year on year (miss vs. expectations of up 0.3% year on year)

- Market Capitalization: $4.18 billion

“Our team continues to execute against our decisive actions, including commencing our supply chain consolidation and making meaningful progress toward the potential sale of Worldpac,” said Shane O’Kelly, president and chief executive officer.

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Sales Growth

Advance Auto Parts is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

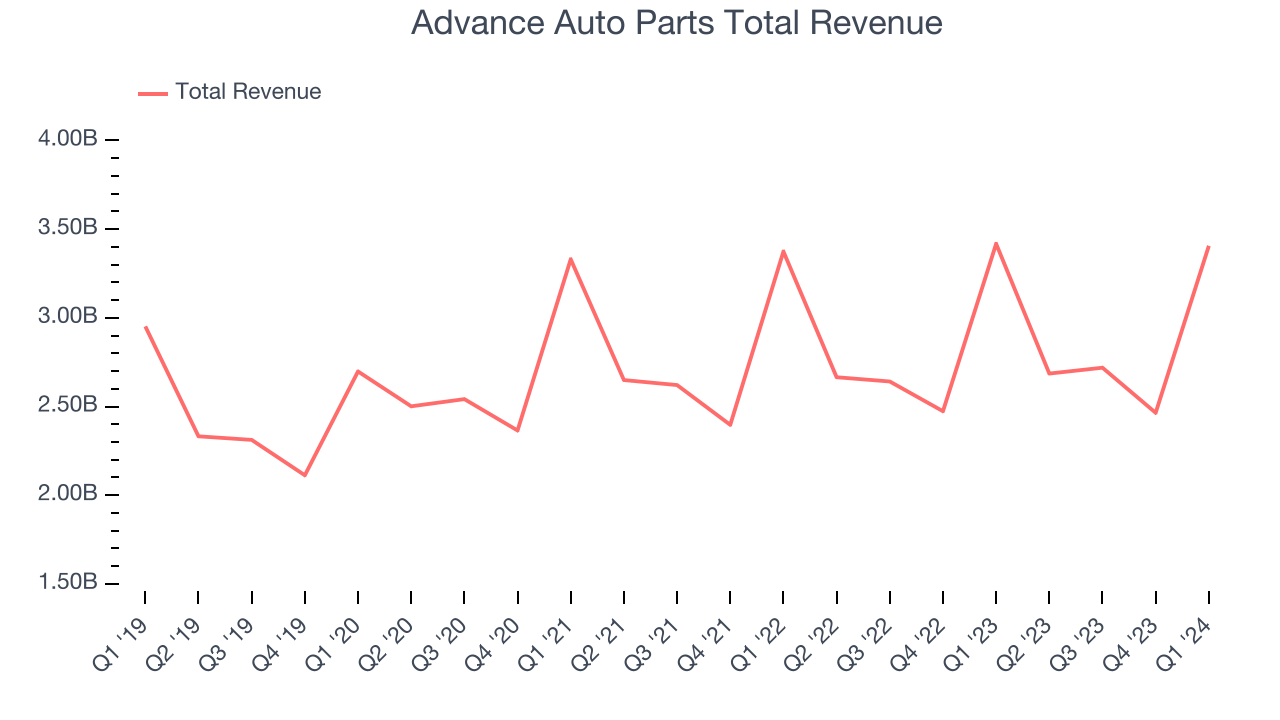

As you can see below, the company's annualized revenue growth rate of 3.1% over the last five years was weak as its store footprint remained relatively unchanged.

This quarter, Advance Auto Parts missed Wall Street's estimates and reported a rather uninspiring 0.3% year-on-year revenue decline, generating $3.41 billion in revenue. Looking ahead, Wall Street expects sales to grow 1.2% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

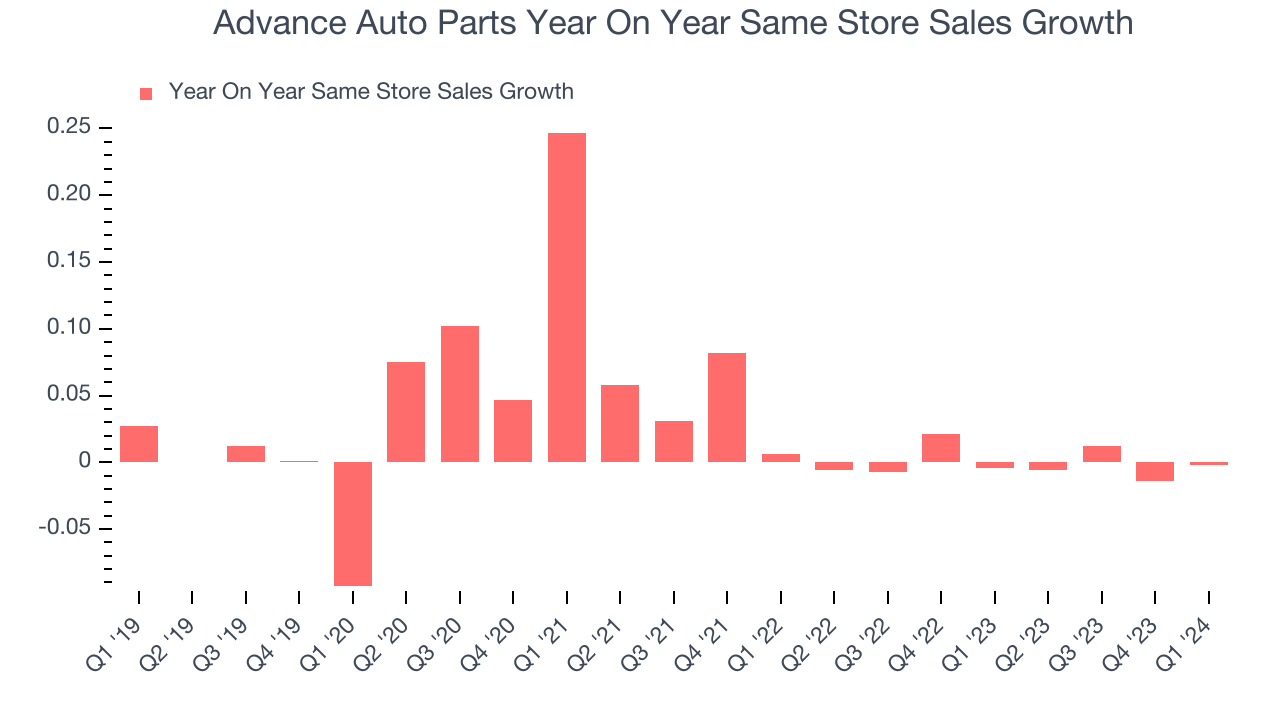

Advance Auto Parts's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 0.1% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Advance Auto Parts's year on year same-store sales were flat. This performance was more or less in line with the same quarter last year.

Key Takeaways from Advance Auto Parts's Q1 Results

We were glad the company's EPS outperformed Wall Street's estimates. Full year guidance for revenue and EPS was maintained, and both are ahead of current expectations. On the other hand, its revenue unfortunately missed analysts' expectations on lower-than-expected same-store sales. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 4.7% after reporting and currently trades at $73.50 per share.

Advance Auto Parts may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.