Slot machine and terminal operator Accel Entertainment (NYSE:ACEL) reported Q1 CY2024 results topping analysts' expectations, with revenue up 2.9% year on year to $301.8 million. It made a GAAP profit of $0.09 per share, down from its profit of $0.11 per share in the same quarter last year.

Is now the time to buy Accel Entertainment? Find out by accessing our full research report, it's free.

Accel Entertainment (ACEL) Q1 CY2024 Highlights:

- Revenue: $301.8 million vs analyst estimates of $295.8 million (2.1% beat)

- EPS: $0.09 vs analyst expectations of $0.14 (35.8% miss)

- Gross Margin (GAAP): 30.7%, up from 30.1% in the same quarter last year

- Video Gaming Terminals Sold: 25,321

- Market Capitalization: $963.4 million

Accel CEO Andy Rubenstein commented, “I am happy to report that we delivered another solid quarter despite some unfavorable weather early on, once again demonstrating the strength of our business model. We are cautiously optimistic about legislative trends we are seeing outside of Illinois and continue to explore opportunities to expand our national footprint. Given the strength of our balance sheet and experience with locally-focused gaming markets, we continue to believe that we offer one of the best investments in the industry.”

Established in Illinois, Accel Entertainment (NYSE:ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

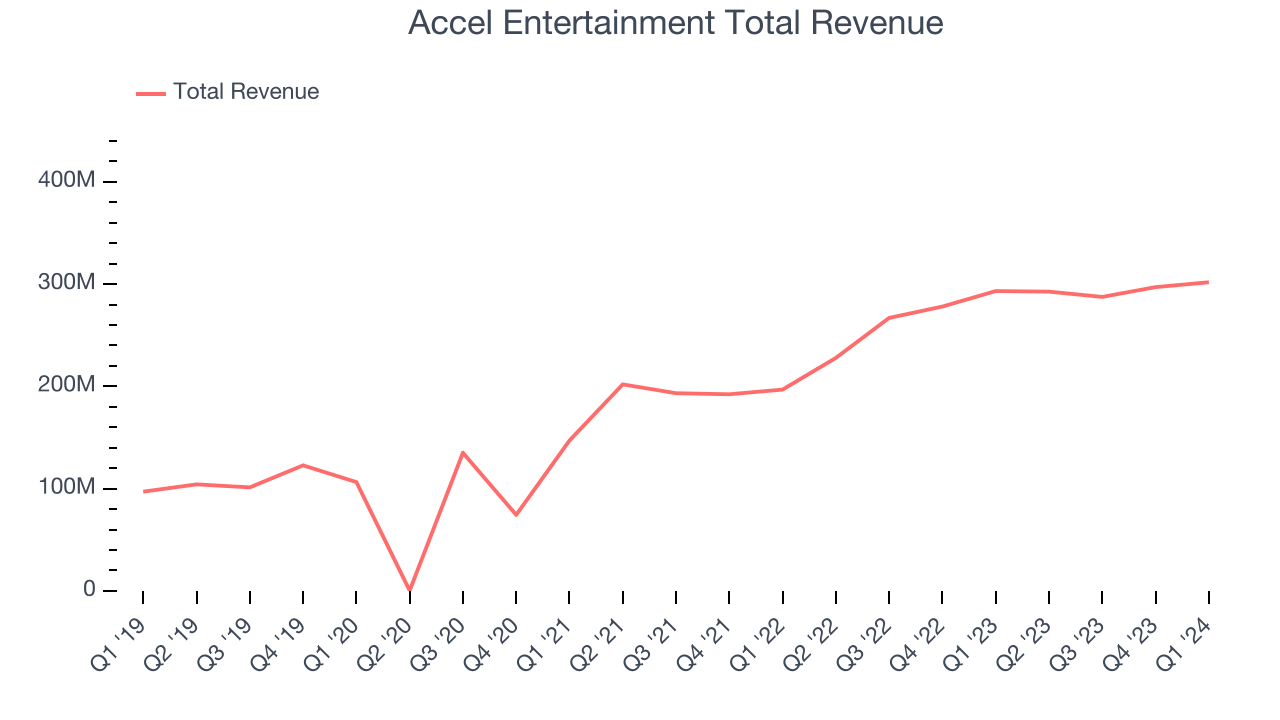

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Accel Entertainment's annualized revenue growth rate of 26.9% over the last five years was excellent for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Accel Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 22.6% over the last two years is below its five-year trend.

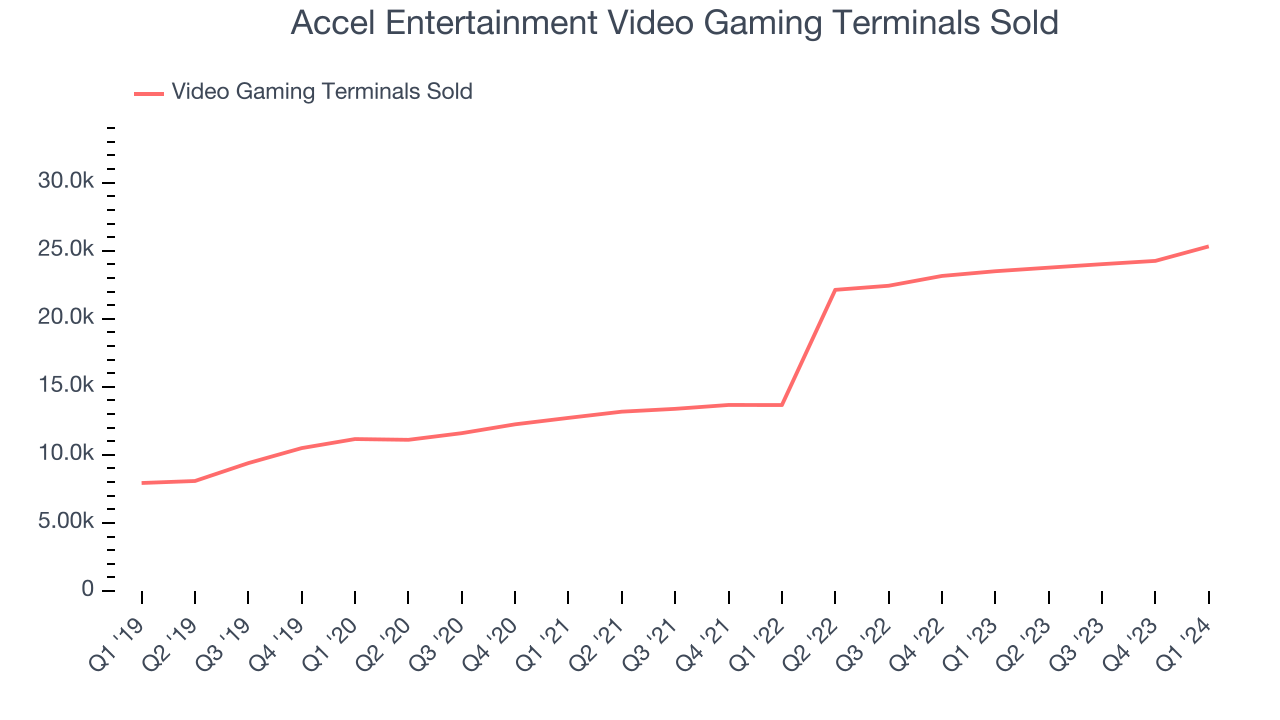

We can better understand the company's revenue dynamics by analyzing its number of video gaming terminals sold, which reached 25,321 in the latest quarter. Over the last two years, Accel Entertainment's video gaming terminals sold averaged 38% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, Accel Entertainment reported reasonable year-on-year revenue growth of 2.9%, and its $301.8 million of revenue topped Wall Street's estimates by 2.1%. Looking ahead, Wall Street expects sales to grow 2.1% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

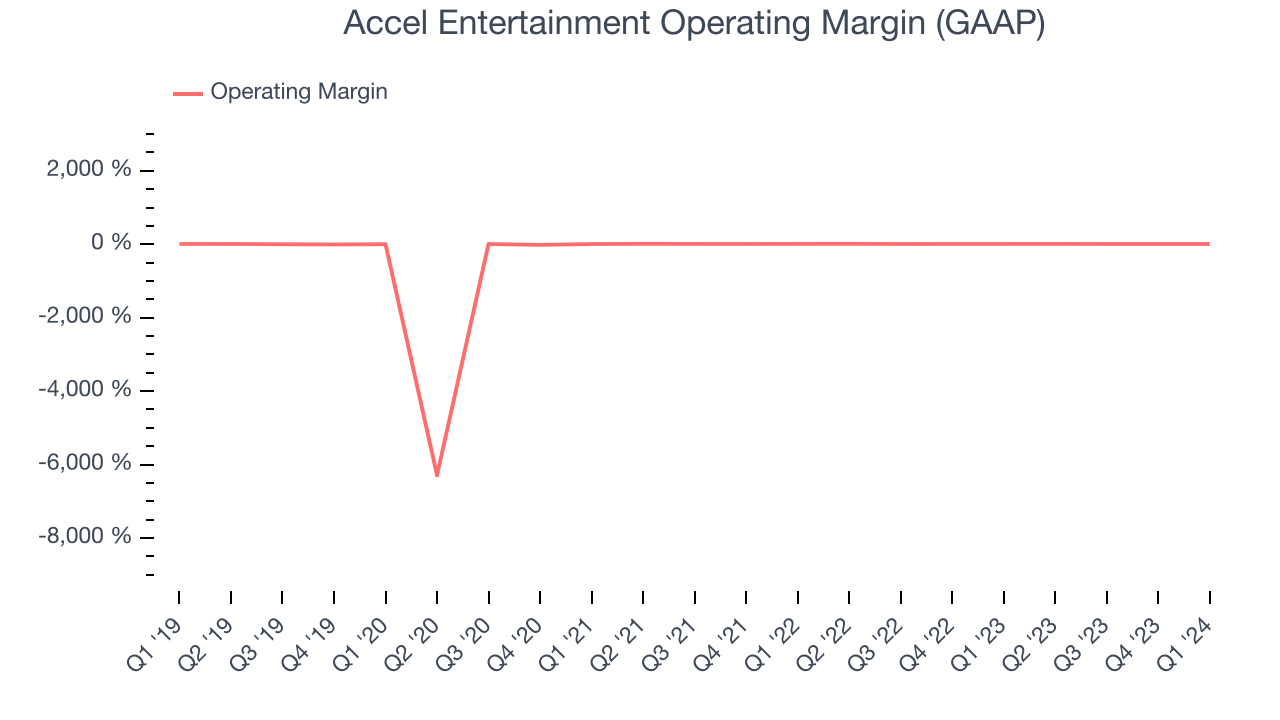

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Accel Entertainment was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 9.3%.

In Q1, Accel Entertainment generated an operating profit margin of 8.5%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Key Takeaways from Accel Entertainment's Q1 Results

It was good to see Accel Entertainment beat analysts' revenue expectations this quarter as its number of video gaming terminals sold outperformed. On the other hand, its EPS missed Wall Street's estimates. Overall, this was a bad quarter for Accel Entertainment. The company is down 2.8% on the results and currently trades at $11.3 per share.

Accel Entertainment may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.