Slot machine and terminal operator Accel Entertainment (NYSE:ACEL) reported Q4 FY2023 results topping analysts' expectations, with revenue up 6.8% year on year to $297.1 million. It made a GAAP profit of $0.19 per share, down from its profit of $0.24 per share in the same quarter last year.

Accel Entertainment (ACEL) Q4 FY2023 Highlights:

- Revenue: $297.1 million vs analyst estimates of $285 million (4.2% beat)

- EPS: $0.19 vs analyst estimates of $0.12 ($0.07 beat)

- Gross Margin (GAAP): 31%, up from 29.8% in the same quarter last year

- Video Gaming Terminals Sold: 25,083

- Market Capitalization: $890.4 million

Established in Illinois, Accel Entertainment (NYSE:ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment was founded to capitalize on new legislation in Illinois that permitted video gaming terminals (VGTs) in licensed non-casino locations such as bars, restaurants, and truck stops. This strategic move allowed the company to establish a foothold in a niche market, providing gaming solutions in environments different from traditional casinos.

The company specializes in providing an array of electronic gaming machines tailored for use in various entertainment settings. By offering engaging gaming experiences, it addresses the needs of venue owners seeking to enhance their customers' entertainment options. This service diversifies the entertainment experience for patrons and provides an additional revenue stream for venue operators.

Accel Entertainment’s revenue model is built on partnerships with venue operators. The company installs gaming machines at partner locations and participates in revenue share agreements, where it gets paid depending on how much money its machines win per day. This model is mutually beneficial as operators do not have to purchase these expensive machines outright, which can cost north of $10,000.

Casinos and Gaming

Casino and gaming companies that offer slot machines, Texas Hold ‘Em, Blackjack and the like can enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits-have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casino and gaming companies may face stroke-of-the-pen risk that suddenly limits what they do or where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing casino and gaming companies to adapt to keep up with changing consumer preferences such as being able to wager anywhere on demand.

Competitors in the video gaming terminal (VGT) market include Everi Holdings (NYSE:EVRI), PlayAGS (NYSE:AGS), and Inspired Entertainment (NASDAQ:INSE)Sales Growth

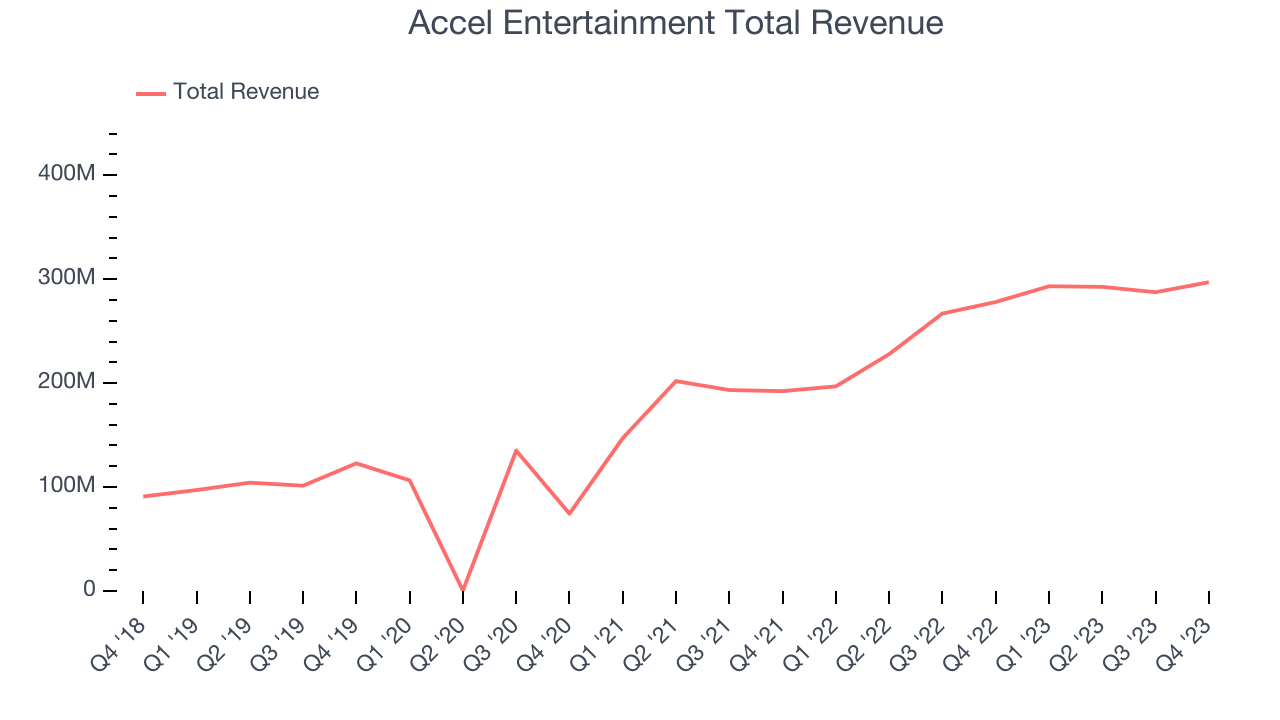

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Accel Entertainment's annualized revenue growth rate of 27.6% over the last five years was incredible for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Accel Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 26.2% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Accel Entertainment's recent history shows its momentum has slowed as its annualized revenue growth of 26.2% over the last two years is below its five-year trend.

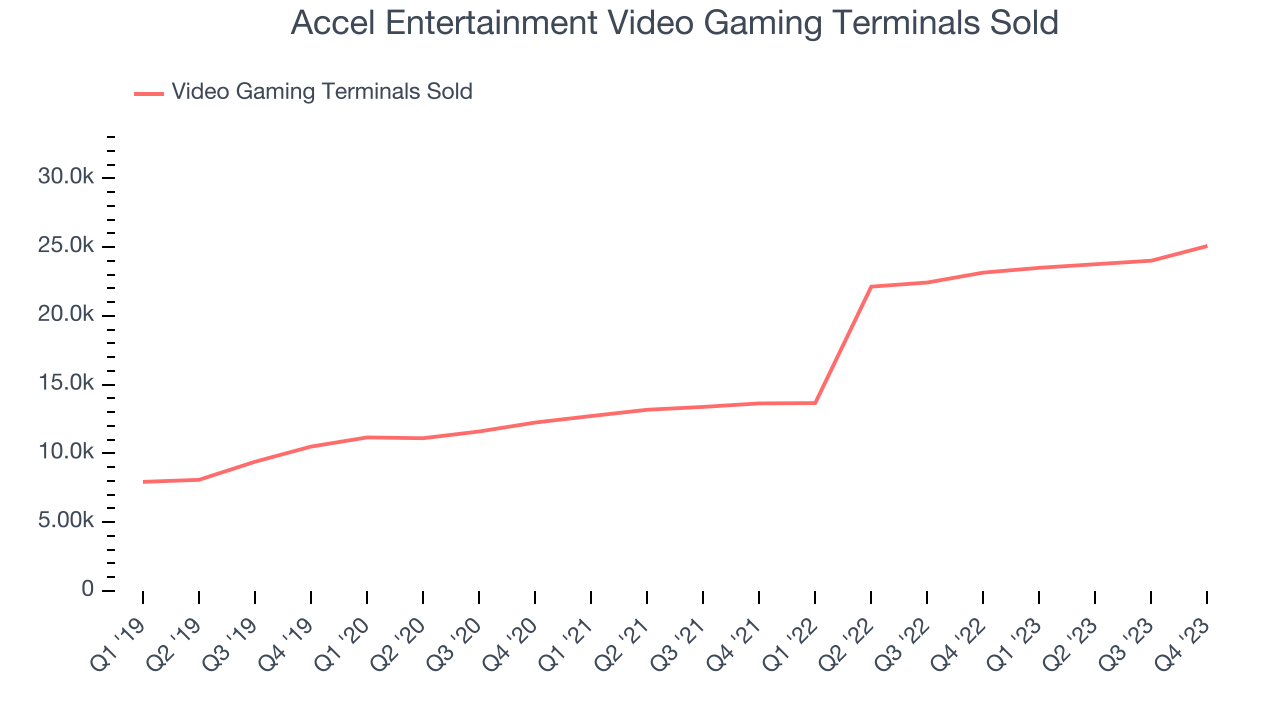

We can dig even further into the company's revenue dynamics by analyzing its number of video gaming terminals sold, which reached 25,083 in the latest quarter. Over the last two years, Accel Entertainment's video gaming terminals sold averaged 38.4% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company's monetization has fallen.

This quarter, Accel Entertainment reported solid year-on-year revenue growth of 6.8%, and its $297.1 million of revenue outperformed Wall Street's estimates by 4.2%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Accel Entertainment was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 9.5%.

In Q4, Accel Entertainment generated an operating profit margin of 8.6%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

EPS

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

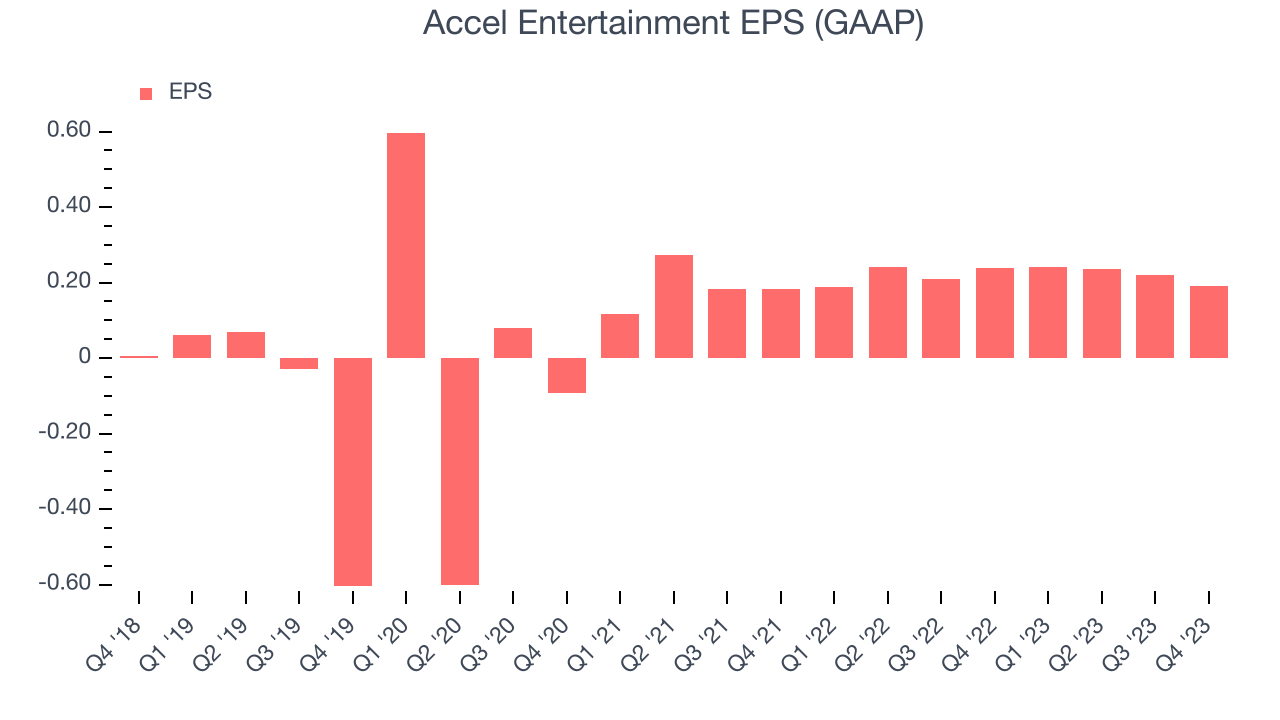

Over the last five years, Accel Entertainment's EPS dropped 63.4%, translating into 10.3% annualized declines. Thankfully, Accel Entertainment has bucked its trend as of late, growing its EPS over the last three years. We'll see if the company's growth is sustainable.

In Q4, Accel Entertainment reported EPS at $0.19, down from $0.24 in the same quarter a year ago. This print beat analysts' estimates by 56.7%. We also like to analyze expected revenue growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Accel Entertainment's five-year average return on invested capital was 13.8%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Accel Entertainment's ROIC averaged 11 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Accel Entertainment's Q4 Results

We were impressed by how significantly Accel Entertainment blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. No financial guidance was given in the earnings release, so it is hard to tell what the company's outlook for near-term financial performance is. Overall, we think this was a really good quarter that should please shareholders. The stock is flat after reporting and currently trades at $10.65 per share.

Is Now The Time?

Accel Entertainment may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Accel Entertainment isn't a bad business. First off, its revenue growth has been exceptional over the last five years. And while its declining EPS over the last five years makes it hard to trust, its video gaming terminals sold have surged over the last two years.

Accel Entertainment's price-to-earnings ratio based on the next 12 months is 12.0x. In the end, beauty is in the eye of the beholder. While Accel Entertainment wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $14 per share right before these results (compared to the current share price of $10.65).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.