Young adult apparel retailer American Eagle Outfitters (NYSE:AEO) fell short of the market’s revenue expectations in Q3 CY2024, with sales flat year on year at $1.29 billion. Its non-GAAP profit of $0.48 per share was 3.4% above analysts’ consensus estimates.

Is now the time to buy American Eagle? Find out by accessing our full research report, it’s free.

American Eagle (AEO) Q3 CY2024 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.30 billion (flat year on year, 1% miss)

- Adjusted EPS: $0.48 vs analyst estimates of $0.46 (3.4% beat)

- Q4 Same-Store Sales growth guidance of 1%, a miss vs analyst estimates of 2.5%

- Q4 Operating Profit guidance of $127.5 million, a large miss vs analyst estimates of $160 million

- Operating Margin: 8.2%, down from 9.6% in the same quarter last year

- Locations: 1,186 at quarter end, down from 1,199 in the same quarter last year

- Same-Store Sales rose 3% year on year (5% in the same quarter last year)

- Market Capitalization: $3.83 billion

“Building on our positive performance in the first half of the year, third quarter results provide another proof point of the effectiveness of our Powering Profitable Growth Plan. Led by a strong back-to-school season, we achieved comparable sales growth across brands and channels, and delivered adjusted operating income at the high end of our guidance range,” commented Jay Schottenstein, AEO’s Executive Chairman of the Board and Chief Executive Officer.

Company Overview

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

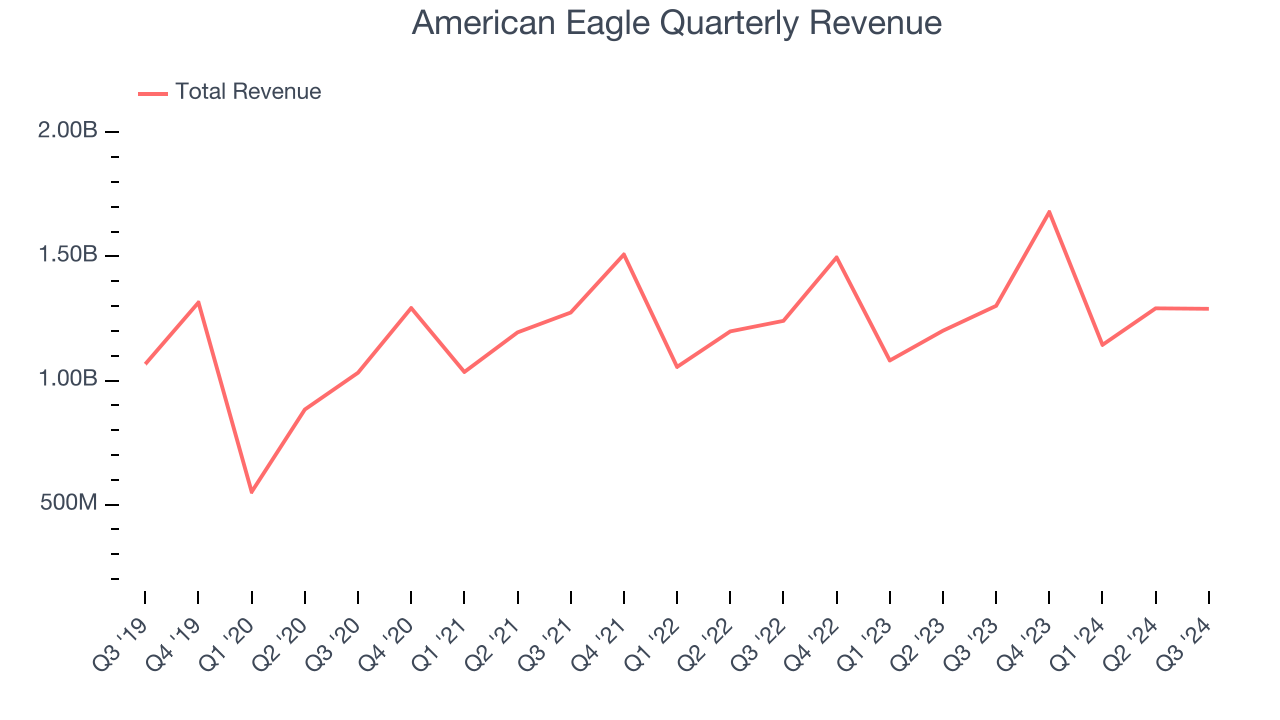

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

American Eagle is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, American Eagle’s 5% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish, but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, American Eagle missed Wall Street’s estimates and reported a rather uninspiring 0.9% year-on-year revenue decline, generating $1.29 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months, a slight deceleration versus the last five years. This projection is underwhelming and indicates its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

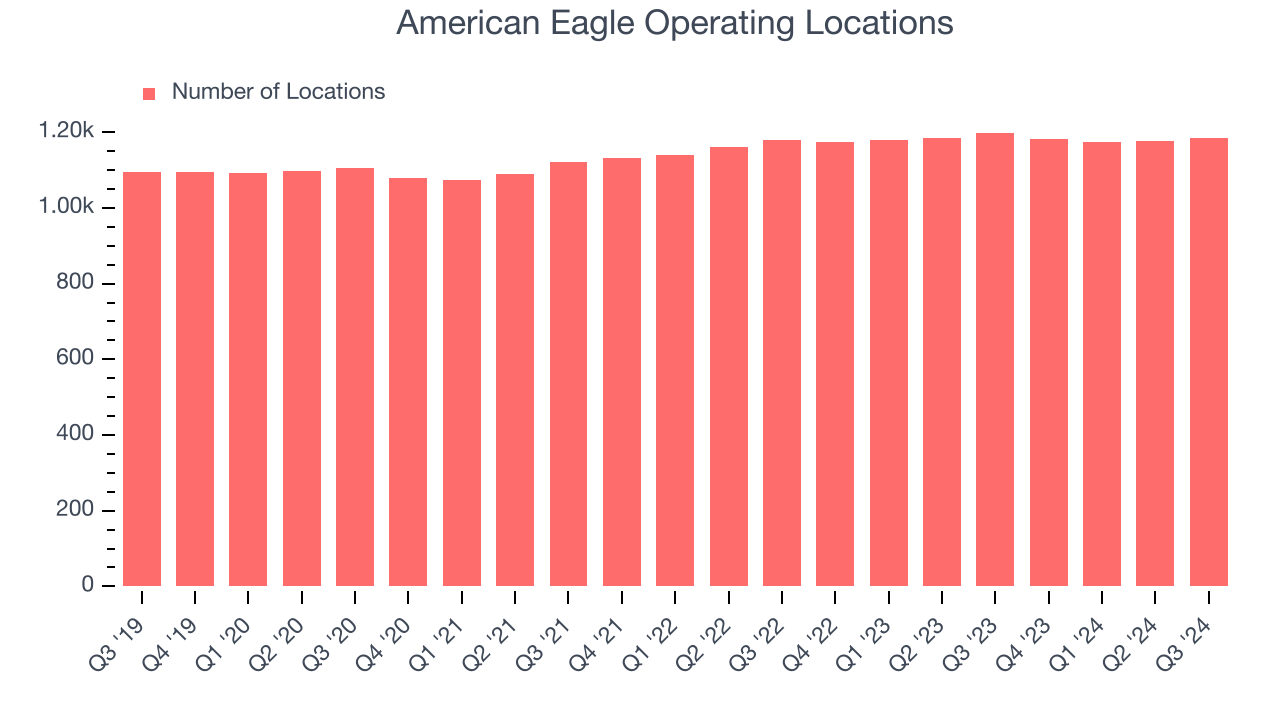

Number of Stores

American Eagle operated 1,186 locations in the latest quarter. It has generally opened new stores over the last two years and averaged 1.2% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

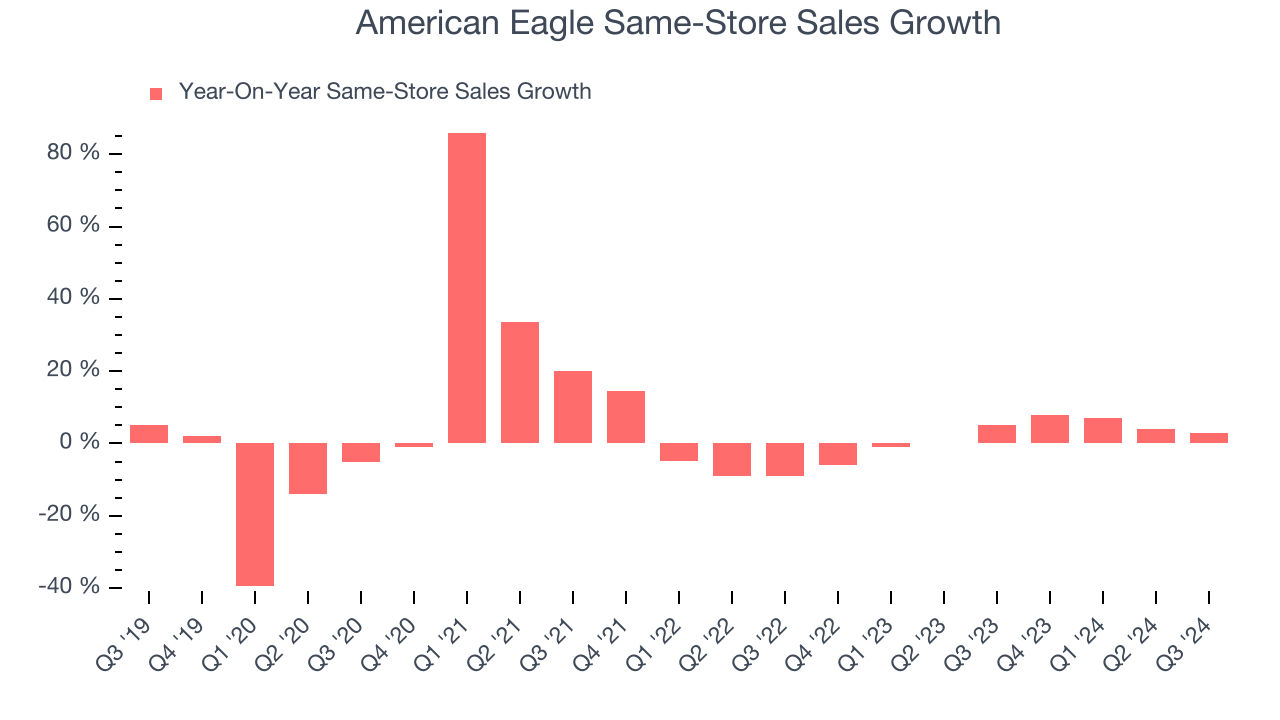

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

American Eagle’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2.5% per year. This performance suggests its measured rollout of new stores could be beneficial for shareholders. When a retailer has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, American Eagle’s same-store sales rose 3% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from American Eagle’s Q3 Results

Revenue and gross margin missed in the quarter. The real bad news was the guidance, though. The company expects same-store sales and operating profit well below Wall Street's estimates for the all-important holiday quarter. Overall, this was a weaker quarter. The stock traded down 14.8% to $17.50 immediately after reporting.

The latest quarter from American Eagle’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.