Young adult apparel retailer American Eagle Outfitters (NYSE:AEO) reported results in line with analysts' expectations in Q2 FY2023, with revenue flat year on year at $1.2 billion. The company also raised its revenue and operating income guidance for the full year. Turning to EPS, American Eagle made a GAAP profit of $0.25 per share, improving from its loss of $0.24 per share in the same quarter last year.

Is now the time to buy American Eagle? Find out by accessing our full research report, it's free.

American Eagle (AEO) Q2 FY2023 Highlights:

- Revenue: $1.2 billion vs analyst estimates of $1.2 billion (small beat)

- EPS: $0.25 vs analyst estimates of $0.15 ($0.10 beat)

- Gross Margin (GAAP): 37.7%, up from 30.9% in the same quarter last year

- Store Locations: 1,184 at quarter end, increasing by 24 over the last 12 months

“I am pleased to report second quarter revenue and operating profit that exceeded our expectations. Demand picked up in June and July reflecting brand strength and on trend collections that are resonating well with customers, supported by exciting new marketing campaigns. It’s encouraging to see positive momentum continue into the third quarter, across brands and channels,” commented Jay Schottenstein, AEO’s Executive Chairman of the Board and Chief Executive Officer.

With a heavy focus on denim, American Eagle Outfitters (NYSE:AEO) is a specialty retailer that sells its own brands of fashionable clothing to young adults.

Apparel sales are not driven so much by personal need but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

American Eagle is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the other hand, it has an edge over smaller competitors with fewer resources and can still flex high growth rates because it's growing off a smaller base than its larger counterparts.

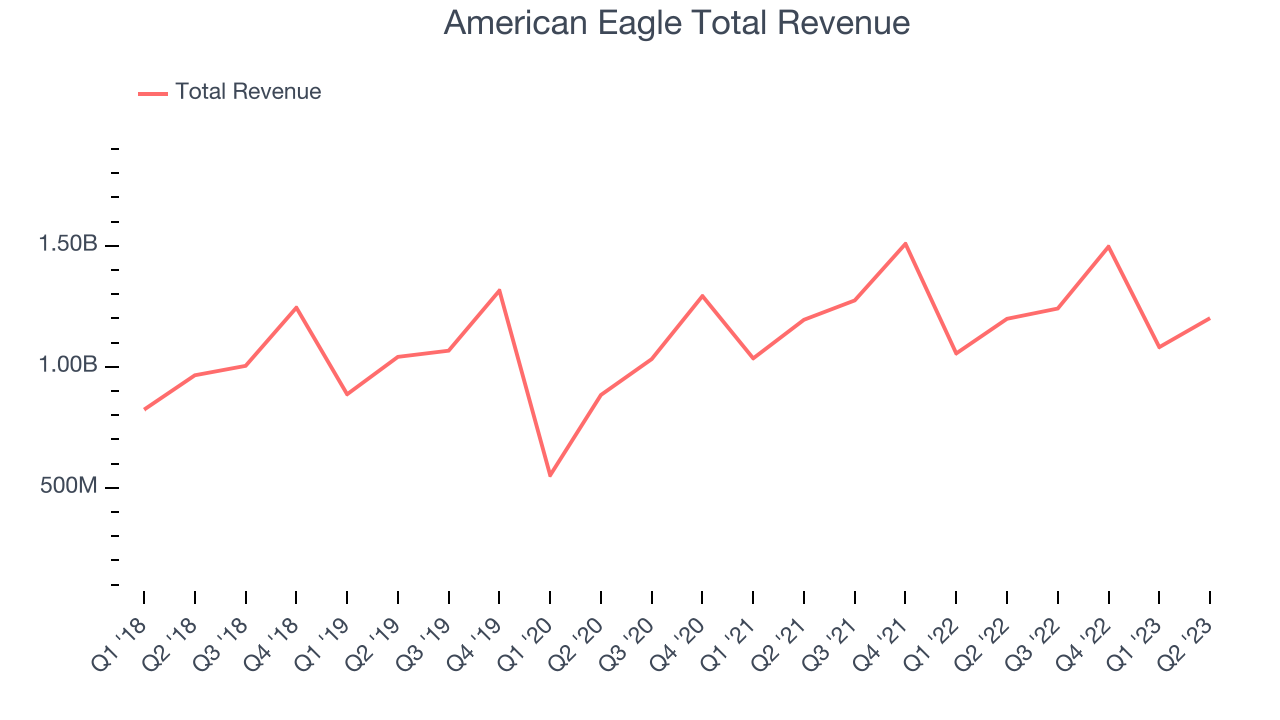

As you can see below, the company's annualized revenue growth rate of 4.71% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as it opened new stores and expanded its reach.

This quarter, American Eagle grew its revenue by 0.23% year on year, in line with Wall Street's expectations. Looking ahead, the analysts covering the company expect sales to grow 1.27% over the next 12 months.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

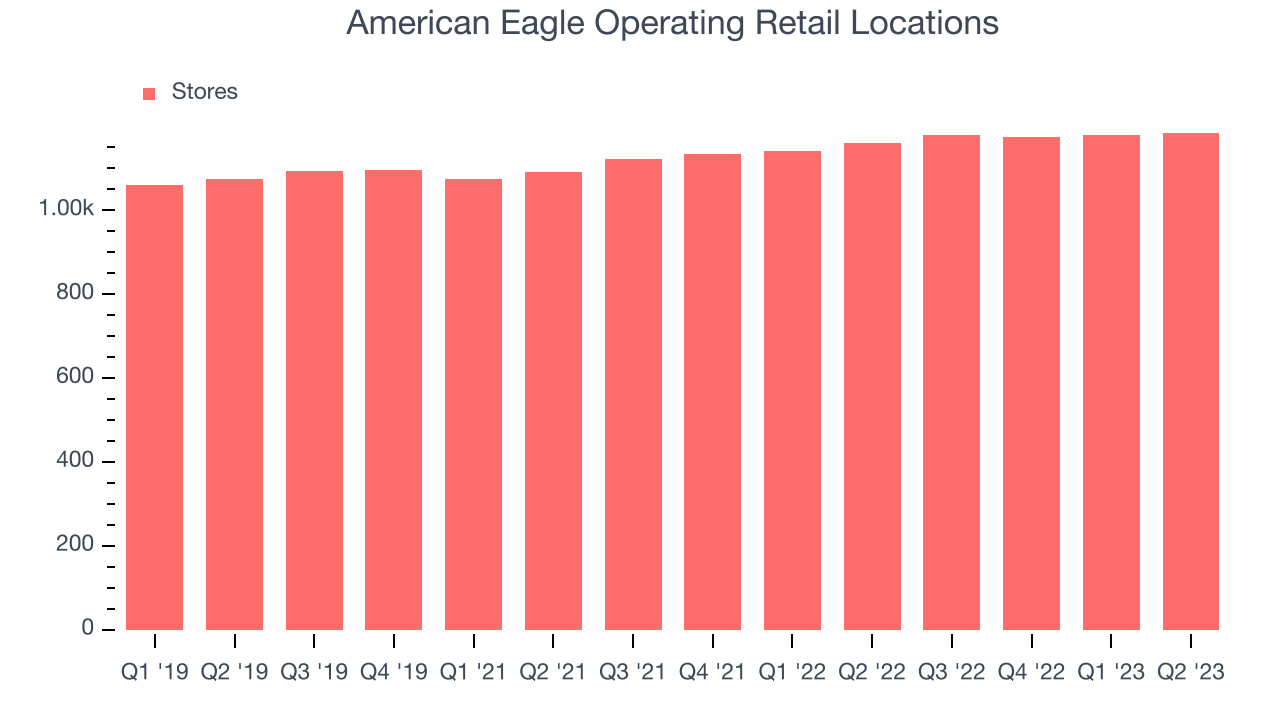

Number of Stores

When a retailer like American Eagle is opening new stores, it usually means that demand is greater than supply, and in turn, it's investing for growth. American Eagle's store count increased by 24 locations, or 2.07%, over the last 12 months to 1,184 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally opened new stores over the last eight quarters, averaging 4.5% annual growth in its physical footprint. This is decent store growth and in line with other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Key Takeaways from American Eagle's Q2 Results

With a market capitalization of $3.39 billion and more than $175.3 million in cash on hand, American Eagle can continue prioritizing growth.

We were impressed by how significantly American Eagle blew past analysts' EPS expectations this quarter, driven by outperformance in its Aerie segment. That and its increased revenue and operating income guidance for the full year ($260 million in operating income to $337.5 million at the midpoint) really stood out as positives. Investors, however, were likely expecting more as the stock is down 4.24% on the results. American Eagle currently trades at $16.48 per share.

So should you invest in American Eagle right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.