Artificial intelligence (AI) software company C3.ai (NYSE:AI) reported Q1 FY2024 results topping analysts' expectations, with revenue up 10.8% year on year to $72.4 million. The company also expects next quarter's revenue to be around $74.3 million, in line with analysts' estimates. Turning to EPS, C3.ai made a GAAP loss of $0.56 per share, improving from its loss of $0.67 per share in the same quarter last year.

Is now the time to buy C3.ai? Find out by accessing our full research report, it's free.

C3.ai (AI) Q1 FY2024 Highlights:

- Revenue: $72.4 million vs analyst estimates of $71.6 million (1.07% beat)

- EPS (non-GAAP): -$0.09 vs analyst estimates of -$0.17

- Revenue Guidance for Q2 2024 is $74.3 million at the midpoint, above analyst estimates of $73.8 million

- The company reconfirmed its revenue guidance for the full year of $307.5 million at the midpoint

- Free Cash Flow was -$8.9 million, down from $16.3 million in the previous quarter

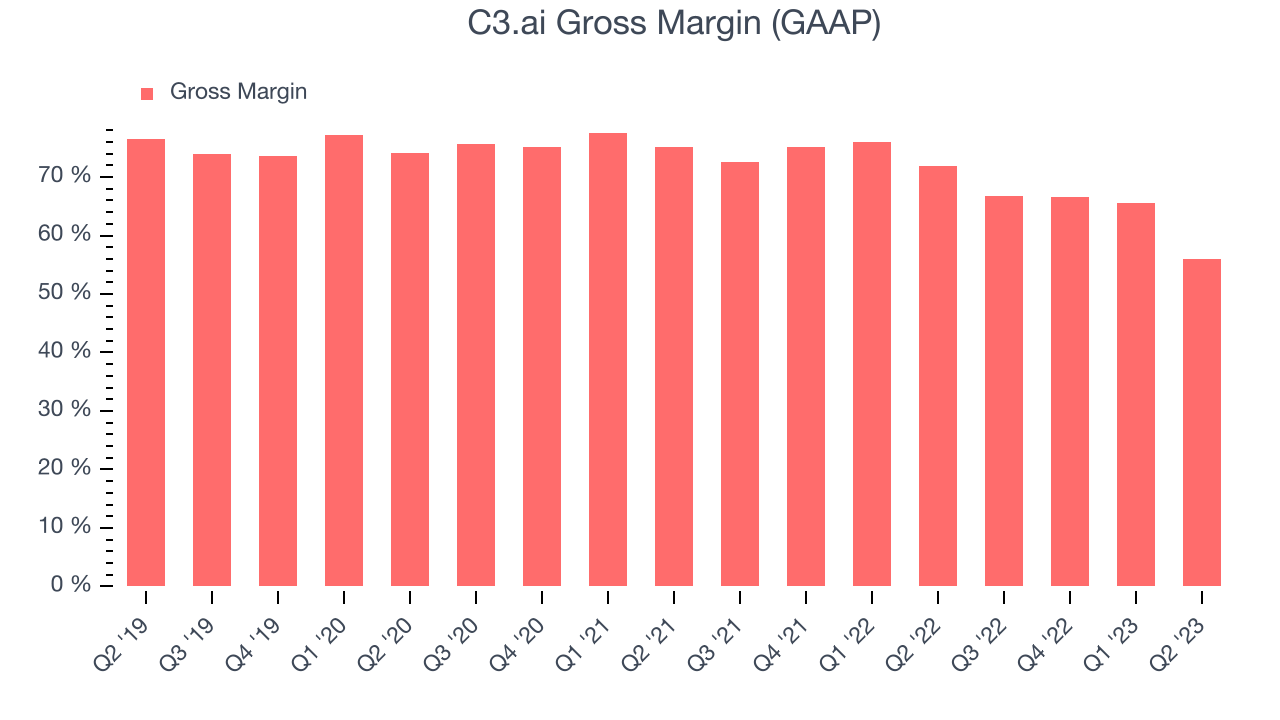

- Gross Margin (GAAP): 56%, down from 71.8% in the same quarter last year

“It is difficult to describe the scale of the increasing interest that we are seeing globally in enterprise AI adoption,” said Thomas M. Siebel, C3 AI CEO.

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Sales Growth

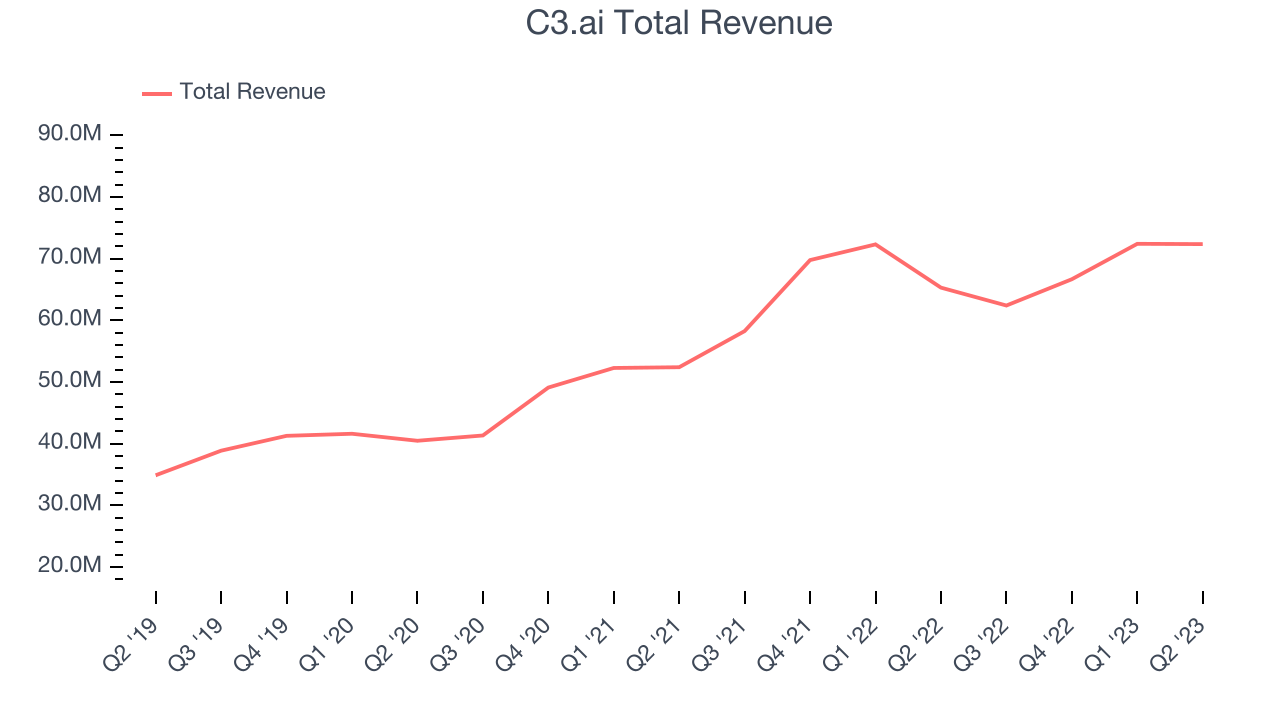

As you can see below, C3.ai's revenue growth has been solid over the last two years, growing from $52.4 million in Q1 FY2022 to $72.4 million this quarter.

This quarter, C3.ai's quarterly revenue was once again up 10.8% year on year. However, the company's revenue actually decreased by $48 thousand in Q1 compared to the $5.74 million increase in Q4 2023. Sales also dropped by a similar amount a year ago and management is guiding for revenue to rebound in the coming quarter, which might hint at an emerging seasonal pattern.

Next quarter's guidance suggests that C3.ai is expecting revenue to grow 19% year on year to $74.3 million, improving on the 7.11% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.8% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Profitability

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. C3.ai's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 56% in Q1.

That means that for every $1 in revenue the company had $0.56 left to spend on developing new products, sales and marketing, and general administrative overhead. C3.ai's gross margin is poor for a SaaS business and it's deteriorated even further over the last year. This is probably the opposite direction that shareholders would like to see it go.

Key Takeaways from C3.ai's Q1 Results

Although C3.ai, which has a market capitalization of $3.71 billion, has been burning cash over the last 12 months, its more than $750.9 million in cash on hand gives it the flexibility to continue prioritizing growth over profitability.

It was encouraging to see C3.ai narrowly top analysts' revenue expectations this quarter. However, gross margin missed and has generally been on a downward trend. We were also glad that its full-year revenue guidance came in higher than Wall Street's estimates. However, the outlook for the full year operating loss is larger (meaning the company expects to lose more money for the full year than its outlook, which was given about three months ago). Zooming out, we think this was a mixed but mediocre quarter. The stock is down 2.7% after reporting, trading at $30.6 per share.

So should you invest in C3.ai right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned in this report.