Artificial intelligence (AI) software company C3.ai (NYSE:AI) beat analysts' expectations in Q1 CY2024, with revenue up 19.6% year on year to $86.59 million. The company expects next quarter's revenue to be around $86.5 million, in line with analysts' estimates. It made a non-GAAP loss of $0.11 per share, down from its loss of $0.11 per share in the same quarter last year.

Is now the time to buy C3.ai? Find out by accessing our full research report, it's free.

C3.ai (AI) Q1 CY2024 Highlights:

- Revenue: $86.59 million vs analyst estimates of $84.4 million (2.6% beat)

- EPS (non-GAAP): -$0.11 vs analyst estimates of -$0.30

- Revenue Guidance for Q2 CY2024 is $86.5 million at the midpoint, roughly in line with what analysts were expecting

- Management's RAISED its revenue guidance for the upcoming financial year 2025 to $382.5 million at the midpoint, beating analyst estimates by 4.1% and implying 23.2% growth (vs 16.3% in FY2024)

- Gross Margin (GAAP): 59.6%, down from 65.6% in the same quarter last year

- Free Cash Flow of $18.81 million is up from -$45.14 million in the previous quarter (beat)

- Market Capitalization: $2.94 billion

“We finished a strong quarter and closed out a huge year for C3 AI. This was our fifth consecutive quarter of accelerating revenue growth. Our fourth quarter revenue grew by 20% year-over-year to $86.6 million, exceeding the top end of our guidance. Our full year revenue grew by 16% to $310.6 million, also exceeding the top end of our guidance,” said C3 AI CEO and Chairman Thomas M. Siebel.

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Sales Growth

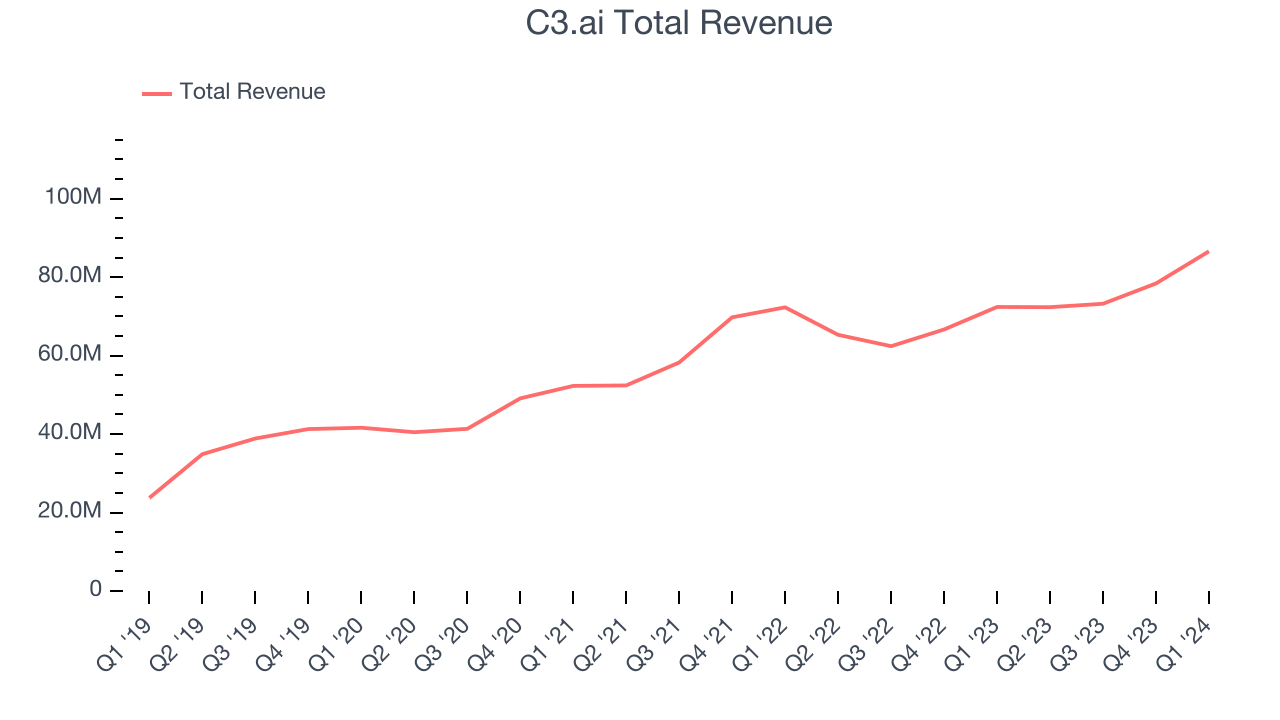

As you can see below, C3.ai's revenue growth has been solid over the last three years, growing from $52.28 million in Q4 2021 to $86.59 million this quarter.

This quarter, C3.ai's quarterly revenue was once again up 19.6% year on year. We can see that C3.ai's revenue increased by $8.19 million quarter on quarter, which is a solid improvement from the $5.17 million increase in Q4 CY2023. Shareholders should applaud the re-acceleration of growth.

Next quarter's guidance suggests that C3.ai is expecting revenue to grow 19.5% year on year to $86.5 million, improving on the 10.8% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $382.5 million at the midpoint, growing 23.2% year on year compared to the 16.4% increase in FY2024.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

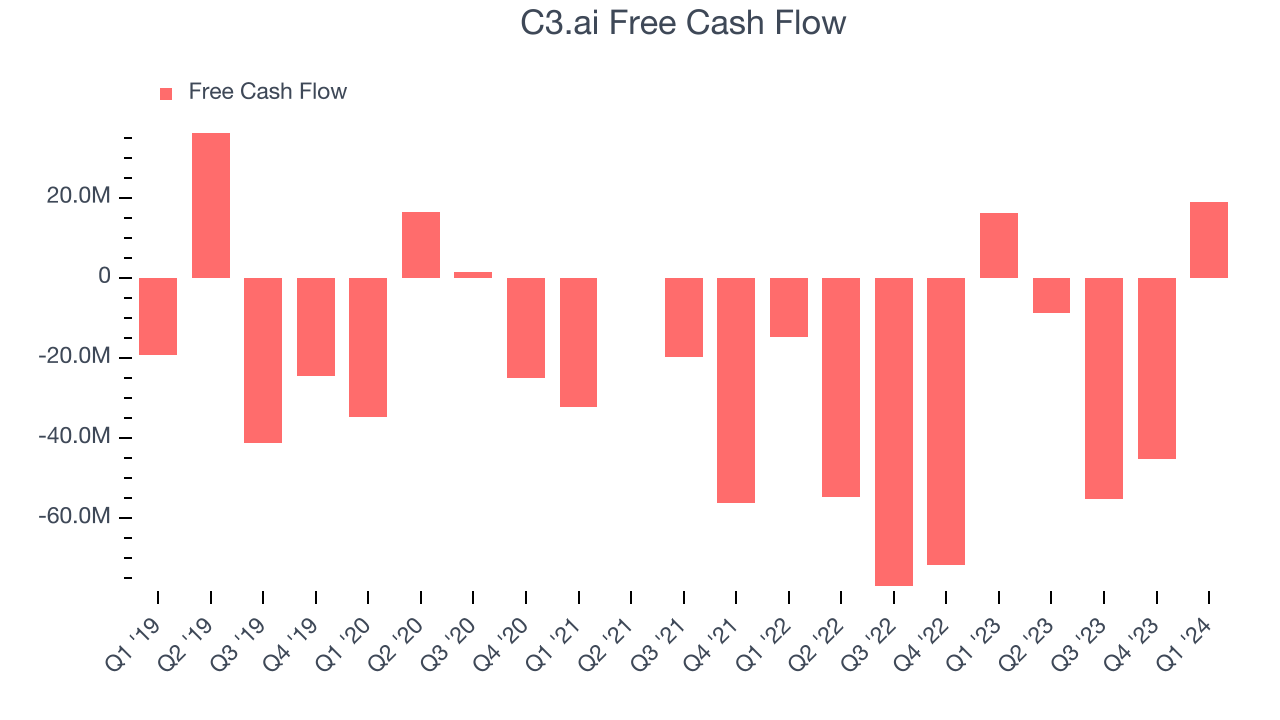

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. C3.ai's free cash flow came in at $18.81 million in Q1, up 15.3% year on year.

C3.ai has burned through $90.37 million of cash over the last 12 months, resulting in a negative 29.1% free cash flow margin. This low FCF margin stems from C3.ai's constant need to reinvest in its business to stay competitive.

Key Takeaways from C3.ai's Q1 Results

This was a beat and raise quarter for the company. Revenue, gross margin, and free cash flow all exceeded expectations. It was also great to see C3.ai expecting revenue growth to accelerate next year with full year revenue guidance that was raised and above expectations. Overall, we think this was a really good quarter that should please shareholders. The stock is up 13.7% after reporting and currently trades at $27.20 per share.

C3.ai may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.