Artificial intelligence (AI) software company C3.ai (NYSE:AI) reported Q3 FY2024 results topping analysts' expectations, with revenue up 17.6% year on year to $78.4 million. The company expects next quarter's revenue to be around $84 million, in line with analysts' estimates. It made a non-GAAP loss of $0.13 per share, down from its loss of $0.04 per share in the same quarter last year.

C3.ai (AI) Q3 FY2024 Highlights:

- Revenue: $78.4 million vs analyst estimates of $76.14 million (3% beat)

- EPS (non-GAAP): -$0.13 vs analyst estimates of -$0.28

- Revenue Guidance for Q4 2024 is $84 million at the midpoint, roughly in line with what analysts were expecting

- Free Cash Flow was -$45.14 million compared to -$55.13 million in the previous quarter

- Gross Margin (GAAP): 57.8%, down from 66.6% in the same quarter last year

- Market Capitalization: $3.61 billion

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

Building a functional AI-powered application from scratch is a really complex and time consuming technical problem, even for a large company. A dysfunctional AI-based software can be at best useless, but at worst can be actually damaging to the company, for example resulting in a false clinical diagnosis or a failure to detect complications in an energy plant.

C3.AI’s software development platform includes features to build AI applications with little or no code and it also provides pre-built AI applications and models tailored to a wide range of industries that can be automatically installed and deployed.

To drive the adoption of its software, C3.AI provides a place for organizations to connect their data so that AI technology can be applied and it also integrates with sales and marketing systems such as CRM to generate more meaningful feedback.

The company was initially called C3 Energy to focus on analyzing electricity flow from plants to homes and has since expanded its scope by developing solutions to address problems in other industries such as predictive maintenance, fraud detection, and network optimization.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

This expanding market opportunity is attracting competition from the likes of Palantir (NYSE:PLTR), IBM (NYSE:IBM) and a number of growing startups.

Sales Growth

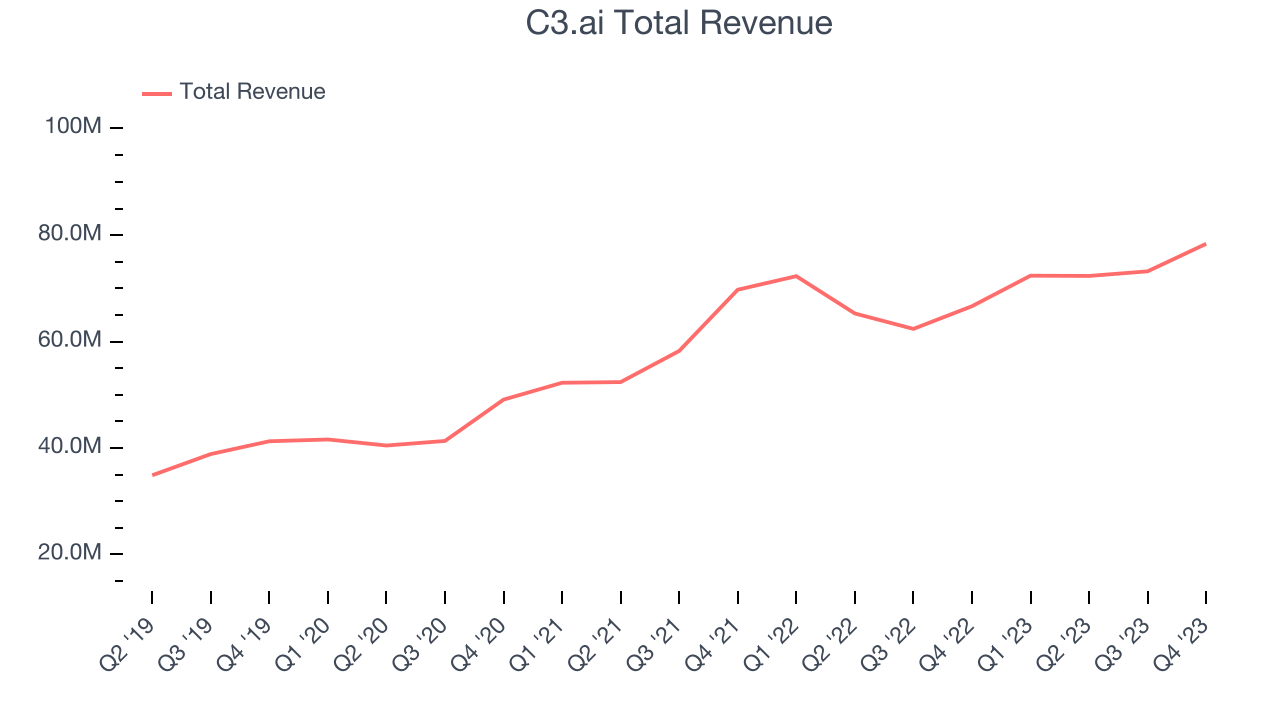

As you can see below, C3.ai's revenue growth has been unremarkable over the last two years, growing from $69.77 million in Q3 FY2022 to $78.4 million this quarter.

This quarter, C3.ai's quarterly revenue was once again up 17.6% year on year. We can see that C3.ai's revenue increased by $5.17 million quarter on quarter, which is a solid improvement from the $867,000 increase in Q2 2024. Shareholders should applaud the re-acceleration of growth.

Next quarter's guidance suggests that C3.ai is expecting revenue to grow 16% year on year to $84 million, improving on the 0.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 17.7% over the next 12 months before the earnings results announcement.

Profitability

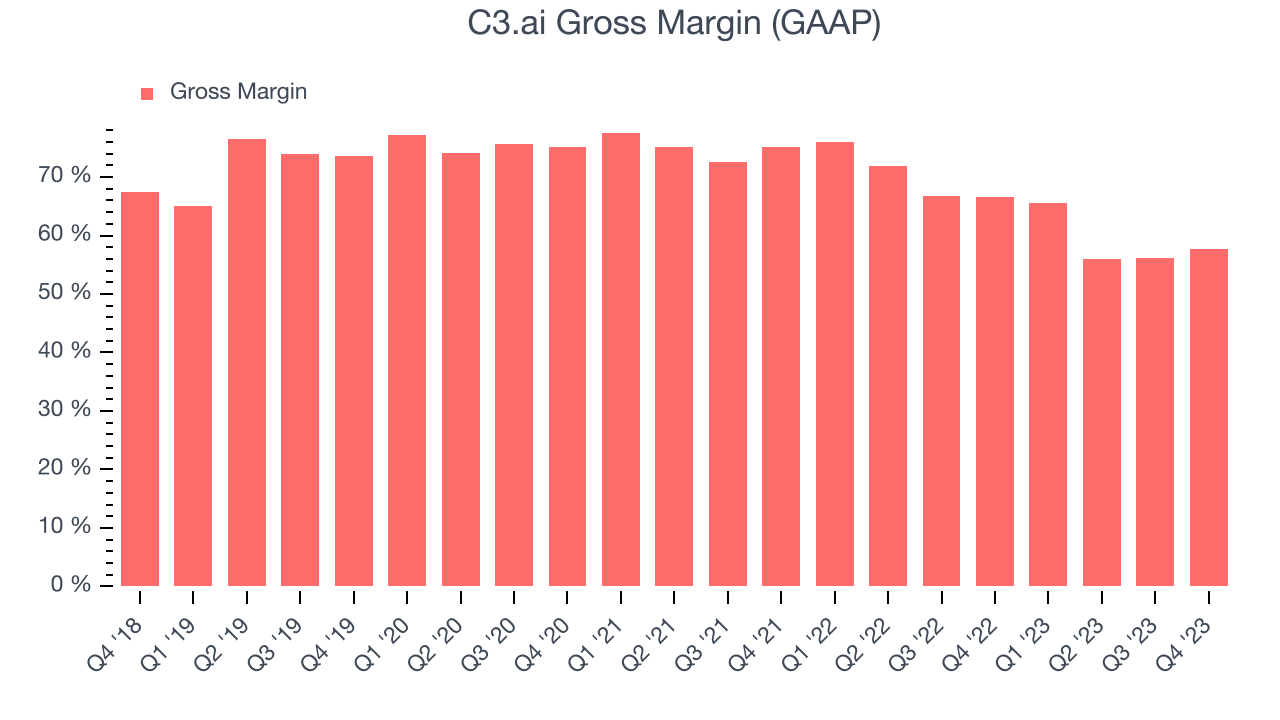

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. C3.ai's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 57.8% in Q3.

That means that for every $1 in revenue the company had $0.58 left to spend on developing new products, sales and marketing, and general administrative overhead. While its gross margin has improved significantly since the previous quarter, C3.ai's gross margin is still poor for a SaaS business. It's vital that the company continues to improve this key metric.

Cash Is King

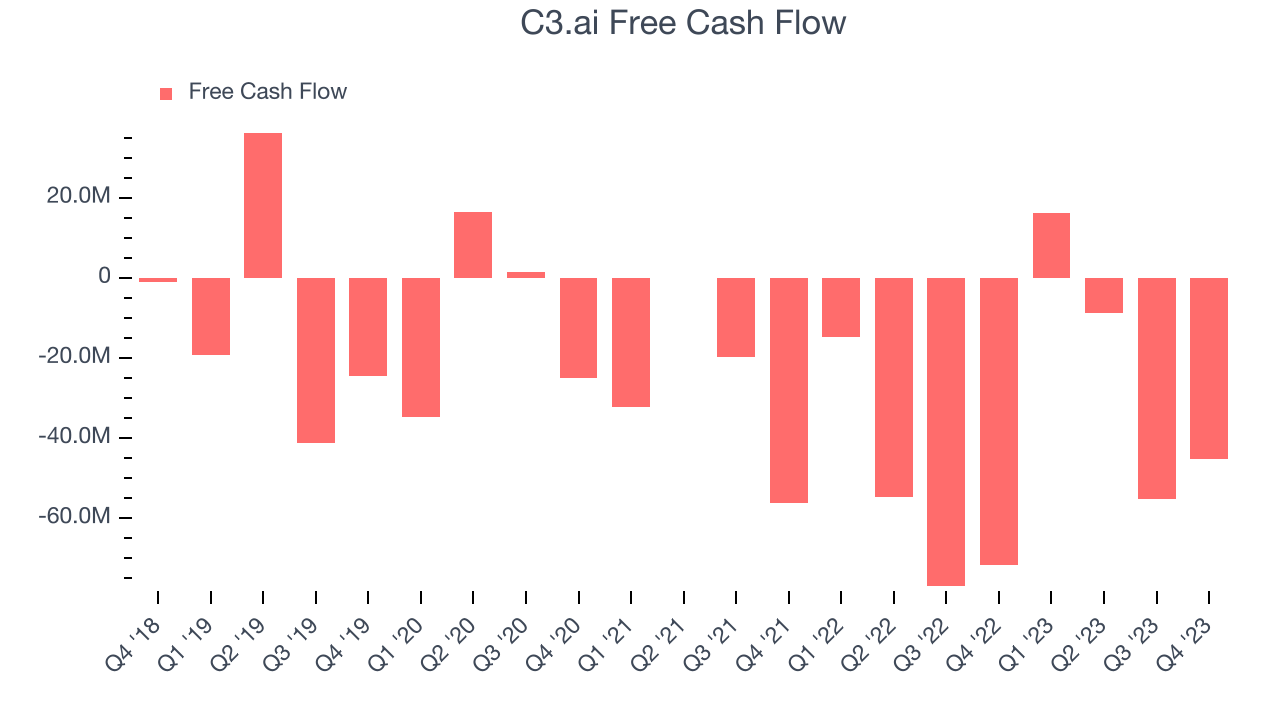

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. C3.ai burned through $45.14 million of cash in Q3 , increasing its cash burn by 37% year on year.

C3.ai has burned through $92.87 million of cash over the last 12 months, resulting in a negative 31.3% free cash flow margin. This low FCF margin stems from C3.ai's constant need to reinvest in its business to stay competitive.

Key Takeaways from C3.ai's Q3 Results

It was great to see C3.ai improve its gross margin this quarter. We were also glad its revenue outperformed Wall Street's estimates. On the other hand, cash burn remains high. Overall, this quarter's results seemed fairly positive. The stock is up 12.9% after reporting and currently trades at $33.52 per share.

Is Now The Time?

When considering an investment in C3.ai, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that C3.ai isn't a bad business. Although its ,

C3.ai's price-to-sales ratio based on the next 12 months of 10.3x indicates that the market is definitely optimistic about its growth prospects. There are things to like about C3.ai and there's no doubt it's a bit of a market darling, at least for some. But we are wondering whether there might be better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $26.67 per share right before these results (compared to the current share price of $33.52).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.