Electronic products manufacturer AMETEK (NYSE:AME) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 5.3% year on year to $1.71 billion. Its non-GAAP profit of $1.66 per share was 2.6% above analysts’ consensus estimates.

Is now the time to buy AMETEK? Find out by accessing our full research report, it’s free.

AMETEK (AME) Q3 CY2024 Highlights:

- Revenue: $1.71 billion vs analyst estimates of $1.71 billion (in line)

- Adjusted EPS: $1.66 vs analyst estimates of $1.62 (2.6% beat)

- Management slightly raised its full-year Adjusted EPS guidance to $6.80 at the midpoint

- Gross Margin (GAAP): 36%, down from 37.1% in the same quarter last year

- Operating Margin: 26.1%, in line with the same quarter last year

- Market Capitalization: $39.11 billion

"AMETEK delivered excellent results in the third quarter with double digit orders growth, outstanding operating performance, excellent cash flow conversion, and earnings ahead of expectations," stated David A. Zapico, AMETEK Chairman and Chief Executive Officer.

Company Overview

Started from its humble beginnings in motor repair, AMETEK (NYSE:AME) manufactures electronic devices used in industries like aerospace, power, and healthcare.

Internet of Things

Industrial Internet of Things (IoT) companies are buoyed by the secular trend of a more connected world. They often specialize in nascent areas such as hardware and services for factory automation, fleet tracking, or smart home technologies. Those who play their cards right can generate recurring subscription revenues by providing cloud-based software services, boosting their margins. On the other hand, if the technologies these companies have invested in don’t pan out, they may have to make costly pivots.

Sales Growth

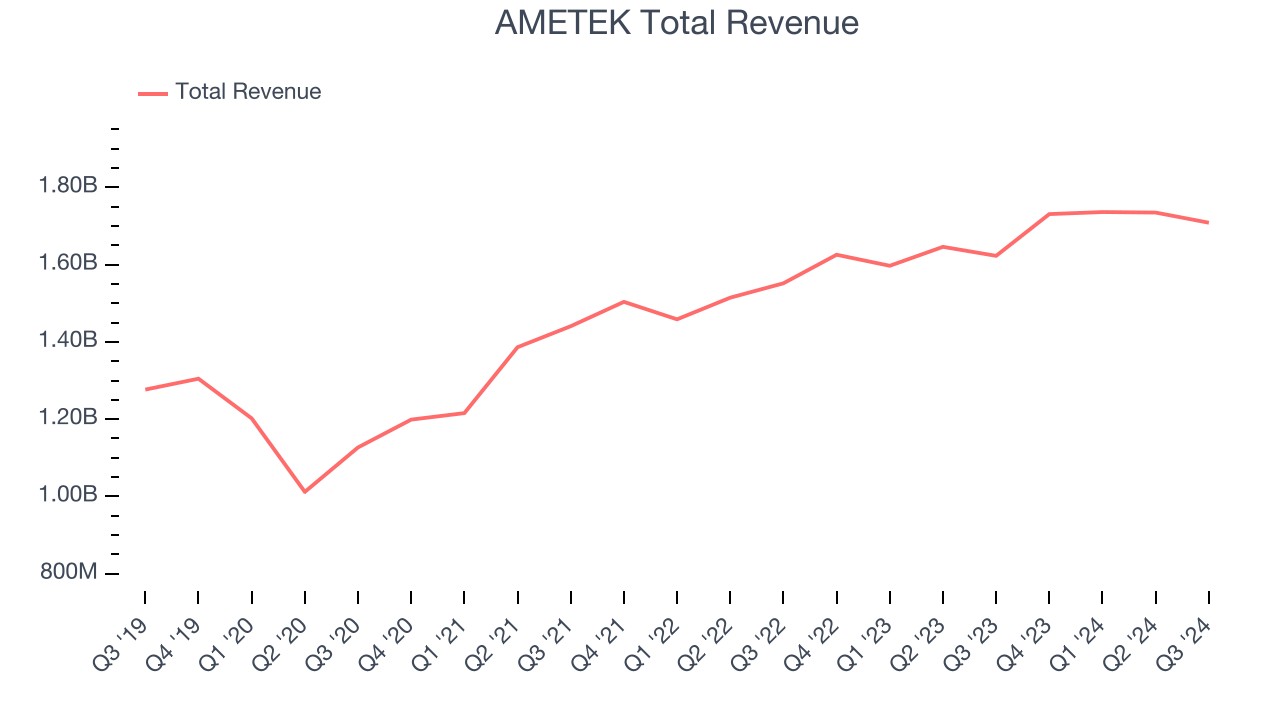

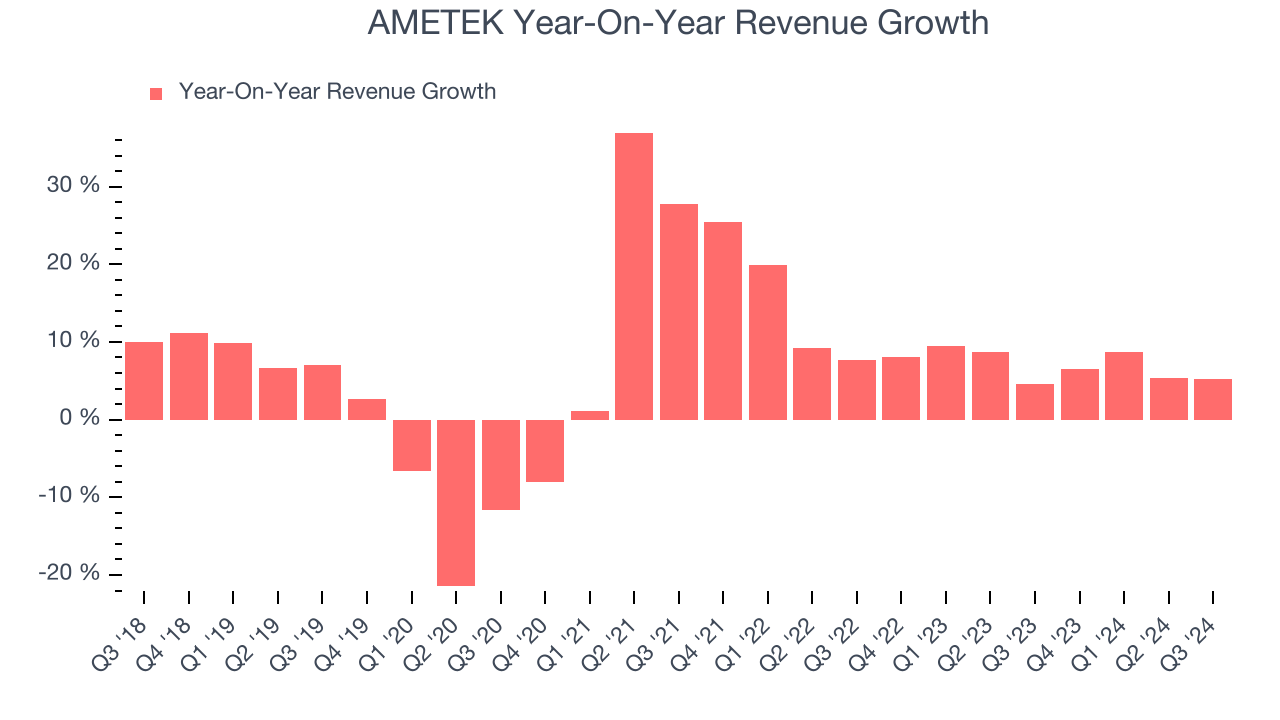

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Regrettably, AMETEK’s sales grew at a mediocre 6.2% compounded annual growth rate over the last five years. This shows it couldn’t expand in any major way, a tough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AMETEK’s annualized revenue growth of 7.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak. We also note many other Internet of Things businesses have faced declining sales because of cyclical headwinds. While AMETEK grew slower than we’d like, it did perform better than its peers.

This quarter, AMETEK grew its revenue by 5.3% year on year, and its $1.71 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and illustrates the market believes its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

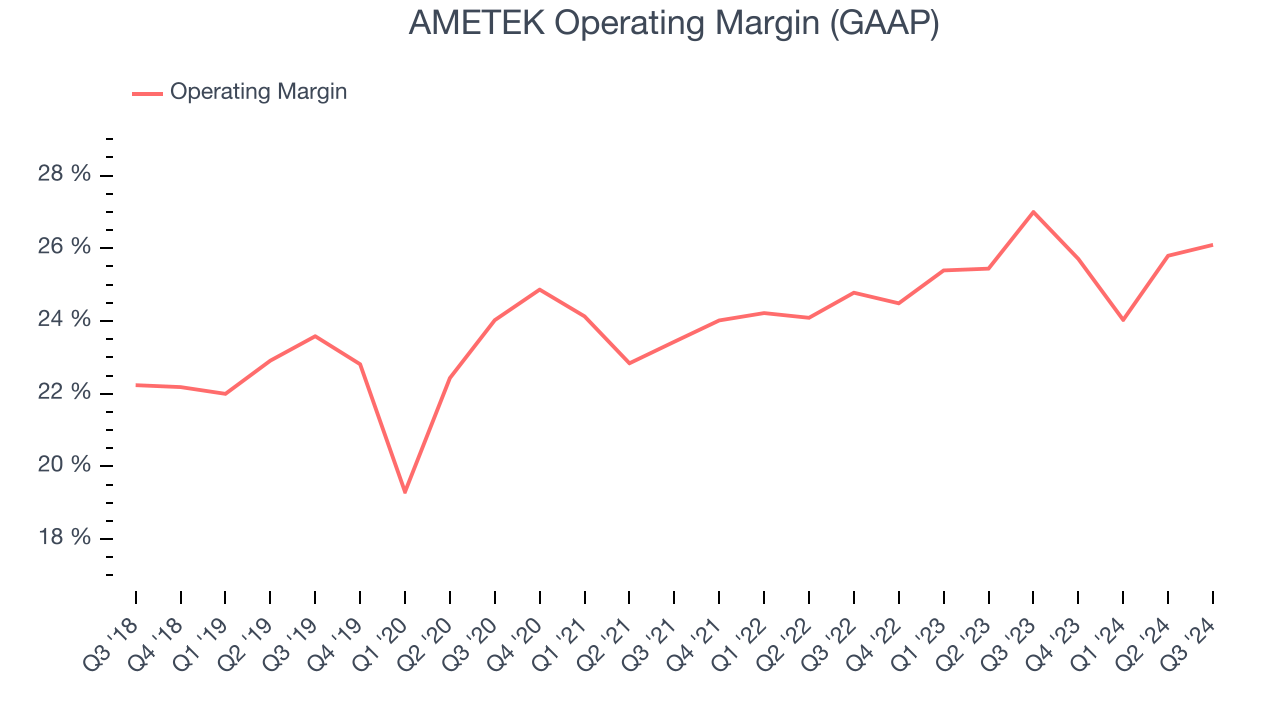

Operating Margin

AMETEK has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.4%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, AMETEK’s annual operating margin rose by 3.3 percentage points over the last five years, showing its efficiency has improved.

This quarter, AMETEK generated an operating profit margin of 26.1%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

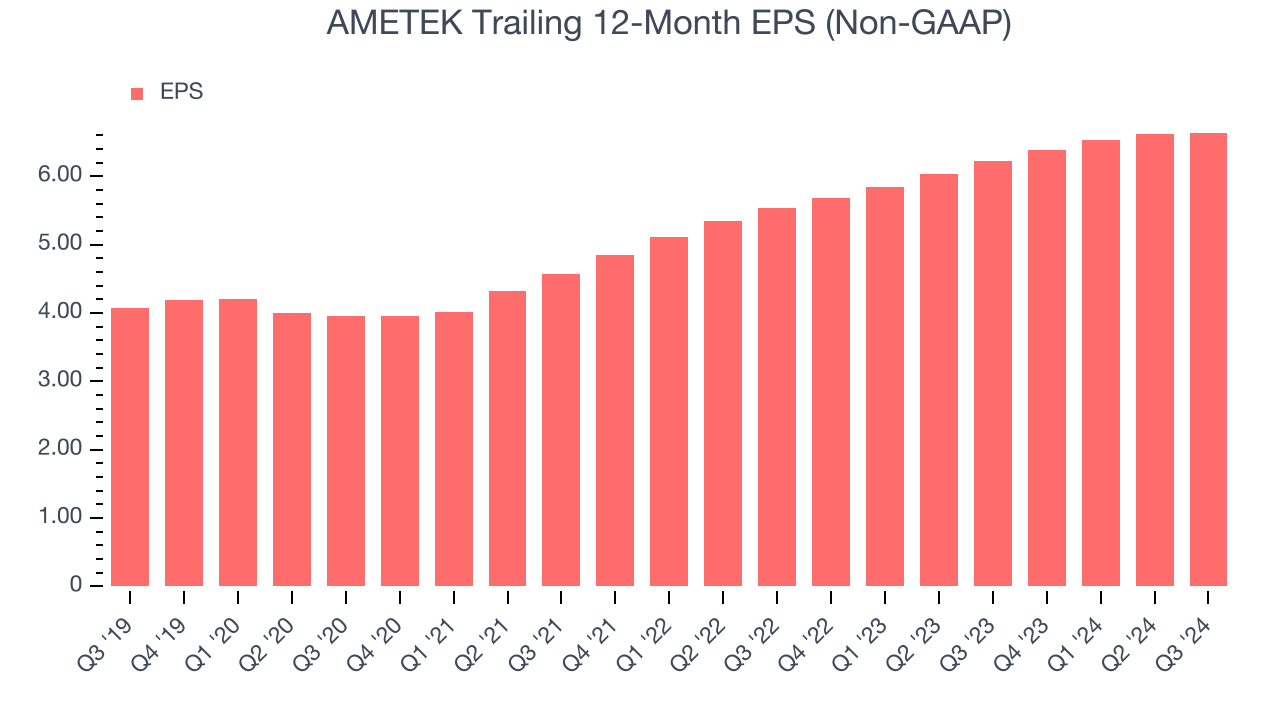

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

AMETEK’s EPS grew at a solid 10.3% compounded annual growth rate over the last five years, higher than its 6.2% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into the nuances of AMETEK’s earnings can give us a better understanding of its performance. As we mentioned earlier, AMETEK’s operating margin was flat this quarter but expanded by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For AMETEK, its two-year annual EPS growth of 9.6% is similar to its five-year trend, implying stable earnings power.In Q3, AMETEK reported EPS at $1.66, up from $1.64 in the same quarter last year. This print beat analysts’ estimates by 2.6%. Over the next 12 months, Wall Street expects AMETEK’s full-year EPS of $6.64 to grow by 8.5%.

Key Takeaways from AMETEK’s Q3 Results

We enjoyed seeing AMETEK beat analysts’ EPS expectations. We were also glad it raised its full-year EPS guidance. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 1.1% to $170.83 immediately following the results.

So do we think AMETEK is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.