Fast-food chain Arcos Dorados (NYSE:ARCO) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 9.1% year on year to $1.08 billion. It made a GAAP profit of $0.14 per share, down from its profit of $0.18 per share in the same quarter last year.

Arcos Dorados (ARCO) Q1 CY2024 Highlights:

- Revenue: $1.08 billion vs analyst estimates of $1.02 billion (5.6% beat)

- Adjusted EBITDA: $108.9 million vs analyst estimates of $102.0 million (6.8% beat)

- EPS: $0.14 vs analyst expectations of $0.17 (17.6% miss)

- Gross Margin (GAAP): 12.2%, down from 13.4% in the same quarter last year

- Same-Store Sales were up 38.6% year on year (beat vs. expectations of up 34.4% year on year)

- Store Locations: 2,381 at quarter end, increasing by 69 over the last 12 months

- Market Capitalization: $2.36 billion

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE:ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

McDonald’s is one of the world’s preeminent fast-food chains and its rapid growth has caught the attention of consumers worldwide.

One such person captivated by McDonald’s was Woods Staton, who joined the company in the 1980s and worked his way up to President of its South Latin America division.

In 2007, Staton saw an opportunity to take on an even larger role in the McDonald’s story. The company decided to sell its operations in Latin America because of the volatile economic environment, and Staton (along with other McDonald’s executives) acquired the stranded assets. Thus, Arcos Dorados was born.

As its largest franchisee, Arcos Dorados controls north of 2,300 McDonald’s restaurants and has access to its extensive knowledge and systems. Furthermore, it has more autonomy than typical franchisees as it has the exclusive right to own, operate, and grant franchises in its territories.

Since its establishment, Arcos Dorados has successfully expanded the McDonald's brand across the region, leveraging its deep understanding of local markets, cultures, and tastes. Its McDonald’s restaurants share many similarities to those in the U.S. aside from a few menu differences, such as the Cheddar McMelt in Brazil.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Fast-food competitors operating in Latin America include Burger King (owned by Restaurant Brands International, NYSE:QSR), Domino’s (NYSE:DPZ), and KFC and Pizza Hut (owned by Yum! Brands, NYSE:YUM).Sales Growth

Arcos Dorados is one of the larger restaurant chains in the industry and benefits from a strong brand, giving it customer mindshare and influence over purchasing decisions.

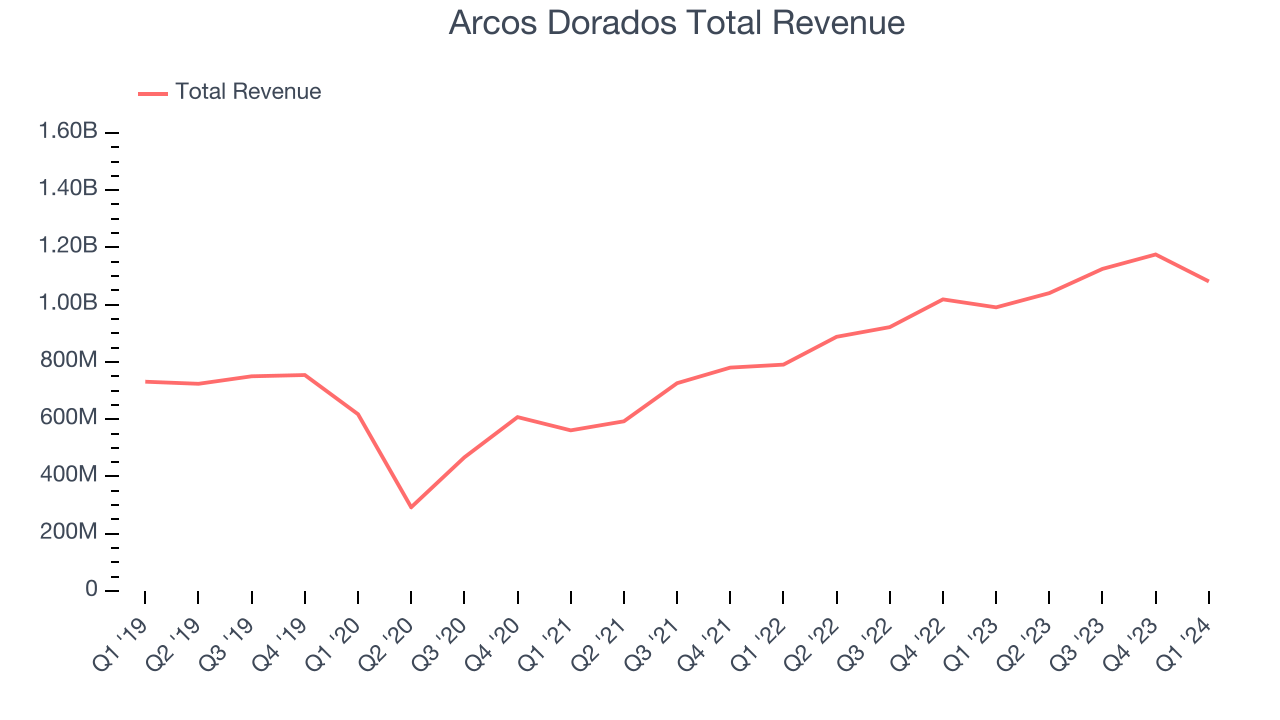

As you can see below, the company's annualized revenue growth rate of 8.3% over the last five years was decent as it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Arcos Dorados reported solid year-on-year revenue growth of 9.1%, and its $1.08 billion in revenue outperformed Wall Street's estimates by 5.6%.

Same-Store Sales

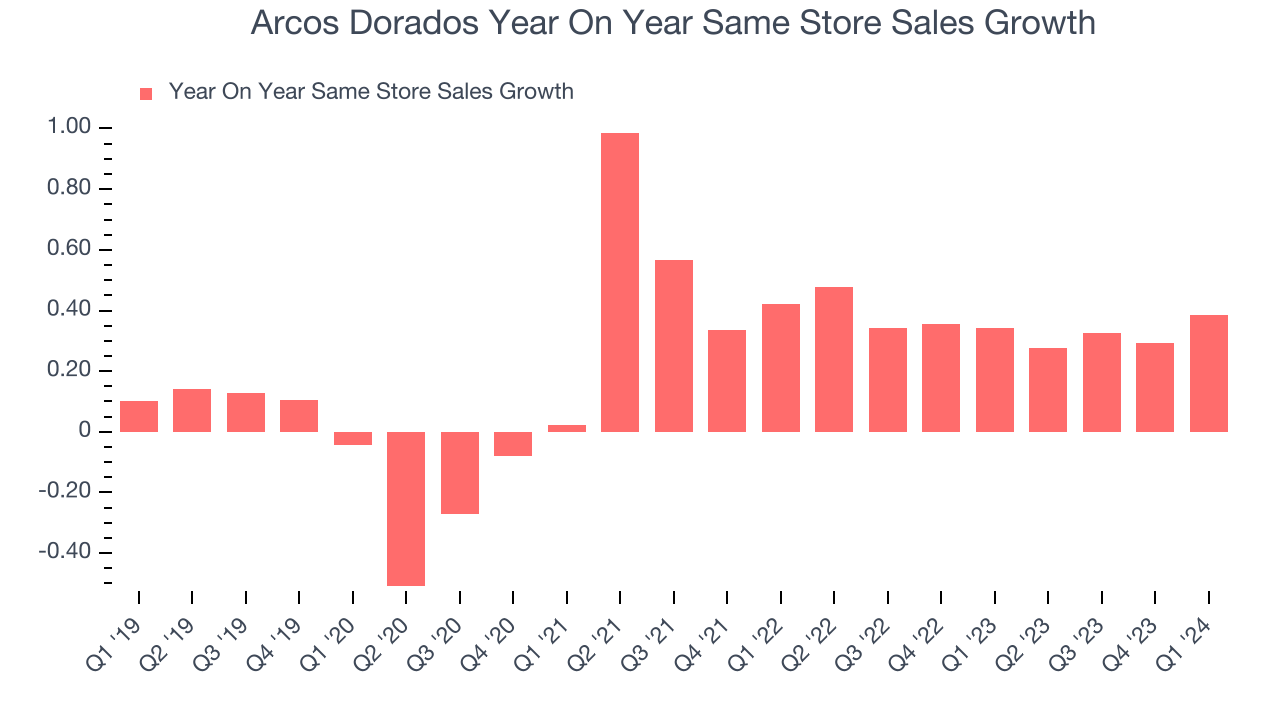

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

Arcos Dorados has been one of the most successful restaurants over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 35%. This performance suggests its steady rollout of new restaurants is beneficial for shareholders. When a chain has strong demand, more locations should help it reach more customers seeking its meals.

In the latest quarter, Arcos Dorados's same-store sales rose 38.6% year on year. This growth was an acceleration from the 34.2% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Number of Stores

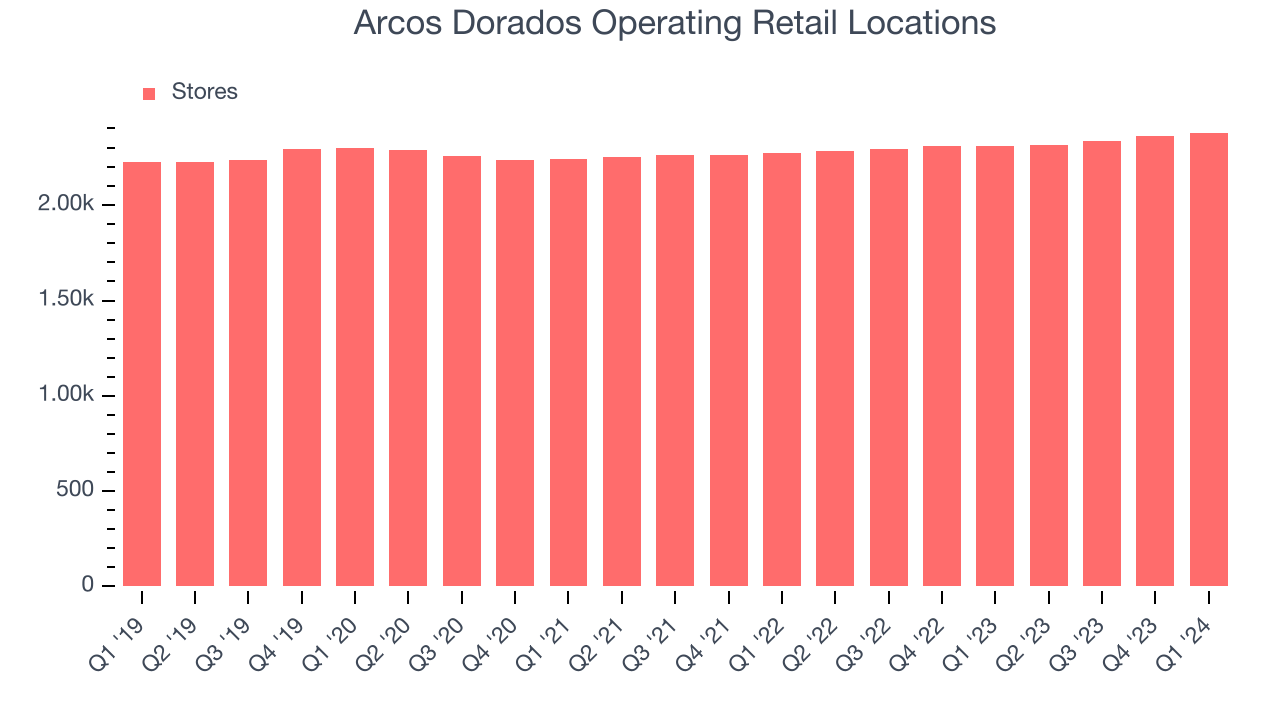

A restaurant chain's total number of dining locations is a crucial factor influencing how much it can sell and how quickly company-level sales can grow.

When a chain like Arcos Dorados is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Arcos Dorados's restaurant count increased by 69, or 3%, over the last 12 months to 2,381 locations in the most recently reported quarter.

Over the last two years, Arcos Dorados has generally opened new restaurants and averaged 1.9% annual growth in new locations, which is on par with the broader sector. Comparisons, however, should be taken with a grain of salt as the industry is quite mature. Analyzing a restaurant's location growth is important because expansion means Arcos Dorados has more opportunities to feed customers and generate sales.

Gross Margin & Pricing Power

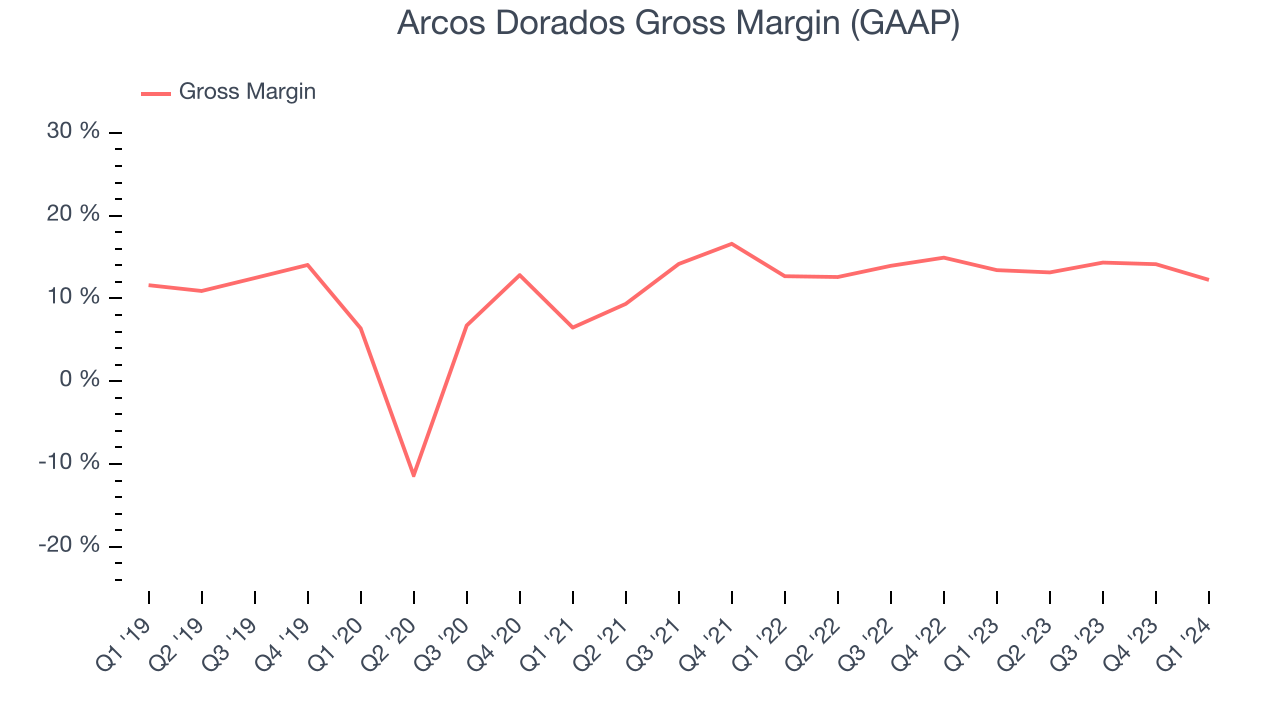

Gross profit margins are an important measure of a restaurant's pricing power and differentiation, whether it be the dining experience or quality and taste of food.

In Q1, Arcos Dorados's gross profit margin was 12.2%. down 1.2 percentage points year on year. This means the company makes $0.14 for every $1 in revenue before accounting for its operating expenses.

Arcos Dorados has poor unit economics for a restaurant company, leaving it with little room for error if things go awry. As you can see above, it's averaged a 13.6% gross margin over the last two years. Its margin has also been trending down over the last year, averaging 1.7% year-on-year decreases each quarter. If this trend continues, it could suggest a more competitive environment where Arcos Dorados has diminishing pricing power and less favorable input costs (such as ingredients and transportation expenses).

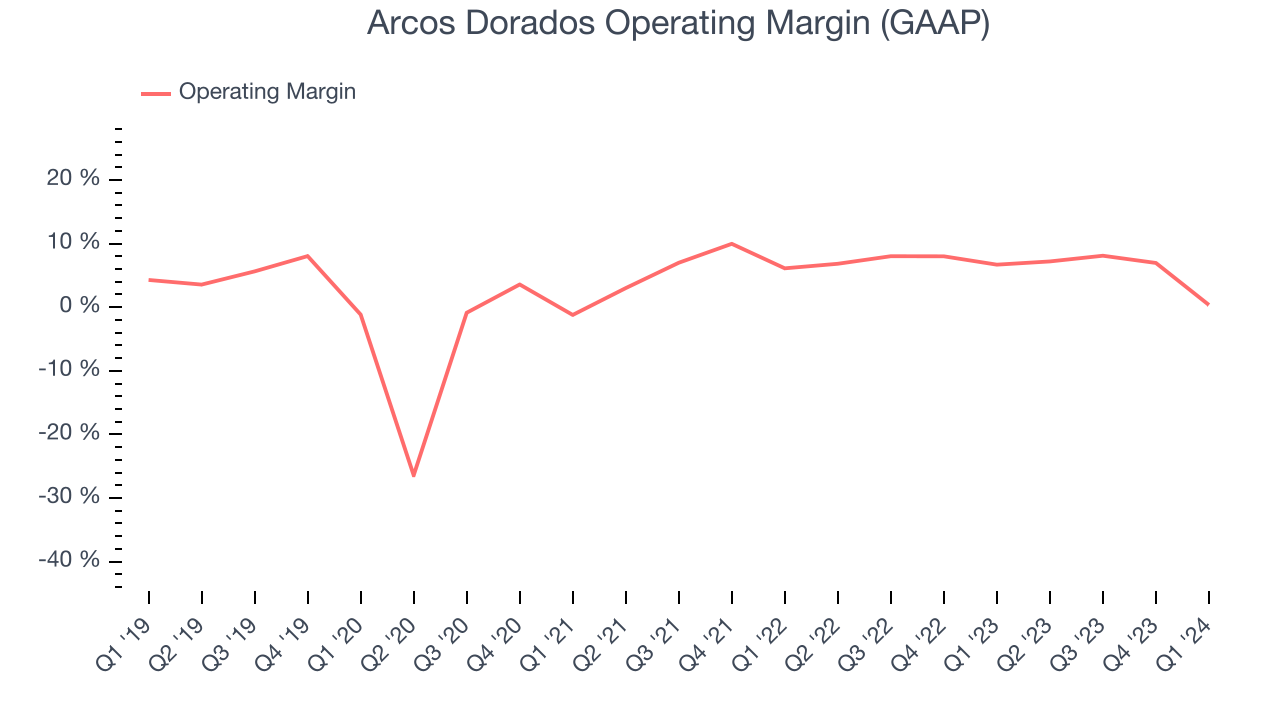

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Arcos Dorados generated an operating profit margin of 0.4%, down 6.3 percentage points year on year. Because Arcos Dorados's operating margin decreased more than its gross margin, we can infer the company was less efficient with its expenses or had lower leverage on its fixed costs.

Zooming out, Arcos Dorados was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a restaurant business, producing an average operating margin of 6.5%. On top of that, Arcos Dorados's margin has declined, on average, by 1.7 percentage points each year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.

Zooming out, Arcos Dorados was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a restaurant business, producing an average operating margin of 6.5%. On top of that, Arcos Dorados's margin has declined, on average, by 1.7 percentage points each year. This shows the company is heading in the wrong direction, and investors are likely hoping for better results in the future.EPS

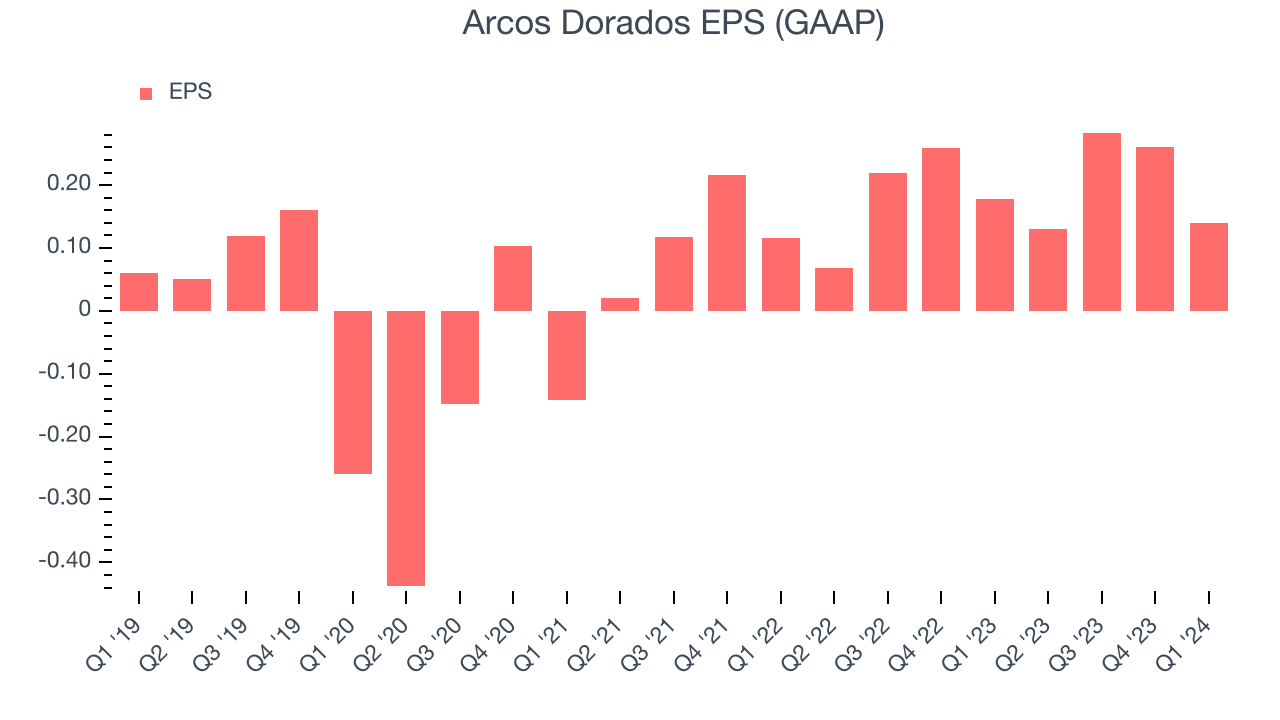

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Arcos Dorados reported EPS at $0.14, down from $0.18 in the same quarter a year ago. This print unfortunately missed Wall Street's estimates, but we care more about long-term EPS growth rather than short-term movements.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 5.4% year-on-year increase in EPS.

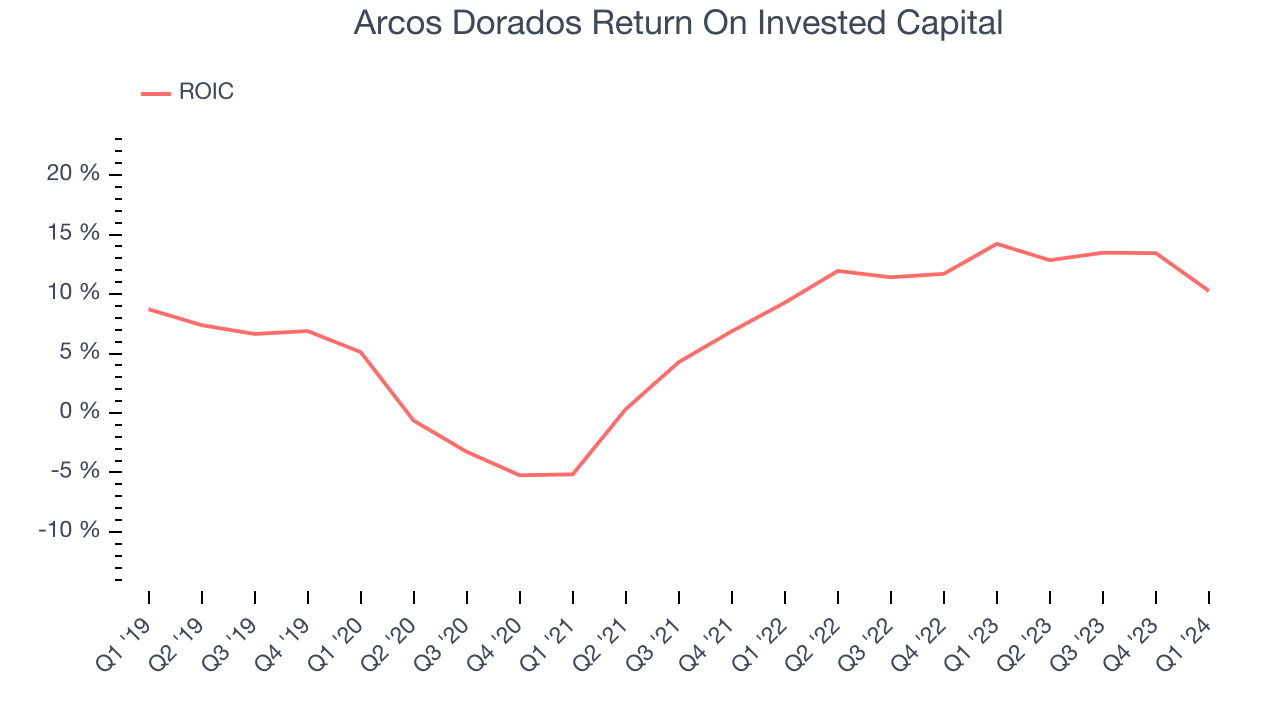

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Arcos Dorados's five-year average ROIC was 6.7%, somewhat low compared to the best restaurant companies that consistently pump out 15%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, Arcos Dorados's ROIC averaged 12.3 percentage point increases. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Arcos Dorados reported $162.5 million of cash and $1.71 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $480.7 million of EBITDA over the last 12 months, we view Arcos Dorados's 3.2x net-debt-to-EBITDA ratio as safe. We also see its $36.92 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Arcos Dorados's Q1 Results

We were impressed by how significantly Arcos Dorados blew past analysts' revenue and adjusted EBITDA expectations this quarter. The CEO struck a positive tone, saying "We see significant growth potential in Latin America and the Caribbean, and we are accelerating restaurant openings." Overall, this was a solid quarter for Arcos Dorados. The stock is up 4.9% after reporting and currently trades at $11.76 per share.

Is Now The Time?

Arcos Dorados may have had a solid quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Arcos Dorados isn't a bad business, but it probably wouldn't be one of our picks. Although its revenue growth has been decent over the last five years, its gross margins make it more challenging to reach positive operating profits compared to other restaurant businesses. And while its marvelous same-store sales growth is on another level, the downside is its projected EPS for the next year is lacking.

We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Arcos Dorados, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $14.13 per share right before these results (compared to the current share price of $11.76).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.