Work management software maker Asana (NYSE:ASAN) reported Q1 FY2022 results beating Wall St's expectations, with revenue up 60.7% year on year to $76.6 million. Asana made a GAAP loss of $60.6 million, down on its loss of $35.8 million, in the same quarter last year.

Is now the time to buy Asana? Get early access to our full analysis of the earnings results here

Asana (NYSE:ASAN) Q1 FY2022 Highlights:

- Revenue: $76.6 million vs analyst estimates of $70.1 million (9.32% beat)

- EPS (non-GAAP): -$0.21 vs analyst estimates of -$0.28

- Revenue guidance for Q2 2022 is $82 million at the midpoint, above analyst estimates of $74 million

- The company lifted revenue guidance for the full year, from $311.5 million to $338 million at the midpoint, a 8.5% increase

- Free cash flow was negative -$7.67 million, compared to negative free cash flow of -$17.49 million in previous quarter

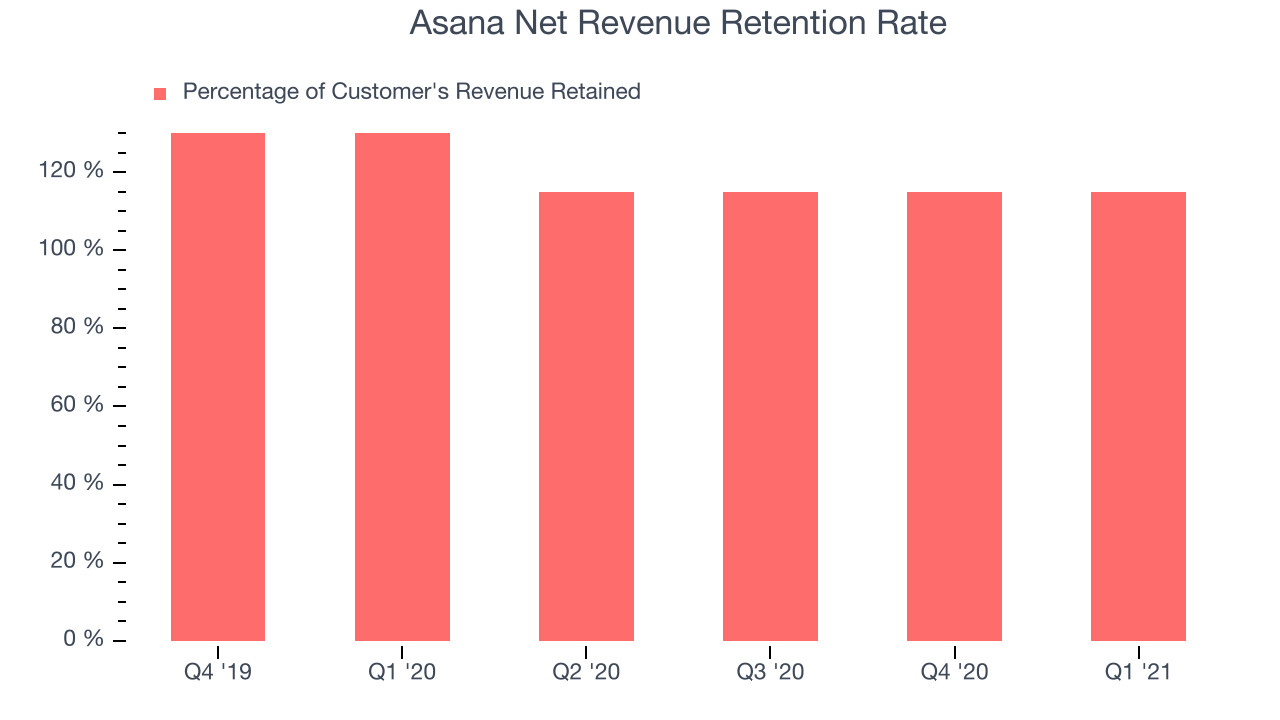

- Net Revenue Retention Rate: 115%, in line with previous quarter

- Customers: 100,000, up from 93,000 in previous quarter

- Gross Margin (GAAP): 89.6%, up from 88% previous quarter

- Updated valuation: Asana is up at $39.5 and accounting for the revenue added in Q1 it now trades at 23.2x price-to-sales (LTM), compared to 25.7x just before the results.

“We are very pleased with the momentum in our first quarter. We reported accelerated revenue growth of 61 percent year over year, we closed large expansions within our existing base and continued to see momentum with some of our largest enterprise customers," said Dustin Moskovitz, co-founder and chief executive officer of Asana.

Eliminating The Work About Work

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work. The software integrates with a large number of other services like Dropbox, Slack or email and aims to create a centralised dashboard with a system of record for all information related to work planning. It is a crowded market and Asana is competing with companies like Atlassian (TEAM), Smartsheet (SMAR), Monday.com or Productboard but the demand is also growing strongly as work becomes more distributed and digitized.

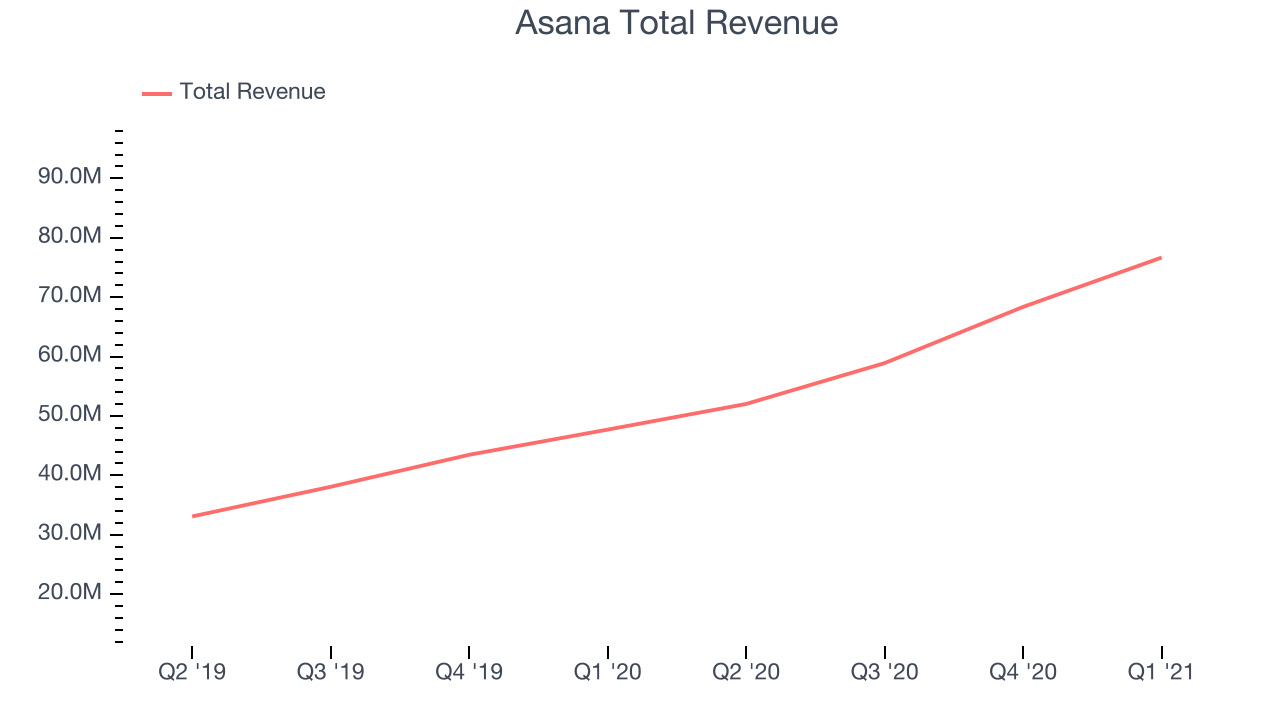

As you can see below, Asana's revenue growth has been exceptional over the last twelve months, growing from $47.7 million to $76.6 million.

This was another standout quarter with the revenue up a splendid 60.7% year on year. But the growth did slow down a little compared to last quarter, as Asana increased revenue by $8.3 million in Q1, compared to $9.46 million revenue add in Q4 2021. We'd like to see revenue increase by a greater amount each quarter, but a one-off fluctuation is usually not concerning.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 80% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Asana's Growth Engine

One of the best things about software as a service businesses (and a reason why they trade at such high multiples) is that customers tend to spend more with the company over time. Asana is offering a limited version of its product for no cost to power a bottom-up distribution model. The software often starts being adopted by a single team in a company and over time penetrates the organization which becomes a paying customer, as more users are invited to collaborate.

Asana's net revenue retention rate, an important measure of how much customers from a year ago were spending at the end of the quarter, was at 115% in Q1. That means even if they didn't win any new customers, Asana would have grown its revenue 15% year on year. Despite it going down over the last year this is still a good retention rate and a proof that Asana's customers are satisfied with their software and are getting more value from it over time. That is good to see.

Key Takeaways from Asana's Q1 Results

Since it is still burning cash it is worth keeping an eye on Asana’s balance sheet, but we note that with market capitalisation of $6.02 billion and more than $386.3 million in cash, the company has the capacity to continue to prioritise growth over profitability.

We were impressed by how strongly Asana outperformed analysts’ revenue expectations this quarter. And we were also excited to see the really strong revenue guidance for the full year. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. Therefore, we think Asana will continue to stand out as a compelling growth stock, arguably even more so than before.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.