Work management software maker Asana (NYSE: ASAN) reported Q3 FY2024 results topping analysts' expectations, with revenue up 17.7% year on year to $166.5 million. The company expects next quarter's revenue to be around $167.5 million, in line with analysts' estimates.

Is now the time to buy Asana? Find out by accessing our full research report, it's free.

Asana (ASAN) Q3 FY2024 Highlights:

- Revenue: $166.5 million vs analyst estimates of $164.1 million (1.5% beat)

- Billings: $160.8 million vs. analyst estimates of $166.4 million (3.4% miss)

- EPS (non-GAAP): -$0.04 vs analyst estimates of -$0.11

- Revenue Guidance for Q4 2024 is $167.5 million at the midpoint, roughly in line with what analysts were expecting

- Full year guidance raised for revenue and non-GAAP operating income

- Free Cash Flow was -$11.47 million, down from $14.61 million in the previous quarter

- Net Revenue Retention Rate: 100%, down from 105% in the previous quarter (miss vs. expectations of ~103%)

- Gross Margin (GAAP): 90.4%, up from 89.3% in the same quarter last year

“Asana’s Q3 results beat expectations on the top and bottom line. Overall revenue growth was better than our guidance, revenues from our Core customers grew 20 percent, and operating margin improved significantly year over year," said Dustin Moskovitz, co-founder and chief executive officer of Asana.

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE:ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

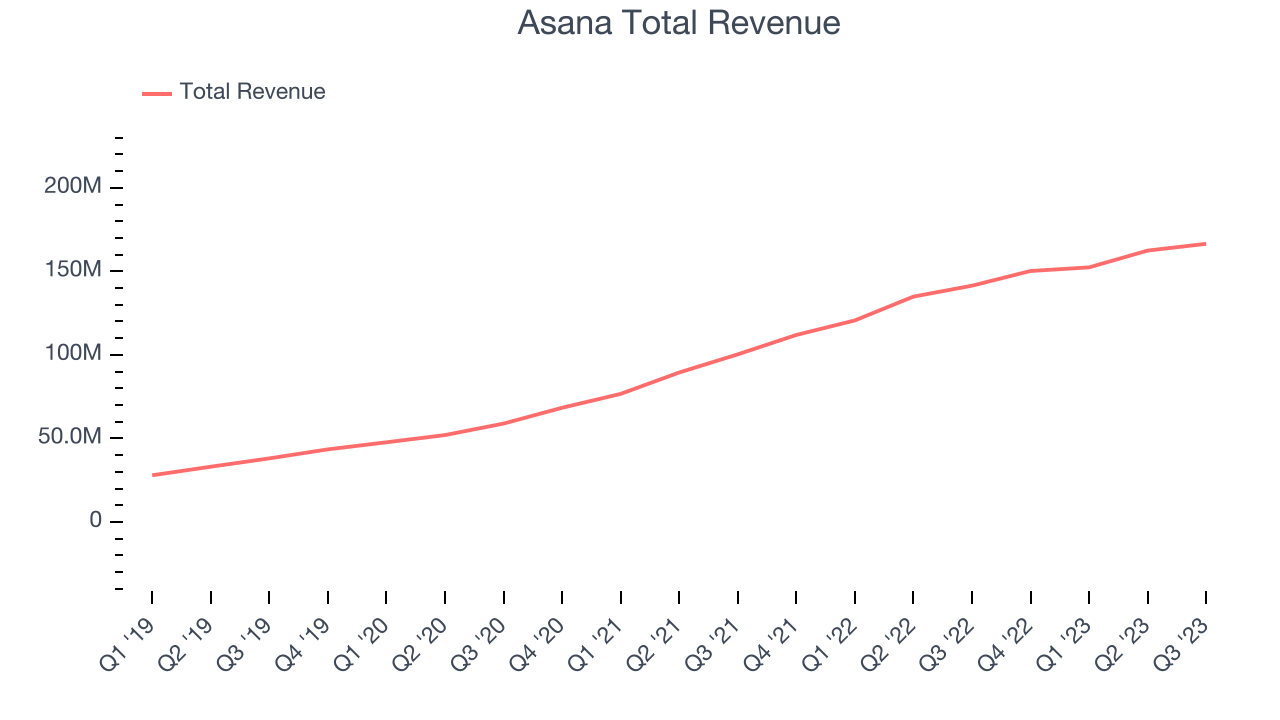

Sales Growth

As you can see below, Asana's revenue growth has been very strong over the last two years, growing from $100.3 million in Q3 FY2022 to $166.5 million this quarter.

This quarter, Asana's quarterly revenue was once again up 17.7% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $4.05 million in Q3 compared to $10.04 million in Q2 2024. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter, Asana is guiding for a 10.3% year-on-year revenue decline to $167.5 million, a further deceleration from the 34.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 11.6% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

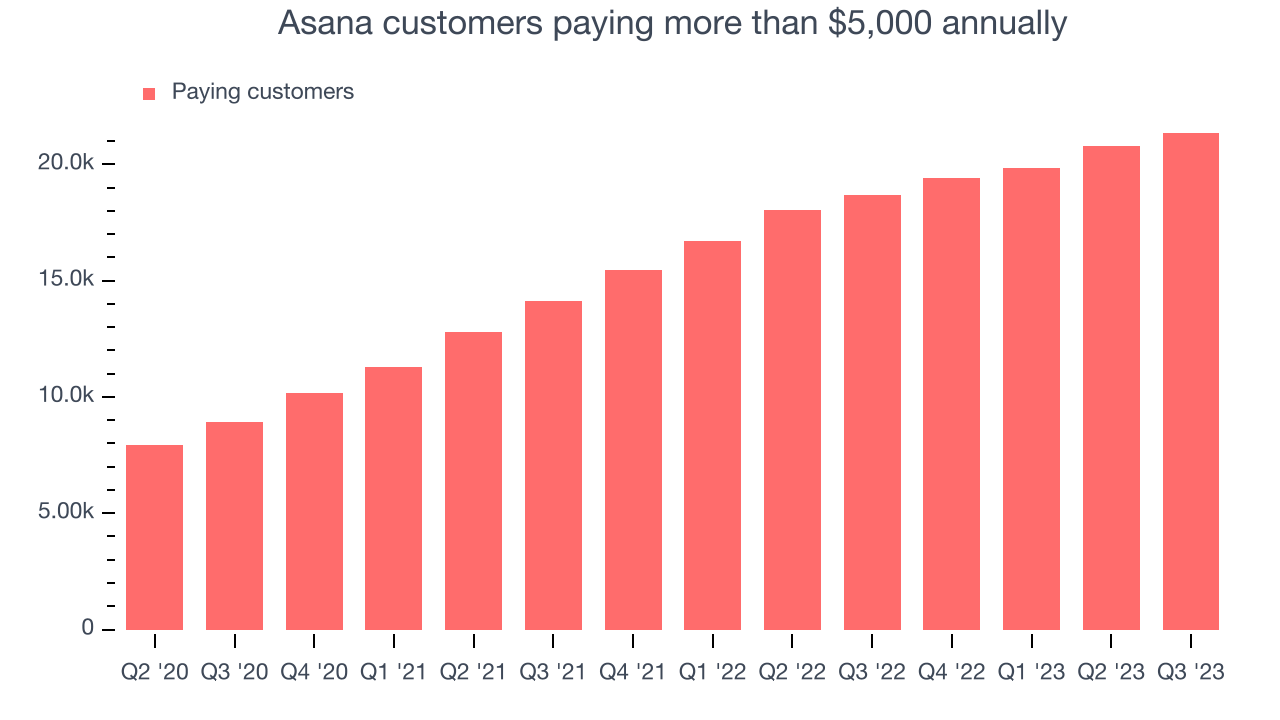

Large Customers Growth

This quarter, Asana reported 21,346 enterprise customers paying more than $5,000 annually, an increase of 564 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from Asana's Q3 Results

With a market capitalization of $5.07 billion, Asana is among smaller companies, but its more than $268.3 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

It was encouraging to see Asana narrowly top analysts' revenue expectations this quarter, although calculated billings (revenue + change in deferred revenue) missed expectations. Additionally, net revenue retention, an important metric that could give hints on customer satisfaction, willingness to increase spending, and even competition, fell and missed. Guidance was good. Next quarter's guidance was ahead and full year guidance was raised for revenue and non-GAAP operating income. Overall, this was a mixed quarter for Asana. The company is down 5.8% on the results and currently trades at $21.95 per share.

So should you invest in Asana right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.