Tax compliance software maker Avalara (NYSE:AVLR) announced better-than-expected results in the Q1 FY2021 quarter, with revenue up 37.8% year on year to $153.6 million. Avalara made a GAAP loss of $29.9 million, down on it's loss of $15.2 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Avalara (AVLR) Q1 FY2021 Highlights:

- Revenue: $153.6 million vs analyst estimates of $143.1 million (7.32% beat)

- EPS (non-GAAP): -$0.08 vs analyst expectations of -$0.12

- Revenue guidance for Q2 2021 is $154 million at the midpoint, above analyst estimates of $148.2 million

- The company lifted revenue guidance for the full year, from $630.5 million to $652 million at the midpoint, a 3.4% increase

- Free cash flow was negative -$31.93 million, down from positive free cash flow of $28.5 million in previous quarter

- Net Revenue Retention Rate: 107%, up from 104% previous quarter

- Customers: 15,580, up from 14,890 in previous quarter

- Gross Margin (GAAP): 70.9%, in line with previous quarter

“We are off to a great start in 2021, continuing the momentum we experienced in 2020. We experienced notable strength throughout our business, resulting in total revenue growth of 38% year-over-year in the first quarter and 47% year-over-year calculated billings growth,” said Scott McFarlane, Avalara co-founder and chief executive officer.

Automating Tax Compliance

Founded in 2004, Avalara (NYSE:AVLR) offers software as a service that provides companies with real-time information on how much tax to charge and automates tax compliance. Transactional taxes are complex, with thousands of rules set by local, regional, state, federal and international authorities. For example, in New York sliced bagel is taxed, but if you just take a plain bagel to go - no tax. Navigating these rules and staying up to date is challenging for any company, but especially for small and mid-sized businesses that have limited resources and have been typically keeping track of tax rates for their products manually in spreadsheets.

Avalara works through integration with a wide variety of point-of-sales systems (cash registers) and online billing platforms like Shopify or Stripe. Every time a customer is about to be charged, either in the real world or online, a request is sent to Avalara to determine the tax. The company maintains a huge database of millions of products and their appropriate tax rates in different geographies worldwide, and within few milliseconds returns back the correct tax amount to be charged. It then passes the information into merchant's tax software and even helps with filing the tax.

Avalara is mainly replacing work their customers either used to do manually themselves or with outside help, but there are other software companies operating in this space like Vertex (NASDAQ:VERX) that are focusing on large enterprises. The demand is driven by increase in digital commerce and ongoing adoption of technology by merchants which then allows for automation services like Avalara.

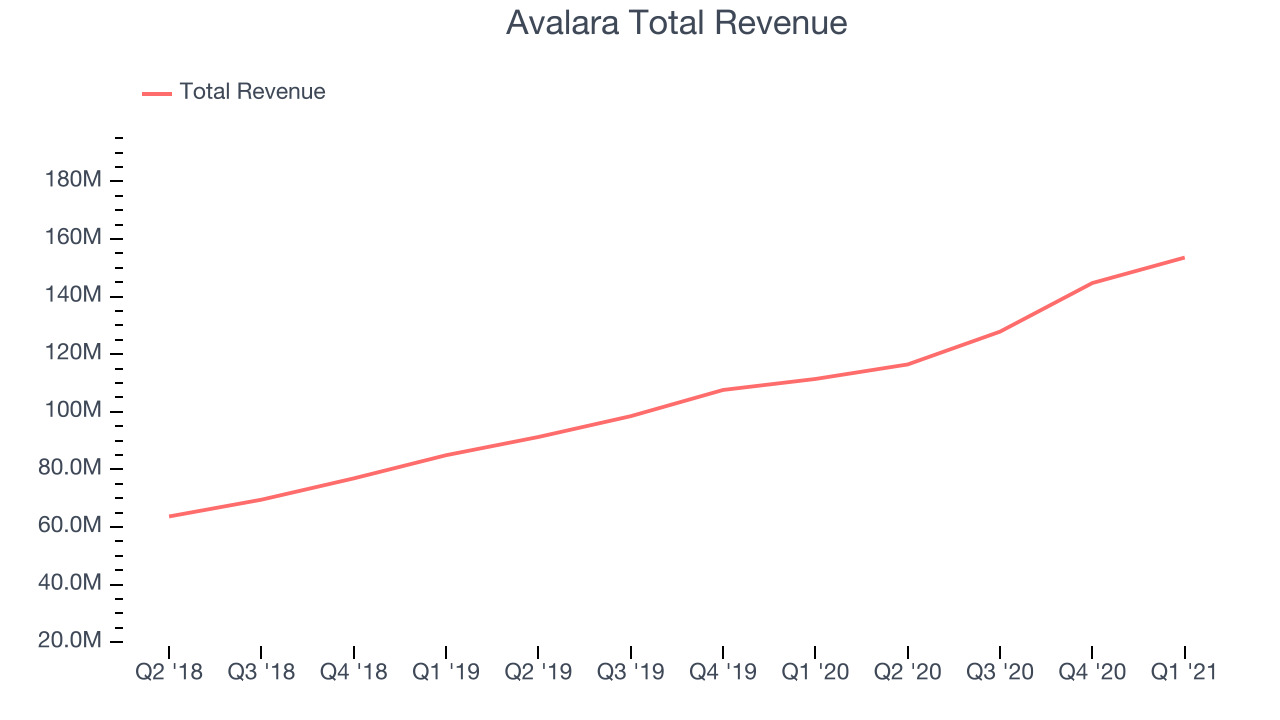

As you can see below, Avalara's revenue growth has been very strong over the last twelve months, growing from $111.4 million to $153.6 million.

And unsurprisingly, this was another great quarter for Avalara with revenue up an absolutely stunning 37.8% year on year. But the growth did slow down compared to last quarter, as the revenue increased by just $8.84 million in Q1, compared to $16.8 million in Q4 2020. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Bringing Small And Medium Sized Businesses Into The Cloud Era

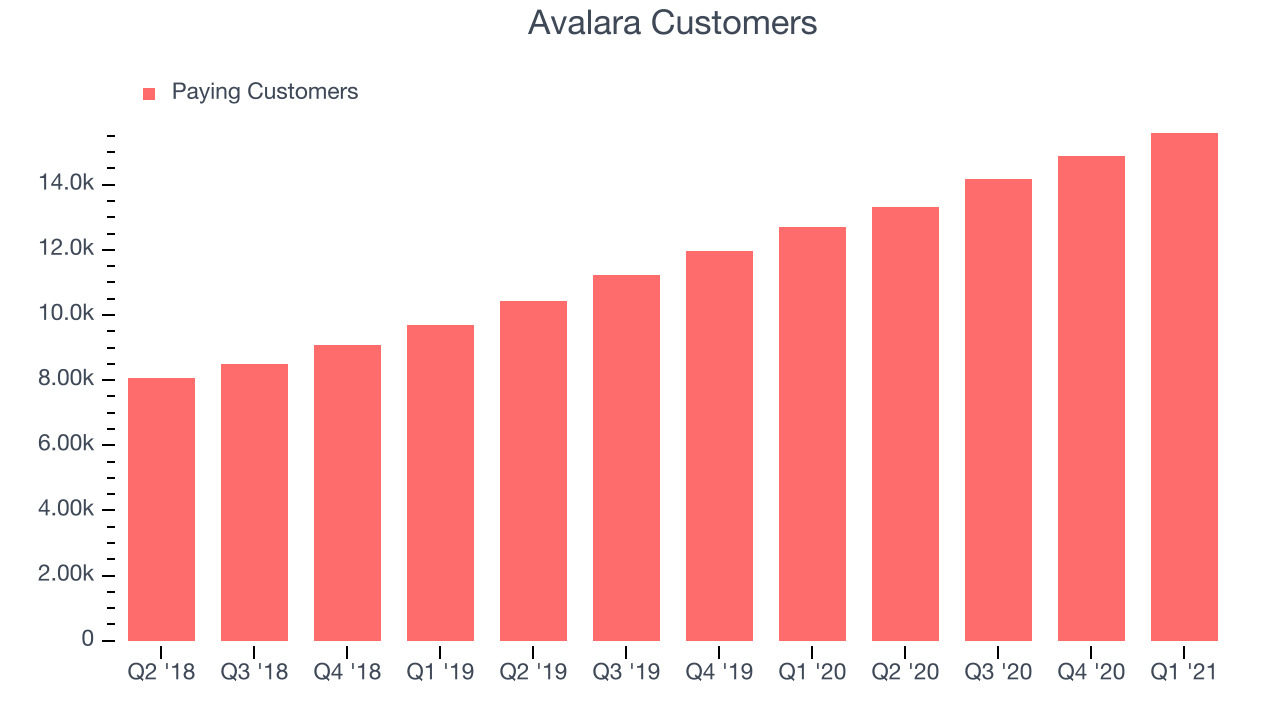

Most of Avalara's customers are small and medium size businesses that have until now been lacking the tools to deal with transaction tax compliance. Most of them are in the United States, but the company also supports transaction tax compliance in Europe, South America, and Asia.

You can see below that Avalara reported 15,580 customers at the end of the quarter, an increase of 690 on last quarter. That is in line with the customer growth we have seen over the last couple of quarters, suggesting that the company can maintain its current sales momentum.

Key Takeaways from Avalara's Q1 Results

With market capitalisation of $11.2 billion, more than $638.7 million in cash and with free cash flow over the last twelve months being positive, the company is in a very strong position to invest in growth.

We were impressed by how strongly Avalara outperformed analysts’ revenue expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Zooming out, we think this impressive quarter should have shareholders feeling very positive. Therefore, we think Avalara will become more attractive to investors, compared to before these results.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.