Looking back on finance and HR software stocks' Q3 earnings, we examine this quarters’ best and worst performers, including Avalara (NYSE:AVLR) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a strong Q3; on average, revenues beat analyst consensus estimates by 6.37%, while on average next quarter revenue guidance was 4.1% above consensus. The whole tech sector has been facing a sell-off since late last year and finance and HR software stocks have not been spared, with share price down 27.9% since earnings, on average.

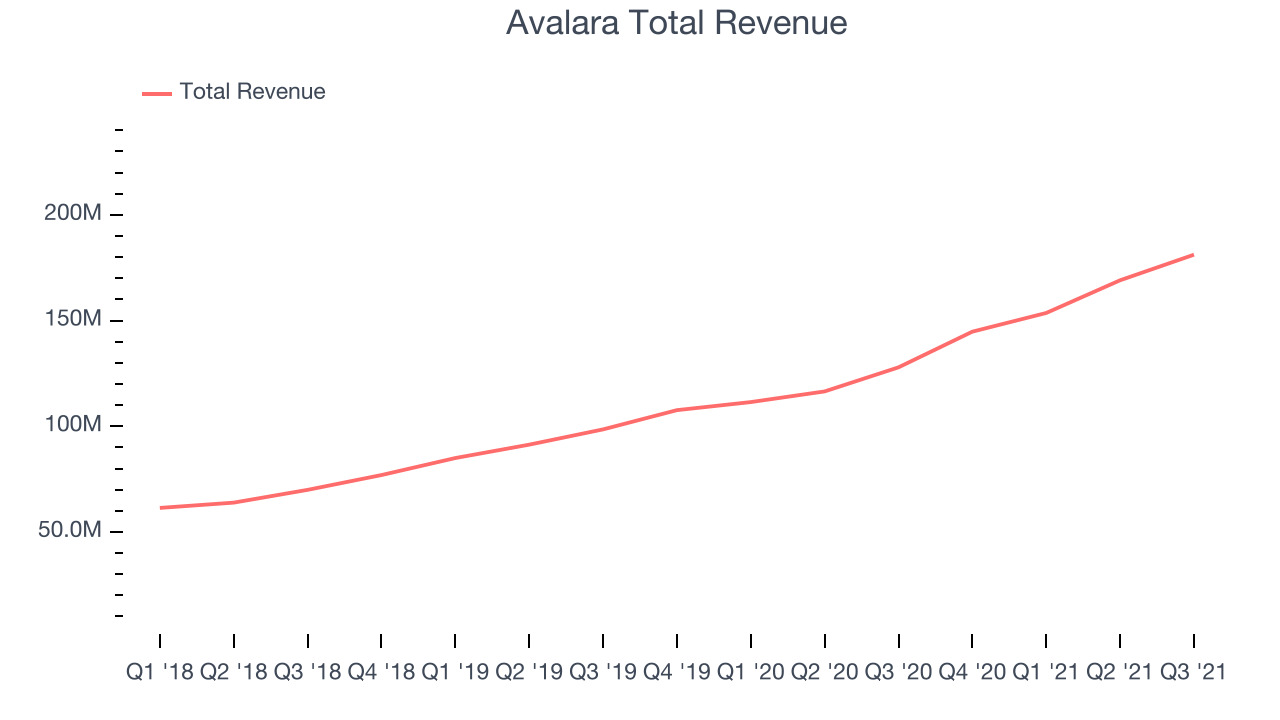

Avalara (NYSE:AVLR)

Founded by Scott McFarlane in 2004, Avalara (NYSE:AVLR) offers software as a service that provides companies with real-time information on how much tax to charge and automates tax compliance.

Avalara reported revenues of $181.1 million, up 41.6% year on year, beating analyst expectations by 6.35%. It was a strong quarter for the company, with an exceptional revenue growth and a solid beat of analyst estimates.

“The third quarter was another great quarter for Avalara, demonstrating the strength and durability of our business model. We reported total revenue of $181 million, representing an increase of 42% year-over-year, one of our strongest quarters in history,” said Scott McFarlane, Avalara co-founder and chief executive officer.

The popular fintech stock is down 44.8% since the results and currently trades at $102.76.

Is now the time to buy Avalara? Access our full analysis of the earnings results here, it's free.

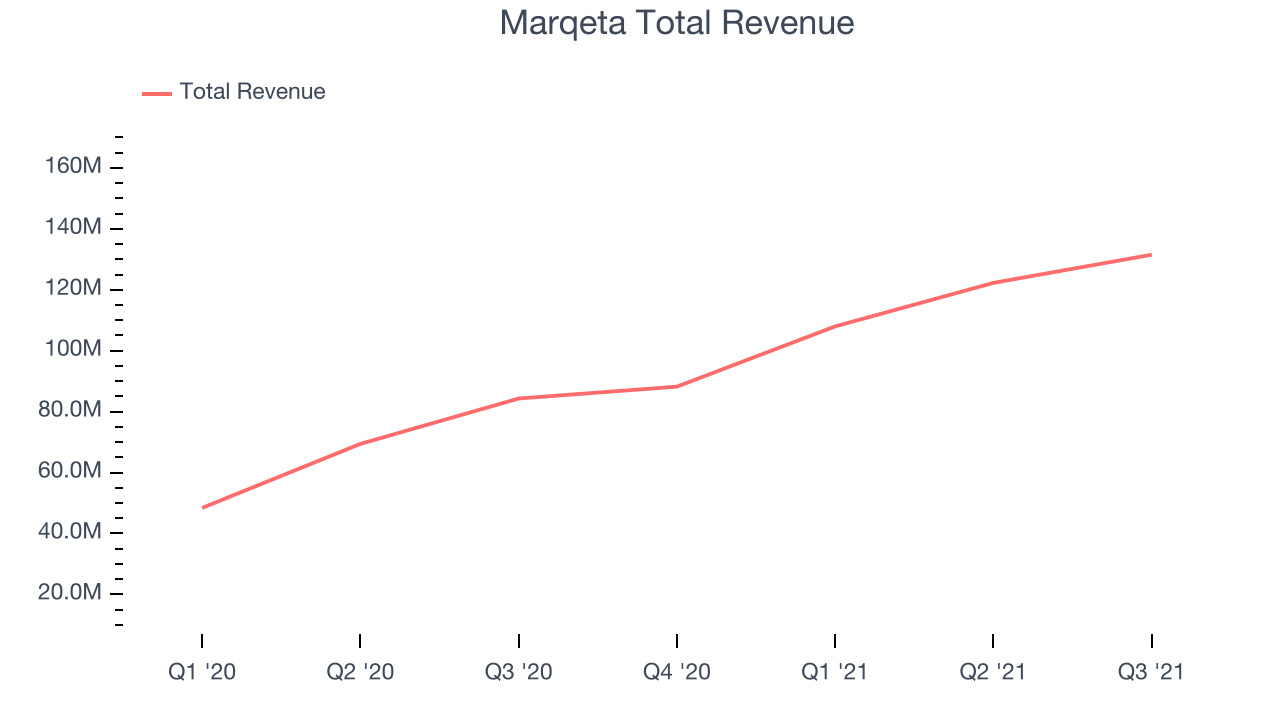

Best Q3: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $131.5 million, up 56% year on year, beating analyst expectations by 10.3%. It was a good quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

The stock is down 49% since the results and currently trades at $12.76.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $257.2 million, up 25.8% year on year, beating analyst expectations by 1.19%. It was a slower quarter for the company, with a decline in gross margin and decelerating customer growth.

Ceridian had the weakest full year guidance update in the group. The company added 63 customers to a total of 5,227. The stock is down 37.6% since the results and currently trades at $79.98.

Read our full analysis of Ceridian's results here.

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $89.2 million, up 15.5% year on year, beating analyst expectations by 3.1%. It was a strong quarter for the company, with accelerating growth in large customers .

The company added 26 enterprise customers paying more than $100,000 annually to a total of 720. The stock is down 13.2% since the results and currently trades at $16.00.

Read our full, actionable report on Zuora here, it's free.

Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $2 billion, up 51.7% year on year, beating analyst expectations by 10.6%. It was an strong quarter for the company, with an impressive beat of analyst estimates.

The stock is down 15.1% since the results and currently trades at $535.51.

Read our full, actionable report on Intuit here, it's free.

The author has no position in any of the stocks mentioned