As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the finance and HR software stocks, starting with Avalara (NYSE:AVLR).

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a solid Q4; on average, revenues beat analyst consensus estimates by 5.66%, while on average next quarter revenue guidance was 2.56% above consensus. There has been a stampede out of high valuation technology stocks, but finance and HR software stocks held their ground better than others, with the share price up 9.61% since earnings, on average.

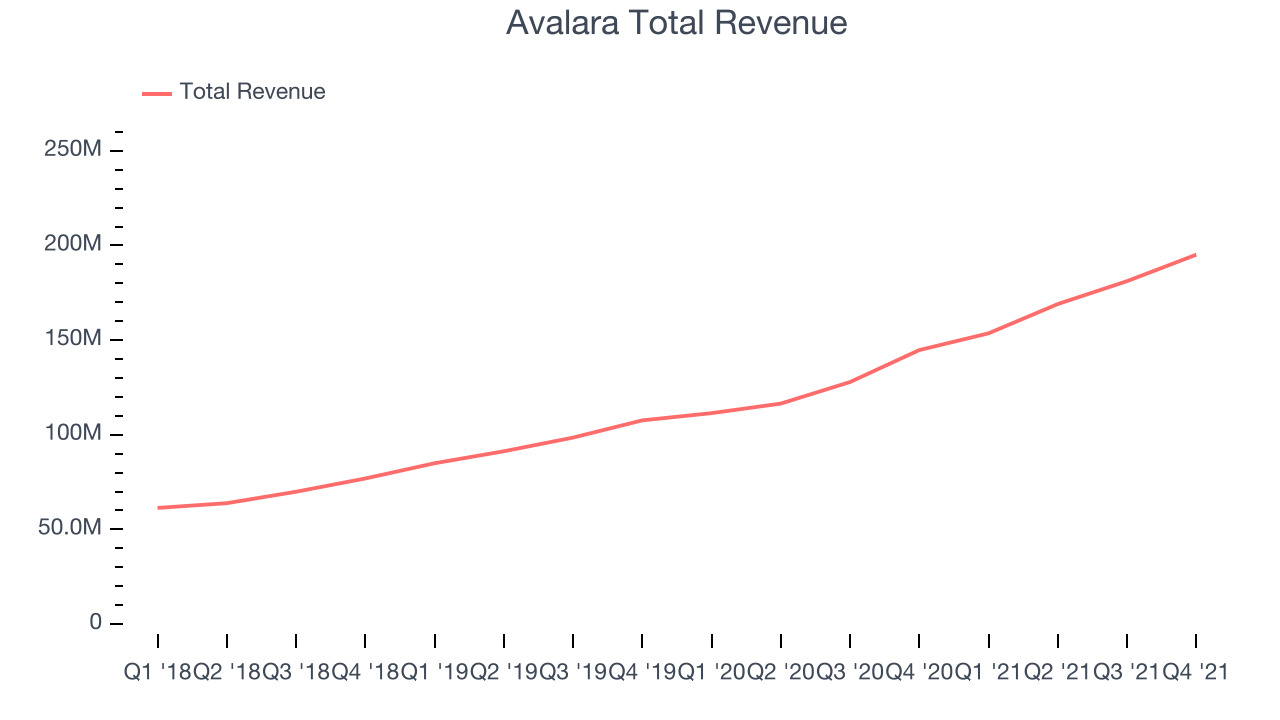

Avalara (NYSE:AVLR)

Founded by Scott McFarlane in 2004, Avalara (NYSE:AVLR) offers software as a service that provides companies with real-time information on how much tax to charge and automates tax compliance.

Avalara reported revenues of $195.1 million, up 34.8% year on year, beating analyst expectations by 5.84%. It was a strong quarter for the company, with a solid beat of analyst estimates and revenue guidance for the next quarter above analysts' estimates.

“For the full year we accelerated our topline, achieving revenue growth of 40% year-over-year, and we delivered our third consecutive year of positive operating and free cash flow,” said Scott McFarlane, Avalara co-founder and chief executive officer.

The stock is down 4.36% since the results and currently trades at $107.61.

Is now the time to buy Avalara? Access our full analysis of the earnings results here, it's free.

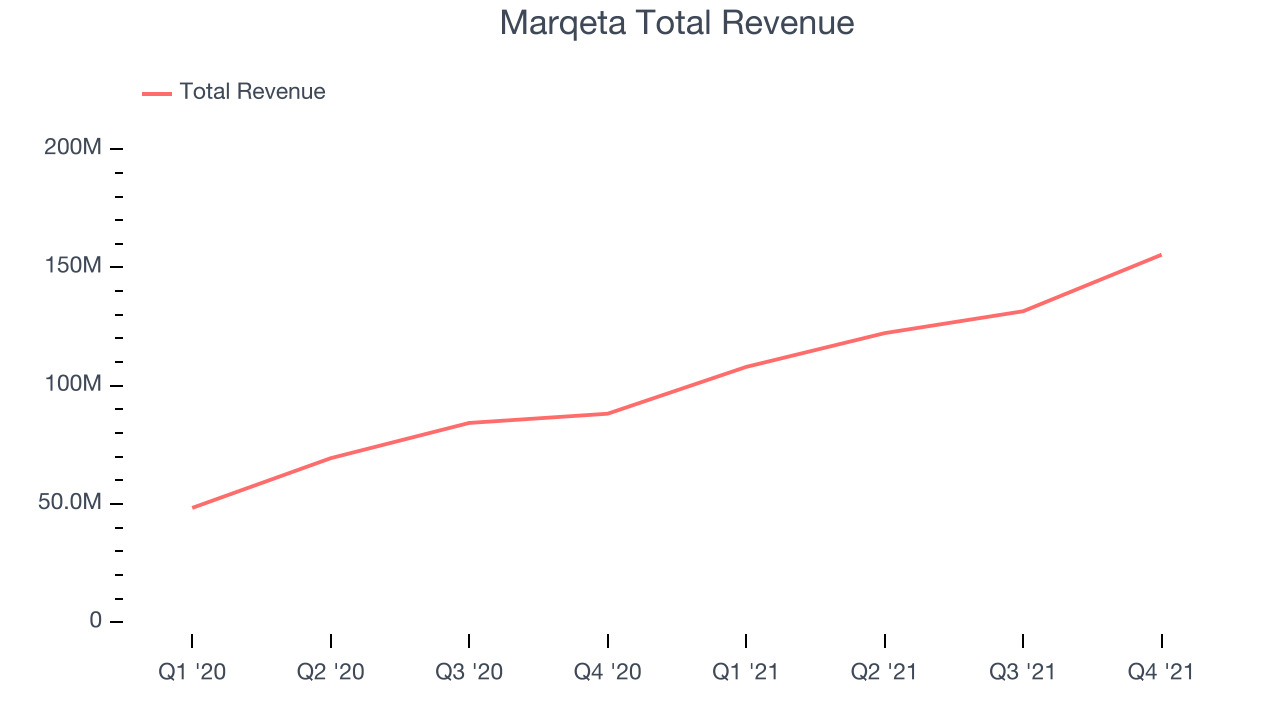

Best Q4: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $155.4 million, up 76.2% year on year, beating analyst expectations by 12.7%. It was an incredible quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

The stock is up 9.99% since the results and currently trades at $11.78.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Coupa (NASDAQ:COUP)

Founded in 2006 by former Oracle executives, Coupa Software (COUP) is a software as a service platform that helps enterprises manage their spending across procurement, billing and business expenses and get a better visibility into how the money is spent.

Coupa reported revenues of $193.2 million, up 18.1% year on year, beating analyst expectations by 3.82%. It was a weak quarter for the company, with the guidance for both the next quarter and the full year below analyst estimates.

Coupa had the weakest full year guidance update in the group. The stock is up 20.1% since the results and currently trades at $108.

Read our full analysis of Coupa's results here.

Workiva (NYSE:WK)

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $120.7 million, up 28.7% year on year, beating analyst expectations by 3.14%. It was a mixed quarter for the company, with a decent beat of analyst estimates but decelerating customer growth.

The company added 78 enterprise customers paying more than $100,000 annually to a total of 1,121. The stock is up 17% since the results and currently trades at $119.80.

Read our full, actionable report on Workiva here, it's free.

Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $21.1 million, up 28.4% year on year, beating analyst expectations by 2%. It was a decent for the company, with a significant improvement in gross margin and revenue guidance for the next quarter roughly in-line with analysts' estimates.

The stock is down 5.19% since the results and currently trades at $6.39.

Read our full, actionable report on Asure Software here, it's free.

The author has no position in any of the stocks mentioned