Adhesive manufacturing company Avery Dennison (NYSE:AVY) will be announcing earnings results tomorrow before market open. Here’s what to expect.

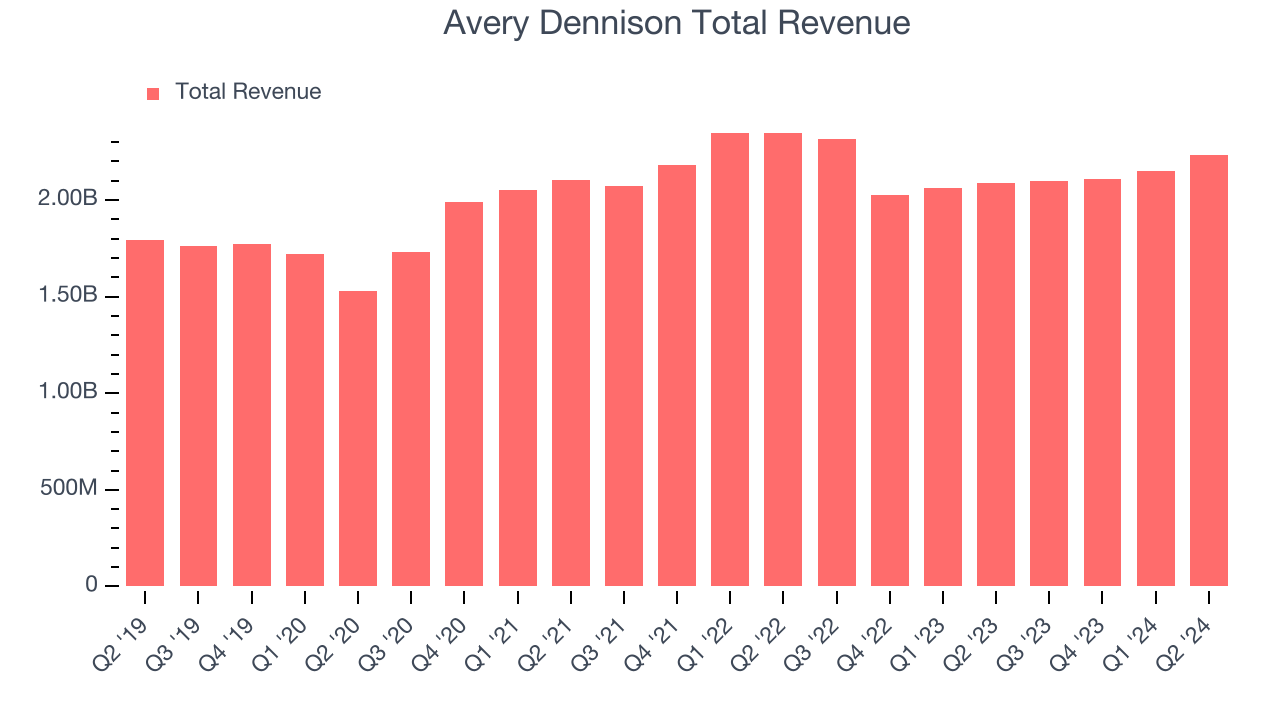

Avery Dennison beat analysts’ revenue expectations by 1.9% last quarter, reporting revenues of $2.24 billion, up 6.9% year on year. It was a very strong quarter for the company, with an impressive beat of analysts’ organic revenue and operating margin estimates.

Is Avery Dennison a buy or sell going into earnings? Read our full analysis here, it’s free.

This quarter, analysts are expecting Avery Dennison’s revenue to grow 4.7% year on year to $2.20 billion, a reversal from the 9.4% decrease it recorded in the same quarter last year. Adjusted earnings are expected to come in at $2.35 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Avery Dennison has missed Wall Street’s revenue estimates four times over the last two years.

Looking at Avery Dennison’s peers in the industrials segment, some have already reported their Q3 results, giving us a hint as to what we can expect. Crown Holdings posted flat year-on-year revenue, meeting analysts’ expectations, and Richardson Electronics reported revenues up 2.2%, topping estimates by 8.7%. Crown Holdings traded up 4.2% following the results while Richardson Electronics was down 2.5%.

Read our full analysis of Crown Holdings’s results here and Richardson Electronics’s results here.

There has been positive sentiment among investors in the industrials segment, with share prices up 2.3% on average over the last month. Avery Dennison’s stock price was unchanged during the same time and is heading into earnings with an average analyst price target of $233.86 (compared to the current share price of $215.41).

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.