As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the auto parts retailer industry, including AutoZone (NYSE:AZO) and its peers.

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

The 5 auto parts retailer stocks we track reported a mixed Q2. As a group, revenues missed analysts’ consensus estimates by 0.7%.

Big picture, the Federal Reserve has a dual mandate of inflation and employment. The former had been running hot throughout 2021 and 2022 but cooled towards the central bank's 2% target as of late. This prompted the Fed to cut its policy rate by 50bps (half a percent) in September 2024. Given recent employment data that suggests the US economy could be wobbling, the markets will be assessing whether this rate cut and future ones (the Fed signaled more to come in 2024 and 2025) are the right moves at the right time or whether they're too little, too late for a macro that has already cooled.

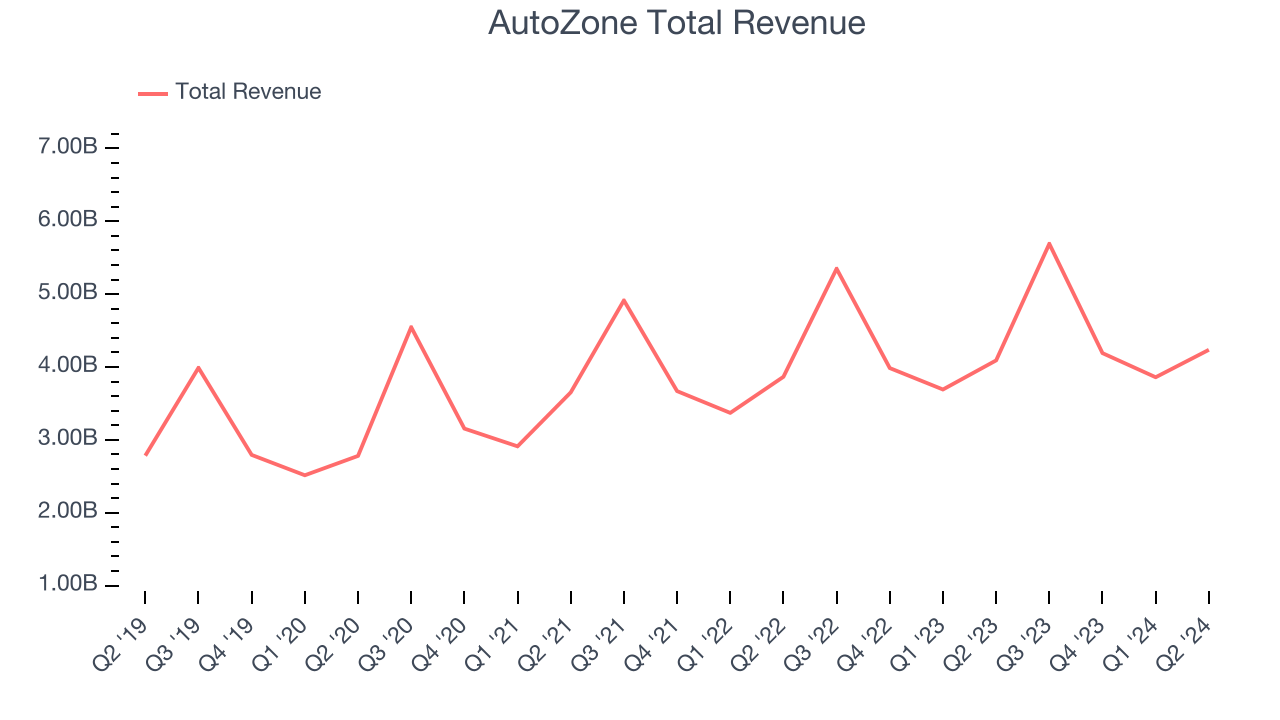

AutoZone (NYSE:AZO)

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

AutoZone reported revenues of $4.24 billion, up 3.5% year on year. This print fell short of analysts’ expectations by 1.3%. Overall, it was a mixed quarter for the company with a narrow beat of analysts’ gross margin estimates.

“Domestically, our sales performance was negatively impacted at the start of the quarter due to the timing of tax refunds while the cooler than usual weather across several areas of the country negatively impacted our results later in the quarter. Conversely, we were pleased with the strong same store sales results we achieved in our international business. As we begin our all-important summer selling season, we are very excited about the initiatives we have in place to enhance our inventory availability, continue to accelerate our domestic Commercial business, and provide great customer service. As we continue to invest in our business, we remain committed to our disciplined approach of increasing operating earnings and cash flow, and delivering strong shareholder value,” said Phil Daniele, President and Chief Executive Officer.

AutoZone delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 5% since reporting and currently trades at $3,075.

Is now the time to buy AutoZone? Access our full analysis of the earnings results here, it’s free.

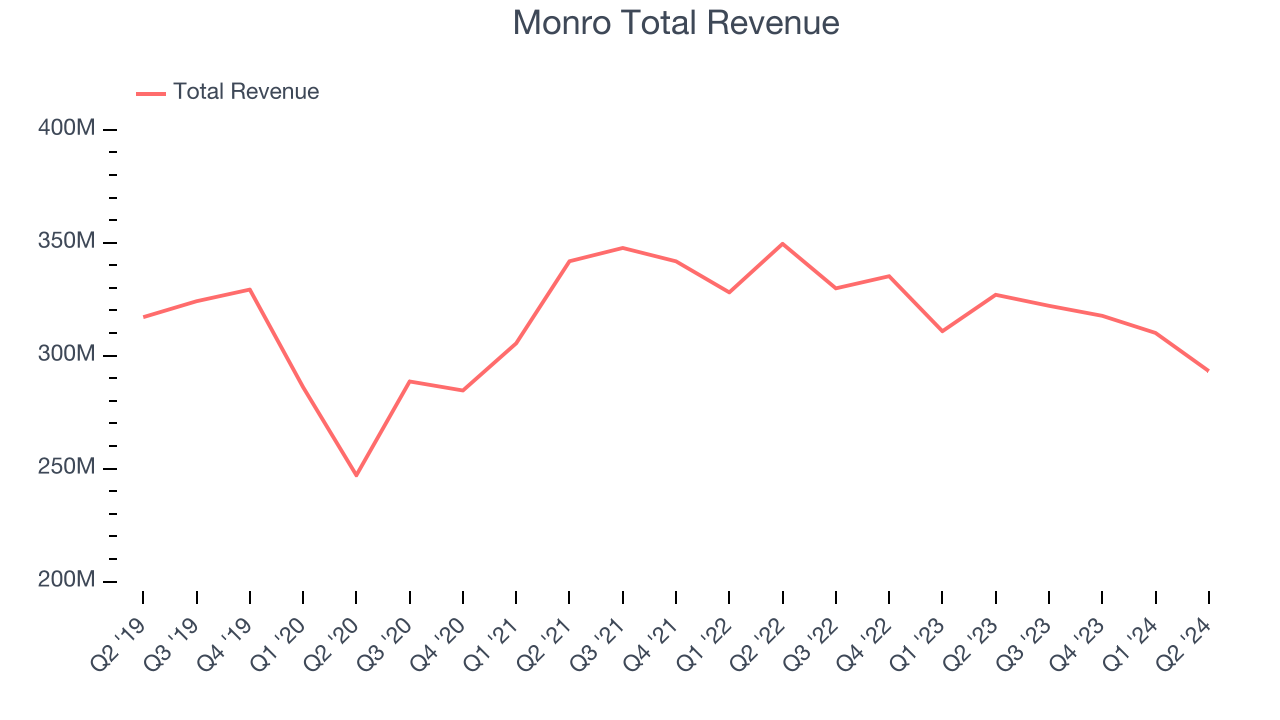

Best Q2: Monro (NASDAQ:MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $293.2 million, down 10.3% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ gross margin estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $26.09.

Is now the time to buy Monro? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Genuine Parts (NYSE:GPC)

Largely targeting the professional customer, Genuine Parts (NYSE:GPC) sells auto and industrial parts such as batteries, belts, bearings, and machine fluids.

Genuine Parts reported revenues of $5.96 billion, flat year on year, falling short of analysts’ expectations by 1.2%. It was a slower quarter as it posted underwhelming earnings guidance for the full year and a miss of analysts’ earnings estimates.

The stock is flat since the results and currently trades at $138.09.

Read our full analysis of Genuine Parts’s results here.

Advance Auto Parts (NYSE:AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.68 billion, flat year on year. This number met analysts’ expectations. Taking a step back, it was a weaker quarter as it produced underwhelming earnings guidance for the full year and a miss of analysts’ earnings estimates.

Advance Auto Parts delivered the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 31.1% since reporting and currently trades at $42.70.

Read our full, actionable report on Advance Auto Parts here, it’s free.

O'Reilly (NASDAQ:ORLY)

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ:ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

O'Reilly reported revenues of $4.27 billion, up 5% year on year. This print missed analysts’ expectations by 1.1%. Overall, it was a slower quarter as it also logged underwhelming earnings guidance for the full year and a miss of analysts’ gross margin estimates.

O'Reilly delivered the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 8.7% since reporting and currently trades at $1,144.

Read our full, actionable report on O'Reilly here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.