Auto parts and accessories retailer AutoZone (NYSE:AZO) missed analysts' expectations in Q2 CY2024, with revenue up 3.5% year on year to $4.24 billion. It made a GAAP profit of $36.69 per share, improving from its profit of $34.12 per share in the same quarter last year.

AutoZone (AZO) Q2 CY2024 Highlights:

- Revenue: $4.24 billion vs analyst estimates of $4.30 billion (1.4% miss)

- EPS: $36.69 vs analyst estimates of $36.01 (1.9% beat)

- Gross Margin (GAAP): 53.5%, up from 52.5% in the same quarter last year

- Free Cash Flow of $434.4 million, down 21.5% from the same quarter last year

- Same-Store Sales were up 1.9% year on year (Domestic same-store sales of 0.0% missed expectations)

- Store Locations: 7,236 at quarter end, increasing by 192 over the last 12 months

- Market Capitalization: $50.59 billion

Aiming to be a one-stop shop for the DIY customer, AutoZone (NYSE:AZO) is an auto parts and accessories retailer that sells everything from car batteries to windshield wiper fluid to brake pads.

While the company has a history of addressing the DIY customer’s needs, it also serves the professional mechanic. The company understands that these DIY mechanics may have varying levels of expertise in auto repair, so stores feature automotive expert sales associates who can help you find which tail light will fit your 2013 Toyota Camry SE, for example. There is also diagnostic testing to pinpoint exact issues. For the professional mechanic, Autozone offers rewards programs, commercial delivery options, and rental of specialized tools.

AutoZone stores are typically located in urban and suburban areas, with many stores situated along major roads and highways. The typical store is roughly 6,000 square feet and organized in a very logical way. Accessories such as floor mats and seat covers are usually near the entrance. Beyond that, there are sections for fluids, filters, brakes, batteries, and electrical, just to name a few.

In addition to its brick-and-mortar stores, AutoZone has an e-commerce presence that was launched in 1999. The company's website allows customers to browse and purchase products online, as well as access repair guides and instructional videos.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Competitors offering auto parts and accessories include Advance Auto Parts (NYSE:AAP), O’Reilly Automotive (NASDAQ:ORLY), Genuine Parts (NYSE:GPC), and private company Pep Boys.Sales Growth

AutoZone is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

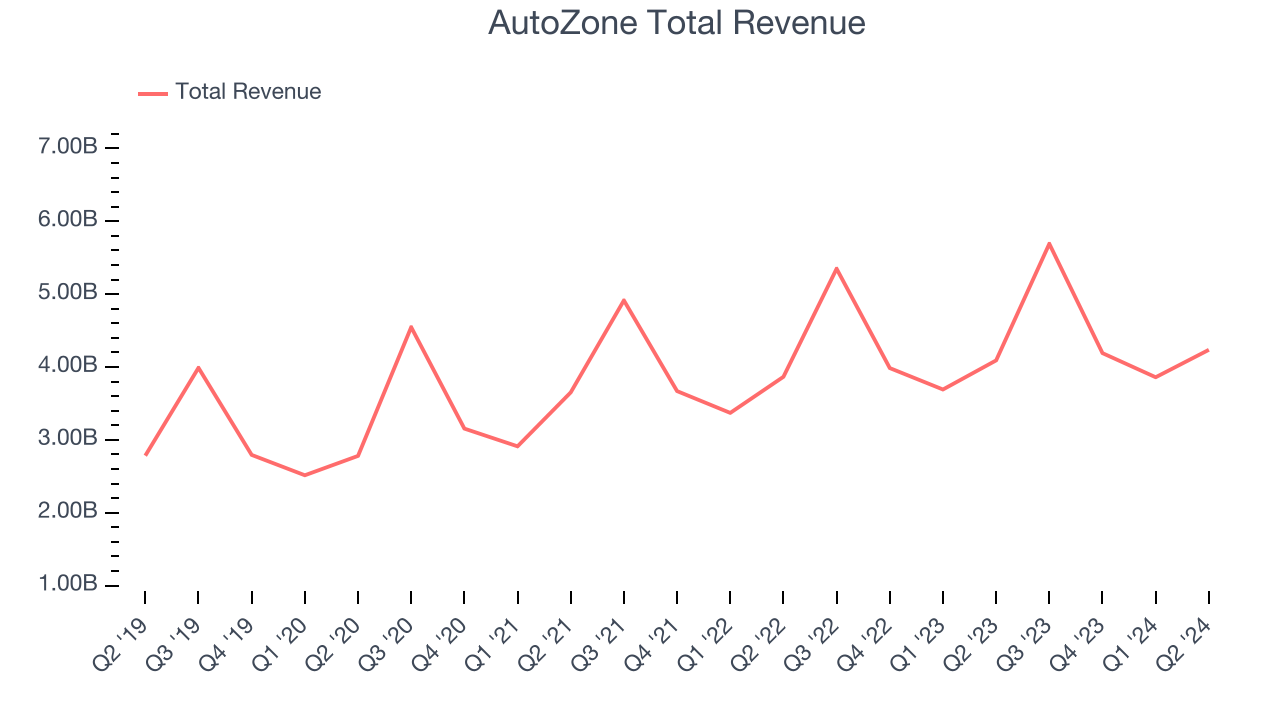

As you can see below, the company's annualized revenue growth rate of 9.5% over the last five years was mediocre as it opened new stores and grew sales at existing, established stores.

This quarter, AutoZone's revenue grew 3.5% year on year to $4.24 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 7.4% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

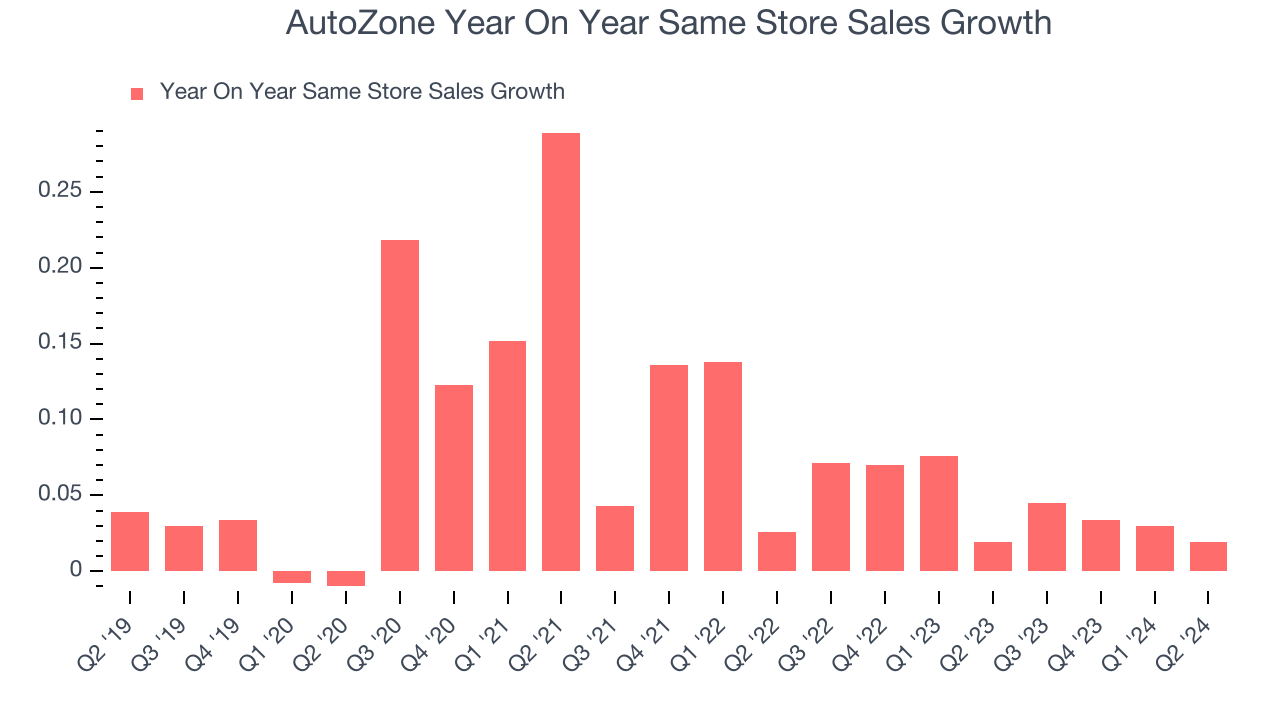

AutoZone's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 4.6% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, AutoZone is reaching more customers and growing sales.

In the latest quarter, AutoZone's same-store sales rose 1.9% year on year. This performance was more or less in line with the same quarter last year.

Number of Stores

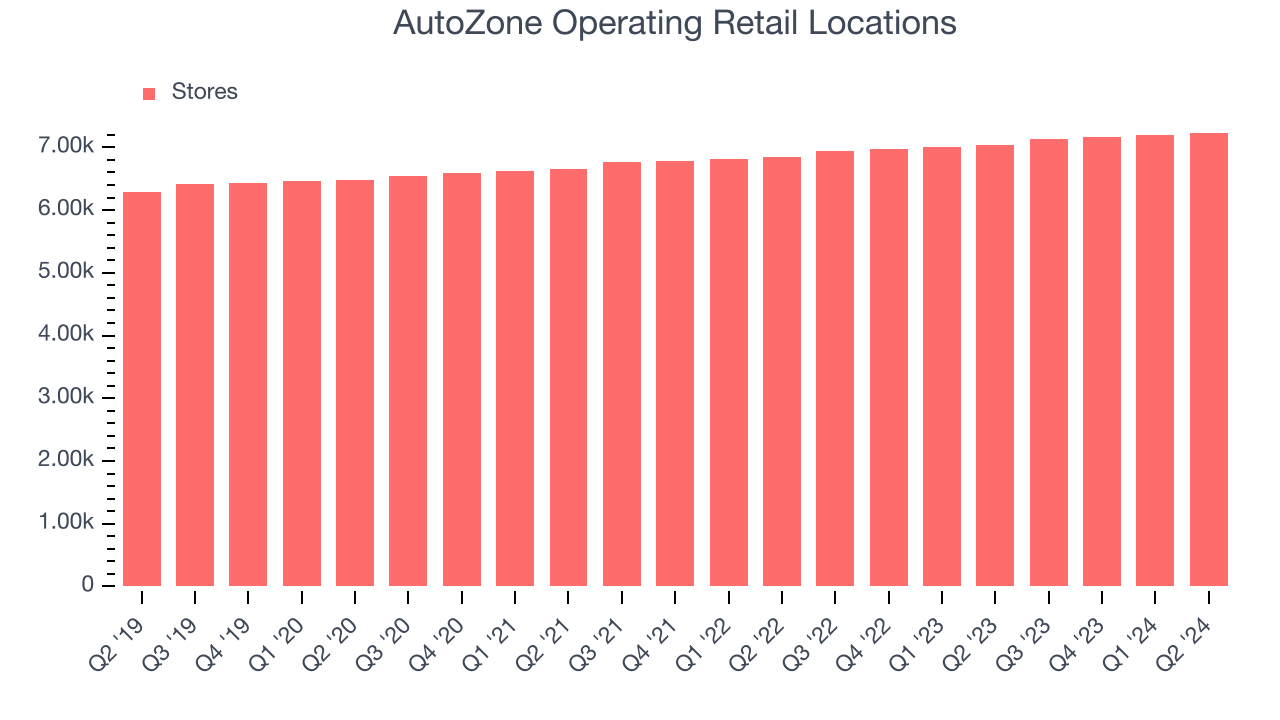

When a retailer like AutoZone is opening new stores, it usually means it's investing for growth because demand is greater than supply. AutoZone's store count increased by 192 locations, or 2.7%, over the last 12 months to 7,236 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally opened new stores over the last eight quarters, averaging 2.8% annual growth in its physical footprint. This is decent store growth and in line with other retailers. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Gross Margin & Pricing Power

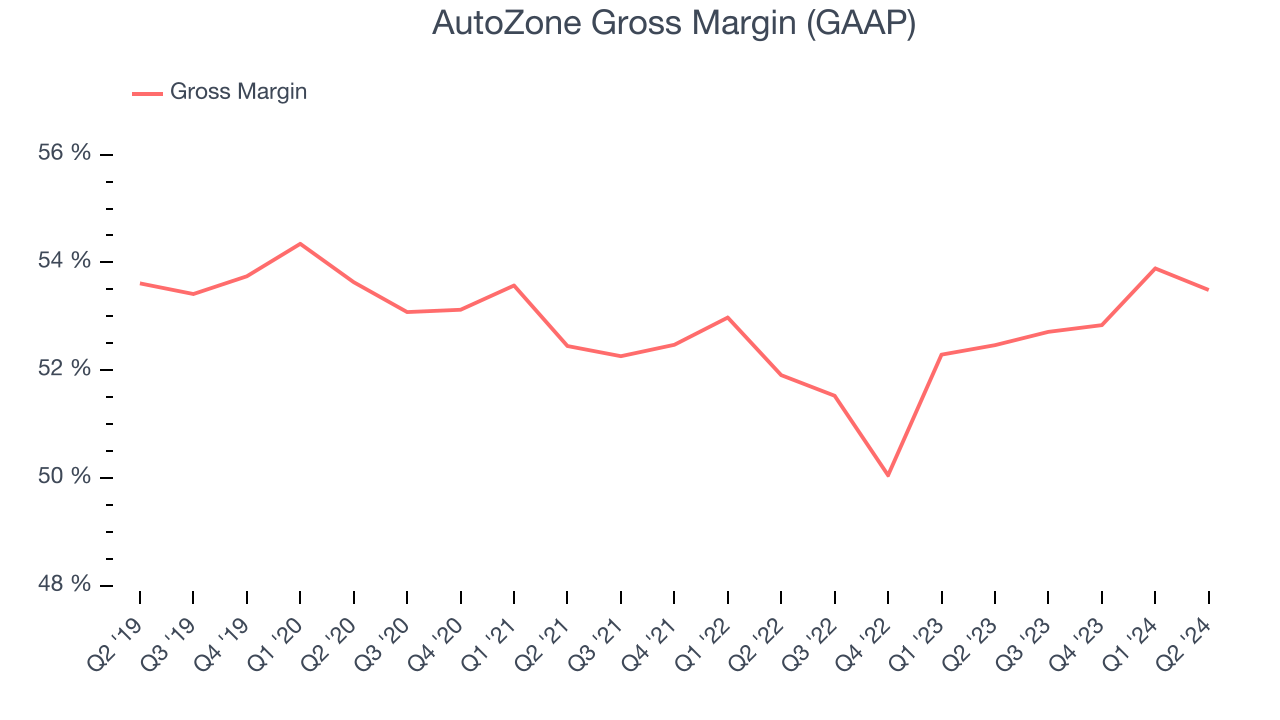

AutoZone has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see below, it's averaged an exceptional 52.4% gross margin over the last two years. This means the company makes $0.52 for every $1 in revenue before accounting for its operating expenses.

AutoZone's gross profit margin came in at 53.5% this quarter, marking a 1 percentage point increase from 52.5% in the same quarter last year. This margin expansion is a good sign in the near term. If this trend continues, it could signal a less competitive environment where the company has better pricing power, less pressure to discount products, and more stable input costs (such as distribution expenses to move goods).

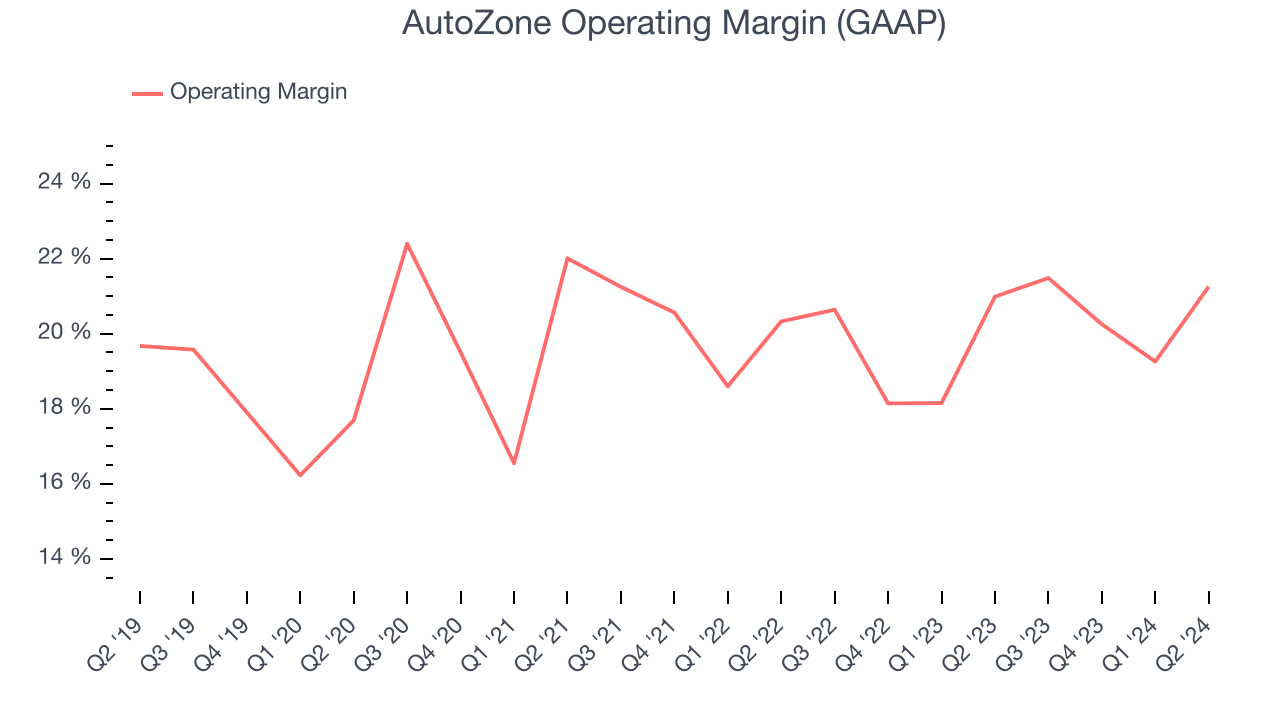

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, AutoZone generated an operating profit margin of 21.3%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, AutoZone has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 20.1%. On top of that, its margin has improved by 1.1 percentage points year on year (on average), an extremely encouraging sign for shareholders.

Zooming out, AutoZone has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 20.1%. On top of that, its margin has improved by 1.1 percentage points year on year (on average), an extremely encouraging sign for shareholders. EPS

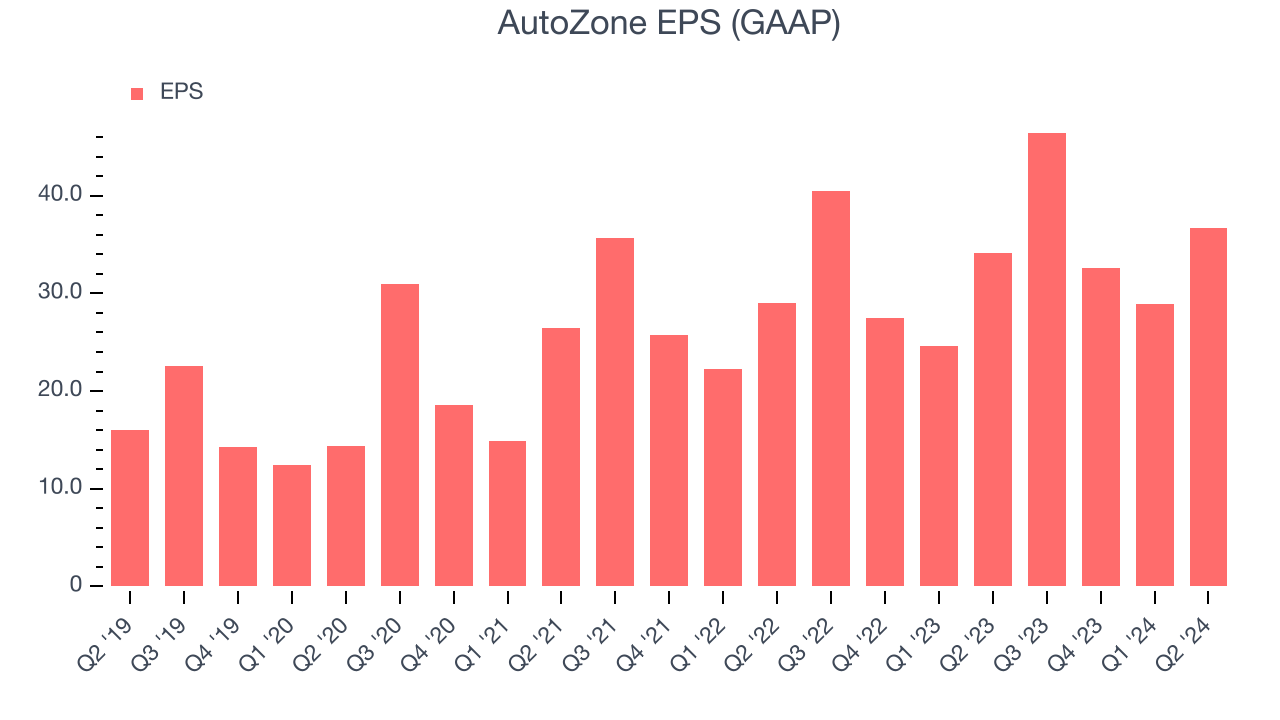

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q2, AutoZone reported EPS at $36.69, up from $34.12 in the same quarter a year ago. This print beat Wall Street's estimates by 1.9%.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 13.1% year-on-year increase in EPS.

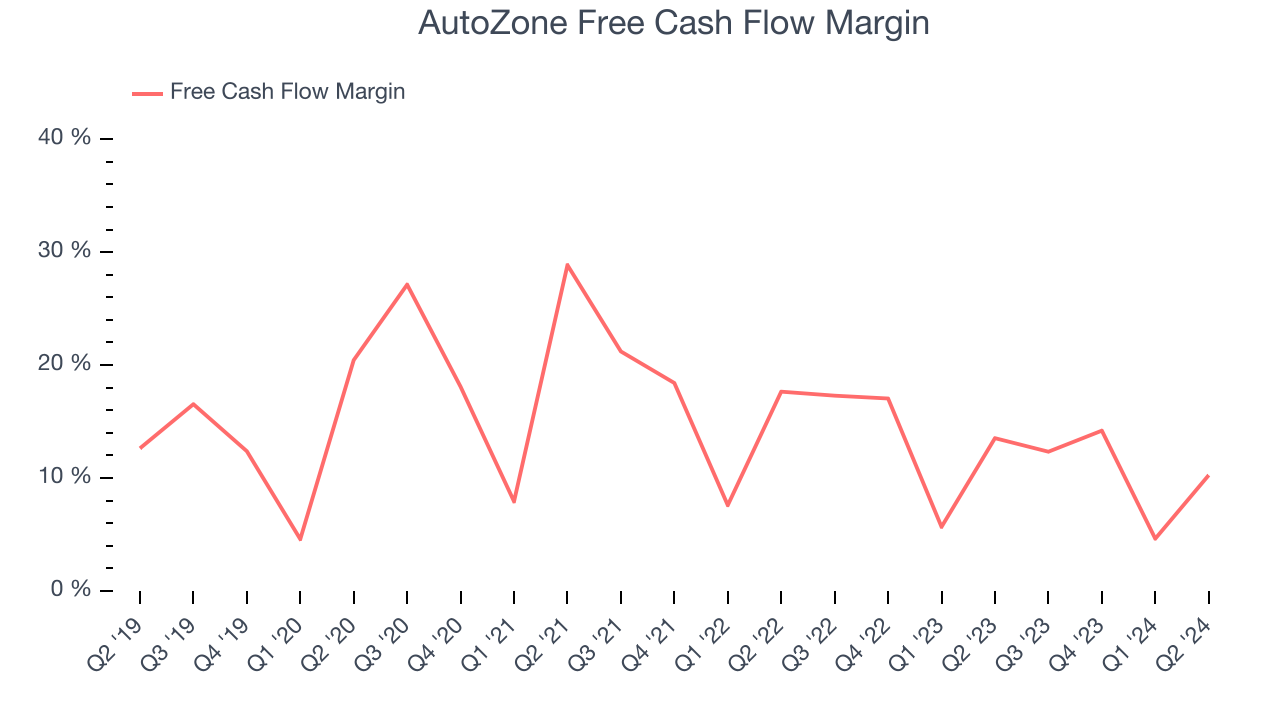

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

AutoZone's free cash flow came in at $434.4 million in Q2, down 21.5% year on year. This result represents a 10.3% margin.

Over the last eight quarters, AutoZone has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in consumer retail, averaging 12.2%. However, its margin has averaged year-on-year declines of 3.2 percentage points. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

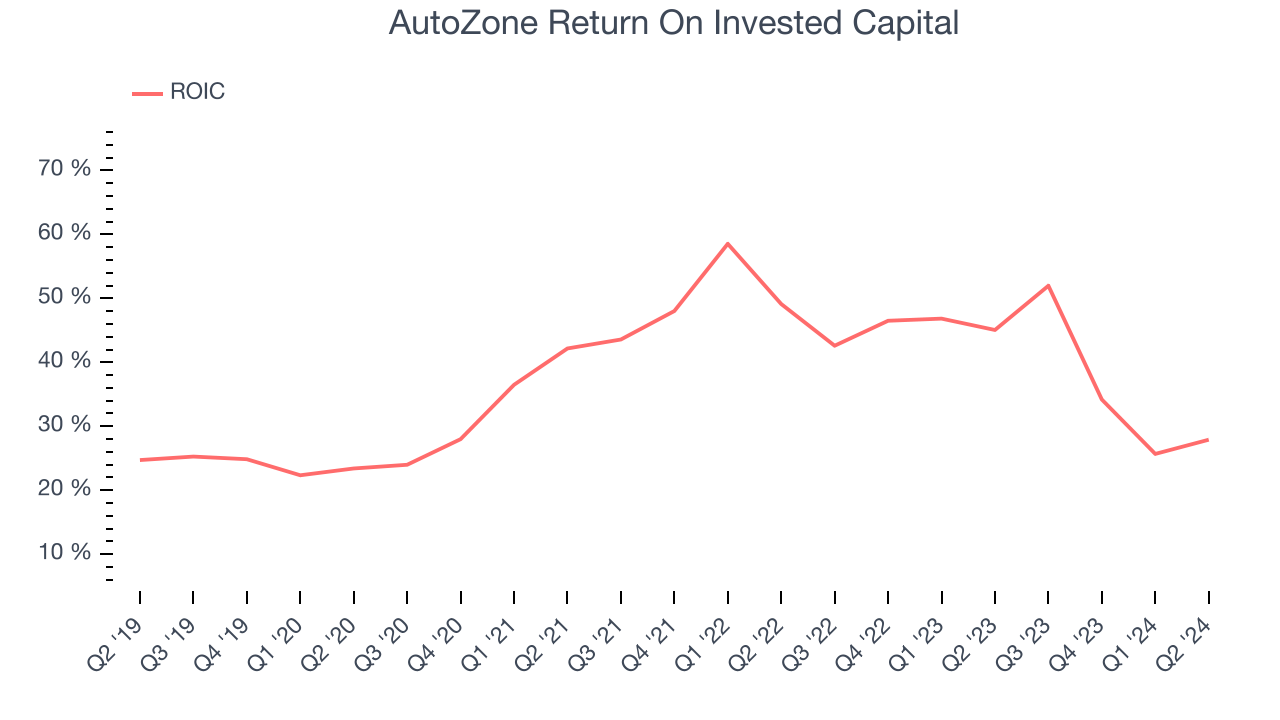

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

AutoZone's five-year average ROIC was 37.5%, placing it among the best retail companies. Just as you’d like your investment dollars to generate returns, AutoZone's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, AutoZone's ROIC averaged 3.7 percentage point increases. The company has historically shown the ability to generate good returns, and its rising ROIC is a great sign. It could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

AutoZone reported $0 of cash and $11.96 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $4.25 billion of EBITDA over the last 12 months, we view AutoZone's 2.8x net-debt-to-EBITDA ratio as safe. We also see its $198.3 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from AutoZone's Q2 Results

It was encouraging to see AutoZone slightly top analysts' gross margin expectations this quarter. On the other hand, its revenue unfortunately missed analysts' expectations on lower-than-expected same-store sales. Overall, this was a mediocre quarter for AutoZone. The stock is flat after reporting and currently trades at $2,945.5 per share.

Is Now The Time?

When considering an investment in AutoZone, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

There are several reasons why we think AutoZone is a great business. Although its revenue growth has been mediocre over the last five years with analysts expecting growth to slow from here, its impressive gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its impressive operating margins show it has a highly efficient business model.

AutoZone's price-to-earnings ratio based on the next 12 months is 17.8x. Looking at the consumer landscape today, AutoZone's qualities stand out and we still like it at this price.

Wall Street analysts covering the company had a one-year price target of $3,259 per share right before these results (compared to the current share price of $2,946), implying they saw upside in buying AutoZone in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.