Metal coating and infrastructure solutions provider AZZ (NYSE:AZZ) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 5.8% year on year to $403.7 million. On the other hand, the company’s full-year revenue guidance of $1.58 billion at the midpoint came in 1.6% below analysts’ estimates. Its non-GAAP profit of $1.39 per share was 9.4% above analysts’ consensus estimates.

Is now the time to buy AZZ? Find out by accessing our full research report, it’s free.

AZZ (AZZ) Q4 CY2024 Highlights:

- Revenue: $403.7 million vs analyst estimates of $396.6 million (5.8% year-on-year growth, 1.8% beat)

- Adjusted EPS: $1.39 vs analyst estimates of $1.27 (9.4% beat)

- Adjusted EBITDA: $90.72 million vs analyst estimates of $86.43 million (22.5% margin, 5% beat)

- The company reconfirmed its revenue guidance for the full year of $1.58 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $5.15 at the midpoint, a 5.1% increase

- EBITDA guidance for the full year is $350 million at the midpoint, in line with analyst expectations

- Operating Margin: 14.5%, in line with the same quarter last year

- Market Capitalization: $2.54 billion

Tom Ferguson, President, and Chief Executive Officer of AZZ, commented, "Third quarter results exceeded expectations as third quarter sales grew to $403.7 million, up 5.8% over the prior year, with Adjusted EPS of $1.39. Consolidated Adjusted EBITDA grew to $90.7 million, or 22.5% of sales, primarily driven by higher volume for hot-dip galvanized steel and coil-coated materials and operational productivity over the prior year. Metal Coatings benefited from lower zinc costs and improved zinc utilization and delivered an Adjusted EBITDA margin of 31.5%. Precoat Metals' Adjusted EBITDA margin improved to 19.1%, primarily due to sales growth, favorable mix and improved operational performance.

Company Overview

Responsible for projects like nuclear facilities, AZZ (NYSE:AZZ) is a provider of metal coating and power infrastructure solutions.

Commercial Building Products

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

Sales Growth

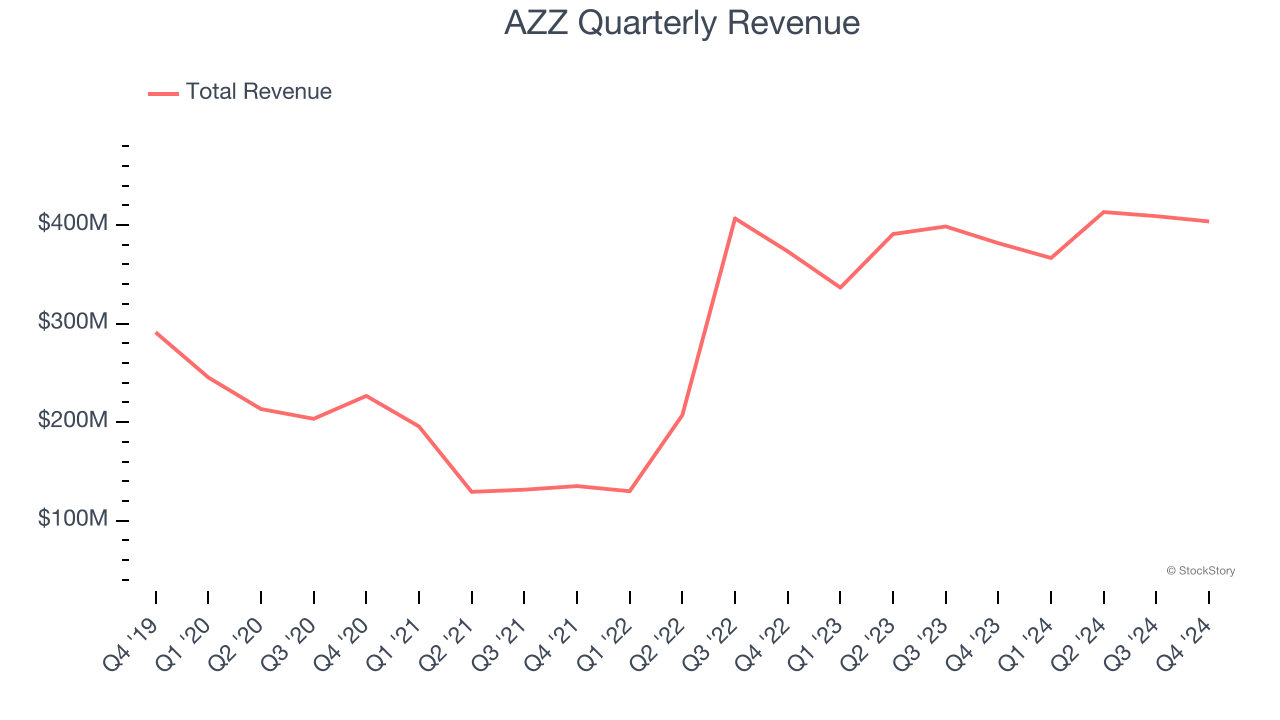

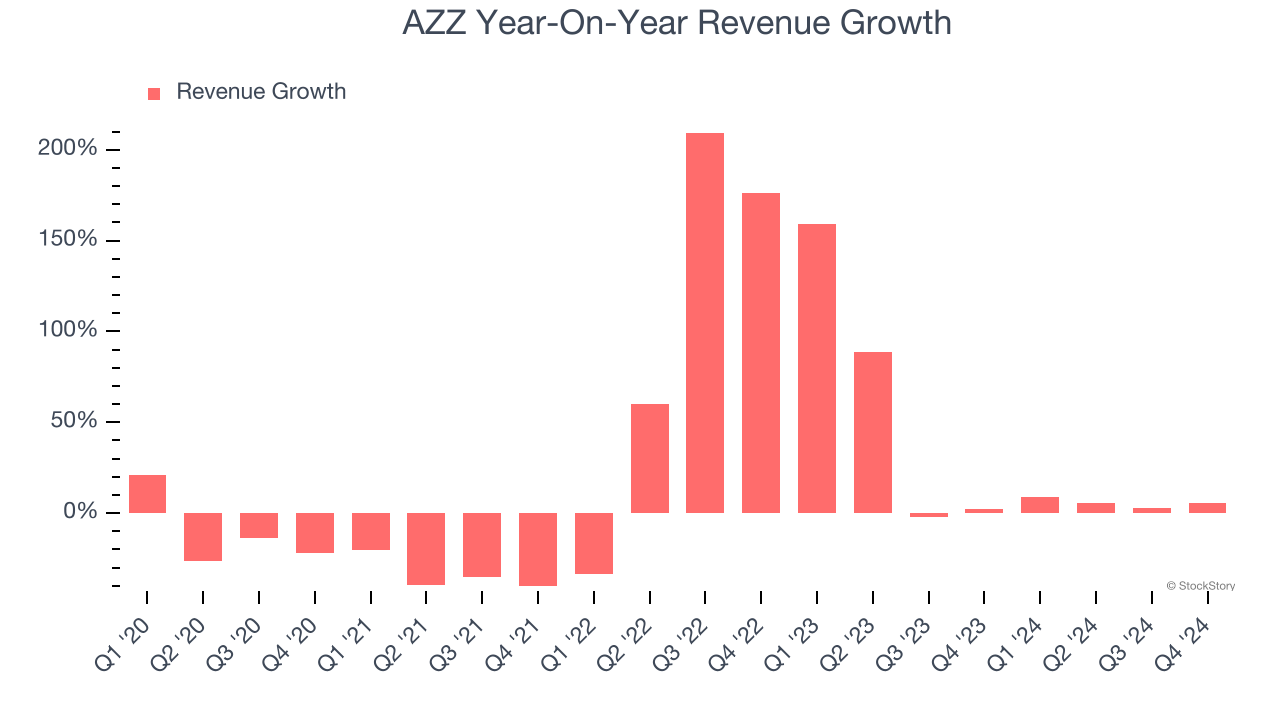

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Thankfully, AZZ’s 9.3% annualized revenue growth over the last five years was solid. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AZZ’s annualized revenue growth of 19.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, AZZ reported year-on-year revenue growth of 5.8%, and its $403.7 million of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

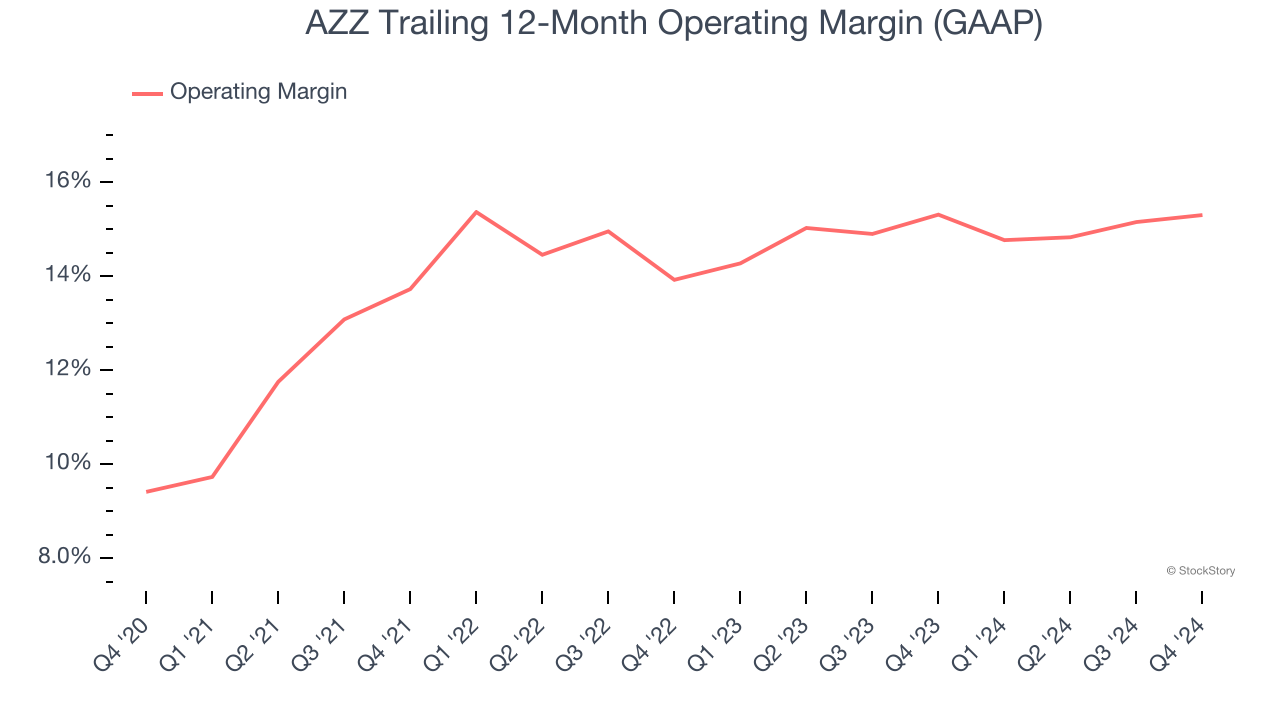

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AZZ has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, AZZ’s operating margin rose by 5.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, AZZ generated an operating profit margin of 14.5%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

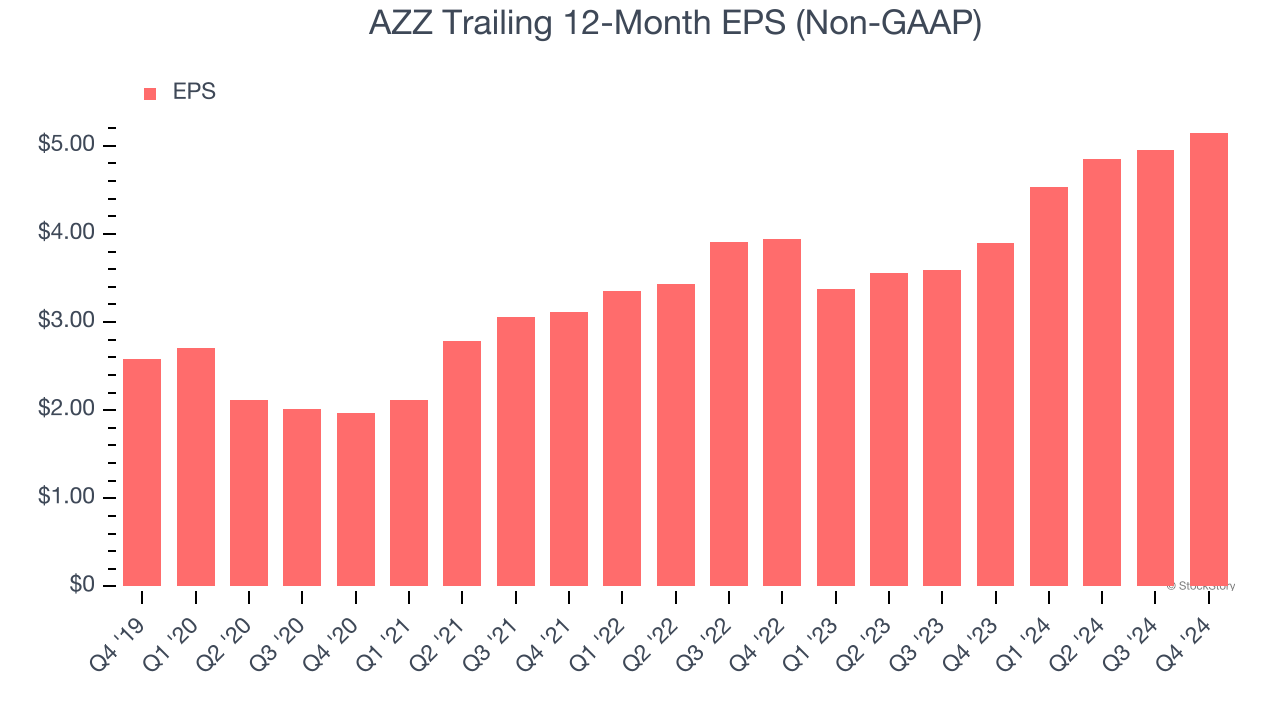

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AZZ’s EPS grew at a spectacular 14.8% compounded annual growth rate over the last five years, higher than its 9.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into AZZ’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, AZZ’s operating margin was flat this quarter but expanded by 5.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For AZZ, its two-year annual EPS growth of 14.3% is similar to its five-year trend, implying strong and stable earnings power.In Q4, AZZ reported EPS at $1.39, up from $1.19 in the same quarter last year. This print beat analysts’ estimates by 9.4%. Over the next 12 months, Wall Street expects AZZ’s full-year EPS of $5.15 to grow 7.1%.

Key Takeaways from AZZ’s Q4 Results

We enjoyed seeing AZZ exceed analysts’ revenue and EBITDA expectations this quarter. We were also glad that the company raised its full year EPS guidance. On the other hand, its full-year revenue guidance missed. Overall, this quarter had some key positives, with the full-year revenue guidance as a blemish on an otherwise solid print. The stock remained flat at $84 immediately after reporting.

Is AZZ an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.