Pet products provider Bark (NYSE:BARK) missed analysts' expectations in Q1 CY2024, with revenue down 3.6% year on year to $121.5 million. Next quarter's revenue guidance of $114.5 million also underwhelmed, coming in 7.7% below analysts' estimates. It made a non-GAAP loss of $0 per share, improving from its loss of $0.04 per share in the same quarter last year.

Is now the time to buy Bark? Find out by accessing our full research report, it's free.

Bark (BARK) Q1 CY2024 Highlights:

- Revenue: $121.5 million vs analyst estimates of $122.5 million (small miss)

- Adjusted EBITDA: $2.2 million vs analyst estimates of $2.1 million (roughly in line)

- EPS (non-GAAP): $0 vs analyst estimates of -$0.01 ($0.01 beat)

- Revenue Guidance for Q2 CY2024 is $114.5 million at the midpoint, below analyst estimates of $124 million (adjusted EBITDA guidance also missed for the period)

- Management's revenue guidance for the upcoming financial year 2025 is $495 million at the midpoint, missing analyst estimates by 3.2% and implying 1% growth (vs -8.2% in FY2024) (adjusted EBITDA guidance also missed for the period)

- Gross Margin (GAAP): 62.7%, up from 57% in the same quarter last year

- Free Cash Flow was -$3.17 million, down from $13.26 million in the previous quarter

- Market Capitalization: $230.3 million

"Fiscal 2024 was a significant year for BARK in that we capped it off with another strong quarter, and we're building momentum entering fiscal 2025," said Matt Meeker, Chief Executive Officer of BARK.

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

Toys and Electronics

The toys and electronics industry presents both opportunities and challenges for investors. Established companies often enjoy strong brand recognition and customer loyalty while smaller players can carve out a niche if they develop a viral, hit new product. The downside, however, is that success can be short-lived because the industry is very competitive: the barriers to entry for developing a new toy are low, which can lead to pricing pressures and reduced profit margins, and the rapid pace of technological advancements necessitates continuous product updates, increasing research and development costs, and shortening product life cycles for electronics companies. Furthermore, these players must navigate various regulatory requirements, especially regarding product safety, which can pose operational challenges and potential legal risks.

Sales Growth

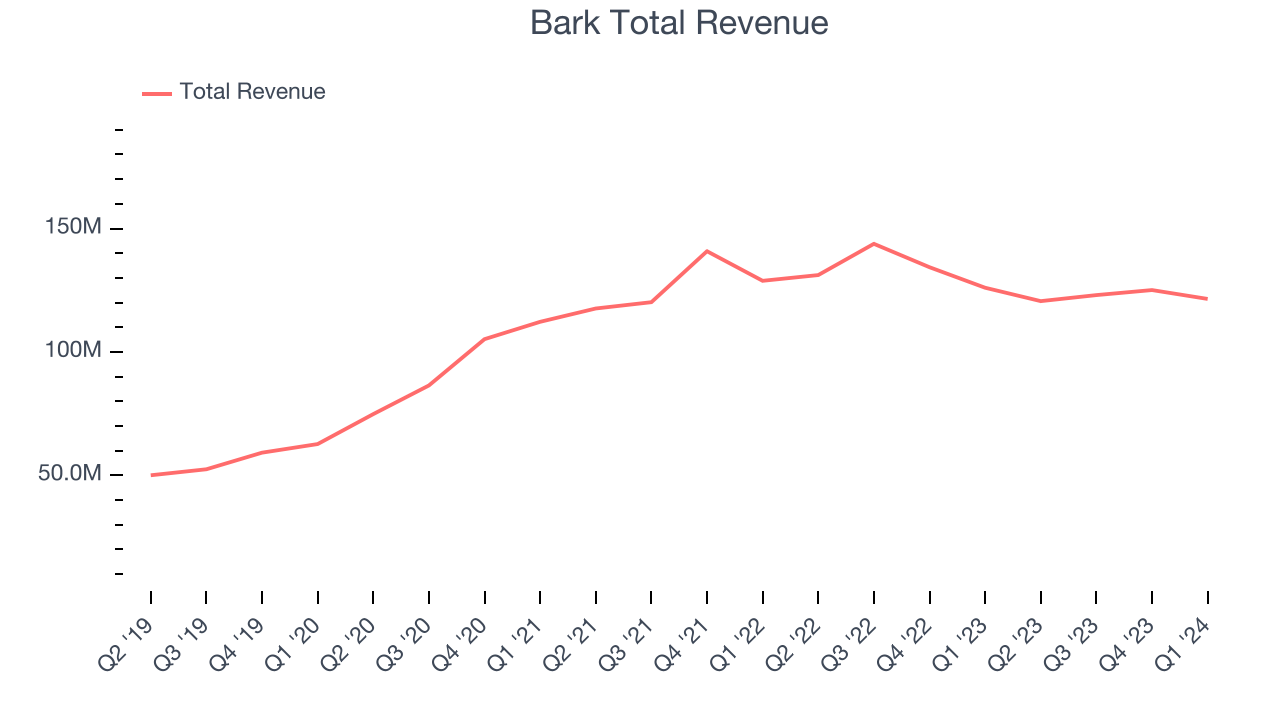

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one tends to grow for years. Bark's 21.6% annualized revenue growth over the last four years was impressive. This is encouraging because it shows Bark's offerings resonate with customers, a helpful starting point for our assessment of quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Bark's recent history marks a sharp pivot from its four-year trend as its revenue has shown annualized declines of 1.7% over the last two years.

This quarter, Bark missed Wall Street's estimates and reported a rather uninspiring 3.6% year-on-year revenue decline, generating $121.5 million of revenue. The company is guiding for a 5.1% year-on-year revenue decline next quarter to $114.5 million, an improvement from the 8.1% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 3.6% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

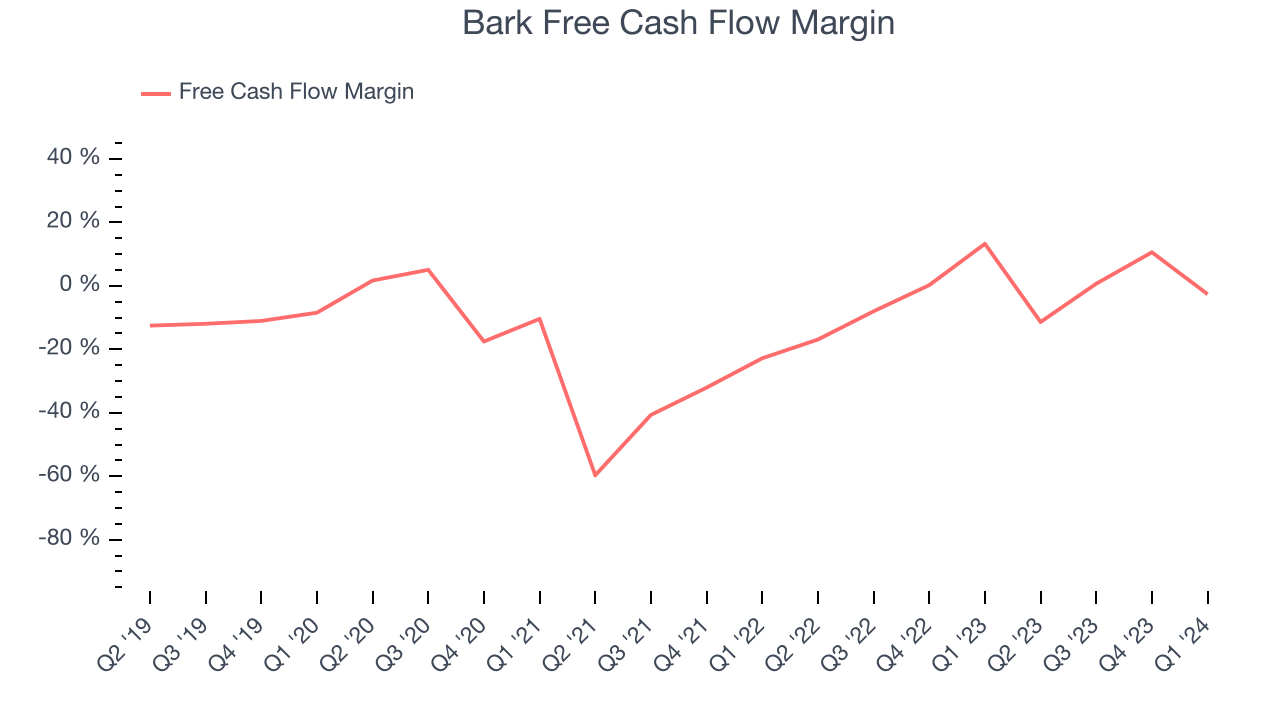

Over the last two years, Bark's demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 1.9%.

Bark burned through $3.17 million of cash in Q1, equivalent to a negative 2.6% margin. The company's quarterly cash flow turned negative after being positive in the same quarter last year, but we wouldn't read too much into it because working capital needs can be seasonal and cause quarter-to-quarter swings in the short term.

Key Takeaways from Bark's Q1 Results

The quarter itself was relatively in line, but guidance was bad. Specifically, revenue and adjusted EBITDA guidance for both the upcoming quarter and the full year came in below expectations. The company is down 12% on the results and currently trades at $1.25 per share.

Bark may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.