Pet products provider Bark (NYSE:BARK) announced better-than-expected results in Q3 FY2024, with revenue down 6.9% year on year to $125.1 million. The company also expects next quarter's revenue to be around $121.1 million, slightly above analysts' estimates. It made a non-GAAP loss of $0.05 per share, improving from its loss of $0.09 per share in the same quarter last year.

Is now the time to buy Bark? Find out by accessing our full research report, it's free.

Bark (BARK) Q3 FY2024 Highlights:

- Revenue: $125.1 million vs analyst estimates of $123.3 million (1.4% beat)

- EPS (non-GAAP): -$0.05 vs analyst estimates of -$0.05

- Revenue Guidance for Q4 2024 is $121.1 million at the midpoint, above analyst estimates of $119.9 million

- Free Cash Flow of $13.26 million, up from $864,000 in the previous quarter

- Gross Margin (GAAP): 61.8%, up from 59.7% in the same quarter last year

- Market Capitalization: $164.4 million

"Our results last quarter highlight the significant strides we've made as a public company. We delivered our strongest customer acquisition quarter in two years, surpassed the high-end of our revenue guidance range, and improved our gross margin by over 200 basis points year-over-year," said Matt Meeker, Co-Founder and Chief Executive Officer.

Making a name for itself with the BarkBox, Bark (NYSE:BARK) specializes in subscription-based, personalized pet products.

Other Specialty Retail

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Those that differentiate themselves and serve consumers well will enjoy brand equity, customer loyalty, and even some pricing power while those who don’t may find themselves in precarious positions due to the discretionary nature of their offerings.

Sales Growth

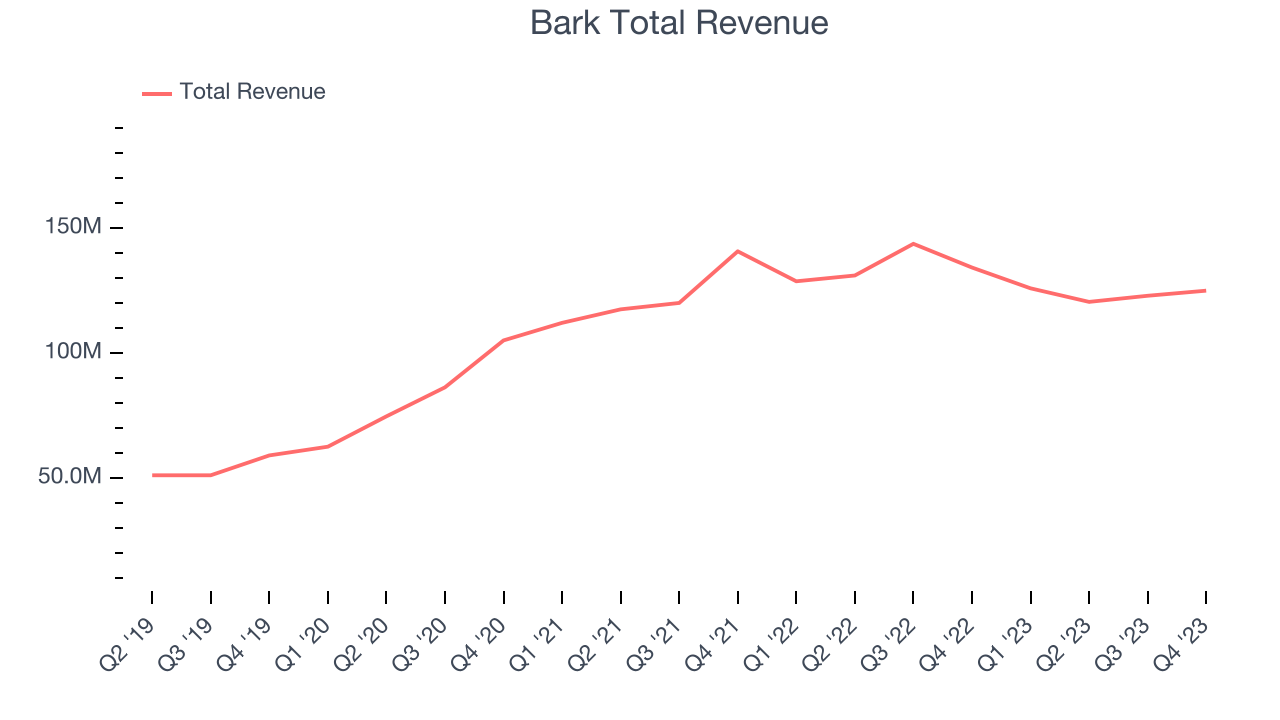

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Bark's annualized revenue growth rate of 22.9% over the last 4 years was exceptional for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Bark's recent history shines a dimmer light on the company, as its revenue was flat over the last 2 years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Bark's recent history shines a dimmer light on the company, as its revenue was flat over the last 2 years.

This quarter, Bark's revenue fell 6.9% year on year to $125.1 million but beat Wall Street's estimates by 1.4%. The company is guiding for a 3.9% year-on-year revenue decline next quarter to $121.1 million, a deceleration from the 2.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

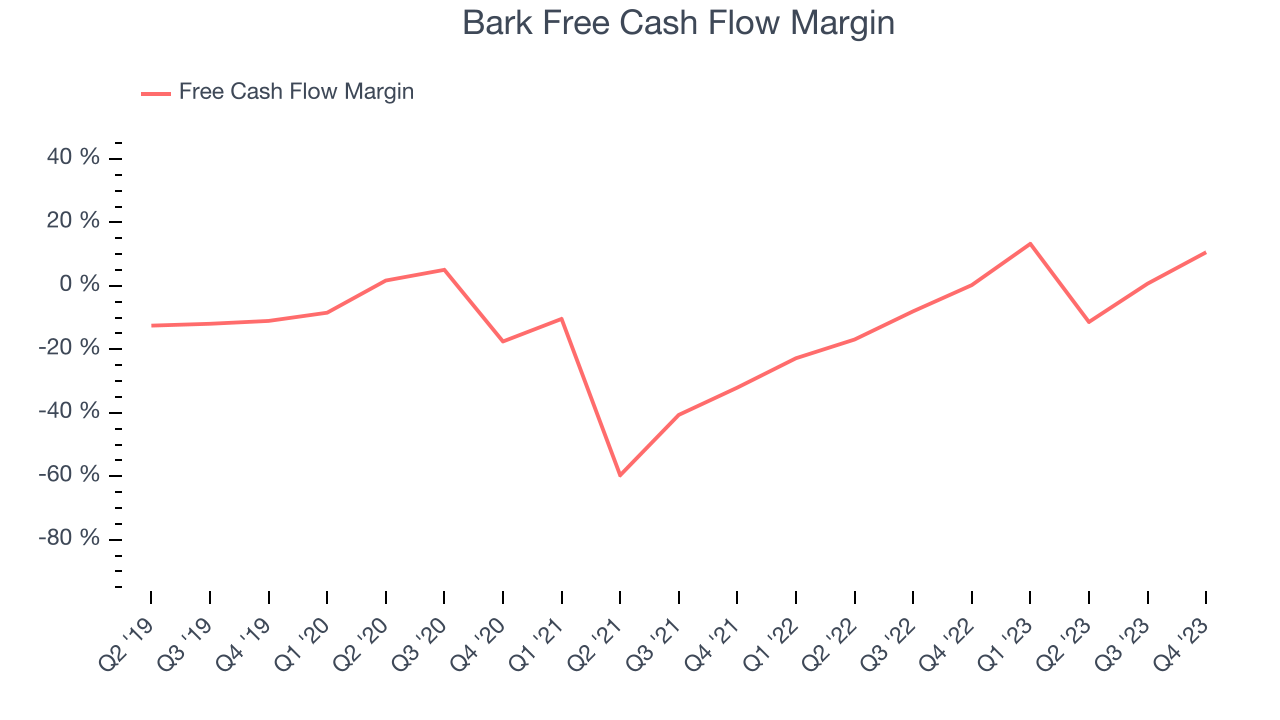

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

While Bark posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Bark's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 4.3%.

Bark's free cash flow came in at $13.26 million in Q3, equivalent to a 10.6% margin and up 3,905% year on year.

Key Takeaways from Bark's Q3 Results

It was encouraging to see Bark slightly beat analysts' revenue estimates, driven by better-than-expected Direct-to-Consumer sales. We were also glad it topped Wall Street's free cash flow projections and lifted its Q4 revenue guidance. On the other hand, its operating margin missed analysts' expectations. Overall, this was a mixed quarter for Bark. The company is down 1.9% on the results and currently trades at $0.9 per share.

Bark may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.