Personal care and home fragrance retailer Bath & Body Works (NYSE:BBWI) reported results ahead of analysts' expectations in Q4 FY2023, with revenue flat year on year at $2.91 billion. It made a GAAP profit of $2.55 per share, improving from its profit of $1.86 per share in the same quarter last year.

Is now the time to buy Bath and Body Works? Find out by accessing our full research report, it's free.

Bath and Body Works (BBWI) Q4 FY2023 Highlights:

- Revenue: $2.91 billion vs analyst estimates of $2.84 billion (2.6% beat)

- EPS: $2.55 vs analyst estimates of $1.80 (42% beat)

- Full year EPS guidance of $3.18 at the midpoint, below expectations of $3.34

- Free Cash Flow of $878 million, down 12.3% from the same quarter last year

- Gross Margin (GAAP): 45.9%, up from 43.3% in the same quarter last year

- Store Locations: 2,335 at quarter end, increasing by 106 over the last 12 months

- Market Capitalization: $10.92 billion

Gina Boswell, CEO of Bath & Body Works, commented, “The team delivered fourth quarter net sales and earnings that exceeded the high end of our expectations. Underpinning these results was strong execution during the holiday season. Customers responded to innovation and newness as we delivered a seamless omnichannel shopping experience and drove continued enrollment in our loyalty program. Additionally, we continued to advance our operational efficiency initiatives. Looking ahead, we remain focused on further improving the customer experience and building on our strong foundation to drive long-term profitable growth.”

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

Bath and Body Works is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

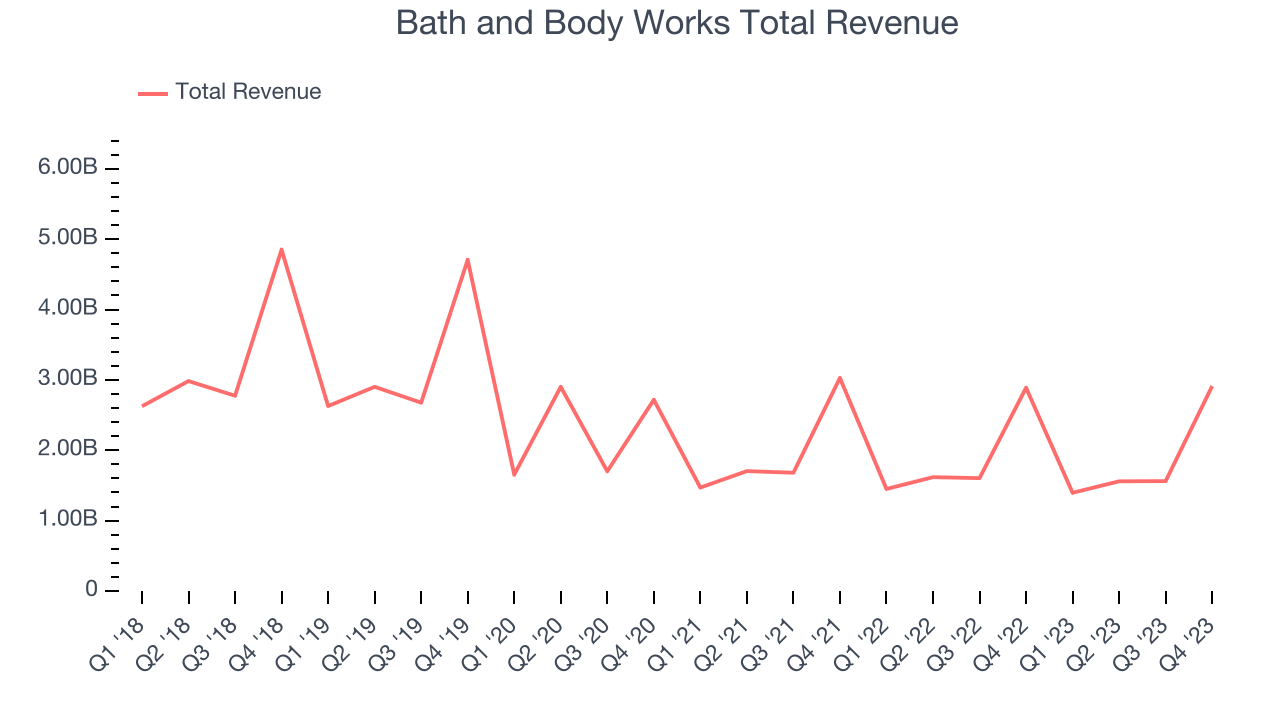

As you can see below, the company's annualized revenue growth rate of 8.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as it opened new stores and expanded its reach.

This quarter, Bath and Body Works reported decent year-on-year revenue growth of 0.8%, and its $2.91 billion in revenue topped Wall Street's estimates by 2.6%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Bath and Body Works's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 5.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Key Takeaways from Bath and Body Works's Q4 Results

We were impressed by how significantly Bath and Body Works blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its full-year earnings forecast missed analysts' expectations and its earnings guidance for next quarter also missed Wall Street's estimates. The stock is down 6.9% after reporting, trading at $45 per share, due to the weak guidance.

So should you invest in Bath and Body Works right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.