Let's dig into the relative performance of Bath and Body Works (NYSE:BBWI) and its peers as we unravel the now-completed Q4 specialty retail earnings season.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 9 specialty retail stocks we track reported a mixed Q4; on average, revenues missed analyst consensus estimates by 1%. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and specialty retail stocks have had a rough stretch, with share prices down 11.7% on average since the previous earnings results.

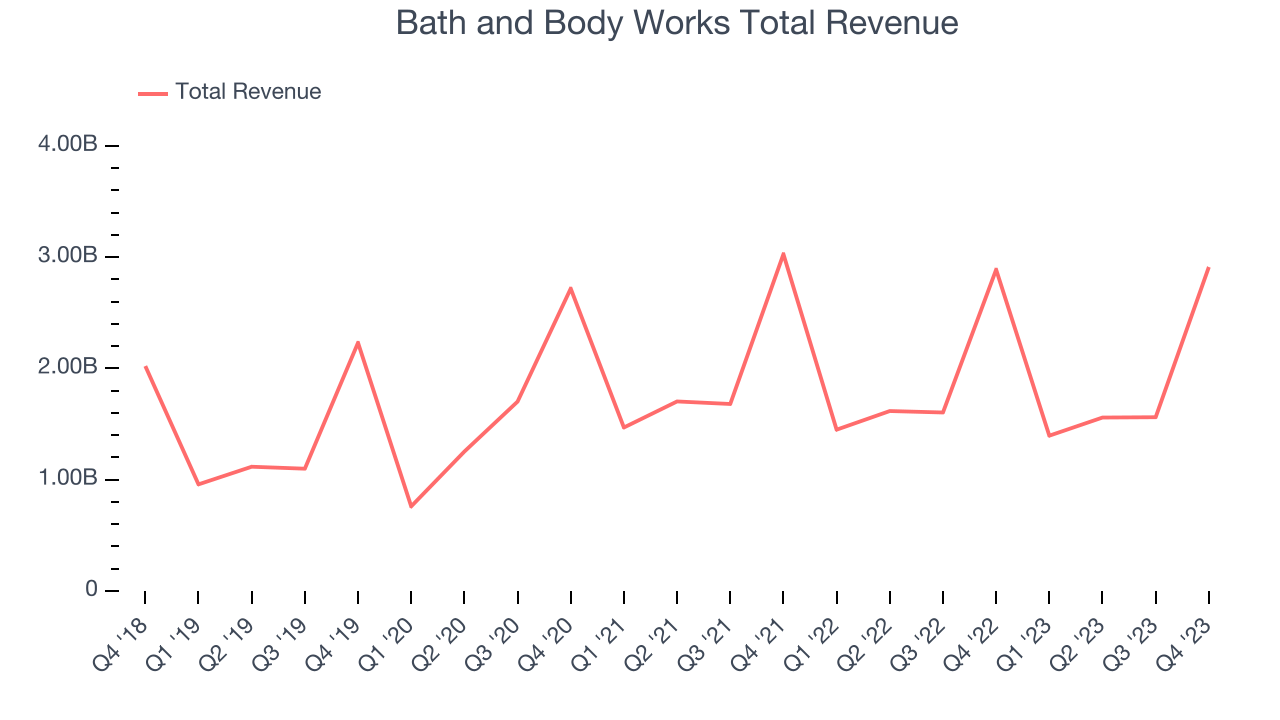

Bath and Body Works (NYSE:BBWI)

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Bath and Body Works reported revenues of $2.91 billion, flat year on year, topping analyst expectations by 2.6%. It was a mixed quarter for the company, with an impressive beat of analysts' earnings estimates but underwhelming earnings guidance for the full year.

Gina Boswell, CEO of Bath & Body Works, commented, “The team delivered fourth quarter net sales and earnings that exceeded the high end of our expectations. Underpinning these results was strong execution during the holiday season. Customers responded to innovation and newness as we delivered a seamless omnichannel shopping experience and drove continued enrollment in our loyalty program. Additionally, we continued to advance our operational efficiency initiatives. Looking ahead, we remain focused on further improving the customer experience and building on our strong foundation to drive long-term profitable growth.”

Bath and Body Works pulled off the biggest analyst estimates beat of the whole group. The stock is down 10.7% since the results and currently trades at $43.19.

Is now the time to buy Bath and Body Works? Access our full analysis of the earnings results here, it's free.

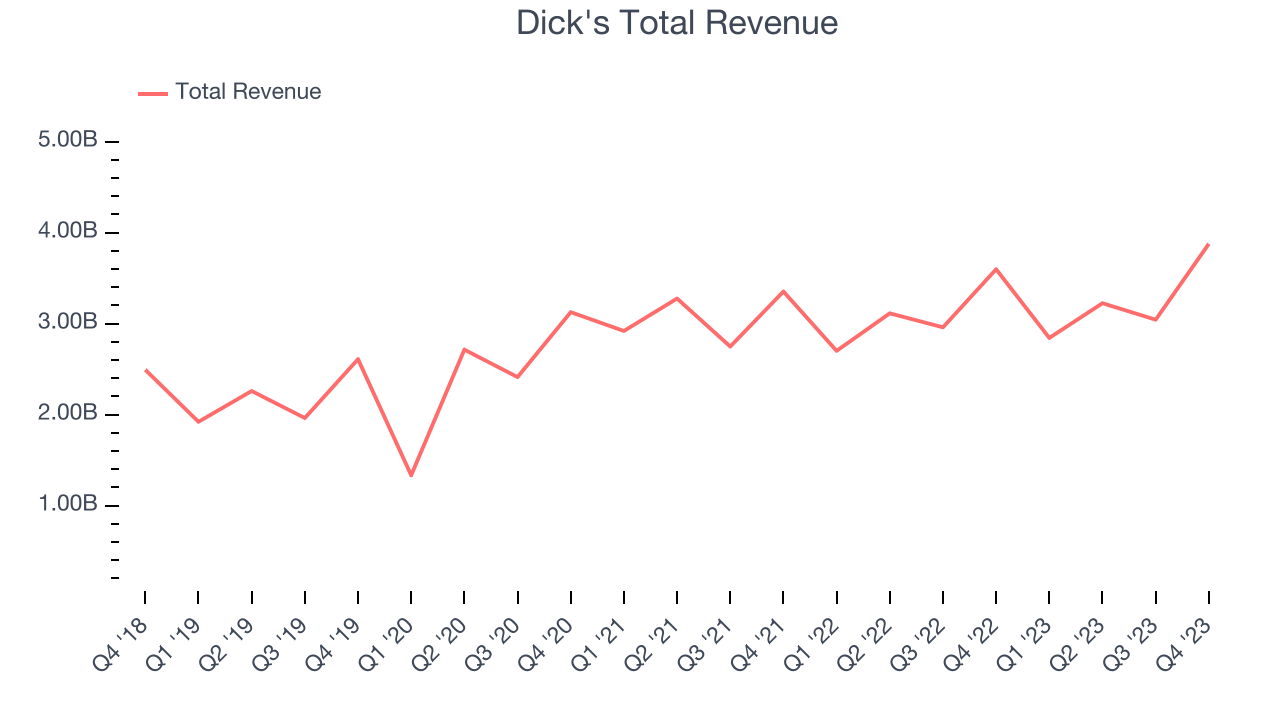

Best Q4: Dick's (NYSE:DKS)

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Dick's reported revenues of $3.88 billion, up 7.8% year on year, outperforming analyst expectations by 2.2%. It was a decent quarter for the company, with a solid beat of analysts' revenue estimates and optimistic earnings guidance for the full year.

The stock is up 4.8% since the results and currently trades at $196.93.

Is now the time to buy Dick's? Access our full analysis of the earnings results here, it's free.

Weakest Q4: GameStop (NYSE:GME)

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE:GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

GameStop reported revenues of $1.79 billion, down 19.4% year on year, falling short of analyst expectations by 12.5%. It was a weak quarter for the company, with a miss of analysts' revenue and earnings estimates.

GameStop had the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is down 33.4% since the results and currently trades at $10.35.

Read our full analysis of GameStop's results here.

Ulta (NASDAQ:ULTA)

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Ulta reported revenues of $3.55 billion, up 10.2% year on year, in line with analyst expectations. It was a mixed quarter for the company, with same store sales, revenue, and gross margin exeeding expectations. On the other hand, while full year revenue guidance was roughly in line, its full-year earnings forecast was underwhelming and missed.

Ulta scored the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 25% since the results and currently trades at $424.25.

Read our full, actionable report on Ulta here, it's free.

Hibbett (NASDAQ:HIBB)

With a focus on small and mid-sized markets, Hibbett (NASDAQ:HIBB) is a specialty retailer that sells athletic apparel and footwear as well as select sports equipment.

Hibbett reported revenues of $466.6 million, up 1.8% year on year, falling short of analyst expectations by 2.3%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year and a miss of analysts' revenue estimates.

The stock is down 1% since the results and currently trades at $72.53.

Read our full, actionable report on Hibbett here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.