Personal care and home fragrance retailer Bath & Body Works (NYSE:BBWI) reported results ahead of analysts' expectations in Q4 FY2023, with revenue flat year on year at $2.91 billion. It made a GAAP profit of $2.55 per share, improving from its profit of $1.86 per share in the same quarter last year.

Bath and Body Works (BBWI) Q4 FY2023 Highlights:

- Revenue: $2.91 billion vs analyst estimates of $2.84 billion (2.6% beat)

- EPS: $2.55 vs analyst estimates of $1.80 (42% beat)

- Full year EPS guidance of $3.18 at the midpoint, below expectations of $3.34

- Free Cash Flow of $878 million, down 12.3% from the same quarter last year

- Gross Margin (GAAP): 45.9%, up from 43.3% in the same quarter last year

- Store Locations: 2,335 at quarter end, increasing by 106 over the last 12 months

- Market Capitalization: $10.92 billion

Spun off from L Brands in 2020, Bath & Body Works (NYSE:BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

While many retailers define themselves based on visuals and aesthetics, Bath & Body Works relies on the scents of their products. These scents are unique and diverse in range, and the company aims to rotate and update them on a seasonal basis in order to have fresh product every few months.

The core customer of Bath & Body Works is typically female, aged 18-45, who values self-care and indulgence. While consumers can buy generic or private label personal care products, the Bath & Body Works customer prefers the affordable luxury of higher-quality, specialty bath gels and moisturizers, for example.

The average Bath & Body Works store is around 3,000 square feet and typically located in shopping malls and strip shopping centers alongside other retailers. While stores are designed to be visually appealing, the main draw is the ability to test products and experience their scents. Bath & Body Works has an e-commerce presence, which was launched relatively late in 2006 when compared to other prominent retailers. The omnichannel approach gives the customer various options for shopping, returns, and exchanges. The e-commerce platform also features online-only promotions and customer reviews.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Retailers offering specialized personal care products include Ulta Beauty (NASDAQ:ULTA) and Victoria’s Secret (NYSE:VSCO) as well as department stores such as Macy’s (NYSE:M) and Kohl’s (NYSE:KSS).Sales Growth

Bath and Body Works is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

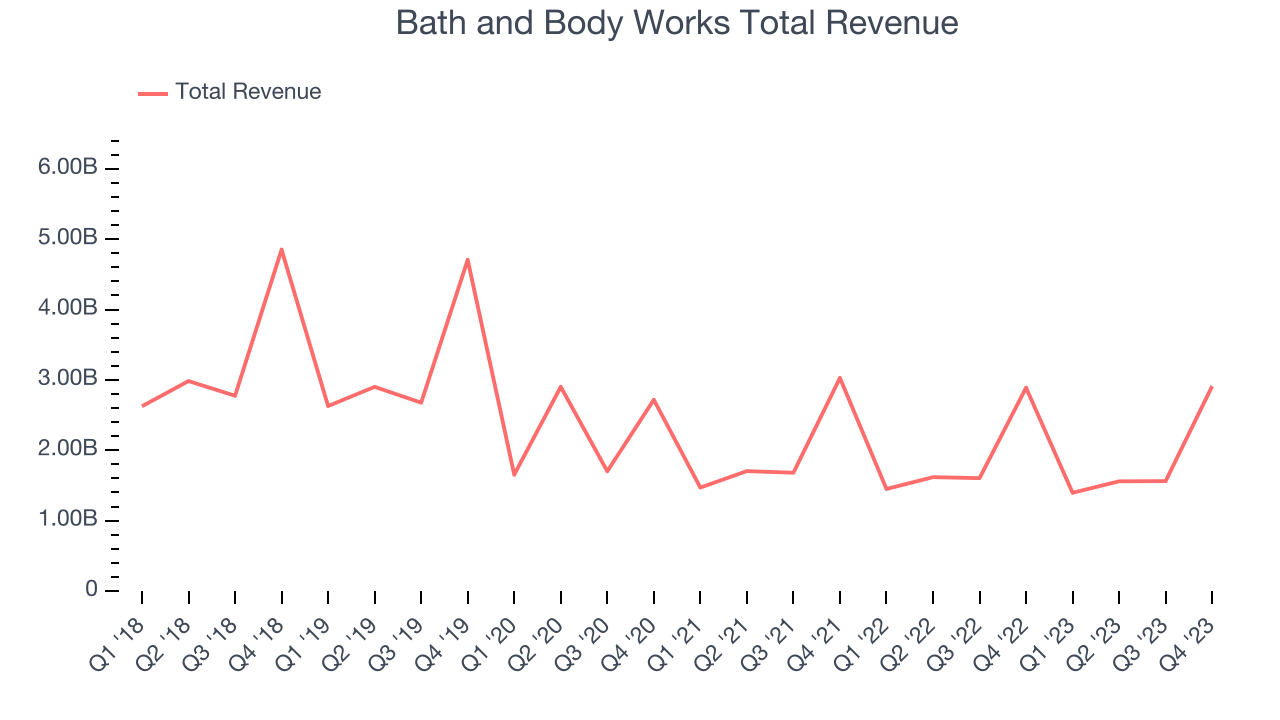

As you can see below, the company's annualized revenue growth rate of 8.3% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was mediocre as it opened new stores and expanded its reach.

This quarter, Bath and Body Works reported decent year-on-year revenue growth of 0.8%, and its $2.91 billion in revenue topped Wall Street's estimates by 2.6%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Number of Stores

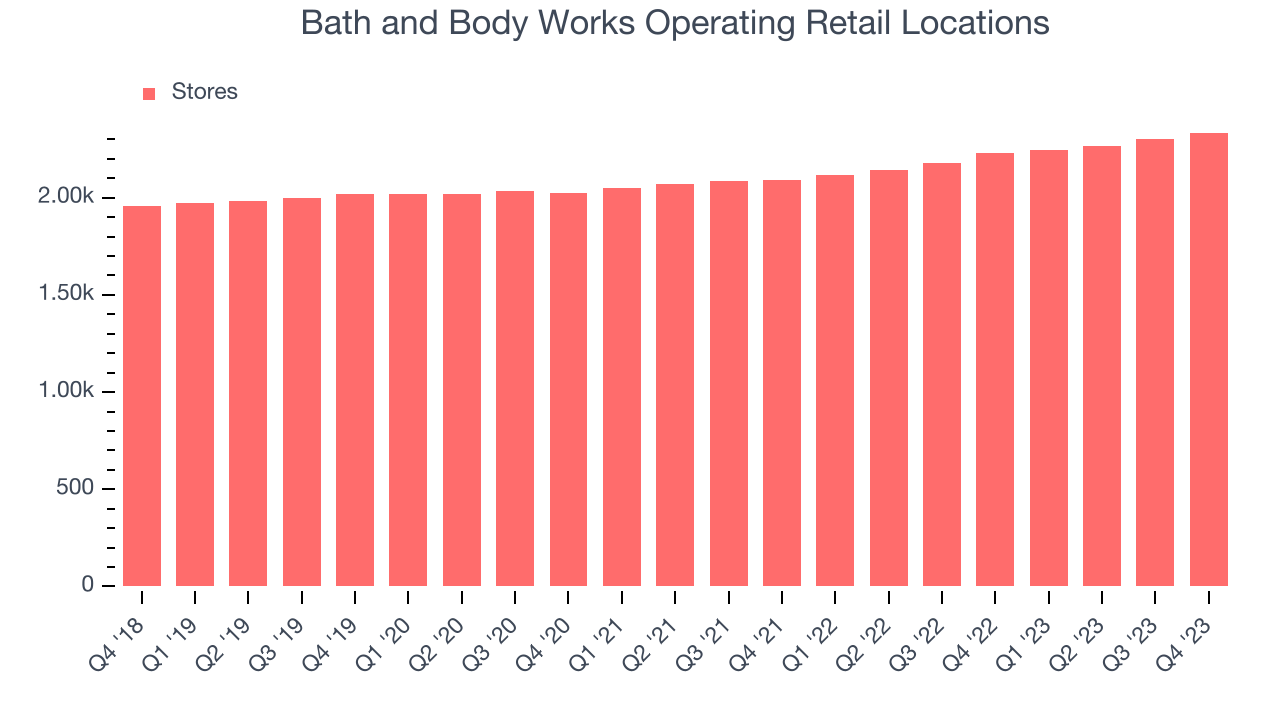

When a retailer like Bath and Body Works is opening new stores, it usually means it's investing for growth because demand is greater than supply. Since last year, Bath and Body Works's store count increased by 106 locations, or 4.8%, to 2,335 total retail locations in the most recently reported quarter.

Taking a step back, the company has opened new stores quickly over the last eight quarters, averaging 5% annual growth in new locations. This store growth outpaces the broader consumer retail sector. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

Bath and Body Works's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 5.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a retailer gets to keep after paying for the goods it sells.

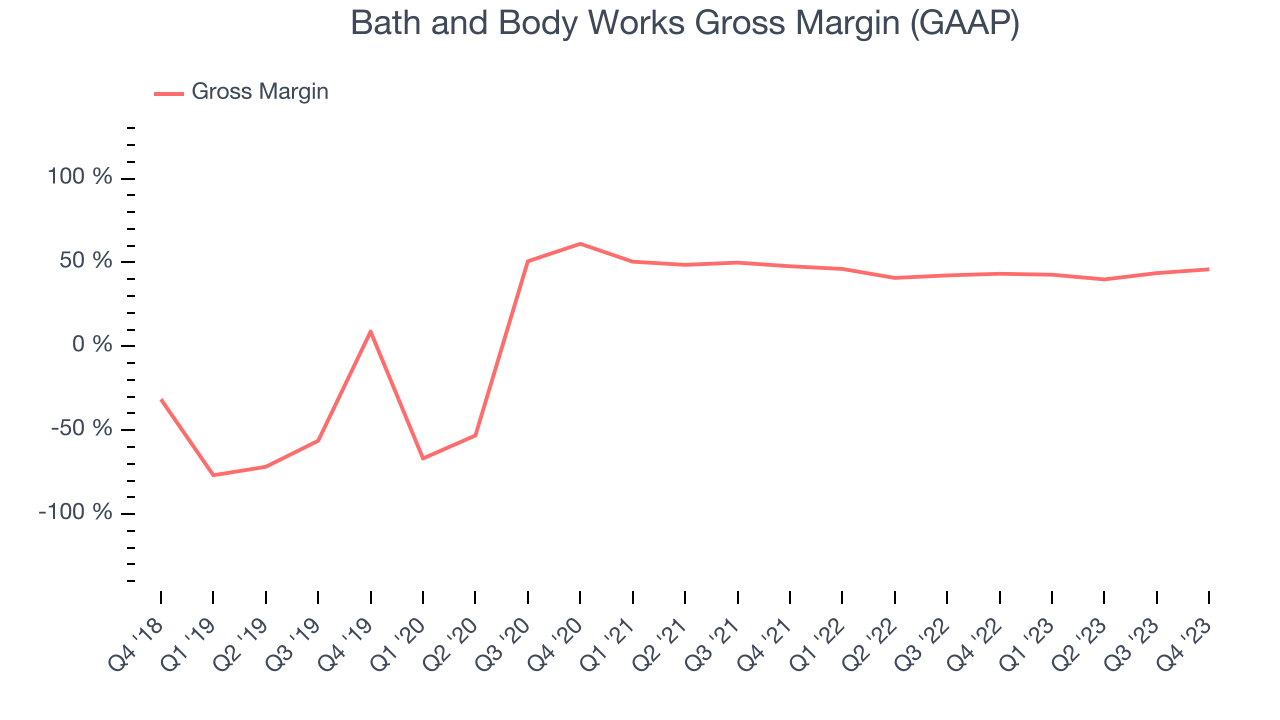

Bath and Body Works has great unit economics for a retailer, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged an impressive 43.3% gross margin over the last eight quarters. This means the company makes $0.43 for every $1 in revenue before accounting for its operating expenses.

Bath and Body Works produced a 45.9% gross profit margin in Q4, marking a 2.7 percentage point increase from 43.3% in the same quarter last year. This margin expansion is a good sign in the near term. If this trend continues, it could signal a less competitive environment where the company has better pricing power, less pressure to discount products, and more stable input costs (such as distribution expenses to move goods).

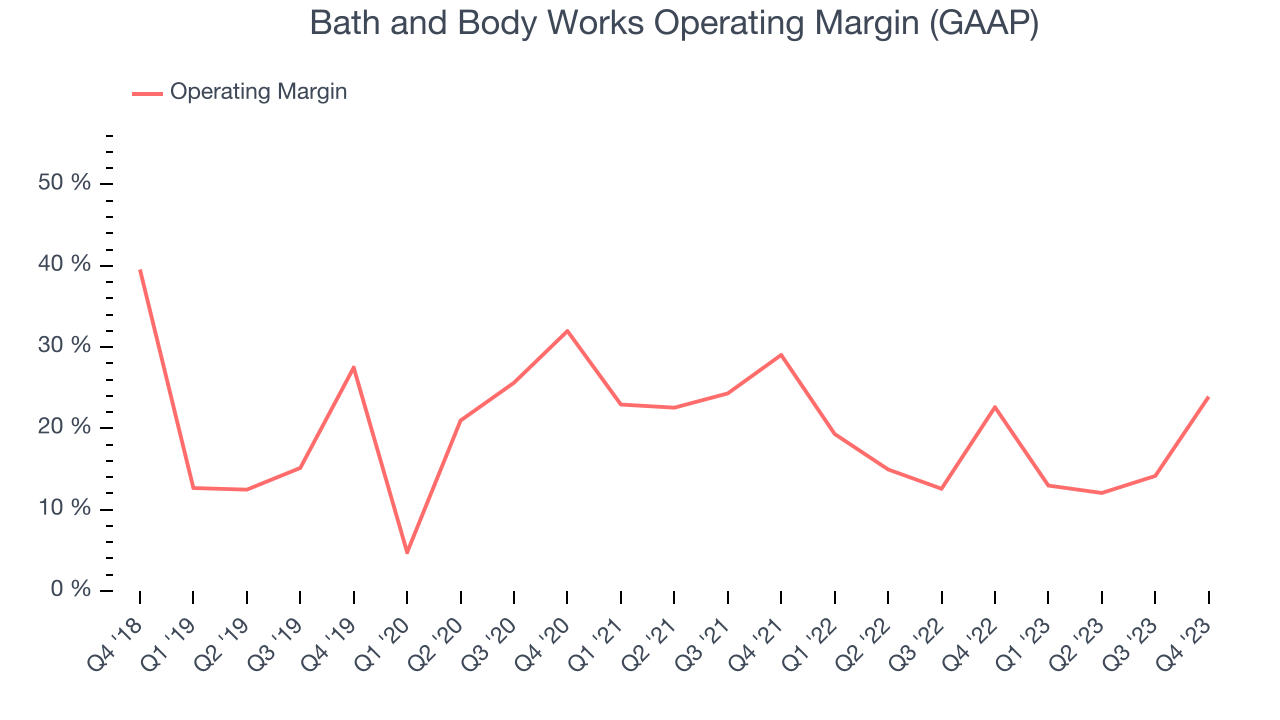

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Bath and Body Works generated an operating profit margin of 23.9%, up 1.3 percentage points year on year. This increase was solid and driven by stronger pricing power, as indicated by the company's larger rise in gross margin.

Zooming out, Bath and Body Works has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 17.8%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Bath and Body Works has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 17.8%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

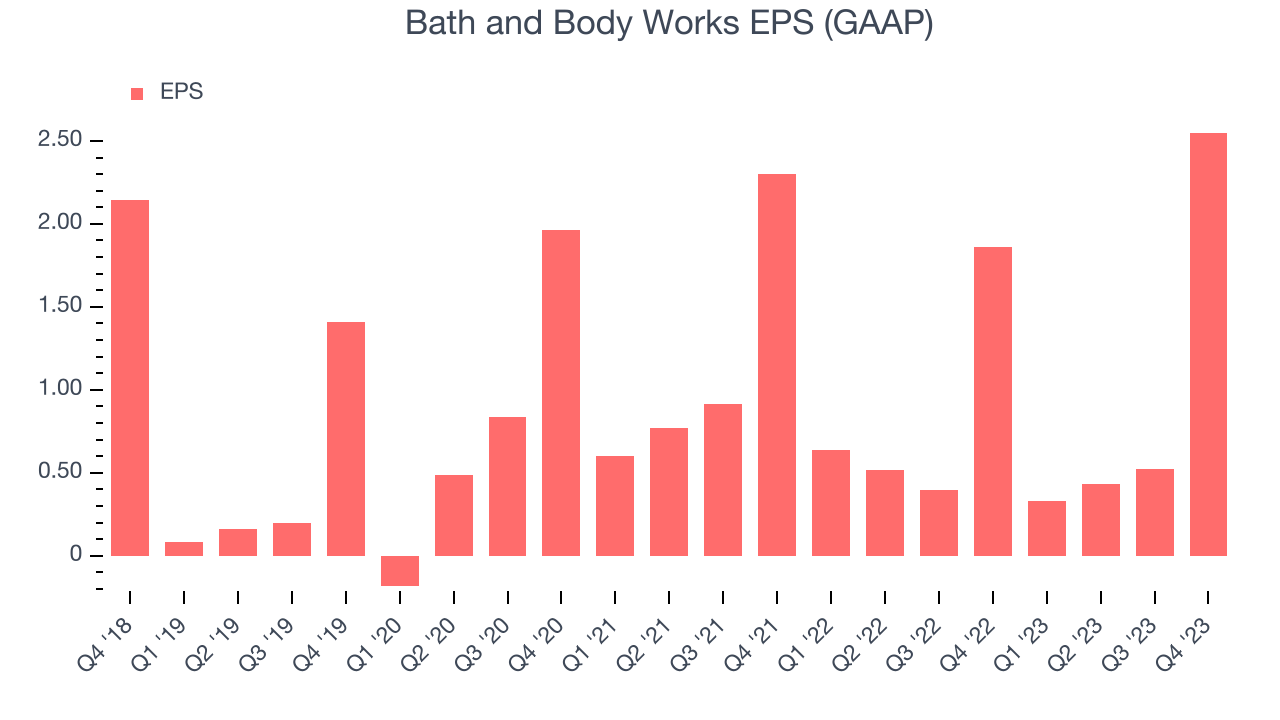

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q4, Bath and Body Works reported EPS at $2.55, up from $1.86 in the same quarter a year ago. This print beat Wall Street's estimates by 42%.

Between FY2019 and FY2023, Bath and Body Works's adjusted diluted EPS grew 389%, translating into an astounding 48.7% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Over the next 12 months, however, Wall Street is projecting an average 14.4% year-on-year decline in EPS.

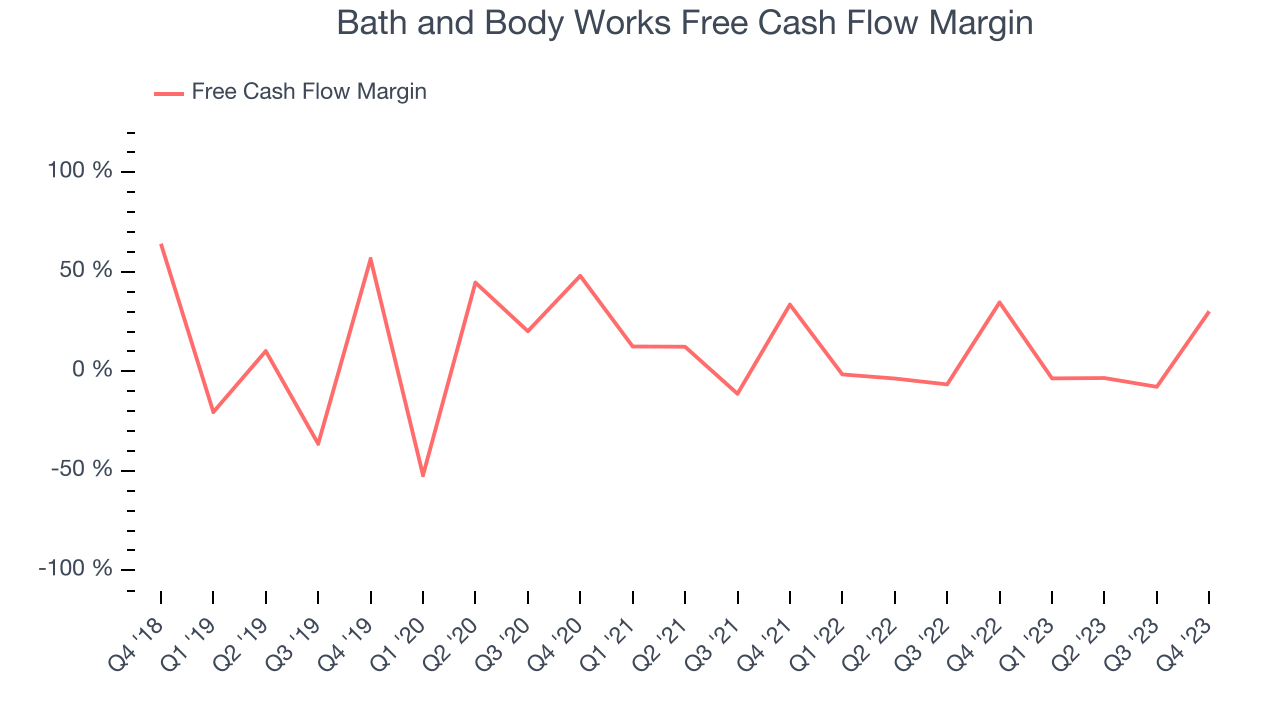

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Bath and Body Works's free cash flow came in at $878 million in Q4, down 12.3% year on year. This result represents a 30.2% margin.

Over the last eight quarters, Bath and Body Works has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company's free cash flow margin has been among the best in consumer retail, averaging 9.8%. However, its margin has averaged year-on-year declines of 2 percentage points. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Bath and Body Works's five-year average ROIC was 48.7%, placing it among the best retail companies. Just as you’d like your investment dollars to generate returns, Bath and Body Works's invested capital has produced excellent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Bath and Body Works's ROIC averaged 7.5 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Bath and Body Works's Q4 Results

We were impressed by how significantly Bath and Body Works blew past analysts' EPS expectations this quarter. We were also excited its revenue outperformed Wall Street's estimates. On the other hand, its full-year earnings forecast missed analysts' expectations and its earnings guidance for next quarter also missed Wall Street's estimates. The stock is down 6.9% after reporting, trading at $45 per share, due to the weak guidance.

Is Now The Time?

Bath and Body Works may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Bath and Body Works isn't a bad business. Although its revenue growth has been mediocre over the last four years with analysts expecting growth to slow from here, its stellar ROIC suggests it has been a well-run company historically. Investors should still be cautious, however, as its shrinking same-store sales suggests it'll need to change its strategy to succeed.

Bath and Body Works's price-to-earnings ratio based on the next 12 months is 14.7x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Bath and Body Works, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $46.93 per share right before these results (compared to the current share price of $45).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.