Electronics retailer Best Buy (NYSE:BBY) fell short of analysts' expectations in Q3 FY2024, with revenue down 7.8% year on year to $9.76 billion. Its full-year revenue guidance of $43.4 billion at the midpoint also came in 1.7% below analysts' estimates. Turning to EPS, Best Buy Co made a non-GAAP profit of $1.29 per share, down from its profit of $1.38 per share in the same quarter last year.

Is now the time to buy Best Buy Co? Find out by accessing our full research report, it's free.

Best Buy Co (BBY) Q3 FY2024 Highlights:

- Revenue: $9.76 billion vs analyst estimates of $9.90 billion (1.4% miss)

- EPS (non-GAAP): $1.29 vs analyst estimates of $1.20 (7.9% beat)

- The company dropped its revenue guidance for the full year from $44.15 billion to $43.4 billion at the midpoint, a 1.7% decrease (EPS guidance also lowered at the midpoint)

- Free Cash Flow was -$108 million, down from $346 million in the same quarter last year

- Gross Margin (GAAP): 22.9%, up from 22% in the same quarter last year (beat)

- Same-Store Sales were down 6.9% year on year (miss vs. expectations of down 5.6% year on year)

With humble beginnings as a stereo equipment seller, Best Buy (NYSE:BBY) now sells a broad selection of consumer electronics, appliances, and home office products.

Electronics & Gaming Retailer

After a long day, some of us want to just watch TV, play video games, listen to music, or scroll through our phones; electronics and gaming retailers sell the technology that makes this possible, plus more. Shoppers can find everything from surround-sound speakers to gaming controllers to home appliances in their stores. Competitive prices and helpful store associates that can talk through topics like the latest technology in gaming and installation keep customers coming back. This is a category that has moved rapidly online over the last few decades, so these electronics and gaming retailers have needed to be nimble and aggressive with their e-commerce and omnichannel investments.

Sales Growth

Best Buy Co is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

As you can see below, the company's annualized revenue growth rate over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was flat, or 0.2%.

This quarter, Best Buy Co reported a rather uninspiring 7.8% year-on-year revenue decline, missing Wall Street's expectations. Looking ahead, analysts expect sales to grow 1.9% over the next 12 months.

The pandemic fundamentally changed several consumer habits. There is a founder-led company that is massively benefiting from this shift. The business has grown astonishingly fast, with 40%+ free cash flow margins. Its fundamentals are undoubtedly best-in-class. Still, the total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

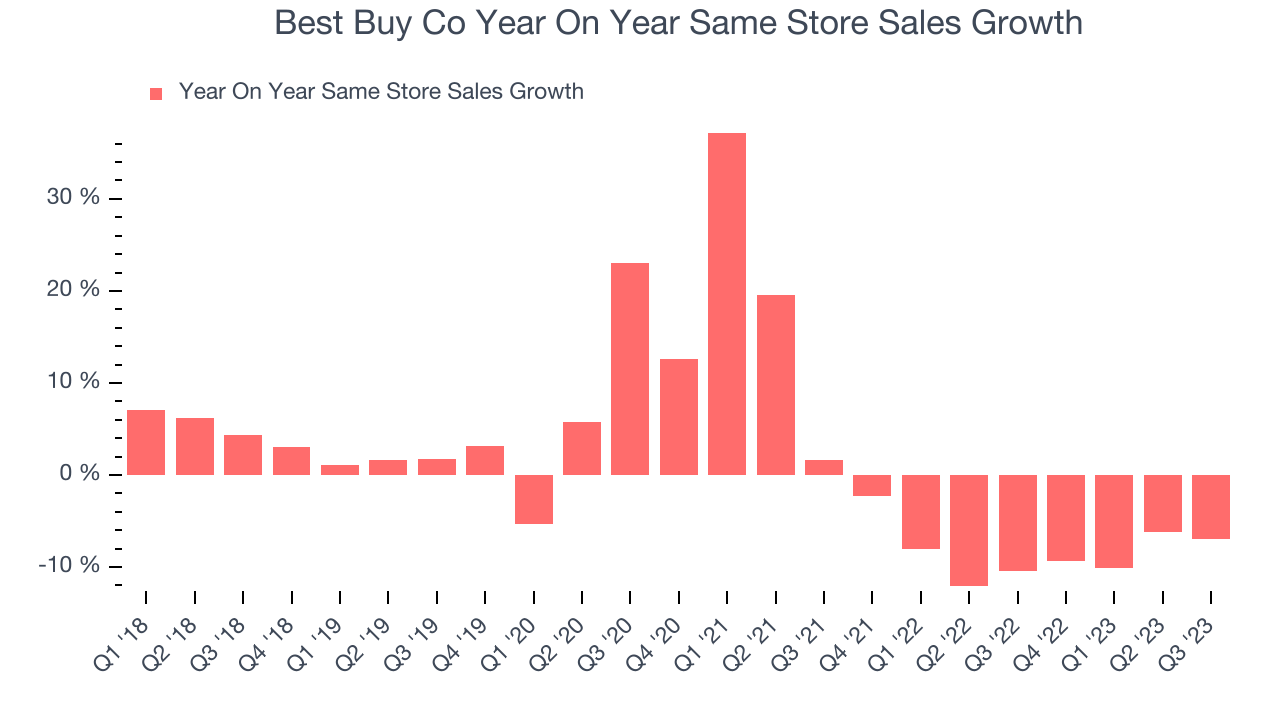

Same-Store Sales

Best Buy Co's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 8.2% year on year.

In the latest quarter, Best Buy Co's same-store sales fell 6.9% year on year. This decrease was a further deceleration from the 10.4% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Best Buy Co's Q3 Results

Sporting a market capitalization of $14.82 billion, more than $636 million in cash on hand, and positive free cash flow over the last 12 months, we believe that Best Buy Co is attractively positioned to invest in growth.

It was good to see Best Buy Co beat analysts' EPS expectations this quarter based on better margin performance. That stood out as a positive in these results. On the other hand, its same-store sales and revenue missed analysts' expectations. Full-year revenue guidance was lowered for revenue and EPS, which both missed Wall Street's estimates. Overall, the results could have been better. The company is down 2.3% on the results and currently trades at $66.5 per share.

Best Buy Co may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.