Boat and marine manufacturer Brunswick (NYSE:BC) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 21.7% year on year to $1.37 billion. On the other hand, next quarter's revenue guidance of $1.55 billion was less impressive, coming in 3.5% below analysts' estimates. It made a non-GAAP profit of $1.35 per share, down from its profit of $2.57 per share in the same quarter last year.

Brunswick (BC) Q1 CY2024 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.37 billion (small miss)

- EPS (non-GAAP): $1.35 vs analyst estimates of $1.35 (small beat)

- Revenue Guidance for Q2 CY2024 is $1.55 billion at the midpoint, below analyst estimates of $1.61 billion

- EPS (non-GAAP) Guidance for Q2 CY2024 is $1.95 at the midpoint, below analyst estimates of $2.04

- The company reconfirmed its revenue guidance for the full year of $6.1 billion at the midpoint

- Gross Margin (GAAP): 27.4%, down from 29% in the same quarter last year

- Free Cash Flow was -$204.5 million, down from $227.1 million in the previous quarter

- Market Capitalization: $5.85 billion

Formerly known as Brunswick-Balke-Collender Company, Brunswick (NYSE: BC) is a designer and manufacturer of recreational marine products, including boats, engines, and marine parts.

Brunswick was founded in the 19th century, initially carving a niche in products like billiards before pivoting to the marine industry. It was created out of a vision to deliver high-quality products that enhance leisure time. Brunswick shifted to the marine industry to take advantage of the expanding leisure market and the appeal of boating.

The company presents a diverse array of marine vehicles and high-performance outboard engines, serving both leisure boaters and professionals. The selection spans from modest-sized vessels suitable for family leisure to advanced marine craft engineered for demanding oceanic excursions.

Brunswick’s primary revenue streams come from boat and engine sales, complemented by a strong aftermarket presence for parts and accessories. It also has a comprehensive dealer network that helps sell its products

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the recreational marine industry include Malibu Boats (NASDAQ:MBUU), Marine Products (NYSE:MPX), and MasterCraft Boat (NASDAQ:MCFT).Sales Growth

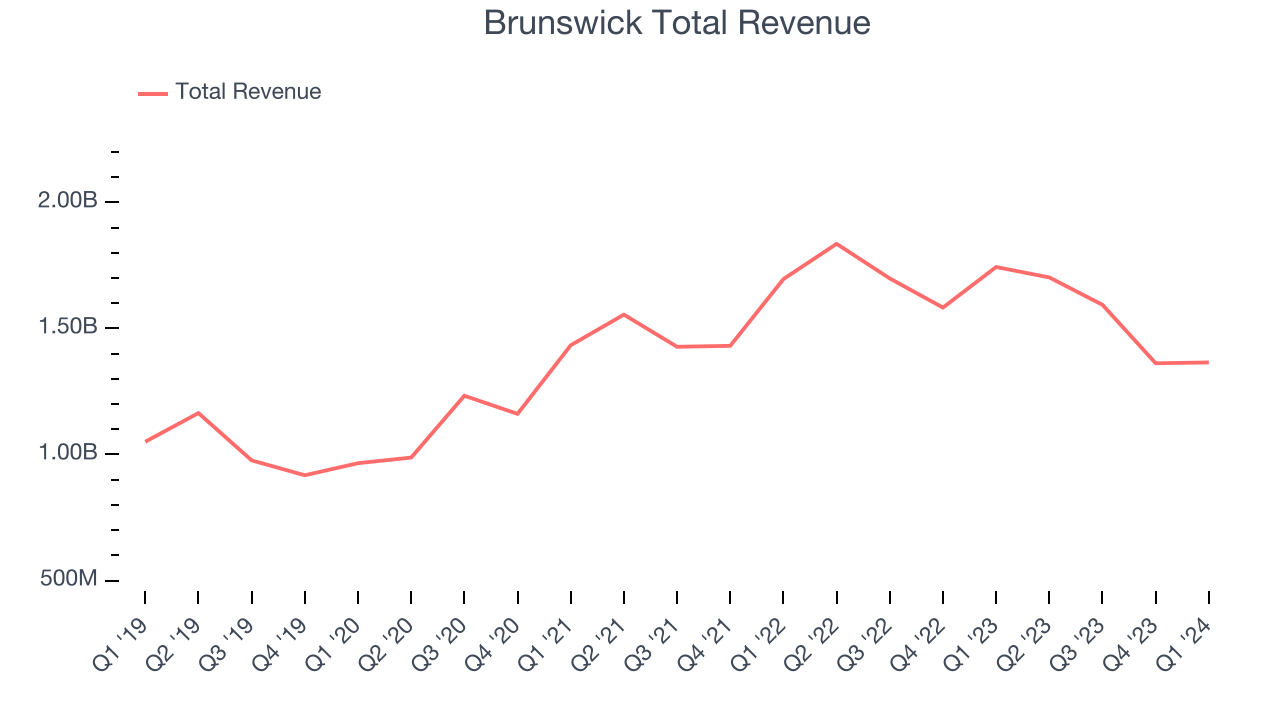

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Brunswick's annualized revenue growth rate of 7.5% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Brunswick's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Brunswick's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

This quarter, Brunswick reported a rather uninspiring 21.7% year-on-year revenue decline to $1.37 billion of revenue, in line with Wall Street's estimates. The company is guiding for a 8.9% year-on-year revenue decline next quarter to $1.55 billion, a deceleration from the 7.3% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 3.6% over the next 12 months, an acceleration from this quarter.

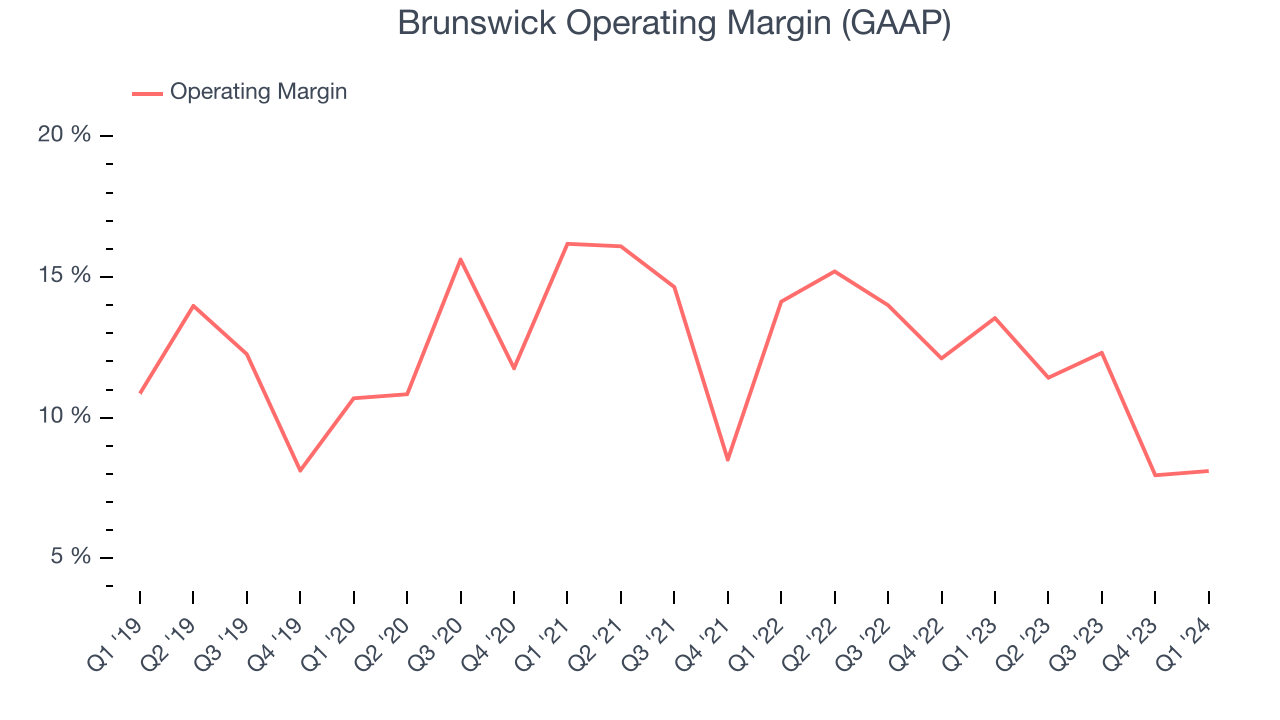

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Brunswick has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.1%, higher than the broader consumer discretionary sector.

This quarter, Brunswick generated an operating profit margin of 8.1%, down 5.4 percentage points year on year.

Over the next 12 months, Wall Street expects Brunswick to become more profitable. Analysts are expecting the company’s LTM operating margin of 10.1% to rise to 12.9%.EPS

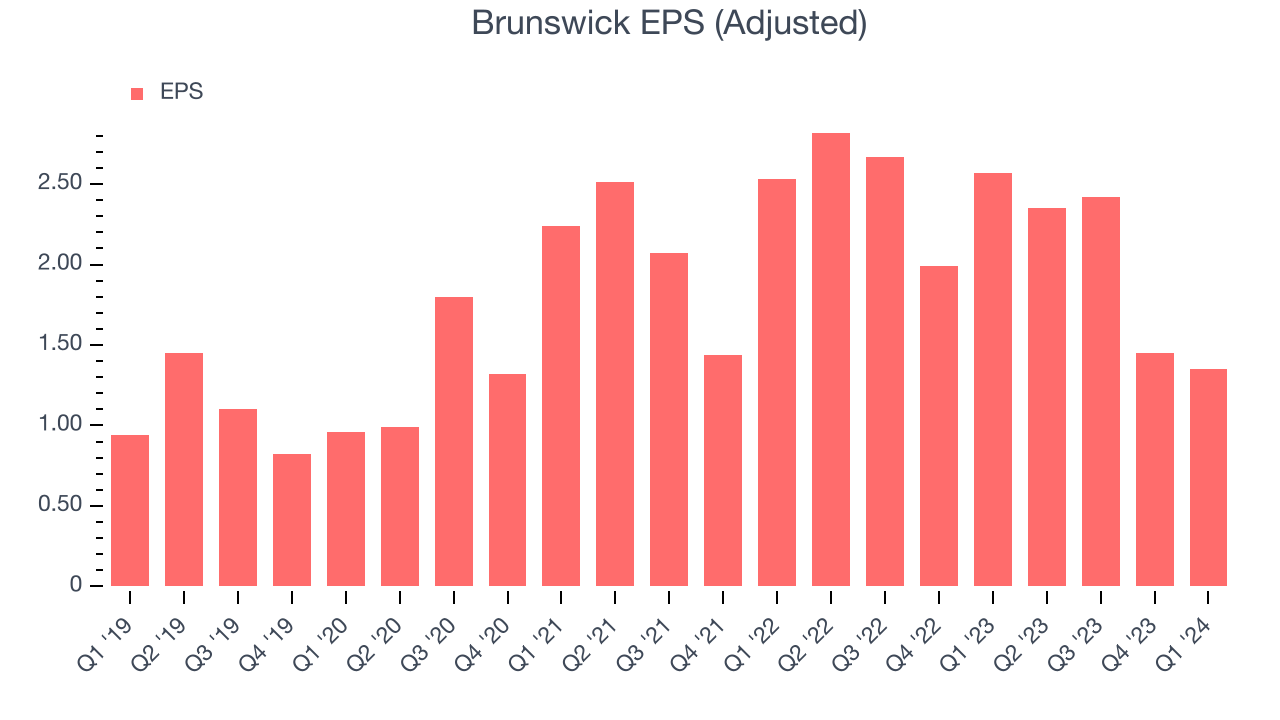

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, Brunswick's EPS grew 81.1%, translating into a decent 12.6% compounded annual growth rate. This performance is materially higher than its 7.5% annualized revenue growth over the same period. Let's dig into why.

A five-year view shows that Brunswick has repurchased its stock, shrinking its share count by 22.2%. This has led to higher per share earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Brunswick reported EPS at $1.35, down from $2.57 in the same quarter last year. This print was close to analysts' estimates. Over the next 12 months, Wall Street expects Brunswick to grow its earnings. Analysts are projecting its LTM EPS of $7.57 to climb by 6.1% to $8.04.

Cash Is King

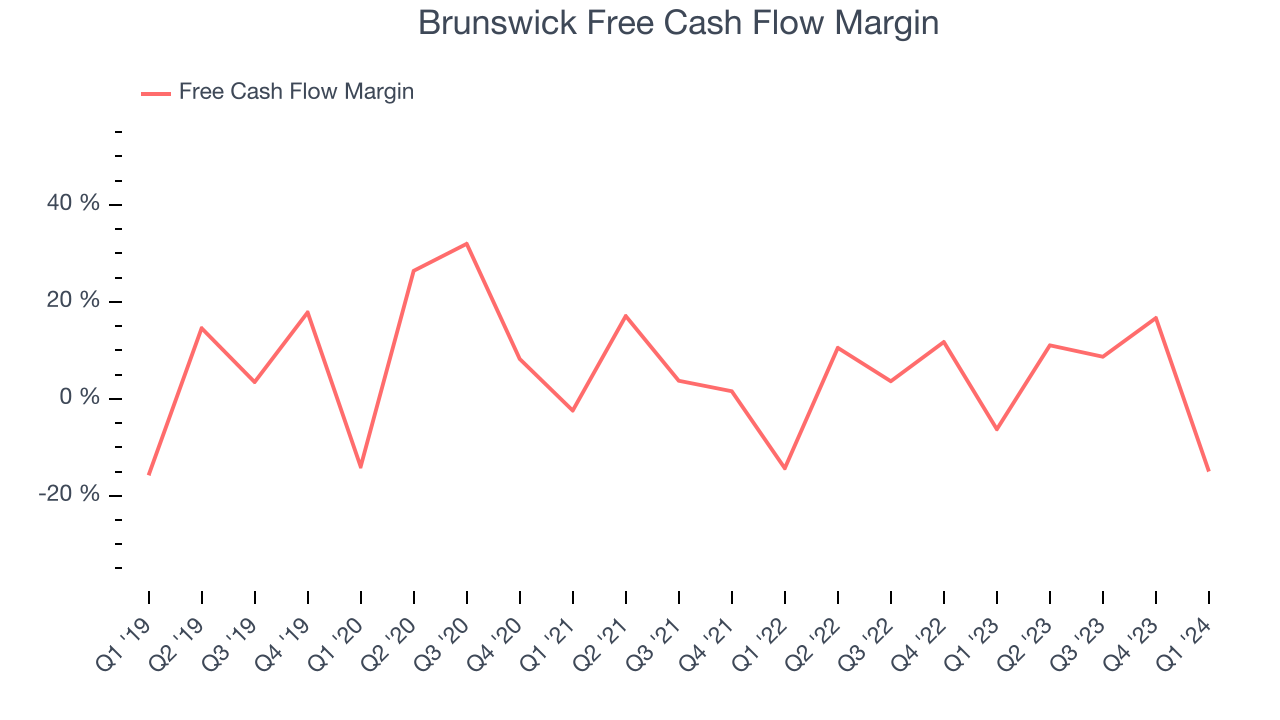

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Brunswick has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 5.3%, subpar for a consumer discretionary business.

Brunswick burned through $204.5 million of cash in Q1, equivalent to a negative 15% margin, reducing its cash burn by 87.1% year on year.

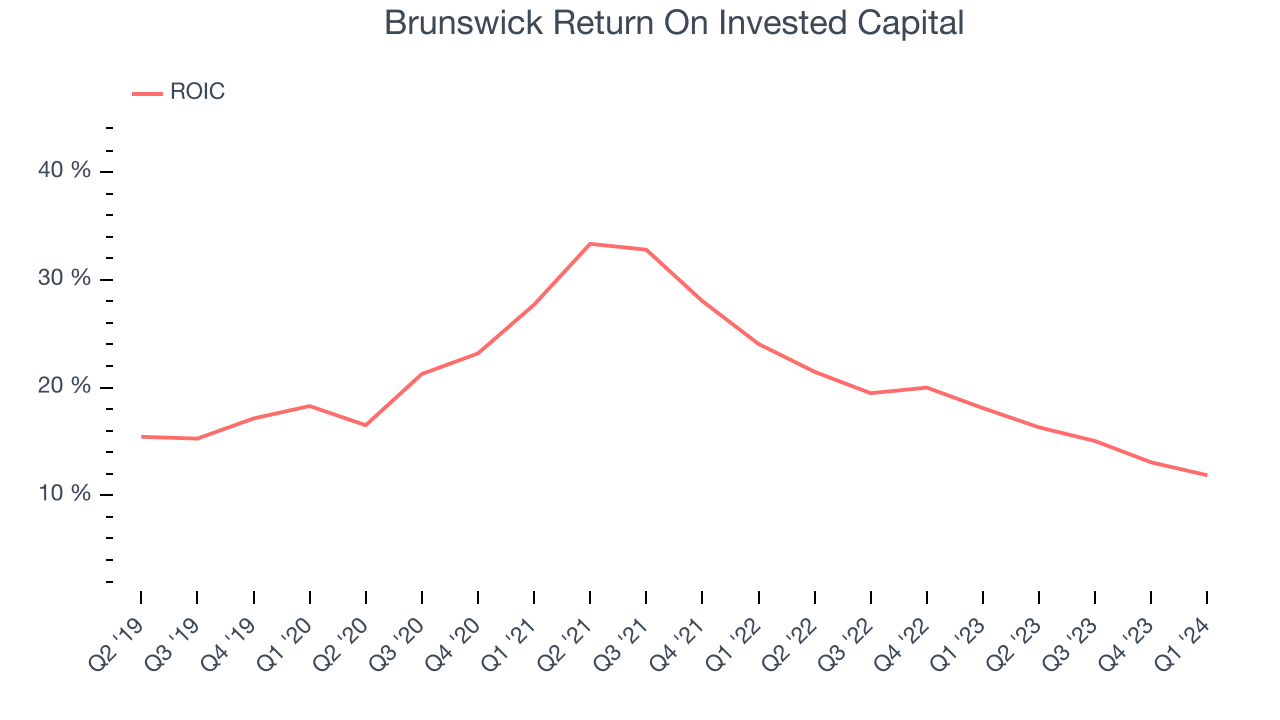

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Although Brunswick hasn't been the highest-quality company lately because of its poor top-line performance, it historically did an excellent job investing in profitable business initiatives. Its five-year average return on invested capital was 20%, impressive for a consumer discretionary company.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Brunswick's ROIC averaged 8 percentage point decreases over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Key Takeaways from Brunswick's Q1 Results

It was good to see Brunswick's full-year revenue forecast beat analysts' expectations. We were also glad its full-year earnings guidance exceeded Wall Street's estimates. On the other hand, its operating margin missed and its revenue guidance for next quarter came in slightly below Wall Street's estimates. Overall, this was a mixed quarter for Brunswick. The company is down 2.4% on the results and currently trades at $84 per share.

Is Now The Time?

When considering an investment in Brunswick, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for all companies serving consumers, but in the case of Brunswick, we'll be cheering from the sidelines. Its revenue growth has been a little slower over the last five years, and analysts expect growth to deteriorate from here. And while its market-beating ROIC suggests it has been a well-managed company historically, the downside is its low free cash flow margins give it little breathing room. On top of that, its projected EPS for the next year is lacking.

Brunswick's price-to-earnings ratio based on the next 12 months is 10.7x. While there are some things to like about Brunswick and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $95.73 per share right before these results (compared to the current share price of $84).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.