Wrapping up Q2 earnings, we look at the numbers and key takeaways for the industrial distributors stocks, including Boise Cascade (NYSE:BCC) and its peers.

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Distributors that boast a reliable selection of products–everything from hardhats and fasteners for jet engines to ceiling systems–and quickly deliver goods to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to better interact with customers. Additionally, distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

The 29 industrial distributors stocks we track reported a slower Q2. As a group, revenues were in line with analysts’ consensus estimates.

Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. On the other hand, 2024 has been a bumpier ride as the market switches between optimism and pessimism around rate cuts and inflation, and while some industrial distributors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.6% since the latest earnings results.

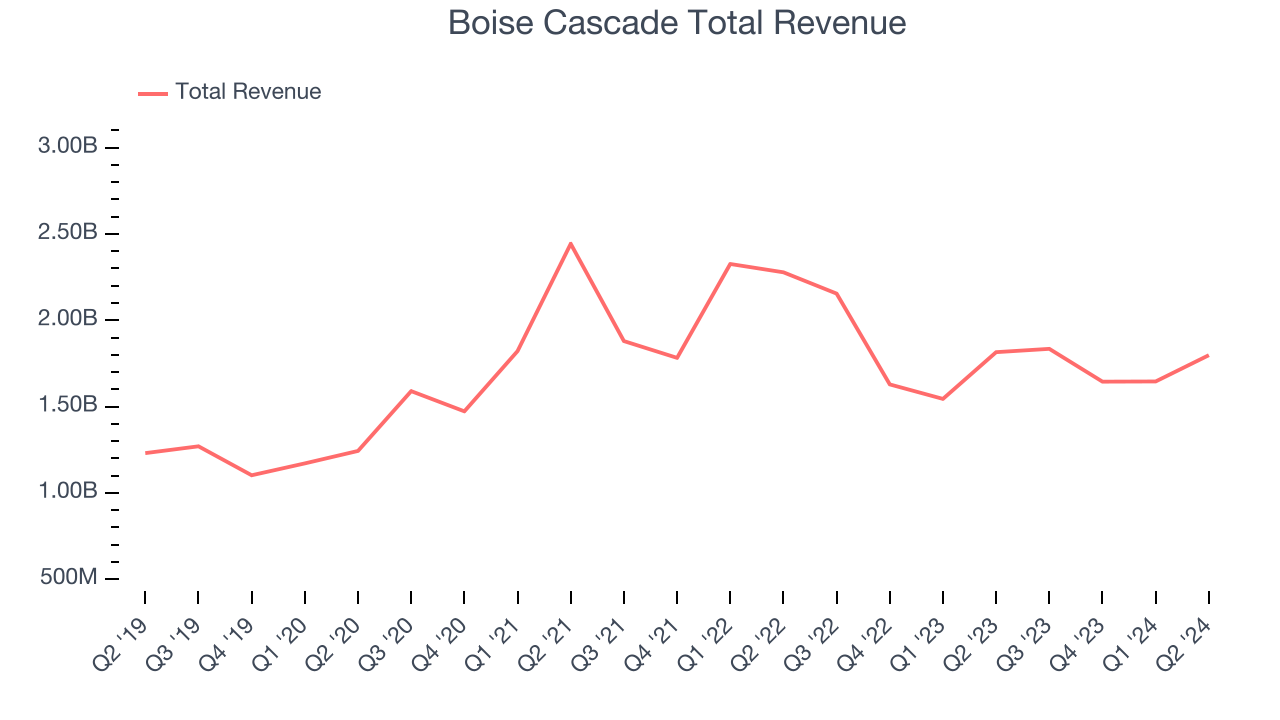

Boise Cascade (NYSE:BCC)

Formed through the merger of two lumber companies, Boise Cascade Company (NYSE:BCC) manufactures and distributes wood products and other building materials.

Boise Cascade reported revenues of $1.80 billion, flat year on year. This print exceeded analysts’ expectations by 1.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ operating margin estimates and a decent beat of analysts’ Building Material Distribution revenue estimates.

Interestingly, the stock is up 9.4% since reporting and currently trades at $135.86.

Is now the time to buy Boise Cascade? Access our full analysis of the earnings results here, it’s free.

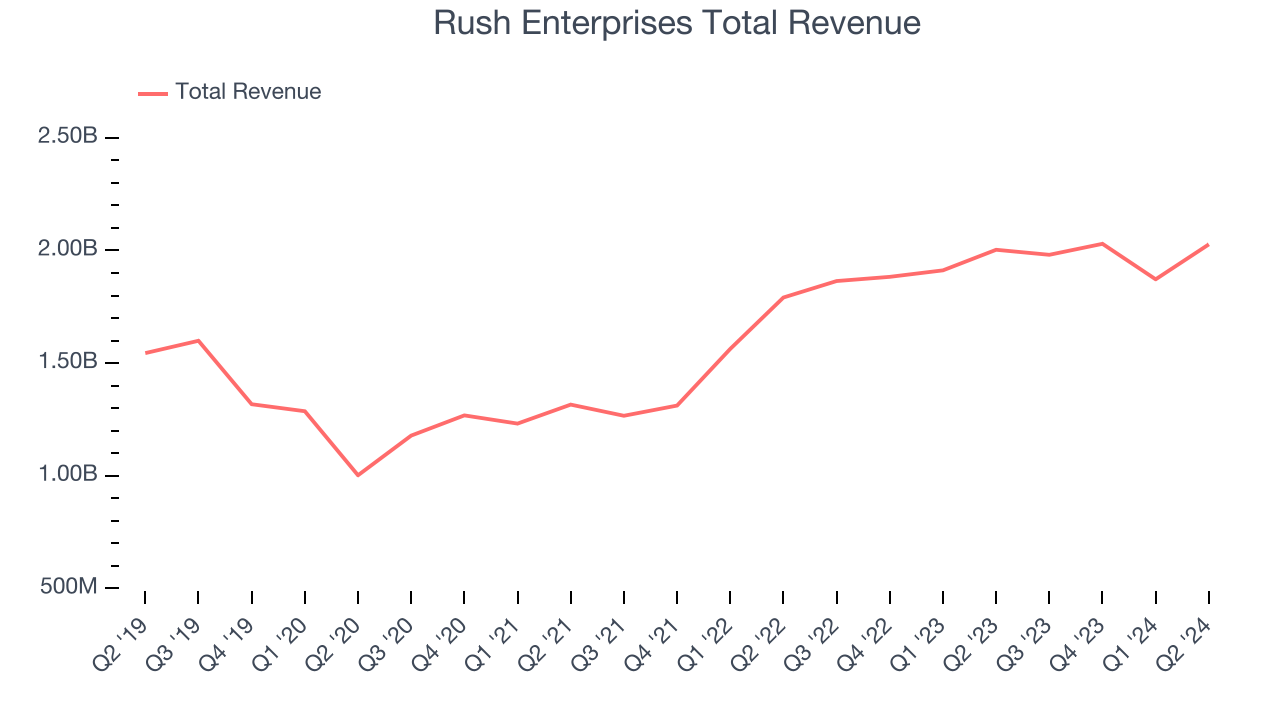

Best Q2: Rush Enterprises (NASDAQ:RUSHA)

Headquartered in Texas, Rush Enterprises (NASDAQ:RUSH.A) provides truck-related services and solutions, including sales, leasing, parts, and maintenance for commercial vehicles.

Rush Enterprises reported revenues of $2.03 billion, up 1.2% year on year, outperforming analysts’ expectations by 8.8%. The business had an exceptional quarter with an impressive beat of analysts’ earnings estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $50.89.

Is now the time to buy Rush Enterprises? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Hudson Technologies (NASDAQ:HDSN)

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $75.28 million, down 16.8% year on year, falling short of analysts’ expectations by 4.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations and a miss of analysts’ earnings estimates.

Hudson Technologies delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 5.6% since the results and currently trades at $7.95.

Read our full analysis of Hudson Technologies’s results here.

Global Industrial (NYSE:GIC)

Formerly known as Systemax, Global Industrial (NYSE:GIC) distributes industrial and commercial products to businesses and institutions.

Global Industrial reported revenues of $347.8 million, up 6.8% year on year. This print met analysts’ expectations. More broadly, it was a decent quarter with key figures such as revenue and EPS largely in line with expectations.

The stock is down 10.1% since reporting and currently trades at $32.21.

Read our full, actionable report on Global Industrial here, it’s free.

Titan Machinery (NASDAQ:TITN)

Founded in 1980, Titan Machinery (NASDAQ:TITN) is a distributor of agricultural and construction equipment across the United States and Europe.

Titan Machinery reported revenues of $633.7 million, down 1.4% year on year. This print was in line with analysts’ expectations. More broadly, it was an ok quarter for the company, as its revenue and EPS were pretty much in line with expectations.

The stock is down 1.4% since reporting and currently trades at $13.97.

Read our full, actionable report on Titan Machinery here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.