Electricity generation and hydrogen production company Bloom Energy (NYSE:BE) reported Q2 CY2024 results topping analysts' expectations, with revenue up 11.5% year on year to $335.8 million. The company's full-year revenue guidance of $1.5 billion at the midpoint also came in 3% above analysts' estimates. It made a non-GAAP loss of $0.06 per share, improving from its loss of $0.32 per share in the same quarter last year.

Is now the time to buy Bloom Energy? Find out by accessing our full research report, it's free.

Bloom Energy (BE) Q2 CY2024 Highlights:

- Revenue: $335.8 million vs analyst estimates of $306.4 million (9.6% beat)

- EPS (non-GAAP): -$0.06 vs analyst estimates of -$0.05

- Gross Margin (GAAP): 20.4%, in line with the same quarter last year

- Adjusted EBITDA Margin: 3%, up from -2.8% in the same quarter last year

- Free Cash Flow was -$187.5 million compared to -$168.7 million in the previous quarter

- Market Capitalization: $2.25 billion

KR Sridhar, CEO of Bloom Energy, said, “It is now widely understood that demand for electricity is expected to far exceed available supply through the grid. It is presenting Bloom with a huge opportunity. We are seeing high levels of commercial interest in our products and solutions. We continue to execute well, advance our technology and build out our team for future growth.”

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

Sales Growth

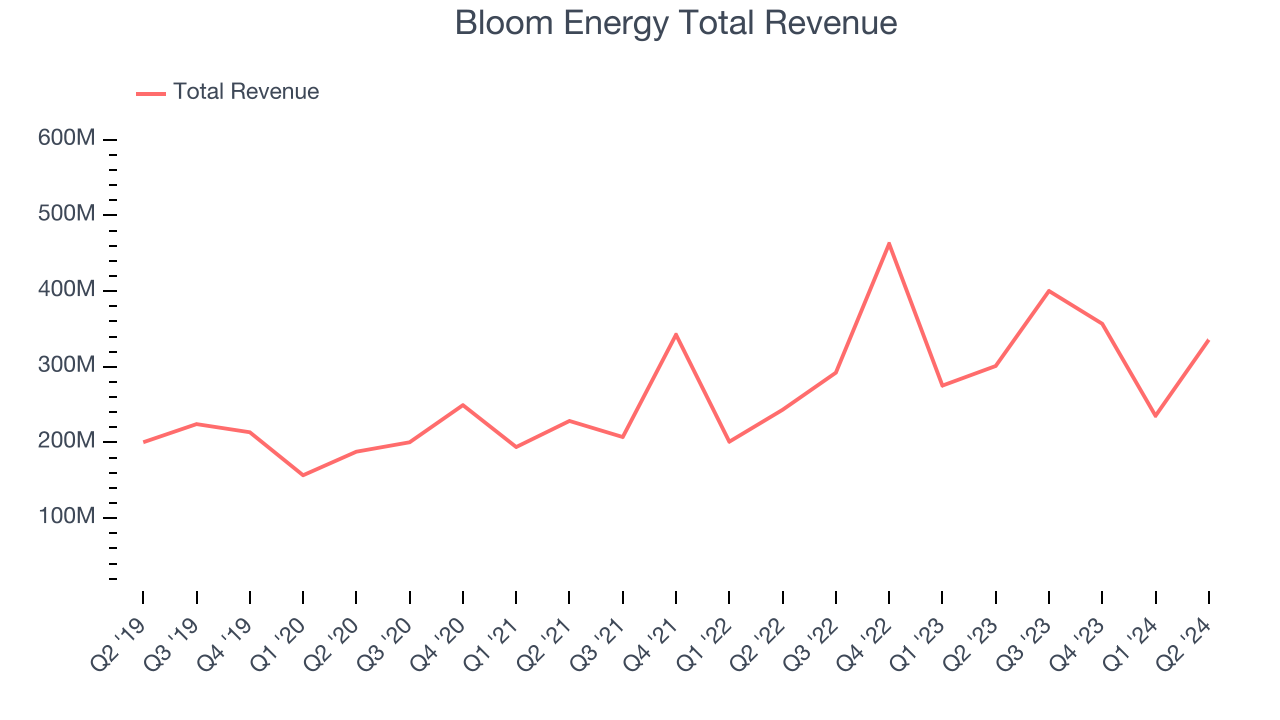

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Bloom Energy grew its sales at an exceptional 13.8% compounded annual growth rate. This is a great starting point for our analysis because it shows Bloom Energy's offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Bloom Energy's annualized revenue growth of 15.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company's revenue dynamics by analyzing its most important segments, Product and Service, which are 67.4% and 15.6% of revenue. Over the last two years, Bloom Energy's Product revenue (energy servers and electrolyzers) averaged 22.4% year-on-year growth while its Service revenue (operations and maintenance agreements) averaged 20.5% growth.

This quarter, Bloom Energy reported robust year-on-year revenue growth of 11.5%, and its $335.8 million of revenue exceeded Wall Street's estimates by 9.6%. Looking ahead, Wall Street expects sales to grow 25.2% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

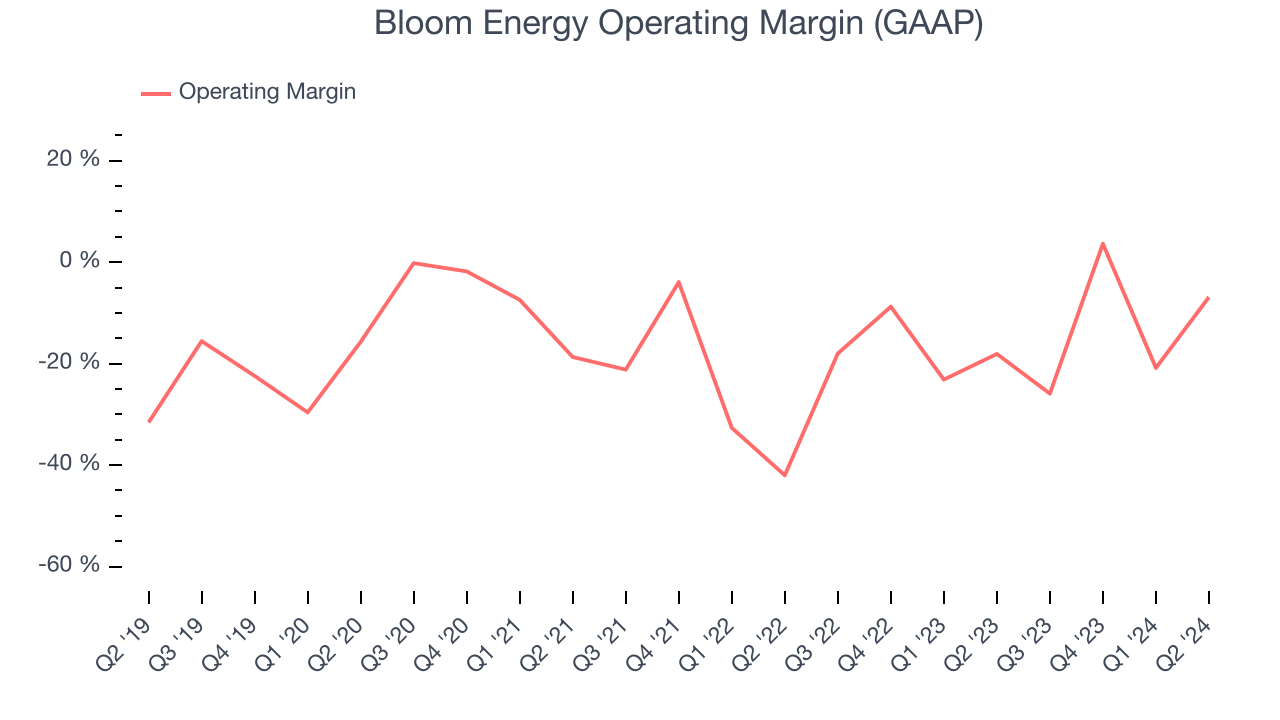

Unprofitable industrials companies require extra attention because they could get caught swimming naked if the tide goes out. It's hard to trust that Bloom Energy can endure a full cycle as its high expenses have contributed to an average operating margin of negative 15.5% over the last five years. This result isn't too surprising given its low gross margin as a starting point.

On the bright side, Bloom Energy's annual operating margin rose by 8 percentage points over the last five years, as its sales growth gave it immense operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Bloom Energy generated an operating profit margin of negative 6.9%, up 11.2 percentage points year on year. This increase was solid, and since the company's operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as sales, marketing, R&D, and administrative overhead.

EPS

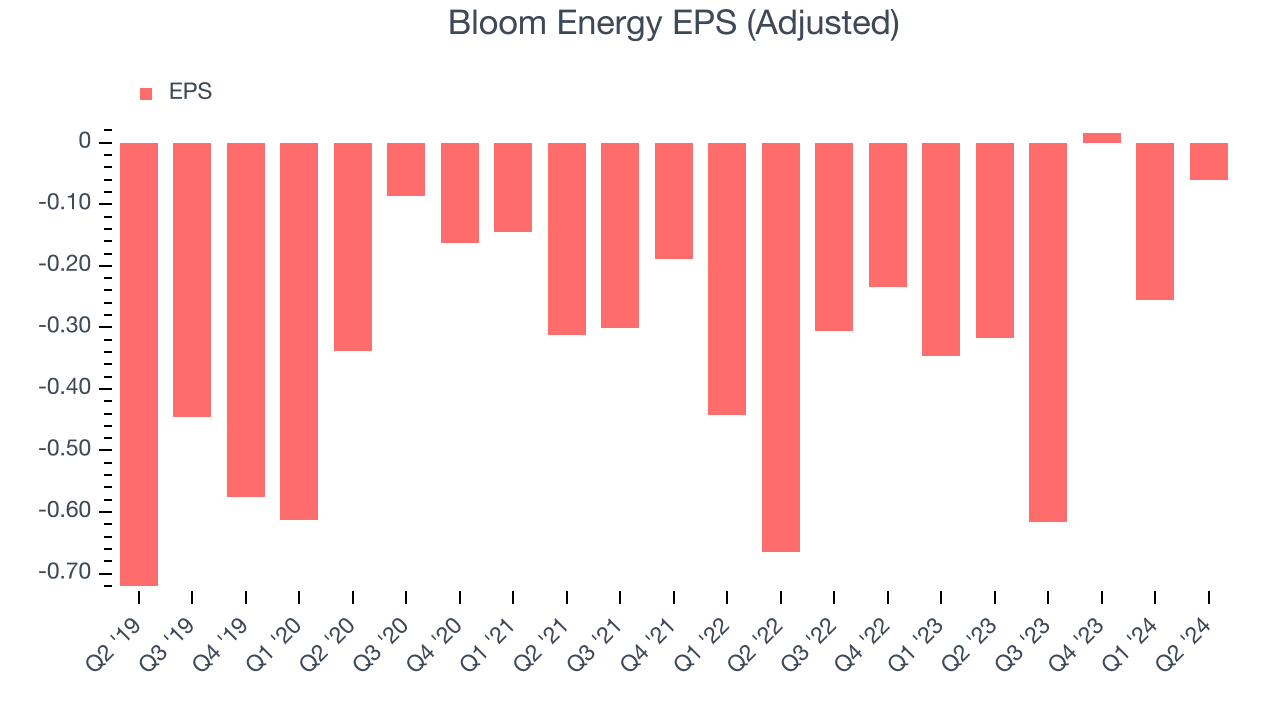

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Bloom Energy's full-year earnings are still negative, it reduced its losses and improved its EPS by 24.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q2, Bloom Energy reported EPS at negative $0.06, up from negative $0.32 in the same quarter last year. Despite growing year on year, this print missed analysts' estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Bloom Energy's EPS of negative $0.91 in the last year to reach break even.

Key Takeaways from Bloom Energy's Q2 Results

We were impressed by how significantly Bloom Energy blew past analysts' revenue expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. On the other hand, its EPS missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 6.7% to $11.26 immediately after reporting.

Bloom Energy may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.