Let’s dig into the relative performance of Brown-Forman (NYSE:BF.B) and its peers as we unravel the now-completed Q4 beverages and alcohol earnings season.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 14 beverages and alcohol stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 13.1% below.

Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. On the other hand, 2024 has been a bumpier ride as the market switches between optimism and pessimism around rate cuts and inflation. However, beverages and alcohol stocks have held steady amidst all this with average share prices relatively unchanged since the latest earnings results.

Weakest Q4: Brown-Forman (NYSE:BF.B)

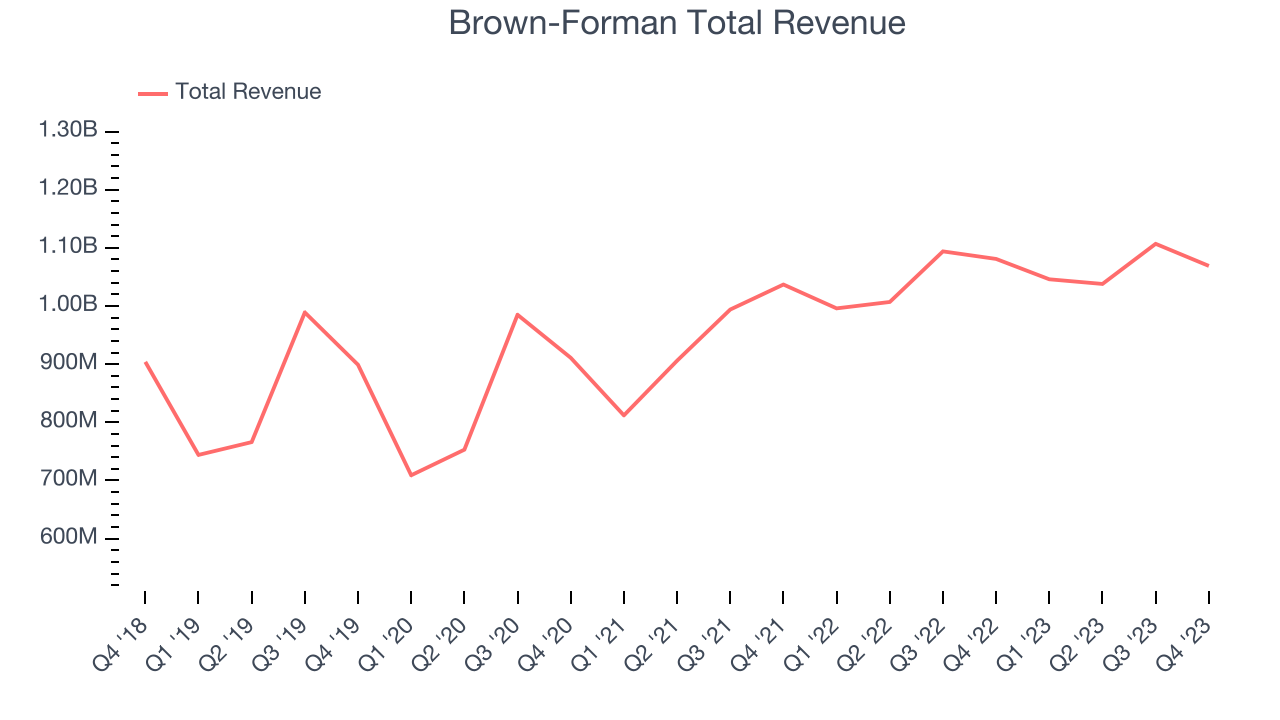

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Brown-Forman reported revenues of $1.07 billion, down 1.1% year on year. This print fell short of analysts’ expectations by 4.5%. Overall, it was a disappointing quarter for the company with a miss of analysts’ organic revenue growth estimates.

Unsurprisingly, the stock is down 25% since reporting and currently trades at $45.58.

Is now the time to buy Brown-Forman? Access our full analysis of the earnings results here, it’s free.

Best Q4: Celsius (NASDAQ:CELH)

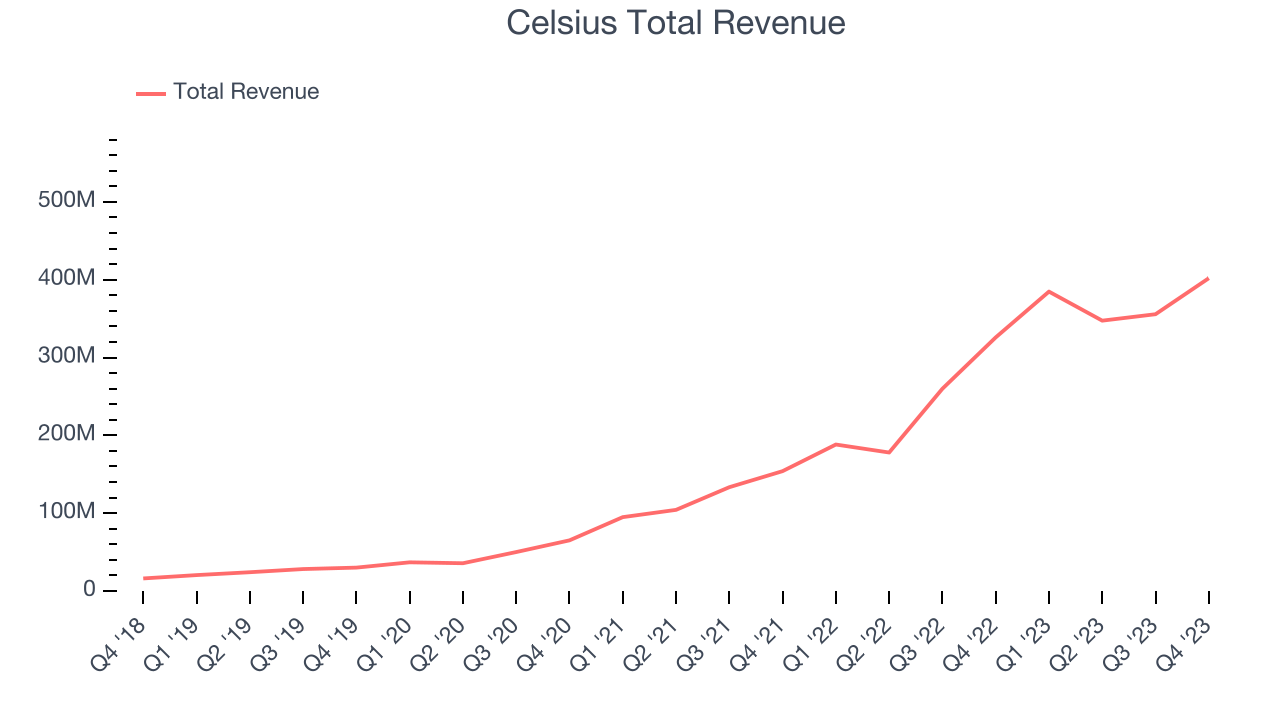

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $402 million, up 23.4% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with a solid beat of analysts’ gross margin estimates.

Celsius delivered the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 21.6% since reporting. It currently trades at $32.43.

Is now the time to buy Celsius? Access our full analysis of the earnings results here, it’s free.

Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $579.1 million, down 4% year on year, falling short of analysts’ expectations by 3.1%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

The stock is flat since the results and currently trades at $270.25.

Read our full analysis of Boston Beer’s results here.

Vita Coco (NASDAQ:COCO)

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ:COCO) offers coconut water products that are a natural way to quench thirst.

Vita Coco reported revenues of $144.1 million, up 3.2% year on year. This number met analysts’ expectations. It was a strong quarter as it also recorded an impressive beat of analysts’ gross margin estimate.

Vita Coco had the weakest full-year guidance update among its peers. The stock is up 6.6% since reporting and currently trades at $26.40.

Read our full, actionable report on Vita Coco here, it’s free.

Molson Coors (NYSE:TAP)

Sporting an impressive roster of iconic beer brands, Molson Coors (NYSE:TAP) is a global brewing giant with a rich history dating back more than two centuries.

Molson Coors reported revenues of $3.25 billion, flat year on year. This print surpassed analysts’ expectations by 2.2%. Overall, it was an impressive quarter as it also produced a decent beat of analysts’ gross margin and earnings estimates.

The stock is up 7.1% since reporting and currently trades at $54.75.

Read our full, actionable report on Molson Coors here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.