Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Brown-Forman (NYSE:BF.B) and the best and worst performers in the beverages and alcohol industry.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 14 beverages and alcohol stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 13.1% below.

Inflation progressed towards the Fed's 2% goal recently, leading the Fed to reduce its policy rate by 50bps (half a percent or 0.5%) in September 2024. This is the first cut in four years. While CPI (inflation) readings have been supportive lately, employment measures have bordered on worrisome. The markets will be debating whether this rate cut's timing (and more potential ones in 2024 and 2025) is ideal for supporting the economy or a bit too late for a macro that has already cooled too much.

In light of this news, beverages and alcohol stocks have held steady with share prices up 3.7% on average since the latest earnings results.

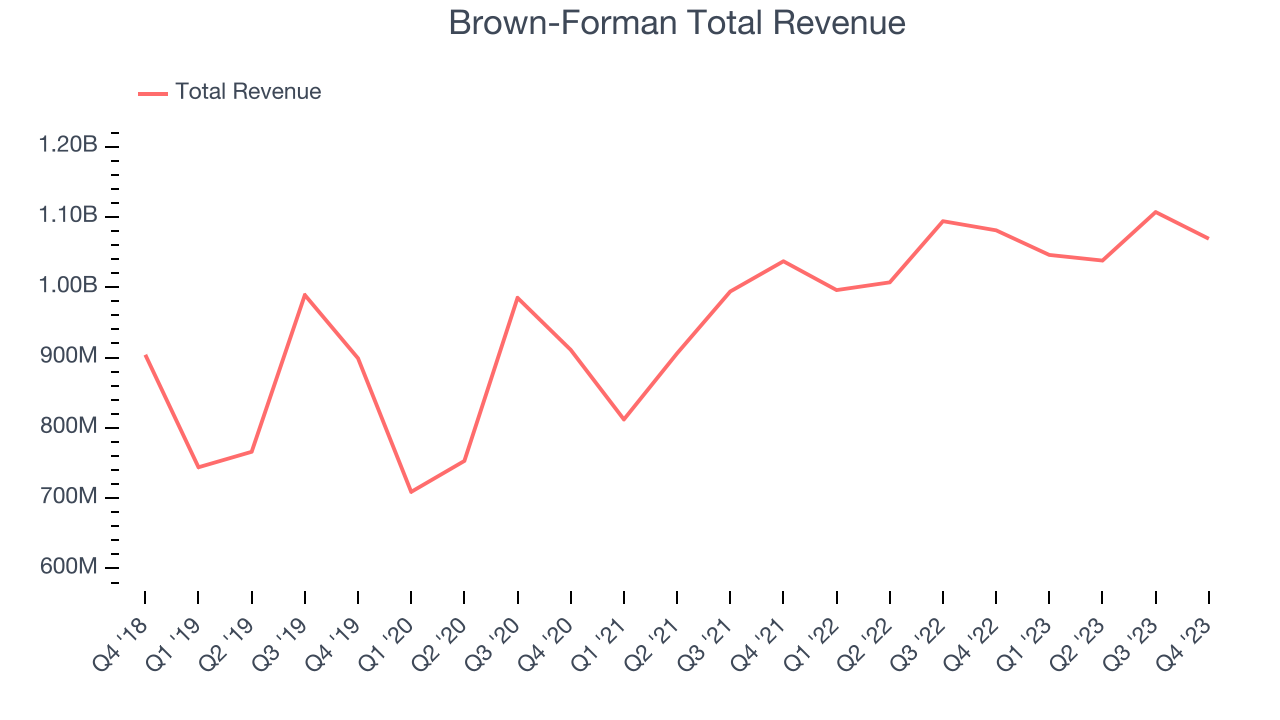

Weakest Q4: Brown-Forman (NYSE:BF.B)

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Brown-Forman reported revenues of $1.07 billion, down 1.1% year on year. This print fell short of analysts’ expectations by 4.5%. Overall, it was a disappointing quarter for the company with a miss of analysts’ organic revenue growth estimates.

Unsurprisingly, the stock is down 20.4% since reporting and currently trades at $48.34.

Is now the time to buy Brown-Forman? Access our full analysis of the earnings results here, it’s free.

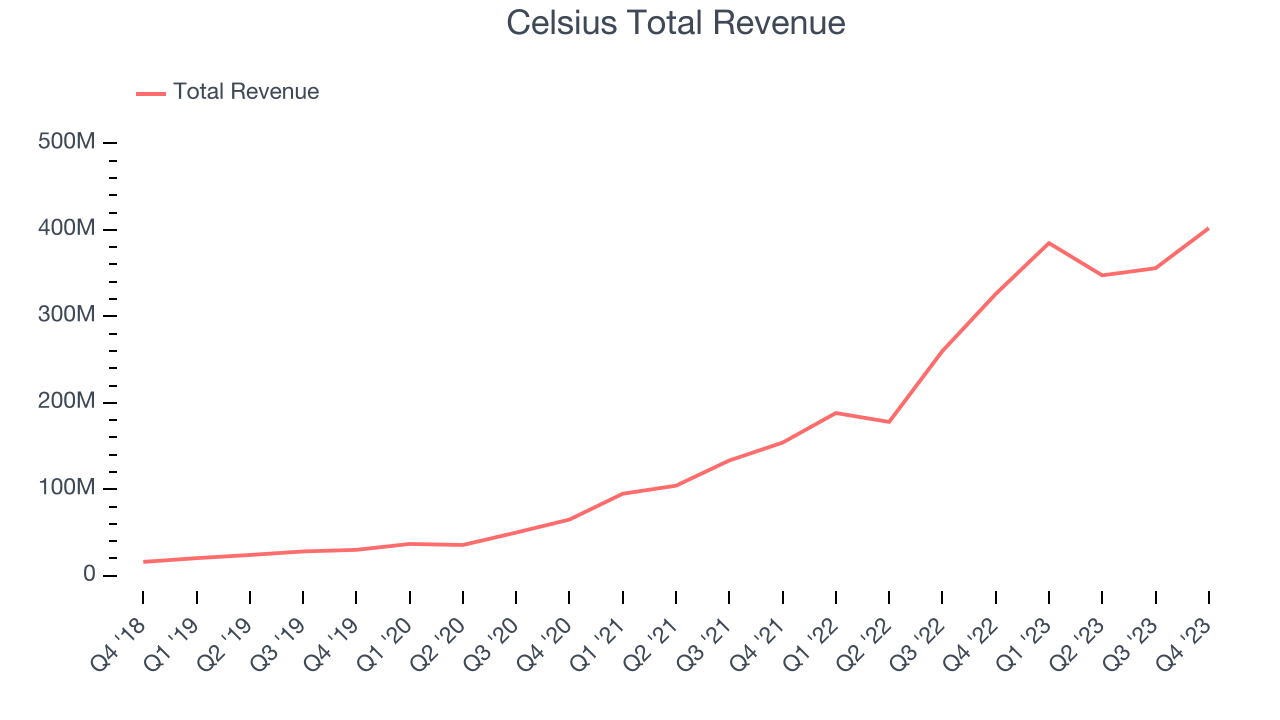

Best Q4: Celsius (NASDAQ:CELH)

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ:CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $402 million, up 23.4% year on year, outperforming analysts’ expectations by 2.4%. The business had a very strong quarter with a solid beat of analysts’ gross margin estimates.

Celsius pulled off the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 21.3% since reporting. It currently trades at $32.55.

Is now the time to buy Celsius? Access our full analysis of the earnings results here, it’s free.

Boston Beer (NYSE:SAM)

Known for its flavorful beverages challenging the status quo, Boston Beer (NYSE:SAM) is a pioneer in craft brewing and a symbol of American innovation in the alcoholic beverage industry.

Boston Beer reported revenues of $579.1 million, down 4% year on year, falling short of analysts’ expectations by 3.1%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Interestingly, the stock is up 4.7% since the results and currently trades at $283.50.

Read our full analysis of Boston Beer’s results here.

Duckhorn (NYSE:NAPA)

With many of their grapes sourced from the famous Napa Valley region of California, The Duckhorn Portfolio (NYSE:NAPA) is a producer of premium wines and known for its Merlot and other Bordeaux varietals.

Duckhorn reported revenues of $92.53 million, up 1.4% year on year. This number was in line with analysts’ expectations. However, it was a disappointing quarter as it logged a miss of analysts’ earnings estimates and underwhelming earnings guidance for the full year.

The stock is down 24.3% since reporting and currently trades at $5.89.

Read our full, actionable report on Duckhorn here, it’s free.

PepsiCo (NASDAQ:PEP)

With a history that goes back more than a century, PepsiCo (NASDAQ:PEP) is a household name in food and beverages today and best known for its flagship soda.

PepsiCo reported revenues of $22.5 billion, flat year on year. This number met analysts’ expectations. More broadly, it was a disappointing quarter as it produced a miss of analysts’ organic revenue growth estimates and underwhelming earnings guidance for the full year.

The stock is up 4.1% since reporting and currently trades at $170.44.

Read our full, actionable report on PepsiCo here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.