Alcohol company Brown-Forman (NYSE:BF.B) missed analysts' expectations in Q3 FY2024, with revenue down 1.1% year on year to $1.07 billion. It made a GAAP profit of $0.60 per share, improving from its profit of $0.21 per share in the same quarter last year.

Brown-Forman (BF.B) Q3 FY2024 Highlights:

- Revenue: $1.07 billion vs analyst estimates of $1.12 billion (4.5% miss)

- EPS: $0.60 vs analyst estimates of $0.57 (5.1% beat)

- Full year guidance calls for "organic net sales to be flat, reflecting the slower than anticipated growth for the nine months" (below expectations)

- Free Cash Flow of $196 million, up from $29 million in the previous quarter

- Gross Margin (GAAP): 59.4%, up from 57.7% in the same quarter last year

- Organic Revenue was down 2% year on year

- Market Capitalization: $28.96 billion

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Aside from Jack Daniel’s, the company also goes to market with Woodford Reserve (bourbon), Finlandia (Vodka), Herradura and El Jimador (tequila), Sonoma-Cutrer Vineyards (wine), Korbel (champagne), and others. Brown-Forman’s history dates back to 1870, and some of its brands were developed and nurtured organically while others were acquired.

The core Brown-Forman customer is a discerning spirits and wine enthusiast. These customers value exceptional taste as well as authenticity and are not afraid to pay for it. Brown-Forman therefore uses quality ingredients and time-honored production techniques to meet these needs, and the company’s products are on the more premium end of the alcoholic beverage price spectrum.

Brown-Forman products can be found in a wide range of establishments. These include grocery stores that feature liquor and wine sections based on state regulations, liquor stores, premium retail outlets such as duty-free stores, and high-end restaurants and bars worldwide.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the alcohol, spirits, and wine space include Diageo (LSE:DGE), Pernod Ricard (ENXTPA:RI), and Constellation Brands (NYSE:STZ).Sales Growth

Brown-Forman is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

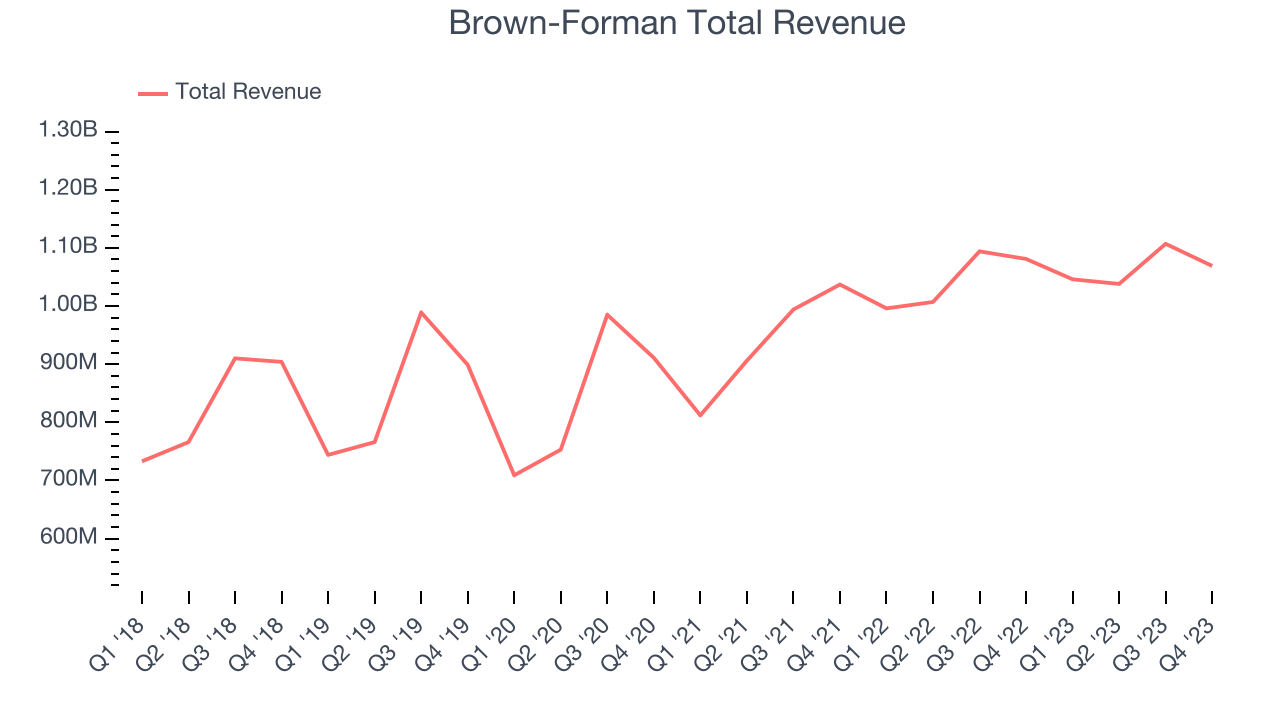

As you can see below, the company's annualized revenue growth rate of 8.3% over the last three years was decent for a consumer staples business.

This quarter, Brown-Forman missed Wall Street's estimates and reported a rather uninspiring 1.1% year-on-year revenue decline, generating $1.07 billion in revenue. Looking ahead, Wall Street expects sales to grow 4.3% over the next 12 months, an acceleration from this quarter.

Organic Revenue Growth

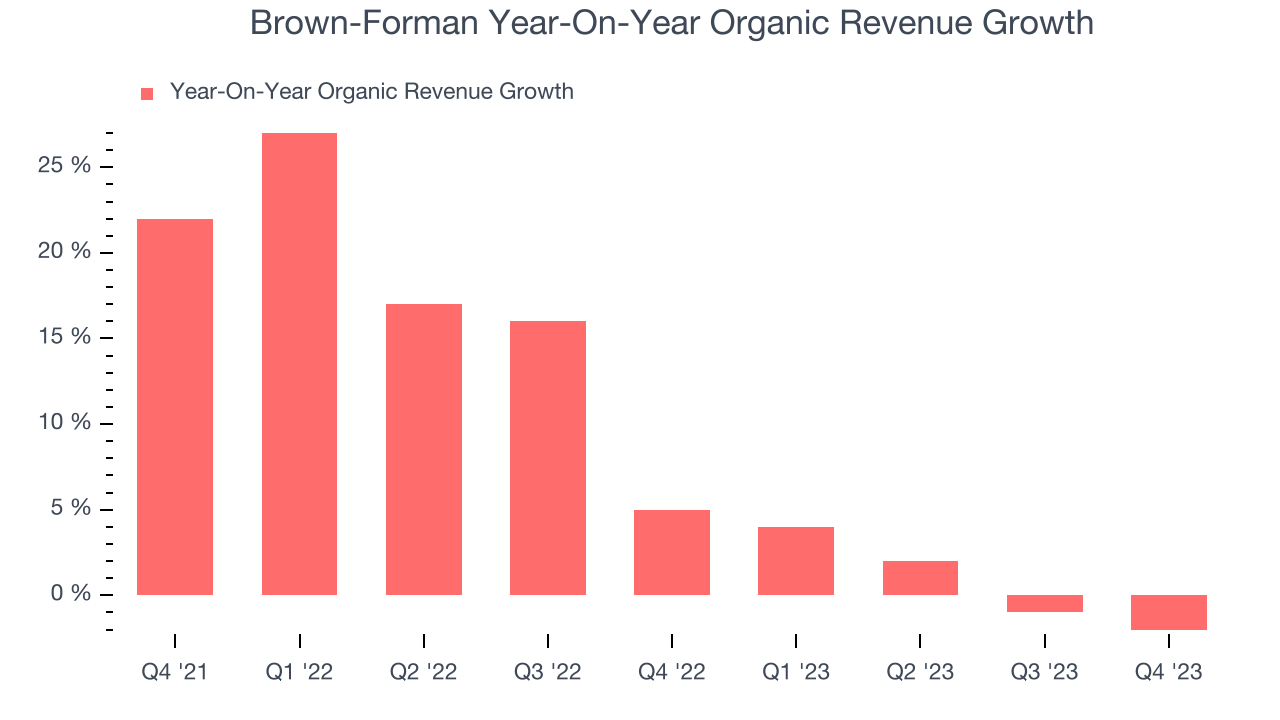

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business's performance excluding the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Brown-Forman has generated solid demand for its products over the last two years. On average, the company's organic sales have grown by 8.5% year on year.

In the latest quarter, Brown-Forman's organic sales fell 2% year on year. This decline was a reversal from the 5% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Gross Margin & Pricing Power

We prefer higher gross margins because they make it easier to generate more operating profits.

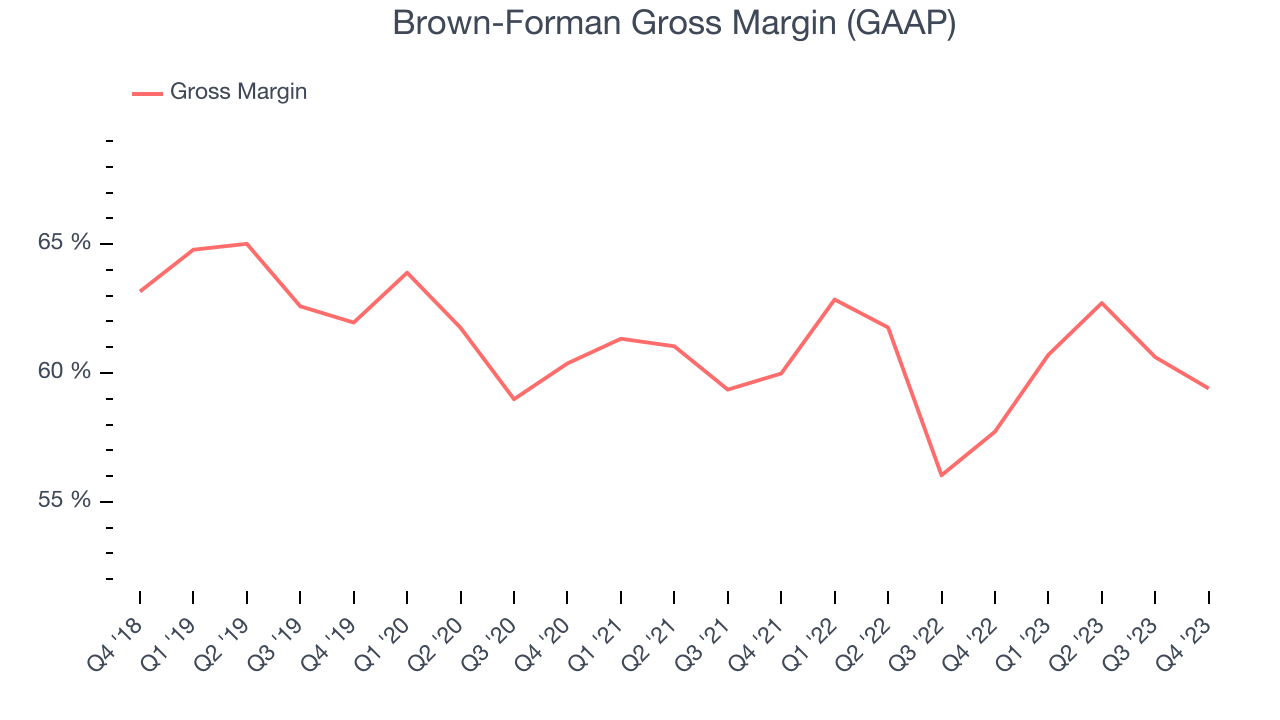

This quarter, Brown-Forman's gross profit margin was 59.4%, up 1.7 percentage points year on year. That means for every $1 in revenue, only $0.41 went towards paying for raw materials, production of goods, and distribution expenses.

Brown-Forman has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 60.2% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 2.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

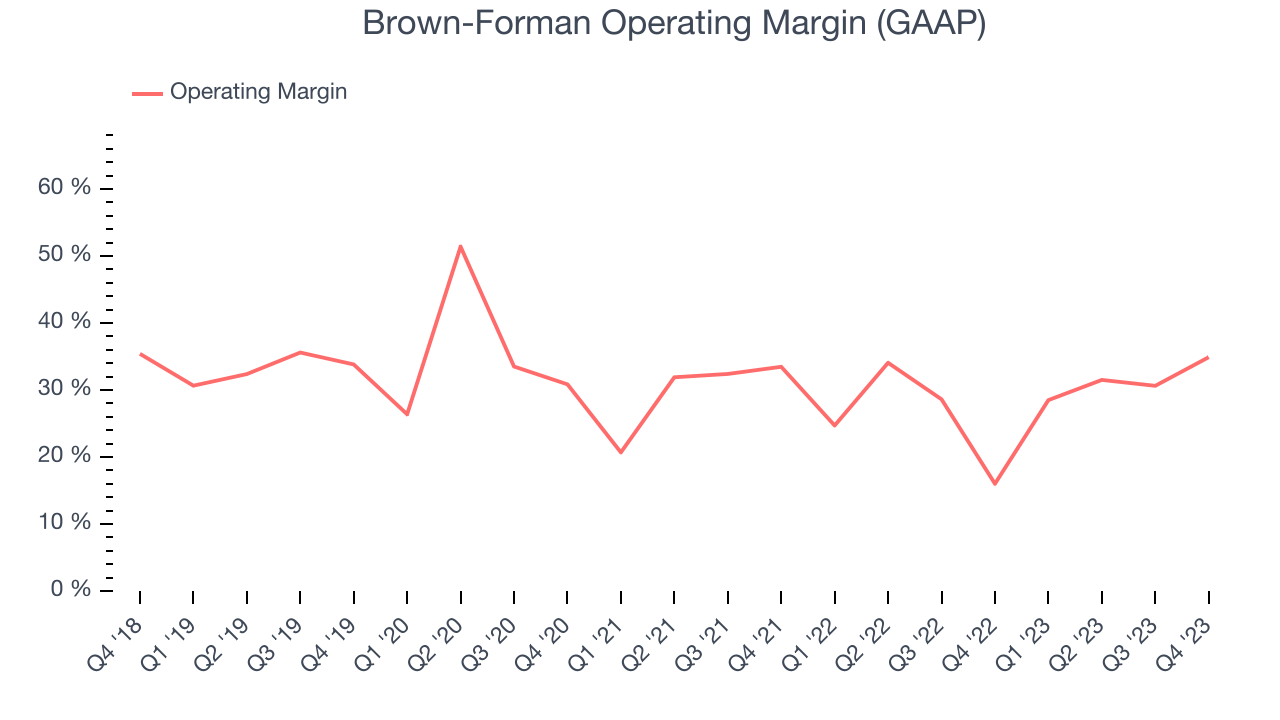

This quarter, Brown-Forman generated an operating profit margin of 34.9%, up 18.9 percentage points year on year. This increase was encouraging, and we can infer Brown-Forman was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, Brown-Forman has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 28.6%. On top of that, its margin has improved by 5.7 percentage points on average over the last year, a great sign for shareholders.

Zooming out, Brown-Forman has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 28.6%. On top of that, its margin has improved by 5.7 percentage points on average over the last year, a great sign for shareholders. EPS

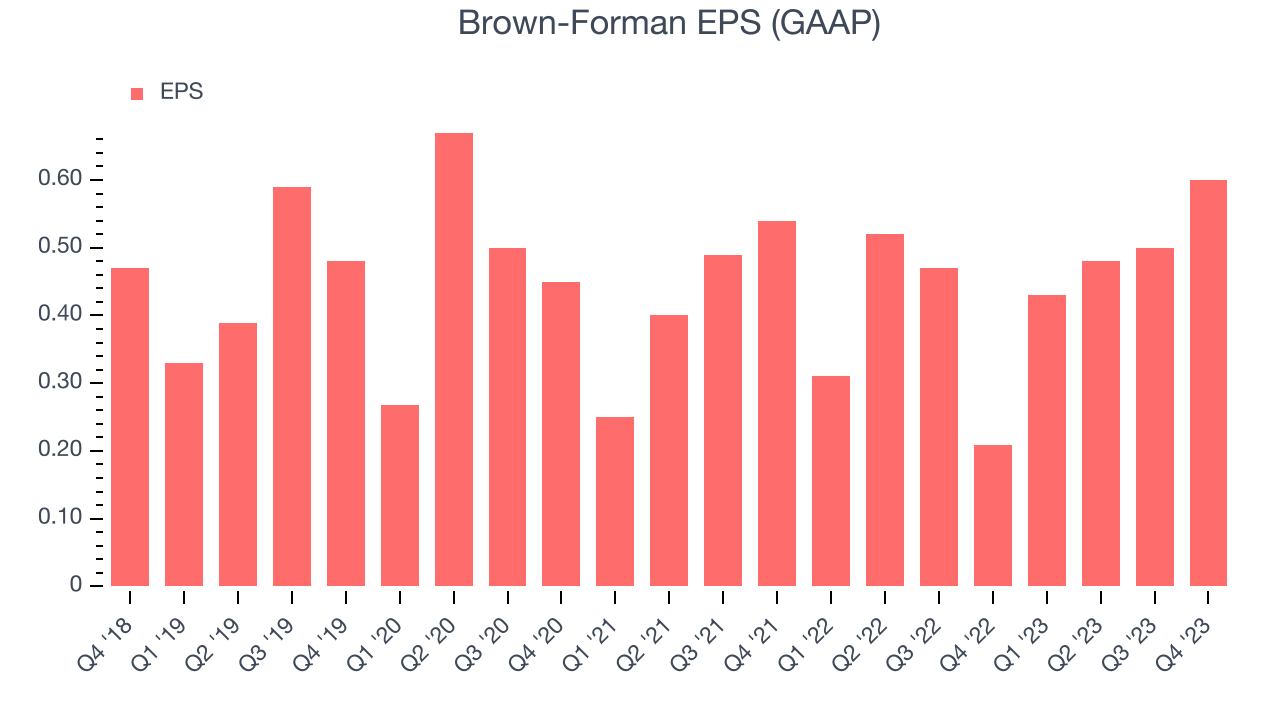

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q3, Brown-Forman reported EPS at $0.60, up from $0.21 in the same quarter a year ago. This print beat Wall Street's estimates by 5.1%.

Between FY2021 and FY2024, Brown-Forman's EPS grew 6.5%, translating into an unimpressive 2.1% compounded annual growth rate.

Cash Is King

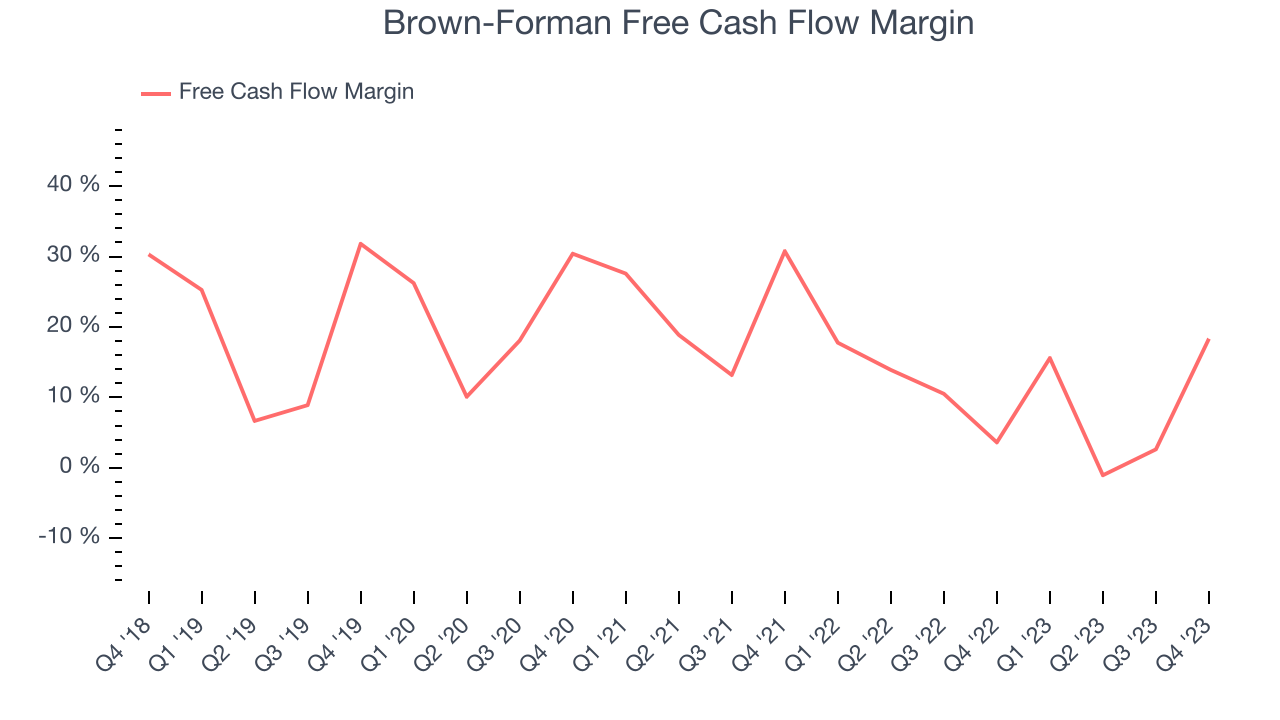

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Brown-Forman's free cash flow came in at $196 million in Q3, up 403% year on year. This result represents a 18.3% margin.

Over the last two years, Brown-Forman has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 10%, quite impressive for a consumer staples business. However, its margin has averaged year-on-year declines of 2.4 percentage points over the last 12 months. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Brown-Forman's five-year average ROIC was 21.5%, beating other consumer staples companies by a wide margin. Just as you’d like your investment dollars to generate returns, Brown-Forman's invested capital has produced robust profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Brown-Forman's ROIC over the last two years averaged 6.1 percentage point decreases each year. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Key Takeaways from Brown-Forman's Q3 Results

It was encouraging to see Brown-Forman slightly top analysts' EPS expectations this quarter. On the other hand, its revenue unfortunately missed analysts' expectations and its organic revenue missed Wall Street's estimates. The company's outlook for the full year was also weak. Specifically, Brown-Forman sees "organic net sales to be flat, reflecting the slower than anticipated growth for the nine months" and 0-2% operating profit growth, below expectations. Overall, this was a weaker quarter for Brown-Forman. The company is down 9.1% on the results and currently trades at $55.19 per share.

Is Now The Time?

Brown-Forman may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Brown-Forman is a good business. First off, its revenue growth has been decent over the last three years. And while its EPS growth over the last three years has been mediocre, its impressive gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its impressive operating margins show it has a highly efficient business model.

There are definitely a lot of things to like about Brown-Forman, and looking at the consumer staples landscape right now, it seems to be trading at a pretty interesting price.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.