Packaged foods company B&G Foods (NYSE:BGS) reported results ahead of analysts' expectations in Q2 CY2024, with revenue down 5.3% year on year to $444.6 million. The company expects the full year's revenue to be around $1.96 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.08 per share, down from its profit of $0.15 per share in the same quarter last year.

Is now the time to buy B&G Foods? Find out by accessing our full research report, it's free.

B&G Foods (BGS) Q2 CY2024 Highlights:

- Revenue: $444.6 million vs analyst estimates of $435.9 million (2% beat)

- EPS (non-GAAP): $0.08 vs analyst expectations of $0.10 (19% miss)

- The company dropped its revenue guidance for the full year from $1.97 billion to $1.96 billion at the midpoint, a 0.6% decrease

- EPS (non-GAAP) guidance for the full year is $0.80 at the midpoint, roughly in line with what analysts were expecting

- Gross Margin (GAAP): 20.7%, down from 21.9% in the same quarter last year

- Adjusted EBITDA Margin: 14.4%, in line with the same quarter last year

- Sales Volumes were down 2% year on year

- Market Capitalization: $661.7 million

Commenting on the results, Casey Keller, President and Chief Executive Officer of B&G Foods, stated, “B&G Foods remains committed to execute against our long-term strategy to improve organic growth and focus the portfolio, despite short-term weakness in consumer packaged food demand. Second quarter results were largely in line with expectations, showing gradual, sequential improvement in base business net sales from the first quarter. Net sales on the highest margin Spices & Flavor Solutions business increased by 4.9% versus last year. As previously announced, we recently refinanced a large portion of our long-term debt, pushing out maturity dates several years into the future to reduce balance sheet risk. We also continue to review and work possible divestitures to reduce debt, increase focus on our core businesses, and position B&G Foods for long-term organic and acquisition growth.”

Started as a small grocery store in New York City, B&G Foods (NYSE:BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

B&G Foods carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, B&G Foods can still achieve high growth rates because its revenue base is not yet monstrous.

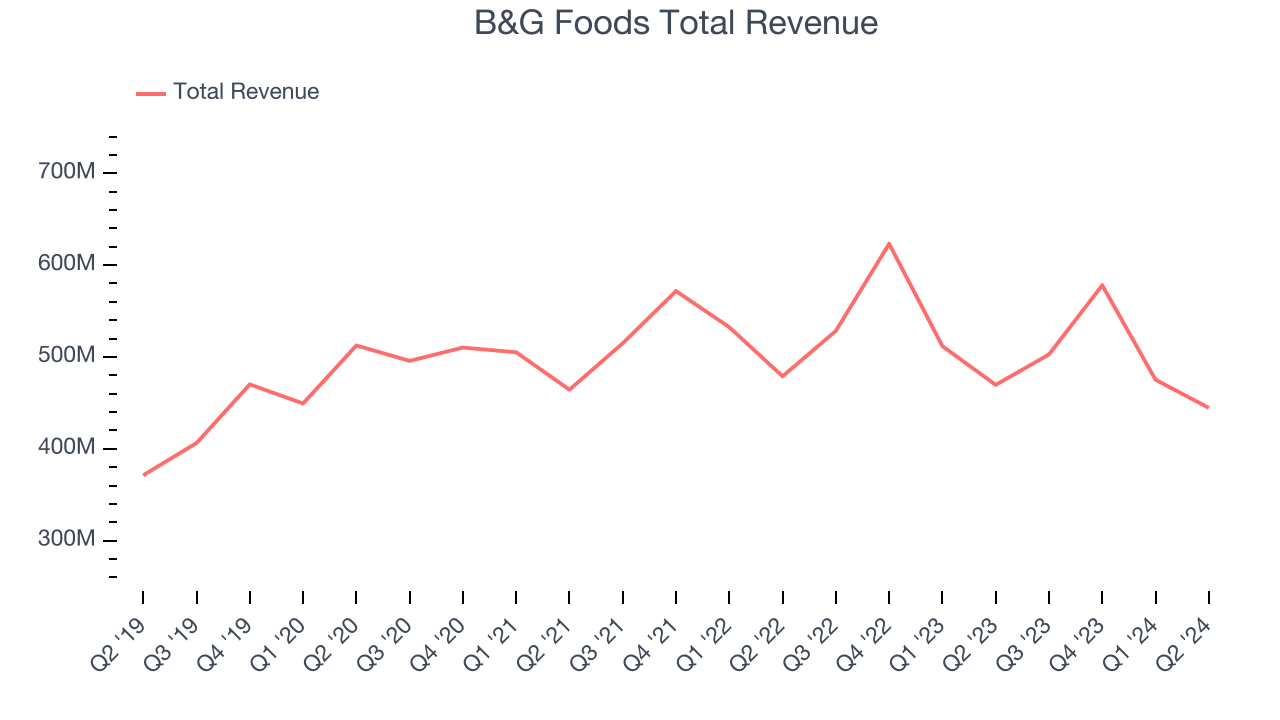

As you can see below, the company's revenue was flat over the last three years. This is poor for a consumer staples business.

This quarter, B&G Foods's revenue fell 5.3% year on year to $444.6 million but beat Wall Street's estimates by 2%. Looking ahead, Wall Street expects revenue to decline 1.8% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

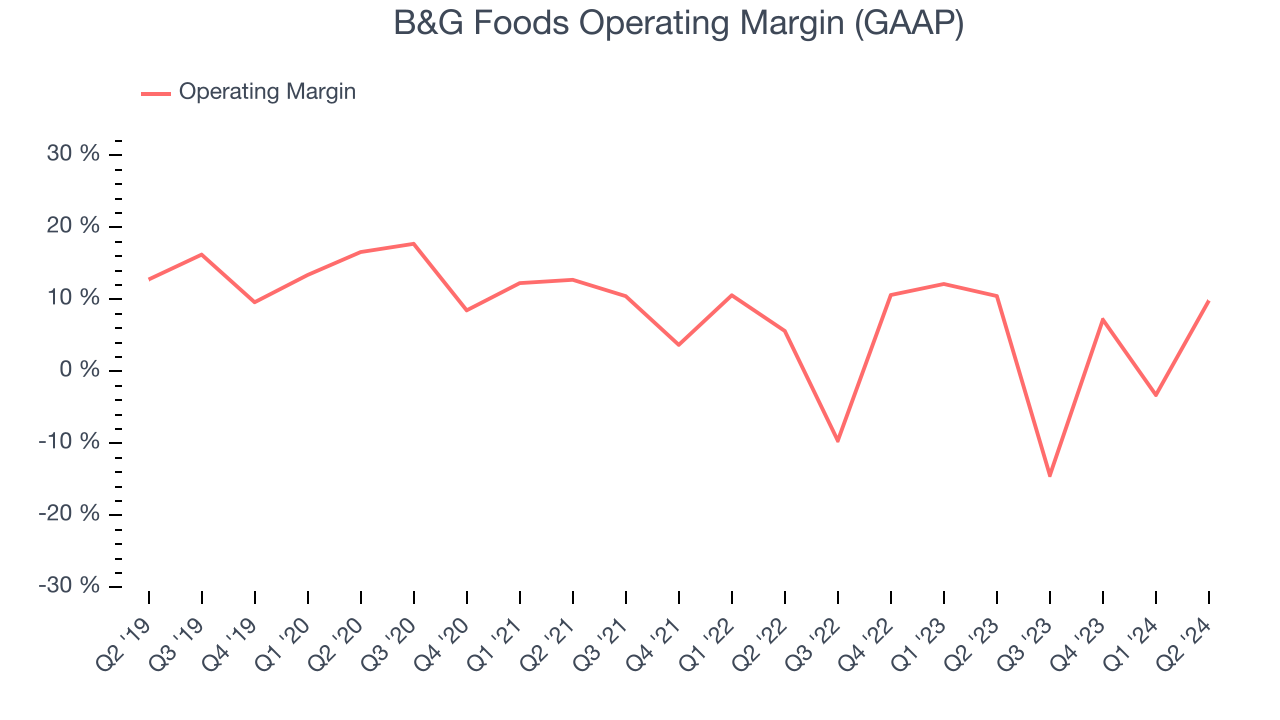

B&G Foods was profitable over the last two years but held back by its large expense base. It demonstrated paltry profitability for a consumer staples business, producing an average operating margin of 3%. This result isn't too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, B&G Foods's annual operating margin decreased by 6.1 percentage points over the last two years. The company's performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn't pass those costs onto its customers.

This quarter, B&G Foods generated an operating profit margin of 9.9%, in line with the same quarter last year. This indicates the company's cost structure has recently been stable.

Key Takeaways from B&G Foods's Q2 Results

It was good to see B&G Foods beat Wall Street's revenue estimates this quarter. On the other hand, its EPS and gross margin missed analysts' expectations, and it slightly lowered its full-year revenue guidance. Overall, this was a mediocre quarter for B&G Foods. The stock remained flat at $8.66 immediately after reporting.

B&G Foods may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.