Packaged foods company B&G Foods (NYSE:BGS) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue down 7.2% year on year to $578.1 million. The company expects the full year's revenue to be around $2.00 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.30 per share, down from its profit of $0.40 per share in the same quarter last year.

B&G Foods (BGS) Q4 FY2023 Highlights:

- Revenue: $578.1 million vs analyst estimates of $571.7 million (1.1% beat)

- EPS (non-GAAP): $0.30 vs analyst estimates of $0.30 (1% beat)

- Management's revenue guidance for the upcoming financial year 2024 is $2.00 billion at the midpoint, in line with analyst expectations and implying -3.1% growth (vs -4.5% in FY2023)

- Management's EPS guidance for the upcoming financial year 2024 is $0.90 at the midpoint, above expectations of $0.85 (5.9 % beat)

- Gross Margin (GAAP): 21.7%, up from 20.6% in the same quarter last year

- Market Capitalization: $736.7 million

Started as a small grocery store in New York City, B&G Foods (NYSE:BGS) is an American packaged foods company with a diverse portfolio of more than 50 brands.

The company was founded in 1889 by brothers Ralph and George Burns, along with their business partner George Brinkman. Their humble grocery store quickly gained popularity on the East Coast for its creamed horseradish, and the rest is history.

Over the next century, B&G Foods would enter the packaged foods business, acquiring several well-known brands such as Ortega, Green Giant, and Cream of Wheat, among others. These acquisitions allowed the company to expand its product offerings and introduce a wide range of beloved food products to consumers. Today, B&G Foods sells everything from canned vegetables to hot sauces, spices, snacks, and breakfast favorites.

The company continuously explores new flavors, packaging innovations, and product formulations to meet changing consumer demands and preferences. For example, it’s collaborated with Cinnamon Toast Crunch, Einstein Bros Bagels, Girl Scouts, and Snickers to manufacture and distribute branded seasoning blends.

While deeply rooted in the United States, B&G Foods has a global reach, and its products are available in various countries. It reaches consumers mostly through retail partnerships with grocery stores and retailers such as Walmart, Kroger, Publix, and Safeway.

Packaged Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods, prepared meals, or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences.The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in the packaged foods industry include Conagra (NYSE:CAG), General Mills (NYSE:GIS), Hormel Foods (NYSE:HRL), Kraft Heinz (NASDAQGS:KHC), and McCormick (NYSE:MKC).Sales Growth

B&G Foods carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, B&G Foods can still achieve high growth rates because its revenue base is not yet monstrous.

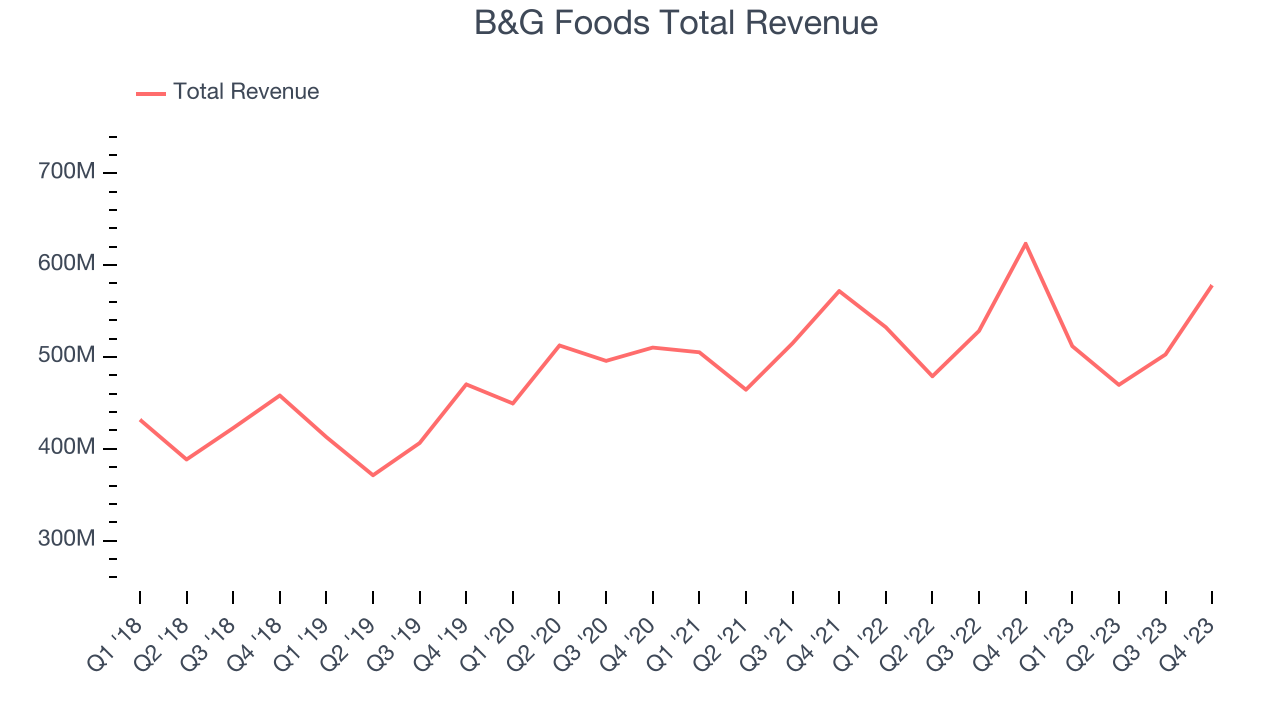

As you can see below, the company's annualized revenue growth rate of 1.6% over the last three years was weak for a consumer staples business.

This quarter, B&G Foods's revenue fell 7.2% year on year to $578.1 million but beat Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects revenue to decline 3.8% over the next 12 months.

Gross Margin & Pricing Power

Gross profit margins tell us how much money a company gets to keep after paying for the direct costs of the goods it sells.

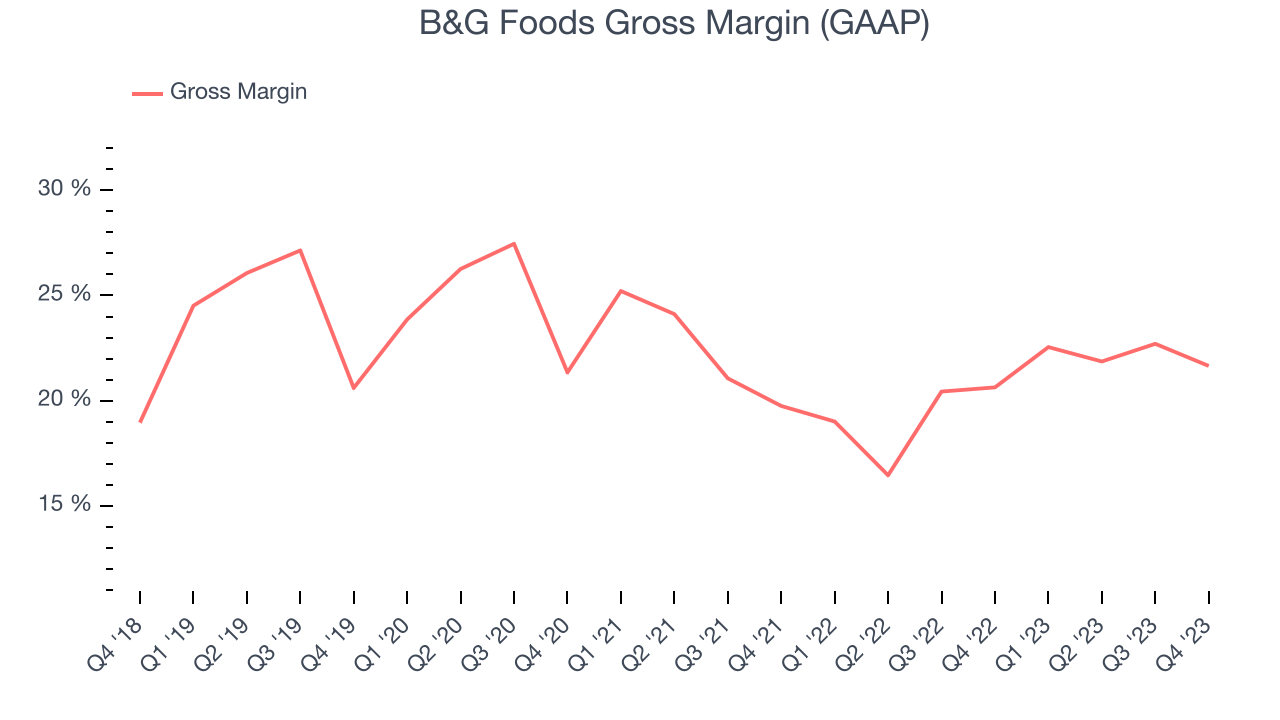

B&G Foods's gross profit margin came in at 21.7% this quarter, up 1 percentage points year on year. That means for every $1 in revenue, a chunky $0.78 went towards paying for raw materials, production of goods, and distribution expenses.

B&G Foods has poor unit economics for a consumer staples company, leaving it with little room for error if things go awry. As you can see above, it's averaged a paltry 20.7% gross margin over the last two years. Its margin, however, has been trending up over the last 12 months, averaging 16.9% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

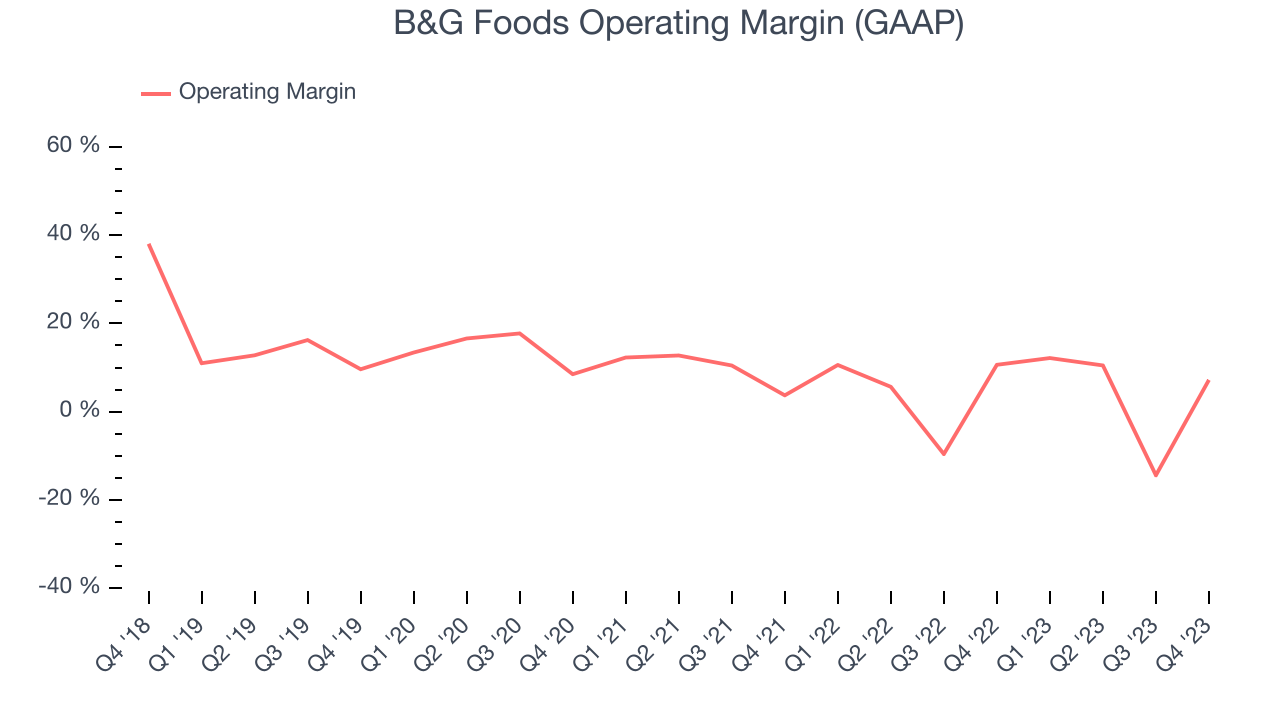

This quarter, B&G Foods generated an operating profit margin of 7.2%, down 3.4 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by operational inefficiencies and a step up in discretionary spending in areas like corporate overhead and advertising.

Zooming out, B&G Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 4.2%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.

Zooming out, B&G Foods was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer staples business, producing an average operating margin of 4.2%. Its margin has also seen few fluctuations, meaning it will likely take a big change to improve profitability.EPS

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

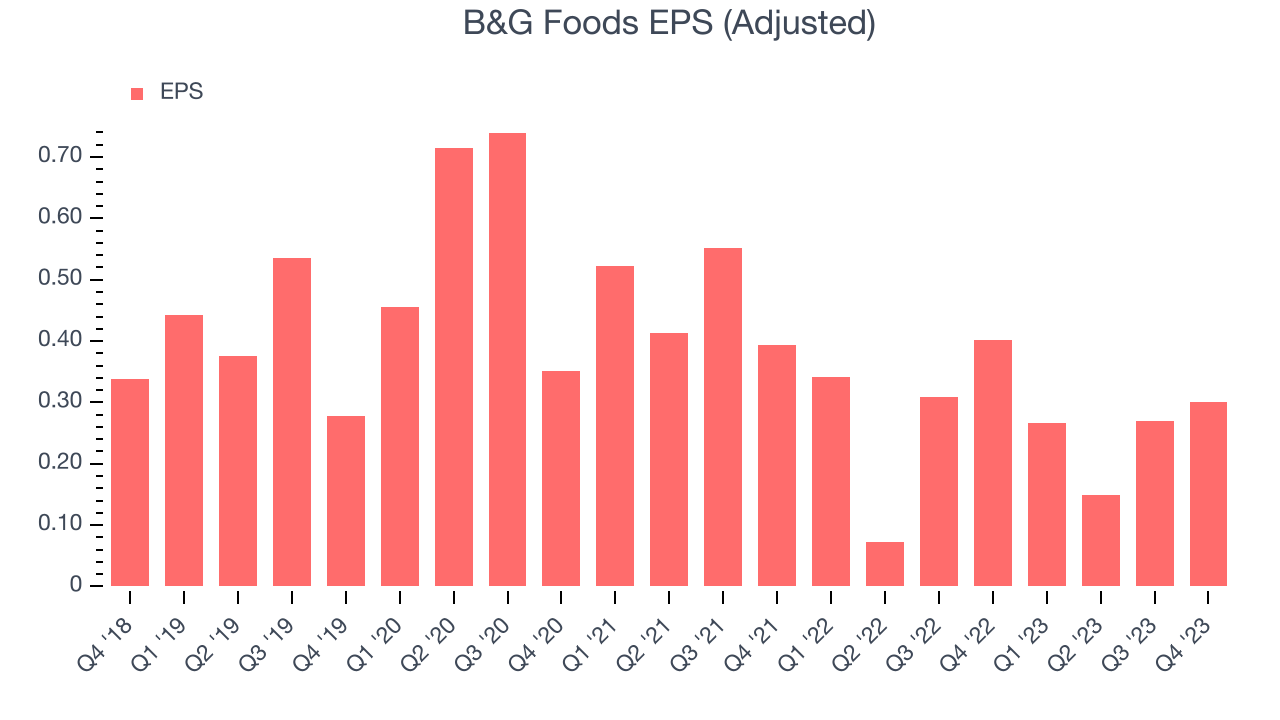

In Q4, B&G Foods reported EPS at $0.30, down from $0.40 in the same quarter a year ago. This print beat Wall Street's estimates by 1%.

Between FY2020 and FY2023, B&G Foods's EPS dropped 56.5%, translating into 24.2% annualized declines. We tend to steer our readers away from companies with falling EPS, especially in the consumer staples sector, where shrinking earnings could imply changing secular trends or consumer preferences. If there's no earnings growth, it's difficult to build confidence in a business's underlying fundamentals, leaving a low margin of safety around the company's valuation (making the stock susceptible to large downward swings).

Wall Street expects B&G Foods to continue performing poorly over the next 12 months, with analysts projecting an average 8.6% year-on-year decline in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

B&G Foods's five-year average ROIC was 5.2%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, B&G Foods's ROIC over the last two years averaged 4.4 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from B&G Foods's Q4 Results

It was great to see B&G Foods's strong earnings forecast for the full year, which exceeded analysts' expectations. We were also glad its revenue, gross margin, and EPS outperformed Wall Street's estimates this quarter. The only minor negative was that its operating margin missed analysts' expectations. Zooming out, we think this was still a good quarter, showing that the company is staying on track. The stock is up 4.2% after reporting and currently trades at $9.77 per share.

Is Now The Time?

B&G Foods may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of B&G Foods, we'll be cheering from the sidelines. Its revenue growth has been weak over the last three years, and analysts expect growth to deteriorate from here. On top of that, its declining EPS over the last three years makes it hard to trust, and its projected EPS for the next year is lacking.

B&G Foods's price-to-earnings ratio based on the next 12 months is 10.4x. While we've no doubt one can find things to like about B&G Foods, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $9.57 per share right before these results (compared to the current share price of $9.77), implying they didn't see much short-term potential in B&G Foods.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.