Payments and billing software maker Bill.com (NYSE:BILL) reported Q3 FY2021 results that beat analyst expectations, with revenue up 44.8% year on year to $59.7 million. Bill.com made a GAAP loss of $26.7 million, down on it's loss of $8.31 million, in the same quarter last year.

Get access to the fastest analysis of earnings results on the market. Get investing superpowers with StockStory. Signup here for early access.

Bill.com (NYSE:BILL) Q3 FY2021 Highlights:

- Revenue: $59.7 million vs analyst estimates of $54.6 million (9.34% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.07

- Revenue guidance for Q4 2021 is $61.4 million at the midpoint, above analyst estimates of $57.3 million

- Free cash flow was negative -$5.39 million, compared to negative free cash flow of -$17.32 million in previous quarter

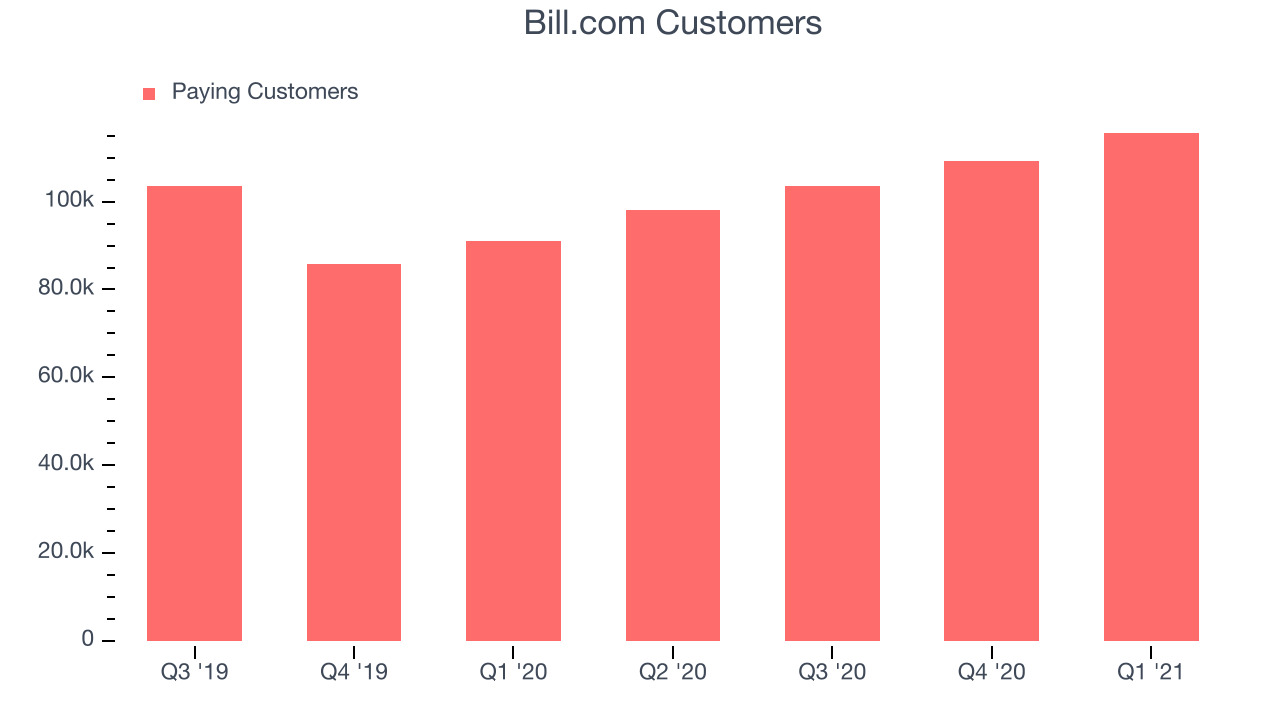

- Customers: 115,600, up from 109,200 in previous quarter

- Gross Margin (GAAP): 74.1%, in line with previous quarter

- Signed a definitive agreement to acquire Divvy, a leading company in spend management for SMBs.

“Our innovation in platform, payments, and go-to-market activities drove strong accelerated growth in transaction fees and total payment volume. We are operating at a large scale, with an annualized run rate of approximately $140 billion of payments processed for our customers. We delivered record results and further increased core revenue growth, driven by the value of our platform, the scale of our network, and the broad range of our payment offerings,” said René Lacerte, Bill.com CEO and Founder.

Small-medium business digital transformation play

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses. It offers a central cloud repository for invoices and provides an interface where its users can issue, process, approve and pay invoices in an easy to use environment. By automating a lot of previously laborious manual work Bill.com brings down the cost of running the accounts receivable/payable department. The company charges its customers software subscription and also processing fees on the payments they make through the platform.

As greater number of small-medium sized businesses digitize their back offices in order to reduce costs, the demand for services like Bill.com will grow. Today, Bill.com is mainly competing with legacy manual processes and software companies like SAP (NYSE:SAP) that primarily focus on large enterprises.

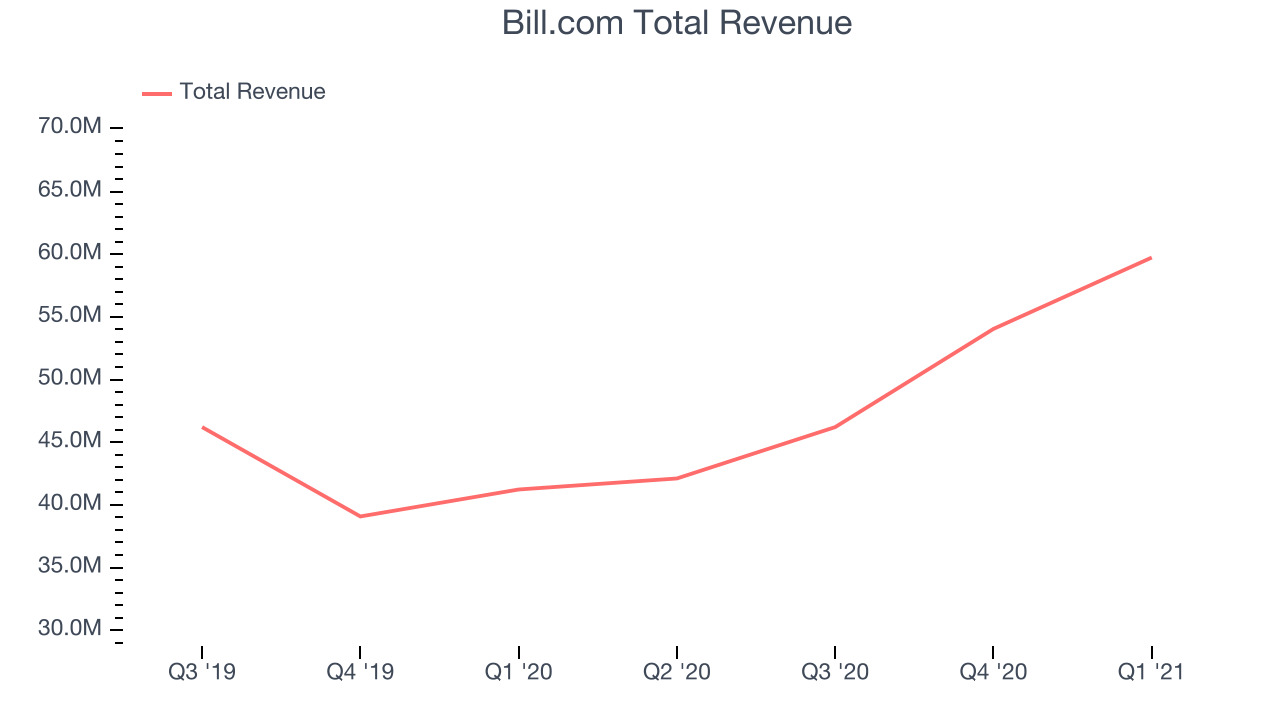

As you can see below, Bill.com's revenue growth has been strong over the last twelve months, growing from $41.2 million to $59.7 million.

This was a standout quarter for Bill.com's with the quarterly revenue up an absolutely stunning 44.8% year on year, which is above average for the company. But the growth did slow down compared to last quarter, as the revenue increased by just $5.69 million in Q3, compared to $7.83 million in Q2 2021. A one-off fluctuation is usually not concerning, but it is worth keeping in mind.

Efficient go-to-market

Bill.com’s go-to-market strategy combines classic top-down sales, partnerships with accounting firms and low-touch direct sales, an efficient sales model pioneered by SaaS companies like Atlassian. Because the platform works as a shared space between businesses and their suppliers and clients, it reaches a very large network of companies that are interacting with it although they are not paying customers themselves. This creates a large pool of new potential customers Bill.com can directly market to at low cost.

You can see below that Bill.com reported 115,600 customers at the end of the quarter, an increase of 6,400 on last quarter. That is quite a bit better customer growth than last quarter and a fair bit above the typical customer growth we have seen lately, demonstrating that the business itself has good sales momentum. We've no doubt shareholders will take this as an indication that the company's go-to-market strategy is working very well.

Key Takeaways from Bill.com's Q3 Results

Since it is still burning cash it is worth keeping an eye on Bill.com’s balance sheet, but we note that with market capitalisation of $11.4 billion and more than $1.73 billion in cash, the company has the capacity to continue to prioritise growth over profitability.

We were impressed by how strongly Bill.com outperformed analysts’ revenue expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. Zooming out, we think this impressive quarter should have shareholders feeling very positive. Therefore, we think Bill.com will become more attractive to investors, compared to before these results.

Get access to insights until now only reserved for the top hedge funds. Discover great tech investments the market is overlooking. Get investing superpowers with StockStory. Signup here for early access.

The author has no position in any of the stocks mentioned.