Payments and billing software maker Bill.com (NYSE:BILL) announced better-than-expected results in Q1 FY2024, with revenue up 32.6% year on year to $305 million. However, next quarter's revenue guidance of $298 million was less impressive, coming in 6.47% below analysts' estimates.

Is now the time to buy Bill.com? Find out by accessing our full research report, it's free.

Bill.com (BILL) Q1 FY2024 Highlights:

- Revenue: $305 million vs analyst estimates of $298.8 million (2.06% beat)

- EPS (non-GAAP): $0.54 vs analyst estimates of $0.50 (8.9% beat)

- Revenue Guidance for Q2 2024 is $298 million at the midpoint, below analyst estimates of $318.6 million

- The company dropped its revenue guidance for the full year from $1.3 billion to $1.23 billion at the midpoint, a 5.59% decrease

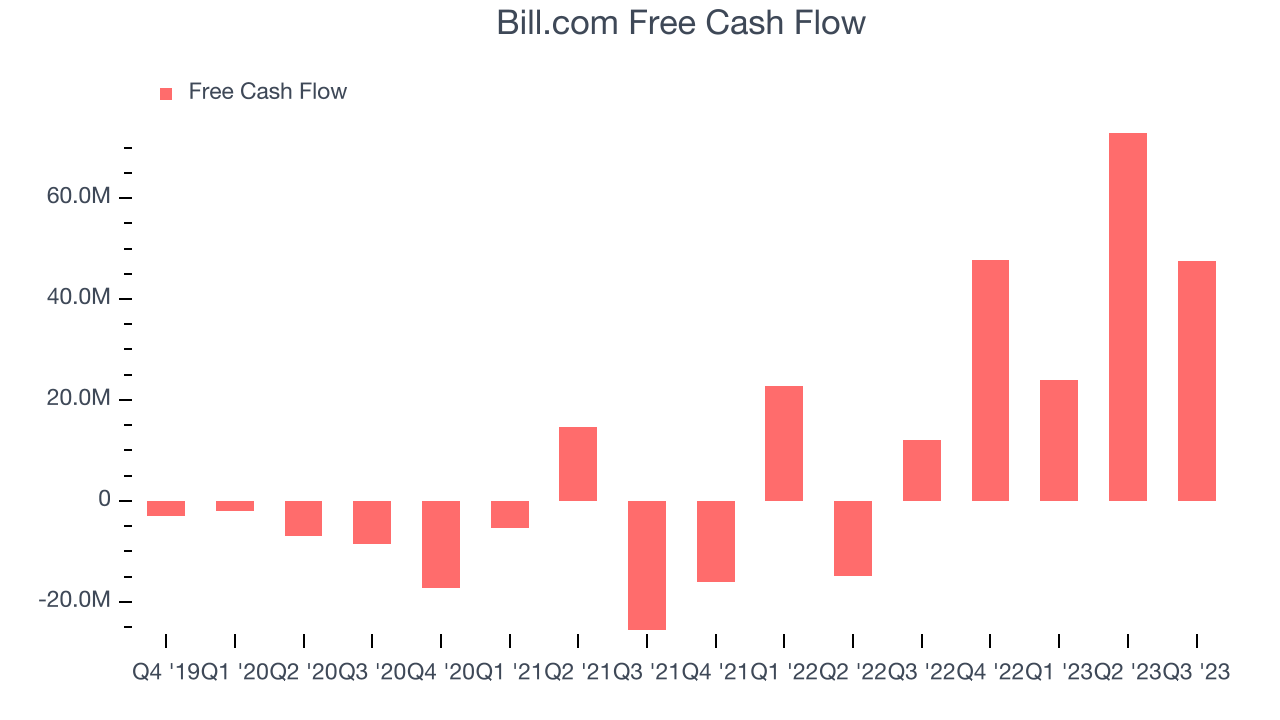

- Free Cash Flow of $47.6 million, down 34.7% from the previous quarter

- Gross Margin (GAAP): 81.6%, down from 84.9% in the same quarter last year

“We delivered strong first quarter results as we executed on our strategy to be the essential financial operations platform for SMBs,” said René Lacerte, BILL CEO and Founder.

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

Sales Growth

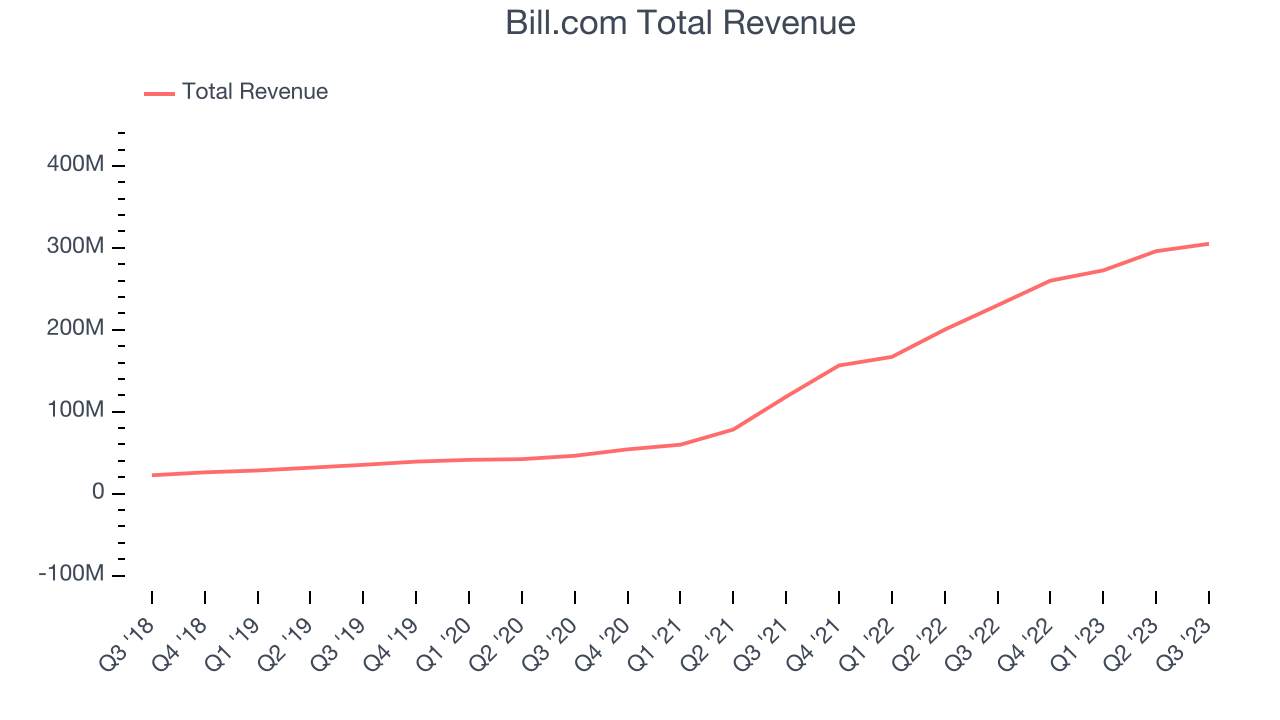

As you can see below, Bill.com's revenue growth has been incredible over the last two years, growing from $118.3 million in Q1 FY2022 to $305 million this quarter.

Unsurprisingly, this was another great quarter for Bill.com with revenue up 32.6% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $9 million in Q1 compared to $23.4 million in Q4 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Bill.com is expecting revenue to grow 14.6% year on year to $298 million, slowing down from the 66.2% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 20.9% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Bill.com's free cash flow came in at $47.6 million in Q1, up 296% year on year.

Bill.com has generated $192.2 million in free cash flow over the last 12 months, a solid 16.8% of revenue. This strong FCF margin stems from its asset-lite business model, giving it optionality and plenty of cash to reinvest in its business.

Key Takeaways from Bill.com's Q1 Results

With a market capitalization of $9.46 billion, Bill.com is among smaller companies, but its $2.65 billion cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

It was good to see Bill.com beat analysts' revenue expectations this quarter. That really stood out as a positive in these results. On the other hand, its full-year revenue guidance was below expectations and its gross and free cash flow margins were down. Bill.com has always been priced for perfection and this quarter was far from perfect. The company is down 38.6% on the results and currently trades at $54.9 per share.

Bill.com may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.