As Q3 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the finance and accounting software stocks, including Bill.com (NYSE:BILL) and its peers.

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

The 4 finance and accounting software stocks we track reported a decent Q3; on average, revenues beat analyst consensus estimates by 4%, while on average next quarter revenue guidance was 1.97% above consensus. The technology sell-off has been putting pressure on stocks since November and accounting software stocks have been hit as well, with share price down 25% since earnings, on average.

Best Q3: Bill.com (NYSE:BILL)

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

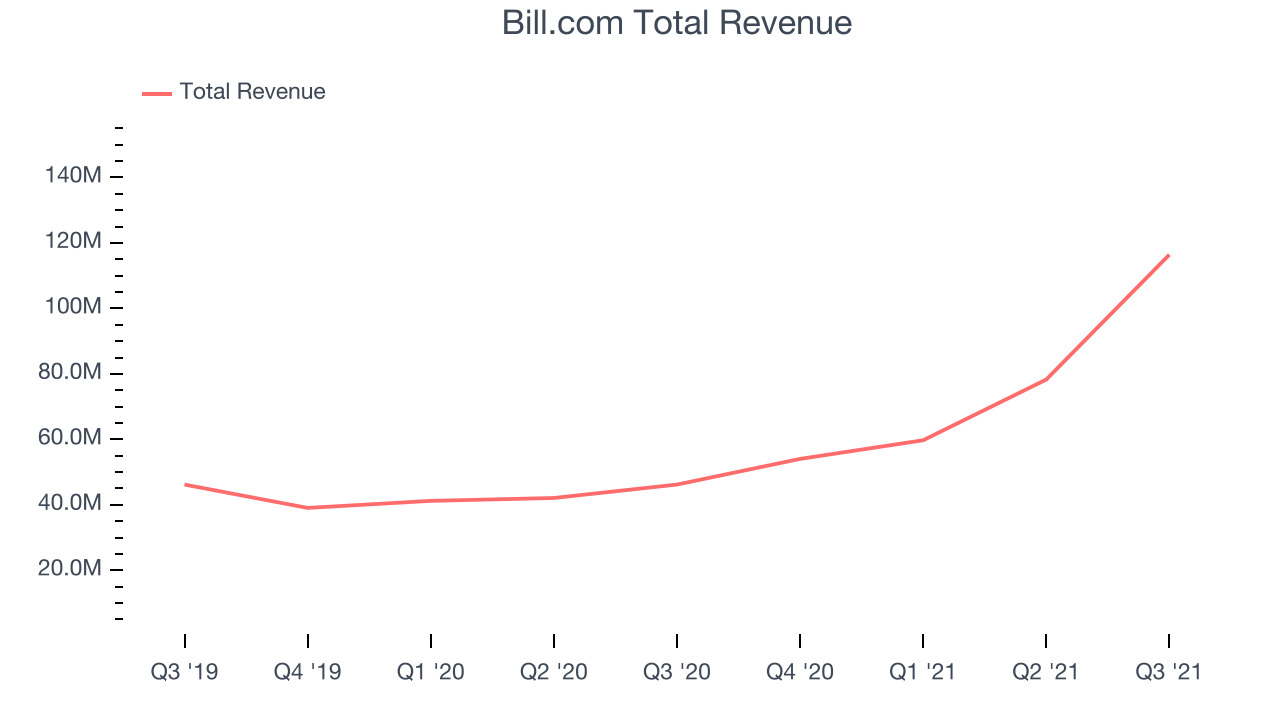

Bill.com reported revenues of $116.4 million, up 151% year on year, beating analyst expectations by 10.7%. It was an impressive quarter for the company, with a strong beat of analyst estimates and a very optimistic guidance for the next quarter.

“We kicked off our fiscal year with momentum and strong first quarter results that exceeded our expectations,” said René Lacerte, Bill.com CEO and Founder.

Bill.com scored the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise of the whole group. The company added 5,600 customers to a total of 126,800. The stock is down 29% since the results and currently trades at $208.01.

Anaplan (NYSE:PLAN)

Founded by Michael Gould in 2006 in a stone barn in Yorkshire, England, Anaplan (NYSE:PLAN) is a financial modelling software that helps large enterprises with complex decision-making around budgets and financial forecasts.

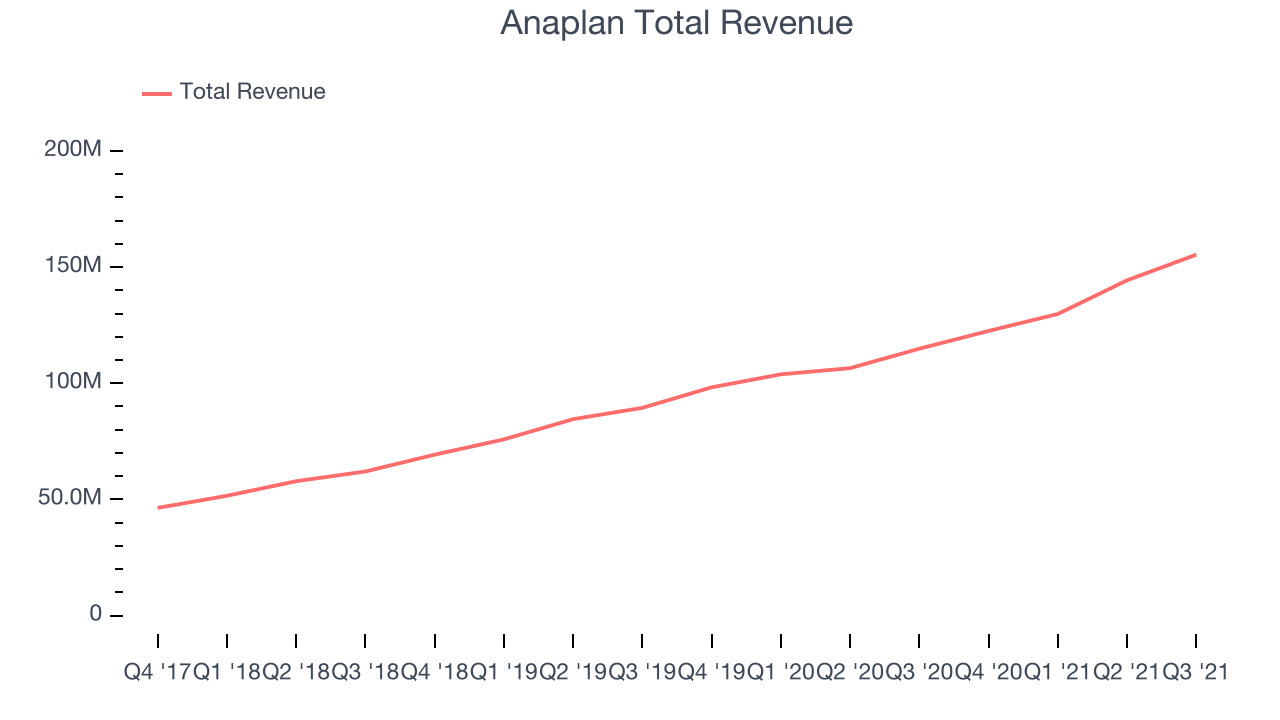

Anaplan reported revenues of $155.3 million, up 35.2% year on year, beating analyst expectations by 6.17%. It was a decent quarter for the company, with a solid beat of analyst estimates and net revenue retention rate in line with previous quarter at 119%.

The stock is down 10.6% since the results and currently trades at $46.50.

Is now the time to buy Anaplan? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Upland (NASDAQ:UPLD)

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ:UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Upland reported revenues of $76 million, up 2.51% year on year, missing analyst expectations by 2.13%. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter.

Upland had the weakest performance against analyst estimates, slowest revenue growth, and weakest full year guidance update in the group. The stock is down 44.6% since the results and currently trades at $18.70.

Read our full analysis of Upland's results here.

Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.32 billion, up 20% year on year, beating analyst expectations by 1.19%. It was a decent quarter for the company, with a strong beat on EPS.

The stock is down 15.6% since the results and currently trades at $252.13.

Read our full, actionable report on Workday here, it's free.

The author has no position in any of the stocks mentioned