As Q3 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the large-format grocery & general merchandise retailer stocks, including BJ's (NYSE:BJ) and its peers.

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

The 4 large-format grocery & general merchandise retailer stocks we track reported a strong Q3; on average, revenues beat analyst consensus estimates by 0.6% Investors abandoned cash-burning companies to buy stocks with higher margins of safety, but large-format grocery & general merchandise retailer stocks held their ground better than others, with the share prices up 6.9% on average since the previous earnings results.

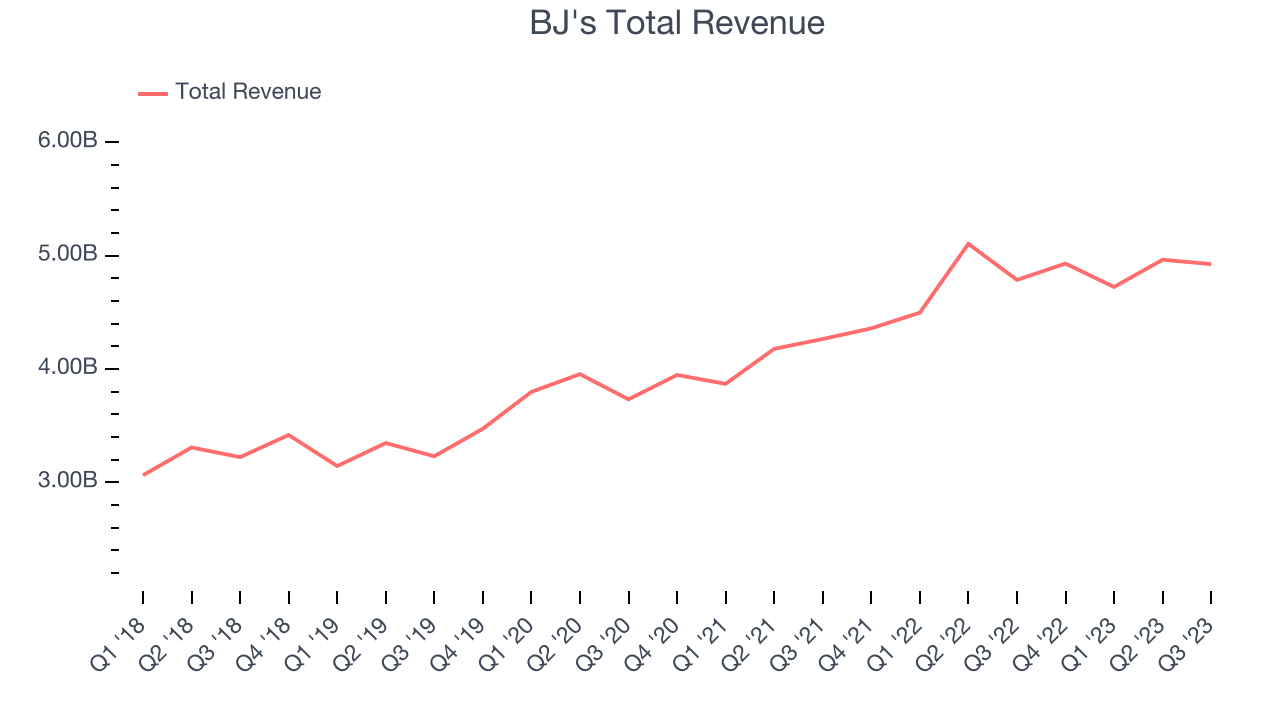

Weakest Q3: BJ's (NYSE:BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE:BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

BJ's reported revenues of $4.92 billion, up 2.9% year on year, in line with analyst expectations. It was a decent quarter for the company, with a narrow beat of analysts' revenue estimates. In addition, the company maintained its full year EPS guidance, which was very slightly ahead of current Consensus.

“Our advantaged model and strong value proposition continue to resonate with our members. During the third quarter, we posted accelerating membership growth, robust traffic gains and continued increases in market share. These gains continue to reinforce the underlying strength of our business and we remain confident in the long-term growth prospects of our Company,” said Bob Eddy, Chairman and Chief Executive Officer, BJ’s Wholesale Club.

The stock is down 3% since the results and currently trades at $65.69.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it's free.

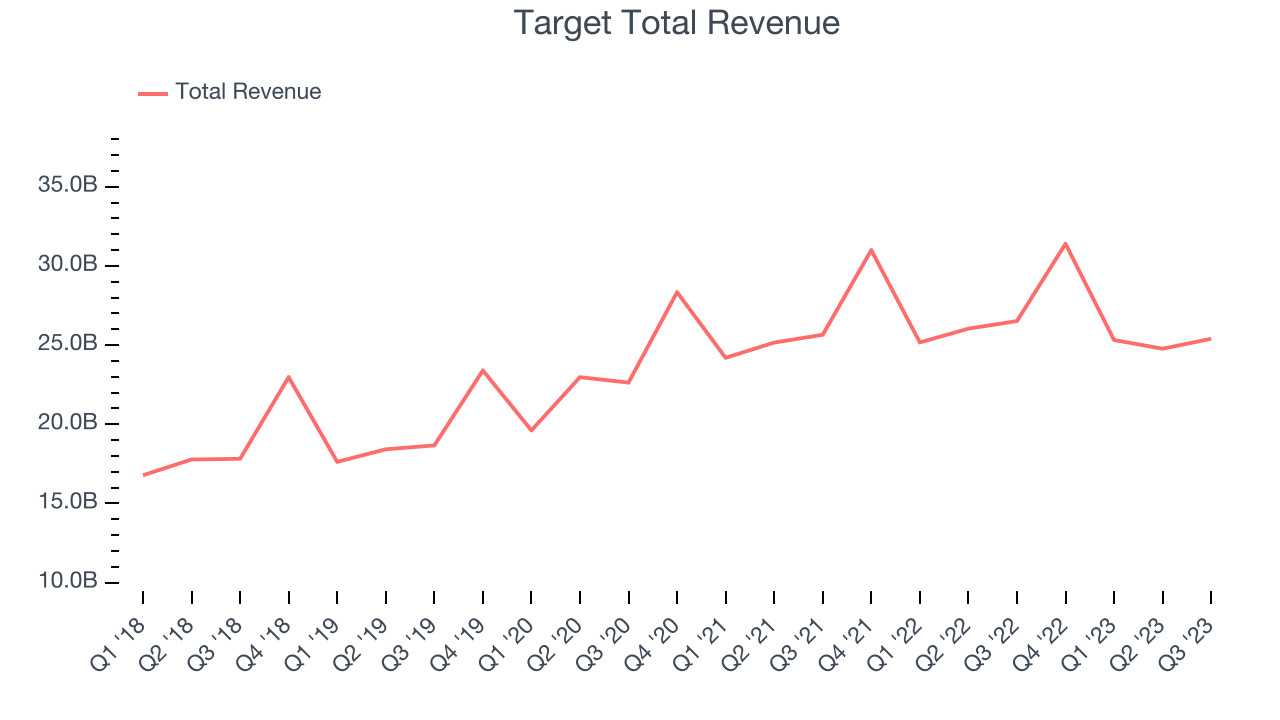

Best Q3: Target (NYSE:TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Target reported revenues of $25.4 billion, down 4.2% year on year, in line with analyst expectations. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

Target had the slowest revenue growth among its peers. The stock is up 24.8% since the results and currently trades at $138.14.

Is now the time to buy Target? Access our full analysis of the earnings results here, it's free.

Walmart (NYSE:WMT)

Known for its large-format Supercenters, Walmart (NYSE:WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

Walmart reported revenues of $160.8 billion, up 5.2% year on year, exceeding analyst expectations by 1.4%. It was a decent quarter for the company, with revenue outperforming Wall Street's estimates, driven by better-than-expected same-store sales growth. On the other hand, its full-year adjusted EPS forecast missed analysts' expectations.

Walmart scored the biggest analyst estimates beat in the group. The stock is down 4.3% since the results and currently trades at $162.39.

Read our full analysis of Walmart's results here.

Costco (NASDAQ:COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ:COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $57.8 billion, up 6.2% year on year, in line with analyst expectations. It was a strong quarter for the company. Despite slightly missing same-store sales expectations on a consolidated basis and in the US specifically, Costco managed to beat revenue expectations by a small margin. Slightly better profits led to a more convincing EPS beat.

Costco pulled off the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 10.1% since the results and currently trades at $695.4.

Read our full, actionable report on Costco here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned