Building materials company Builders FirstSource (NYSE:BLDR) fell short of analysts' expectations in Q2 CY2024, with revenue down 1.6% year on year to $4.46 billion. The company's full-year revenue guidance of $16.8 billion at the midpoint also came in 4.8% below analysts' estimates. It made a non-GAAP profit of $3.50 per share, down from its profit of $3.89 per share in the same quarter last year.

Is now the time to buy Builders FirstSource? Find out by accessing our full research report, it's free.

Builders FirstSource (BLDR) Q2 CY2024 Highlights:

- Revenue: $4.46 billion vs analyst estimates of $4.48 billion (small miss)

- EPS (non-GAAP): $3.50 vs analyst estimates of $3.08 (13.7% beat)

- The company dropped its revenue guidance for the full year from $18 billion to $16.8 billion at the midpoint, a 6.7% decrease

- EBITDA guidance for the full year is $2.3 billion at the midpoint, below analyst estimates of $2.53 billion

- Gross Margin (GAAP): 32.8%, down from 35.2% in the same quarter last year

- Adjusted EBITDA Margin: 15%, down from 17% in the same quarter last year

- Free Cash Flow of $364 million, up 62.5% from the previous quarter

- Market Capitalization: $18.27 billion

“As we continue to operate in this complex environment, I am proud of our resilient second quarter results highlighted by maintaining a mid-teens EBITDA margin, which demonstrates the strength of our differentiated business model and the hard work of our extraordinary team members,” commented Dave Rush, CEO of Builders FirstSource.

Headquartered in Irving, TX, Builders FirstSource (NYSE:BLDR) is a construction materials manufacturer that offers a variety of lumber and lumber-related building products.

Home Construction Materials

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

Sales Growth

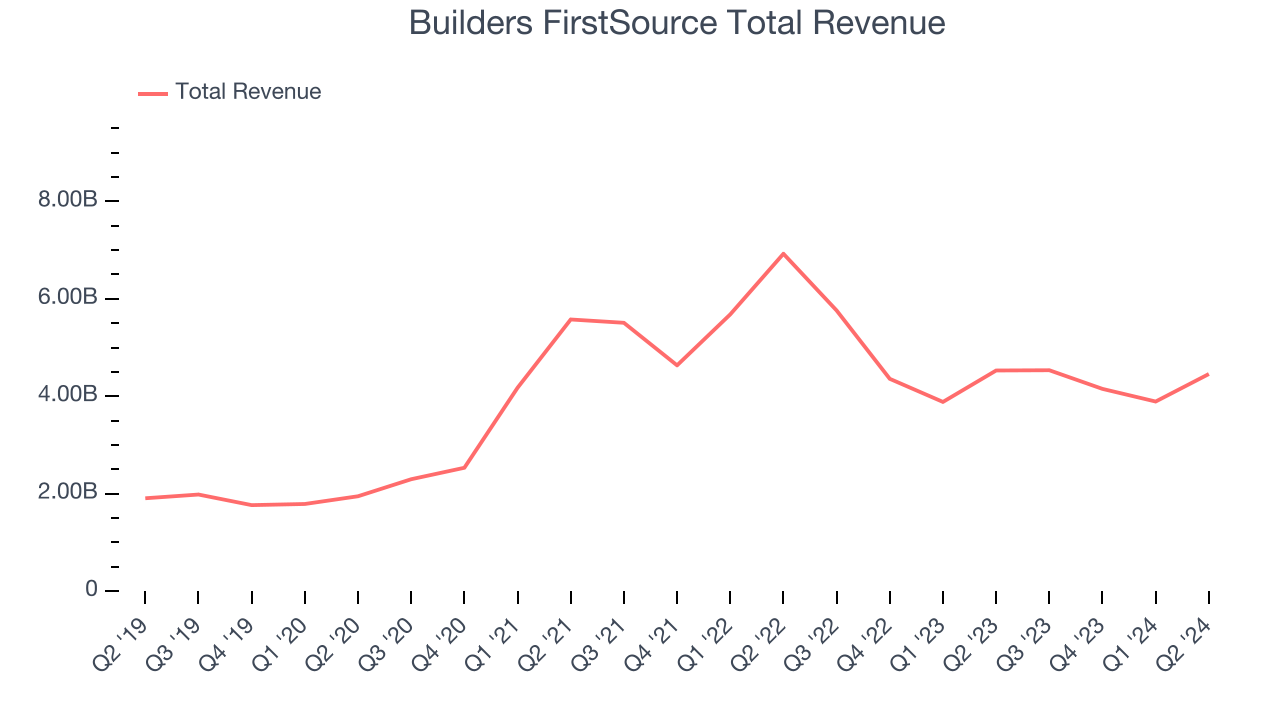

A company's long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Thankfully, Builders FirstSource's 17.9% annualized revenue growth over the last five years was incredible. This shows it expanded quickly, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Builders FirstSource's recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 13.5% over the last two years.

We can better understand the company's revenue dynamics by analyzing its most important segments, Manufactured products and Windows, doors & millwork , which are 23.7% and 25% of revenue. Over the last two years, Builders FirstSource's Manufactured products revenue (floors, wall panels, and engineered wood) averaged 9.9% year-on-year declines. On the other hand, its Windows, doors & millwork revenue (self explanatory) averaged 5.1% growth.

This quarter, Builders FirstSource missed Wall Street's estimates and reported a rather uninspiring 1.6% year-on-year revenue decline, generating $4.46 billion of revenue. Looking ahead, Wall Street expects sales to grow 5.7% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Operating Margin

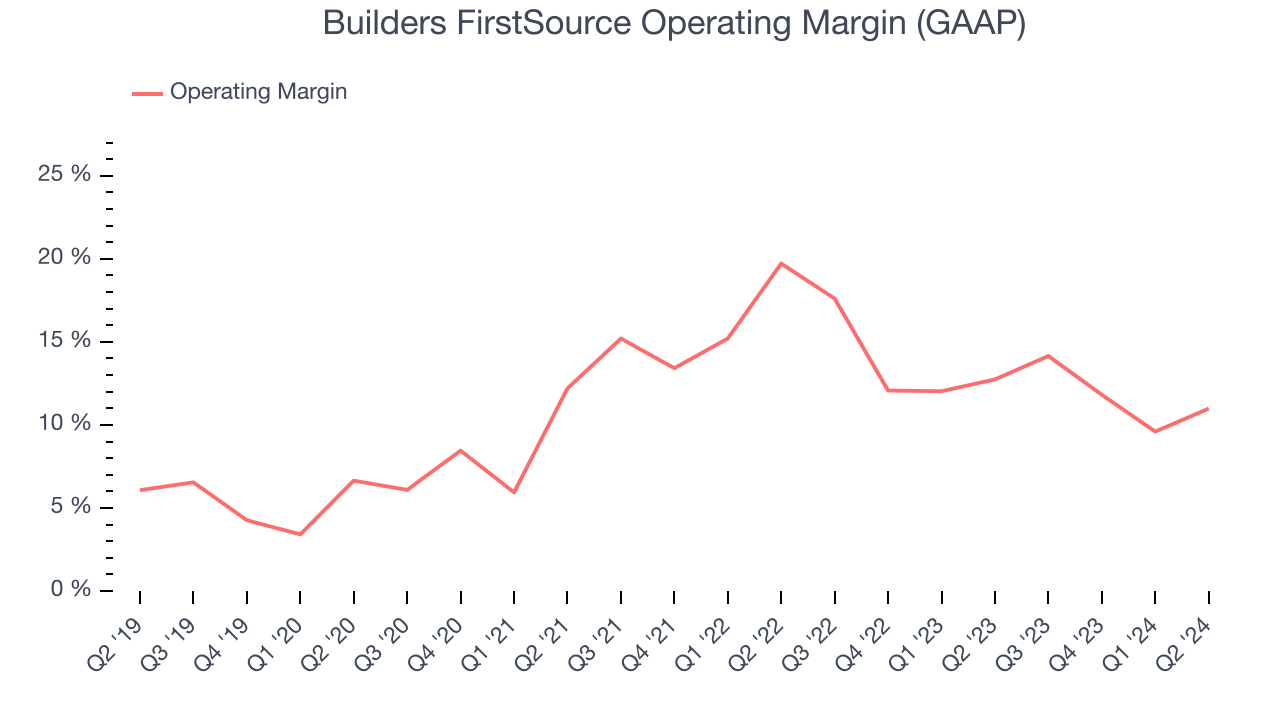

Builders FirstSource has been an optimally-run company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.4%.

Analyzing the trend in its profitability, Builders FirstSource's annual operating margin rose by 6.4 percentage points over the last five years, as its sales growth gave it immense operating leverage.

This quarter, Builders FirstSource generated an operating profit margin of 11%, down 1.8 percentage points year on year. Since Builders FirstSource's gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased sales, marketing, R&D, and administrative overhead expenses.

EPS

We track the long-term growth in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

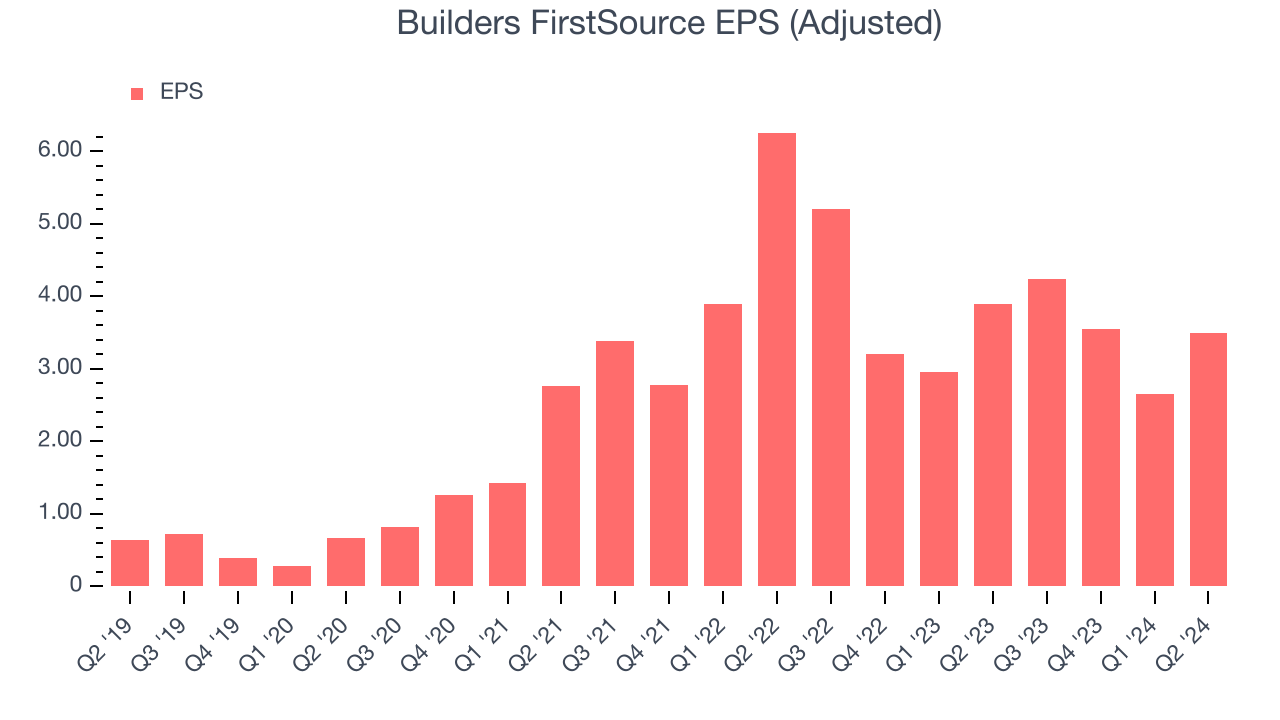

Builders FirstSource's EPS grew at an astounding 46% compounded annual growth rate over the last five years, higher than its 17.9% annualized revenue growth. This tells us the company became more profitable as it expanded.

Diving into Builders FirstSource's quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Builders FirstSource's operating margin declined this quarter but expanded by 6.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don't tell us as much about a company's fundamentals.

Like with revenue, we also analyze EPS over a shorter period to see if we are missing a change in the business. For Builders FirstSource, its two-year annual EPS declines of 7.6% show its recent history was to blame for its underperformance over the last five years. We hope Builders FirstSource can return to earnings growth in the future.

In Q2, Builders FirstSource reported EPS at $3.50, down from $3.89 in the same quarter last year. Despite falling year on year, this print easily cleared analysts' estimates. Over the next 12 months, Wall Street expects Builders FirstSource to perform poorly. Analysts are projecting its EPS of $13.94 in the last year to shrink by 9.5% to $12.62.

Key Takeaways from Builders FirstSource's Q2 Results

We enjoyed seeing Builders FirstSource exceed analysts' EPS expectations this quarter. On the other hand, its full-year revenue guidance was dropped and missed. Additionally, its EBITDA guidance for the full year fell short of Wall Street's estimates. Overall, this was a mediocre quarter for Builders FirstSource. The stock traded down 4.1% to $143.50 immediately following the results.

Builders FirstSource may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.