Clothing and footwear retailer Boot Barn (NYSE:BOOT) fell short of analysts' expectations in Q3 FY2024, with revenue up 1.1% year on year to $520.4 million. Next quarter's revenue guidance of $381 million also underwhelmed, coming in 4.9% below analysts' estimates. It made a GAAP profit of $1.81 per share, improving from its profit of $1.74 per share in the same quarter last year.

Boot Barn (BOOT) Q3 FY2024 Highlights:

- Market Capitalization: $2.24 billion

- Revenue: $520.4 million vs analyst estimates of $528 million (1.4% miss)

- EPS: $1.81 vs analyst estimates of $1.79 (1.1% beat)

- Revenue Guidance for Q4 2024 is $381 million at the midpoint, below analyst estimates of $400.5 million (EPS guidance also below)

- Revenue Guidance for full year 2024 is $1.659 billion at the midpoint, below analyst estimates of $1.680 billion (EPS guidance also below)

- Free Cash Flow of $68.39 million, down 42.3% from the same quarter last year

- Gross Margin (GAAP): 38.3%, up from 36.5% in the same quarter last year

- Same-Store Sales were down 9.7% year on year (in line)

- Store Locations: 382 at quarter end, increasing by 49 over the last 12 months

With a strong store presence in Texas, California, Florida, and Oklahoma, Boot Barn (NYSE:BOOT) is a western-inspired apparel and footwear retailer.

Cowboy boots, western hats, jeans, and belts from brands such as Wrangler, Stetson, and Carhartt are perennially popular items. Because the western theme unifies its merchandise, Boot Barn is able to offer more breadth and depth in that style than most other general apparel retailers. The core Boot Barn customer tends to be anyone who embraces the western lifestyle, whether that’s because they’re actual ranchers or cowboys or because they simple like the aesthetic.

The average Boot Barn store is quite small, approximately 11,000 square feet and typically located in rural or suburban malls and shopping centers with other retailers. In addition to its physical stores, Boot Barn has an e-commerce presence that was launched in 2012. It allows the company to reach US customers who may not have access to one of its physical stores, as states such as New York, Ohio, Massachusetts, Michigan, and some others do not have a single store.

Footwear Retailer

Footwear sales–like their apparel counterparts–are driven by seasons, trends, and innovation more so than absolute need and similarly face the bigger-picture secular trend of e-commerce penetration. Footwear plays a part in societal belonging, personal expression, and occasion, and retailers selling shoes recognize this. Therefore, they aim to balance selection, competitive prices, and the latest trends to attract consumers. Unlike their apparel counterparts, footwear retailers most sell popular third-party brands (as opposed to their own exclusive brands), which could mean less exclusivity of product but more nimbleness to pivot to what’s hot.

Niche apparel competitors include The Buckle (NYSE:BKE), Urban Outfitters (NASDAQ:URBN), and American Eagle Outfitters (NYSE:AEO).Sales Growth

Boot Barn is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

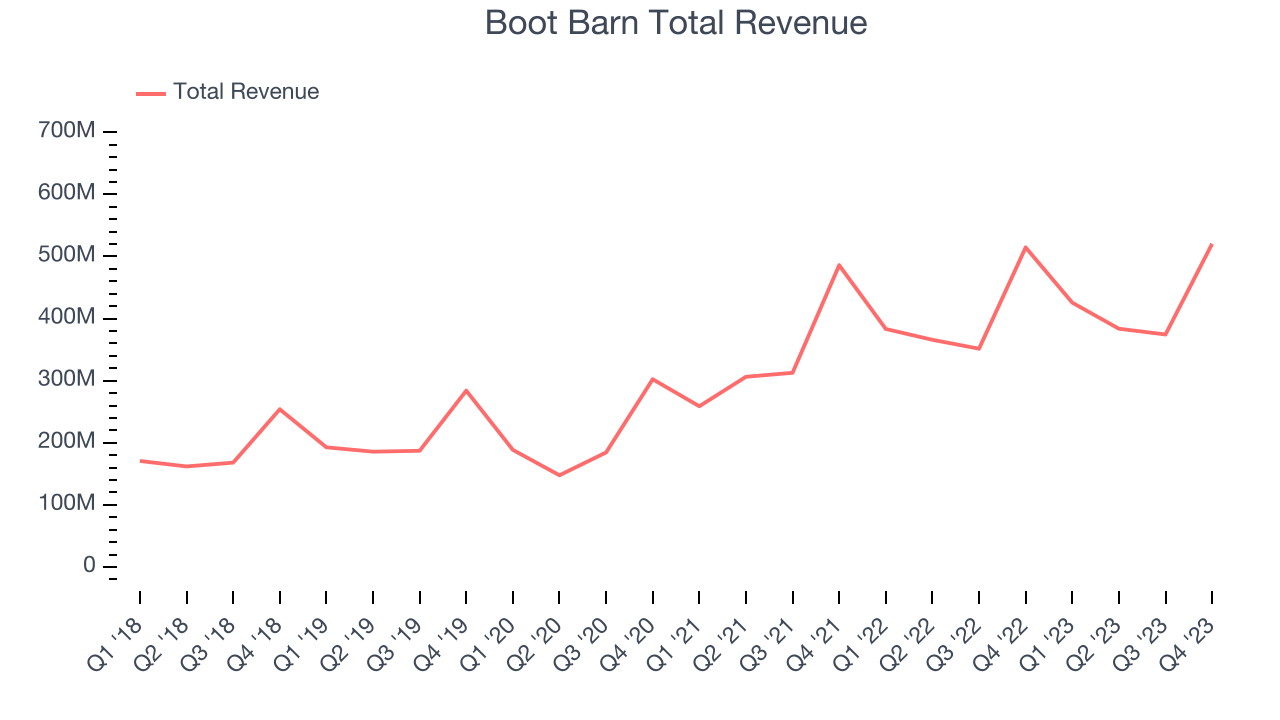

As you can see below, the company's annualized revenue growth rate of 19% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was excellent as it added more brick-and-mortar locations and increased sales at existing, established stores.

This quarter, Boot Barn's revenue grew 1.1% year on year to $520.4 million, falling short of Wall Street's estimates. The company is guiding for a 10.5% year-on-year revenue decline next quarter to $381 million, a reversal from the 11% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 4.2% over the next 12 months, an acceleration from this quarter.

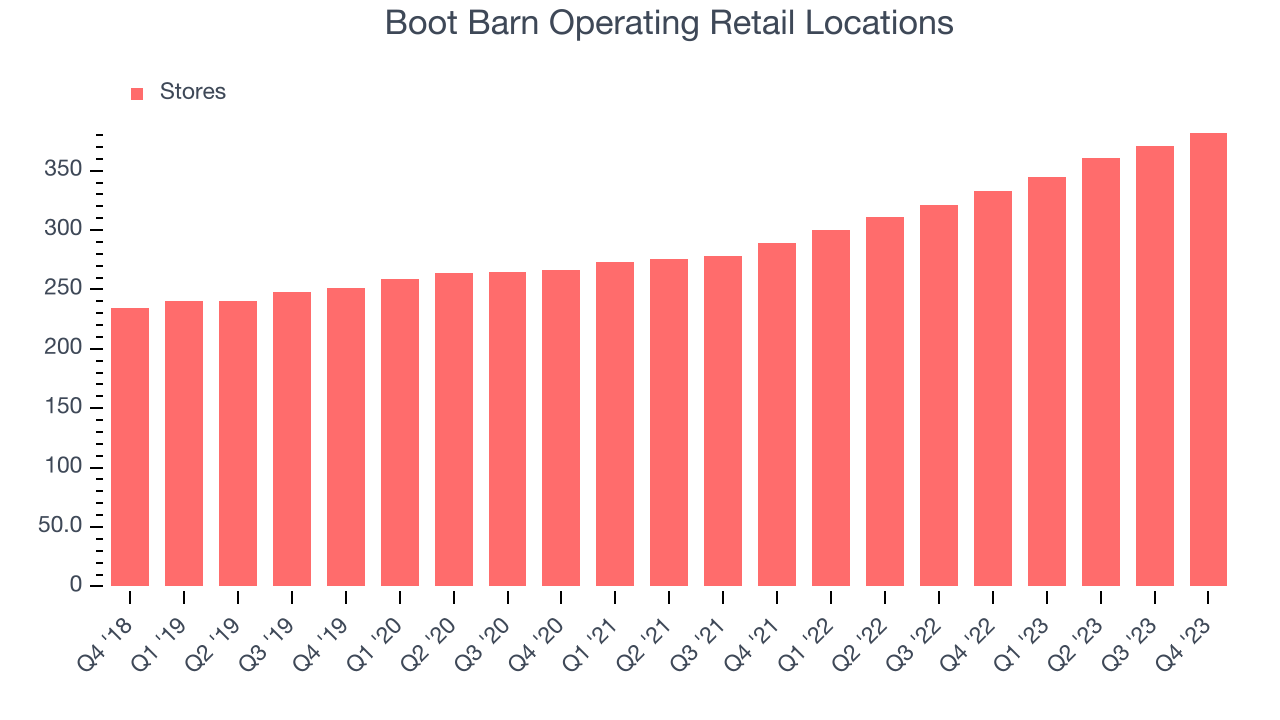

Number of Stores

A retailer's store count often determines on how much revenue it can generate.

When a retailer like Boot Barn is opening new stores, it usually means it's investing for growth because demand is greater than supply. Boot Barn's store count increased by 49 locations, or 14.7%, over the last 12 months to 382 total retail locations in the most recently reported quarter.

Taking a step back, the company has rapidly opened new stores over the last eight quarters, averaging 14.3% annual growth in its physical footprint. This store growth is much higher than other retailers and gives Boot Barn a chance to scale towards a mid-sized company over time. With an expanding store base and demand, revenue growth can come from multiple vectors: sales from new stores, sales from e-commerce, or increased foot traffic and higher sales per customer at existing stores.

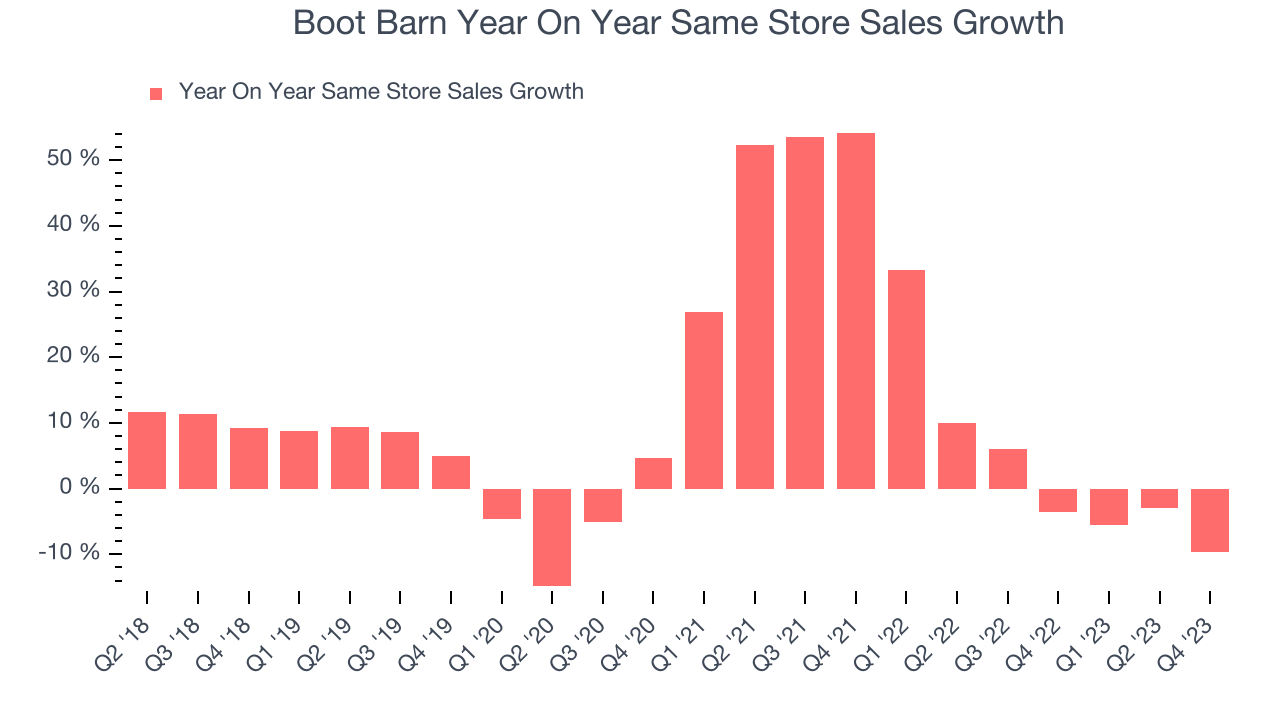

Same-Store Sales

Boot Barn's demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.4% year on year. With positive same-store sales growth amid an increasing physical footprint of stores, Boot Barn is reaching more customers and growing sales.

In the latest quarter, Boot Barn's same-store sales fell 9.7% year on year. This decrease was a further deceleration from the 3.6% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

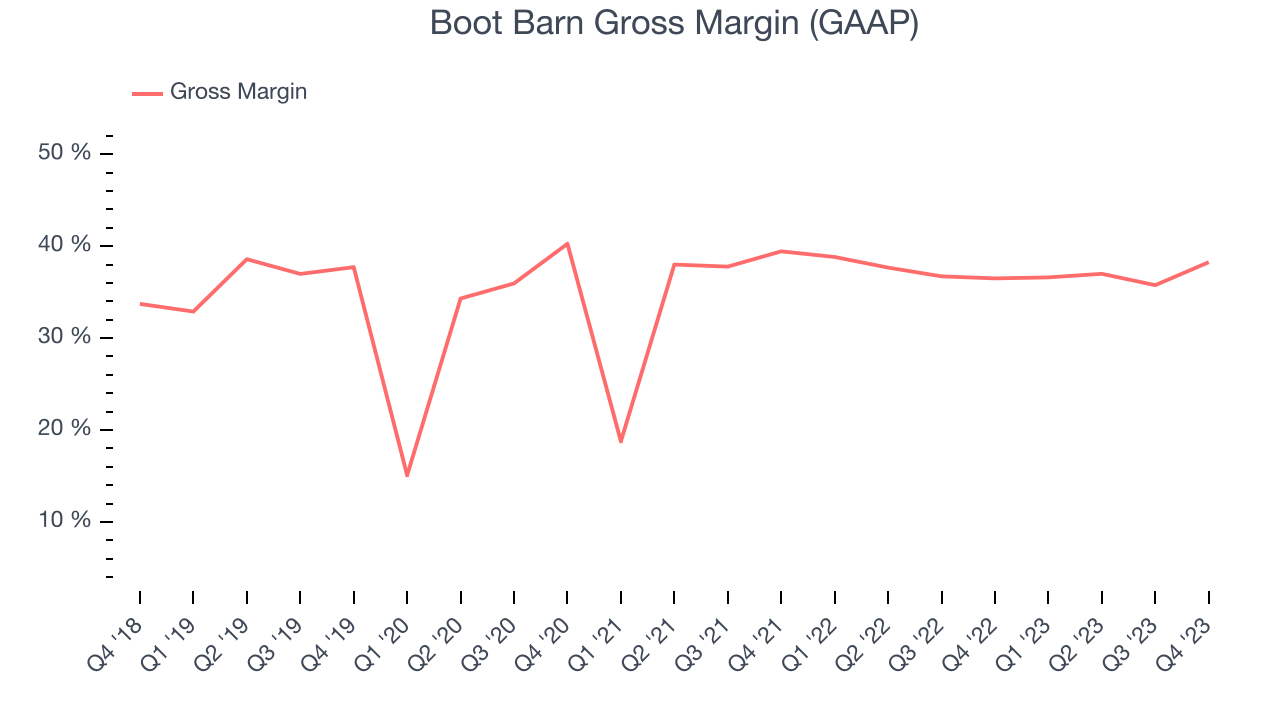

Gross Margin & Pricing Power

Boot Barn's unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it's averaged a decent 37.2% gross margin over the last eight quarters. This means the company makes $0.37 for every $1 in revenue before accounting for its operating expenses.

Boot Barn produced a 38.3% gross profit margin in Q3, marking a 1.8 percentage point increase from 36.5% in the same quarter last year. This margin expansion is a good sign in the near term. If this trend continues, it could signal a less competitive environment where the company has better pricing power, less pressure to discount products, and more stable input costs (such as distribution expenses to move goods).

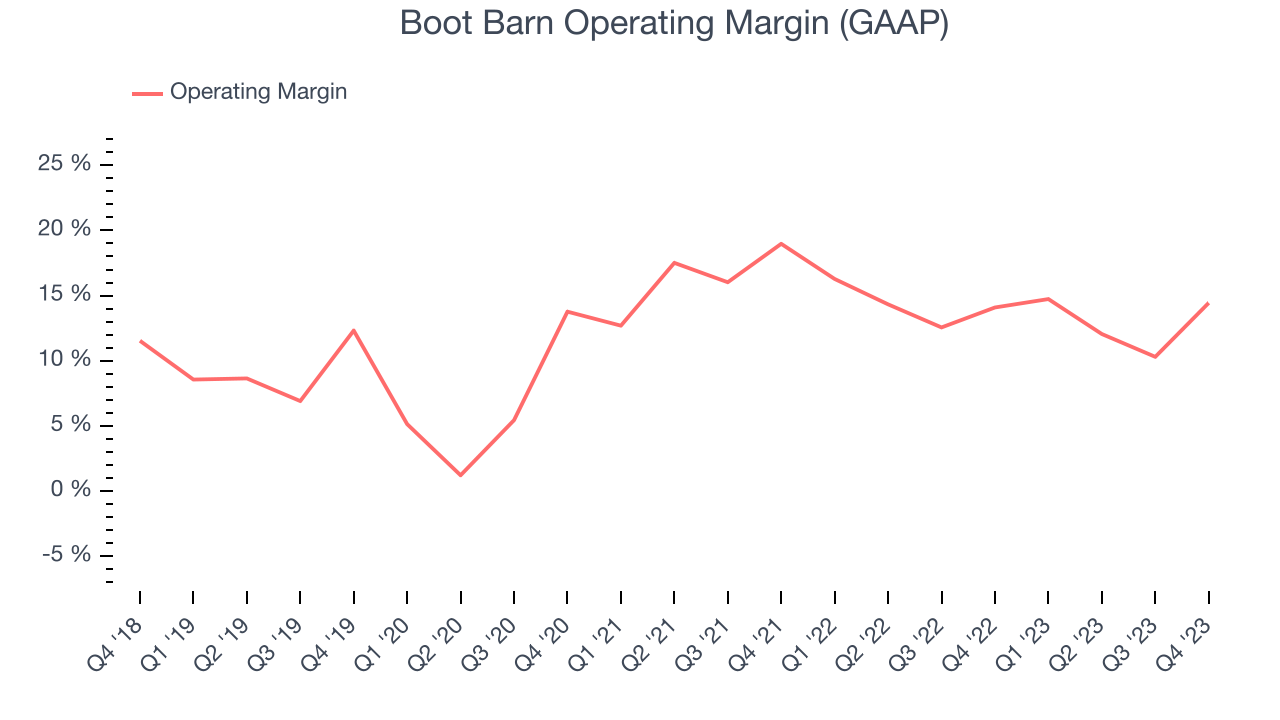

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q3, Boot Barn generated an operating profit margin of 14.4%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Boot Barn has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be wildly profitable for a consumer retail business, boasting an average operating margin of 13.6%. However, Boot Barn's margin has slightly declined by 1.3 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way.

Zooming out, Boot Barn has exercised operational efficiency over the last eight quarters. The company has demonstrated it can be wildly profitable for a consumer retail business, boasting an average operating margin of 13.6%. However, Boot Barn's margin has slightly declined by 1.3 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way. EPS

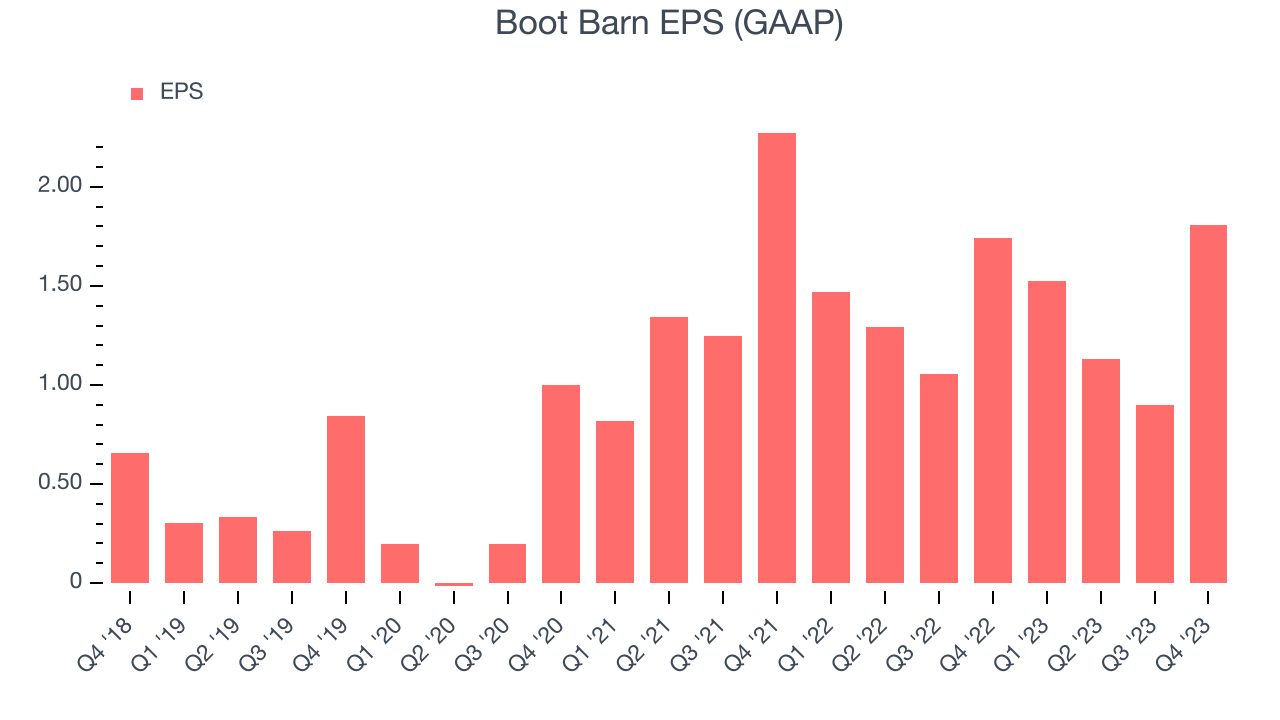

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q3, Boot Barn reported EPS at $1.81, up from $1.74 in the same quarter a year ago. This print beat Wall Street's estimates by 1.1%.

Between FY2020 and FY2024, Boot Barn's adjusted diluted EPS grew 209%, translating into a remarkable 32.5% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that Boot Barn has excelled in managing its expenses.

Over the next 12 months, however, Wall Street is projecting Boot Barn's EPS to stay flat.

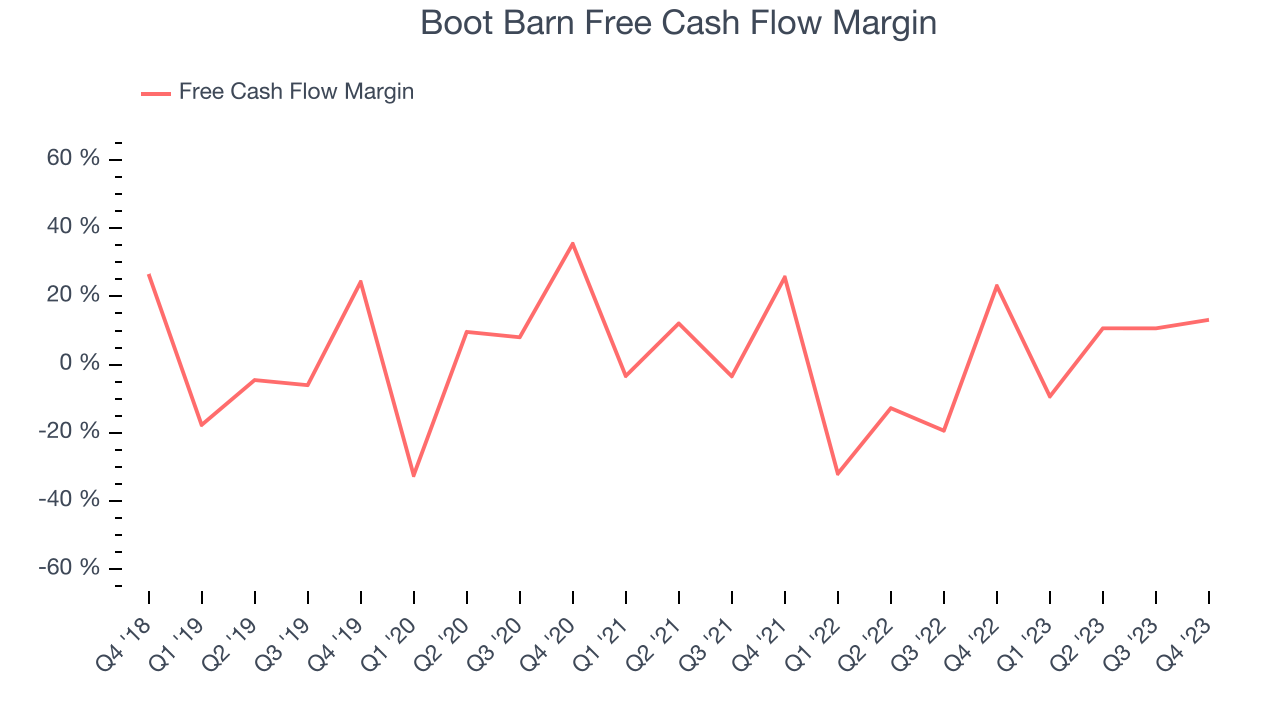

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe in the end, cash is king, and you can't use accounting profits to pay the bills.

Boot Barn's free cash flow came in at $68.39 million in Q3, down 42.3% year on year. This result represents a 13.1% margin.

While Boot Barn posted positive free cash flow this quarter, the broader story hasn't been so clean. Over the last two years, Boot Barn's capital-intensive business model and large investments in new store buildouts have consumed many company resources. Its free cash flow margin has averaged negative 2%, weak for a consumer retail business. However, its margin has averaged year-on-year increases of 13.8 percentage points, showing the company is taking action to improve its situation.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company's revenue growth was profitable. But was it capital-efficient? If two companies had equal growth, we’d prefer the one with lower reinvestment requirements.

Understanding a company’s ROIC (return on invested capital) gives us insight into this because it factors the total debt and equity needed to generate operating profits. This metric is a proxy for not only the capital efficiency of a business but also a management team's ability to allocate limited resources.

Boot Barn's five-year average ROIC was 16.1%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Boot Barn's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Boot Barn's ROIC has averaged a 5.5 percentage point increase each year. This is a good sign, and if Boot Barn's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Boot Barn's Q2 Results

Sporting a market capitalization of $2.06 billion, Boot Barn is among smaller companies, but its more than $38.7 million in cash on hand and positive free cash flow over the last 12 months puts it in an attractive position to invest in growth.

We struggled to find many strong positives in these results. Revenue and EPS both missed, and full year guidance was lowered, showing that the headwinds to the business will continue. This trend continued with next quarter's guidance, which was also largely below expectations for key metrics such as revenue and EPS. Overall, this was a mediocre quarter for Boot Barn. The company is down 6.19% on the results and currently trades at $65 per share.

Key Takeaways from Boot Barn's Q3 Results

We struggled to find many strong positives in these results. Its earnings forecast for next quarter missed analysts' expectations and its revenue guidance for next quarter missed Wall Street's estimates. Overall, this was a mediocre quarter for Boot Barn. The company is down 3.8% on the results and currently trades at $68.98 per share.

Is Now The Time?

Boot Barn may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Boot Barn isn't a bad business. First off, its revenue growth has been impressive over the last four years. And while its brand caters to a niche market, its new store openings have increased its brand equity.

Boot Barn's price-to-earnings ratio based on the next 12 months is 13.6x. In the end, beauty is in the eye of the beholder. While Boot Barn wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.