Upscale bowling alley chain Bowlero (NYSE:BOWL) reported results ahead of analysts' expectations in Q2 FY2024, with revenue up 11.8% year on year to $305.7 million. The company's full-year revenue guidance of $1.17 billion at the midpoint also came in slightly above analysts' estimates. It made a GAAP loss of $0.44 per share, down from its profit of $0.10 per share in the same quarter last year.

Is now the time to buy Bowlero? Find out by accessing our full research report, it's free.

Bowlero (BOWL) Q2 FY2024 Highlights:

- Revenue: $305.7 million vs analyst estimates of $300.6 million (1.7% beat)

- EPS: -$0.44 vs analyst estimates of $0.12 (-$0.56 miss)

- The company reconfirmed its revenue guidance for the full year of $1.17 billion at the midpoint

- Gross Margin (GAAP): 29.6%, down from 34.3% in the same quarter last year

- Market Capitalization: $1.75 billion

- Initiated a quarterly dividend of $0.055 per share

“Second quarter fiscal year 2024 saw double-digit total growth, amplifying our ability to grow the business despite difficult comparatives as we come out of the record-breaking COVID rebound. Our acquisition of Lucky Strike represents a major milestone for the Company as we focus on higher revenue properties and continue to grow our location count. That deal brought together flagship properties with our best-in-class operators and event sales platform, driving results higher than expectations. We are expanding the well-known Lucky Strike brand by opening our first Lucky Strike new build in Moorpark, California, and the new Lucky Strike Miami will soon follow.,” said Thomas Shannon, Founder and Chief Executive Officer of Bowlero.

Operating over 300 locations globally, Bowlero (NYSE:BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

Leisure Facilities and Products

Consumers have lots of choices when it comes to how they spend their free time and extra money, so the companies offering leisure products and experiences must highlight their value proposition. Fitness companies may be riding the wellness trend, for example, while those selling boats and toys may have to lean into innovation to stand out. Either way, all leisure companies must compete against the 800-pound gorilla of social media and streaming entertainment, which offer instant gratification and have been taking share of consumers’ free time for over a decade.

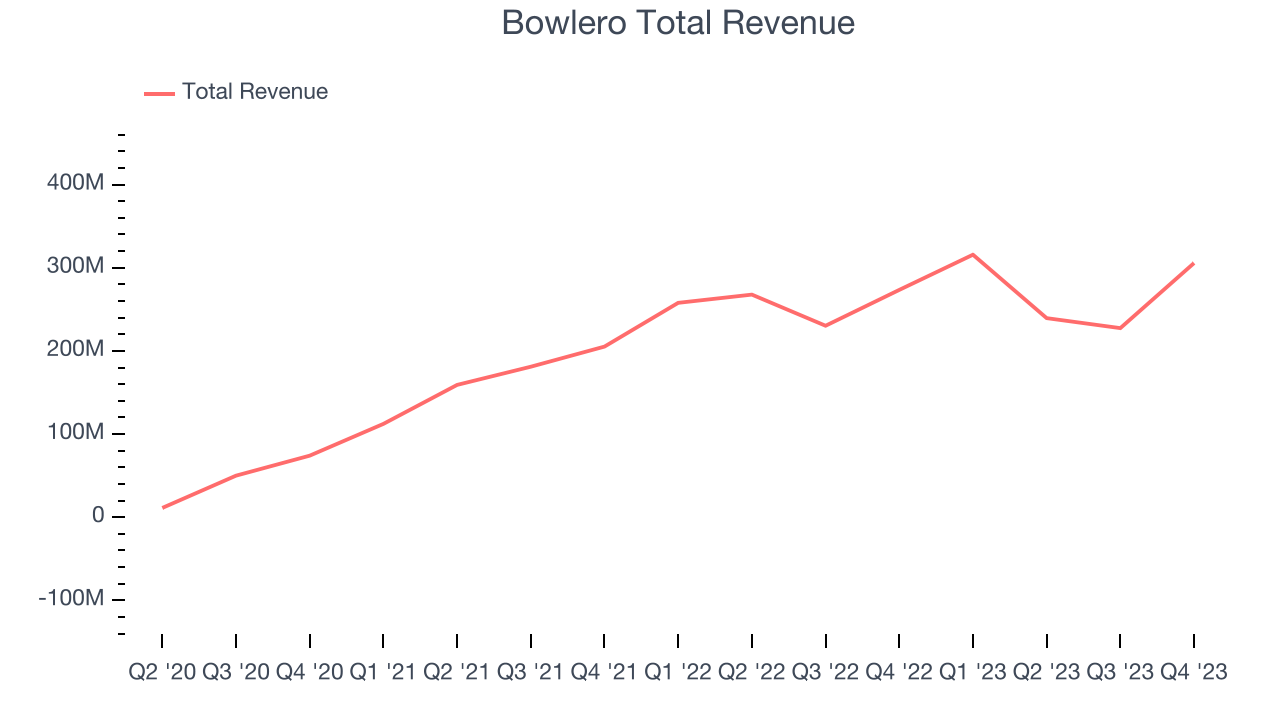

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Bowlero's annualized revenue growth rate of 78.8% over the last 3 years was incredible for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Bowlero's recent history shows its growth has slowed, as its annualized revenue growth of 28.7% over the last 2 years is below its 3-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Bowlero's recent history shows its growth has slowed, as its annualized revenue growth of 28.7% over the last 2 years is below its 3-year trend.

We can understand the company's revenue dynamics even better by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last 2 years, Bowlero's same-store sales averaged 30.4% year-on-year growth. This number doesn't suprise us as it's in line with its revenue growth during the same period.

This quarter, Bowlero reported robust year-on-year revenue growth of 11.8%, and its $305.7 million of revenue exceeded Wall Street's estimates by 1.7%. Looking ahead, Wall Street expects sales to grow 11% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

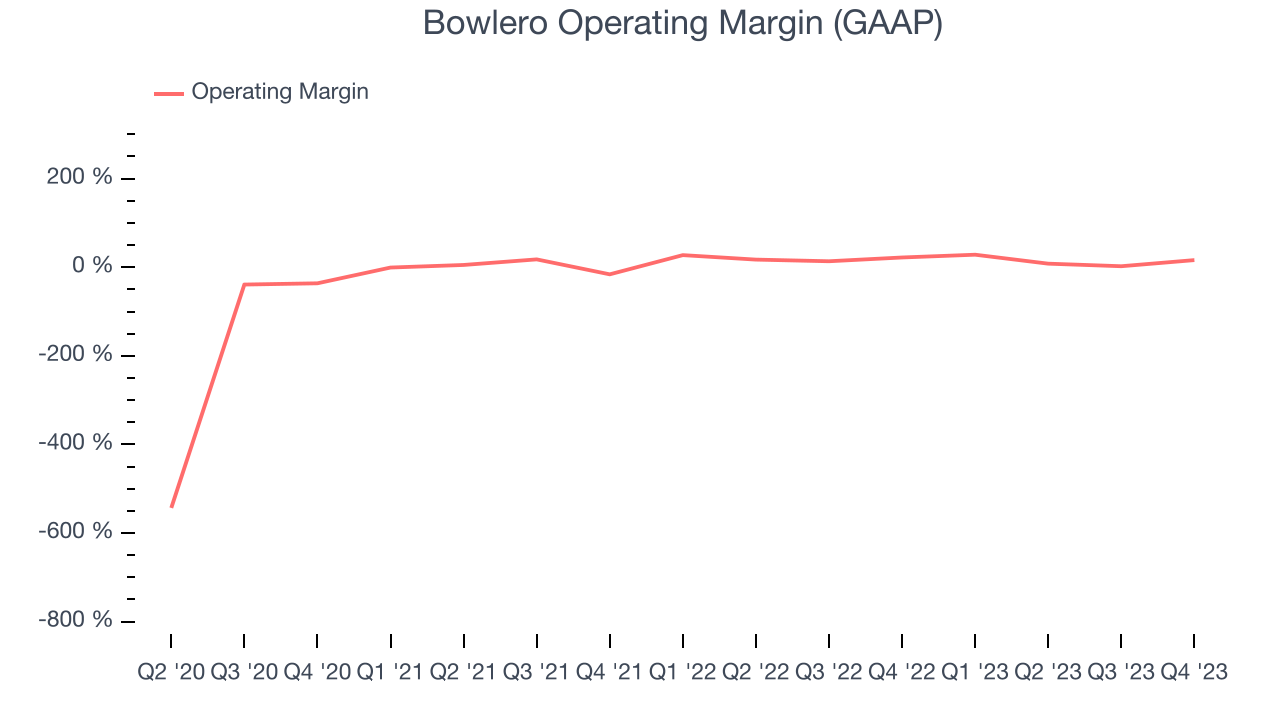

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Bowlero has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 16.9%.

In Q2, Bowlero generated an operating profit margin of 16.2%, down 5.9 percentage points year on year. This reduction indicates the company was less efficient with its expenses over the last year, spending more money in areas like corporate overhead and advertising.

Over the next 12 months, Wall Street expects Bowlero to become more profitable. Analysts are expecting the company’s LTM operating margin of 15.1% to rise to 20.7%, certainly a welcome development.Key Takeaways from Bowlero's Q2 Results

It was good to see Bowlero beat analysts' revenue estimates, driven by better-than-expected bowling center revenue. We were also glad its full-year revenue guidance came in higher than Wall Street's projections. On the other hand, its EPS and operating margin missed Wall Street's estimates. During the quarter, the company initiated a quarterly dividend of $0.055 per share, payable on March 8, 2024, to stockholders of record on February 23, 2024. The integration of last year's Lucky Strike acquisition is also going well, and management expects to open new locations during the year. Overall, this was a mediocre quarter for Bowlero. The stock is up 3.4% after reporting and currently trades at $12 per share.

Bowlero may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.