Upscale bowling alley chain Bowlero (NYSE:BOWL) missed analysts' expectations in Q1 CY2024, with revenue up 7% year on year to $337.7 million. It made a GAAP profit of $0.13 per share, improving from its loss of $0.22 per share in the same quarter last year.

Bowlero (BOWL) Q1 CY2024 Highlights:

- Revenue: $337.7 million vs analyst estimates of $340.9 million (small miss)

- Adjusted EBITDA: $122.8 million vs analyst estimates of $133.1 million (7.7% miss)

- EPS: $0.13 vs analyst expectations of $0.23 ($0.10 miss)

- Gross Margin (GAAP): 33.1%, down from 40% in the same quarter last year

- Market Capitalization: $1.87 billion

Operating over 300 locations globally, Bowlero (NYSE:BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

Established by individuals who recognized the longstanding popularity of bowling, the brand was founded to modernize the typical bowling experience. It achieves this by integrating elements reminiscent of classic bowling with contemporary amenities.

Bowlero's venues feature updated lanes with modern scoring technology, an array of arcade games, and a menu that offers a variety of food and drink options. Locations can be found in both urban and suburban areas.

On the financial front, Bowlero's revenue is derived from multiple channels. Lane reservations are a major contributor, complemented by earnings from food and beverage, arcade games, and event hosting. The company serves a diverse clientele from traditional bowling enthusiasts to large groups and individuals exploring contemporary entertainment venues.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors in the family fun sector include Topgolf Callaway Brands (NYSE:MODG), Dave & Buster's (NASDAQ:PLAY), and Six Flags (NYSE:SIX).Sales Growth

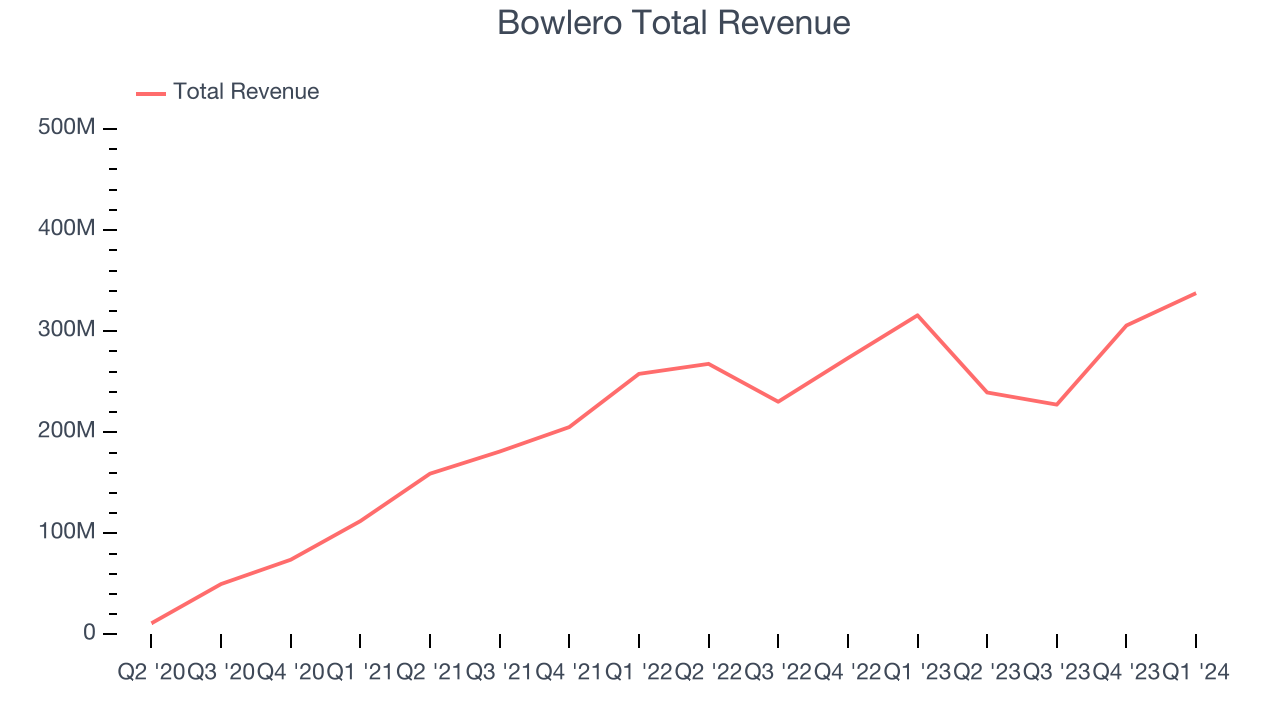

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Bowlero's annualized revenue growth rate of 65% over the last three years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Bowlero's recent history shows its momentum has slowed as its annualized revenue growth of 17.6% over the last two years is below its three-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Bowlero's recent history shows its momentum has slowed as its annualized revenue growth of 17.6% over the last two years is below its three-year trend.

This quarter, Bowlero's revenue grew 7% year on year to $337.7 million, missing Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 11% over the next 12 months, an acceleration from this quarter.

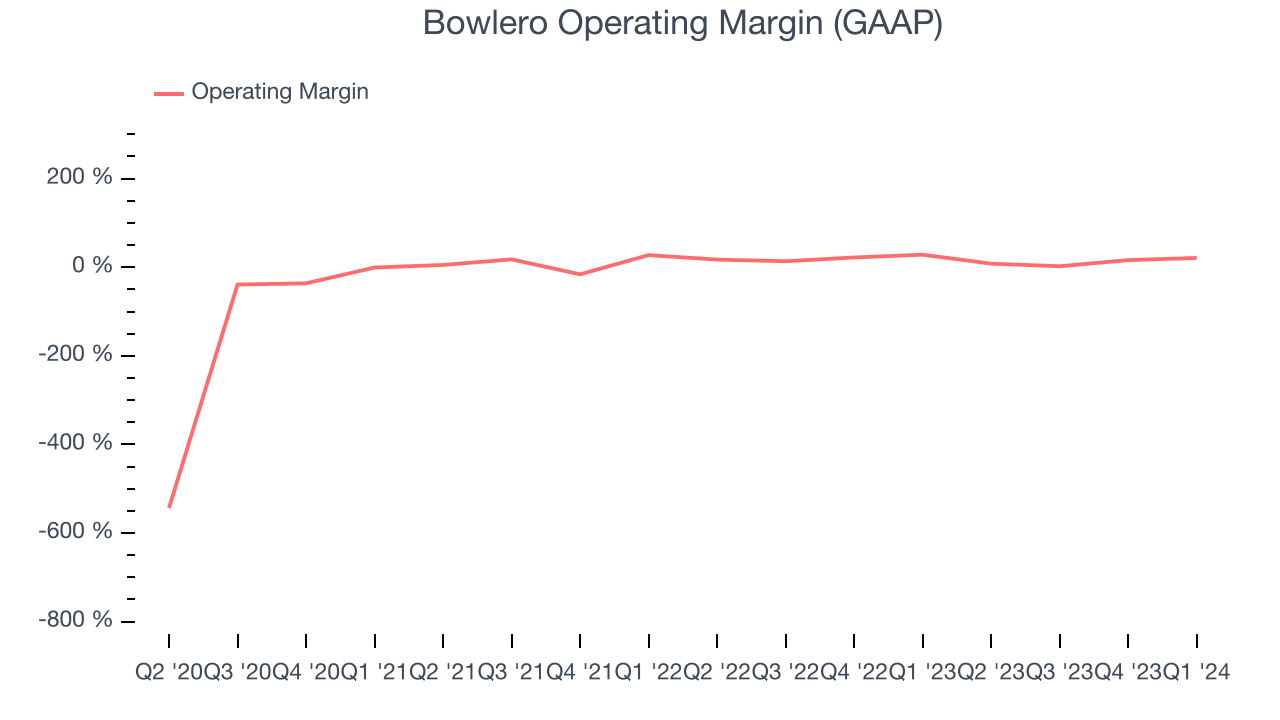

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Bowlero has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 17%.

In Q1, Bowlero generated an operating profit margin of 21%, down 7.3 percentage points year on year.

Over the next 12 months, Wall Street expects Bowlero to become more profitable. Analysts are expecting the company’s LTM operating margin of 13.1% to rise to 19.8%.EPS

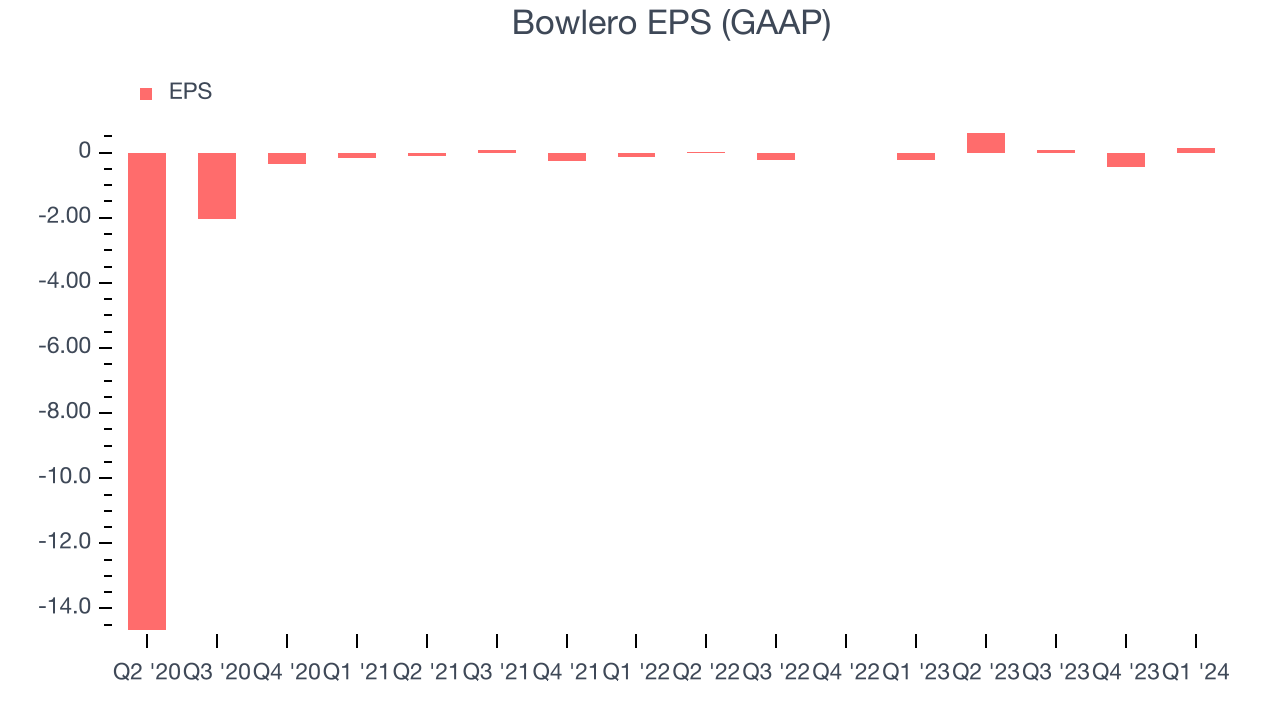

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last three years, Bowlero cut its earnings losses and improved its EPS by 26.5% each year. This performance, however, is worse than its 65% annualized revenue growth over the same period. Let's dig into why.

Bowlero recently raised equity capital, and in the process, grew its share count by 7.5% over the last three years. This has resulted in muted earnings per share growth but doesn't tell us as much about its future. We prefer to look at operating and free cash flow margins in these situations.In Q1, Bowlero reported EPS at $0.13, up from negative $0.22 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Bowlero to perform poorly. Analysts are projecting its LTM EPS of $0.38 to shrink to break even.

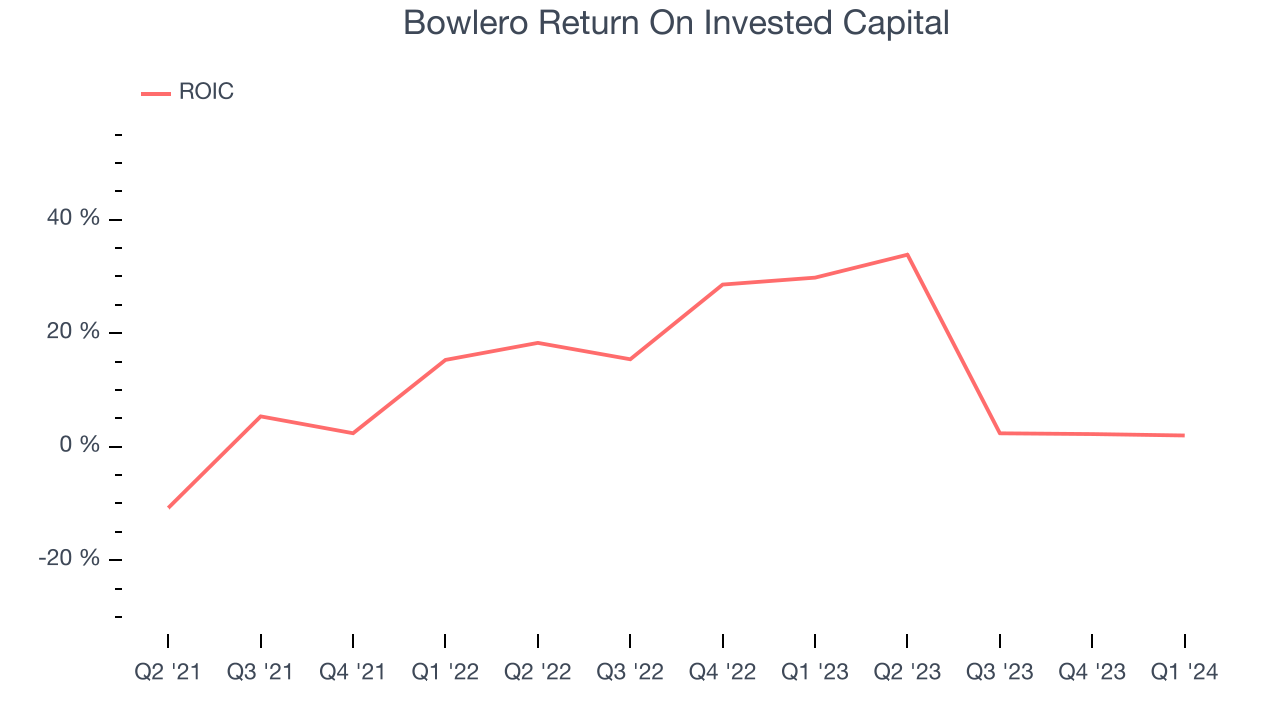

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Bowlero's five-year average return on invested capital was 15.7%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Bowlero's invested capital has produced decent profits.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Bowlero reported $212.4 million of cash and $1.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $342.6 million of EBITDA over the last 12 months, we view Bowlero's 2.8x net-debt-to-EBITDA ratio as safe. We also see its $67.58 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Bowlero's Q1 Results

We struggled to find many strong positives in these results. Its adjusted EBITDA and EPS both missed Wall Street's estimates. Overall, the results could have been better. The company is down 10.9% on the results and currently trades at $11.12 per share.

Is Now The Time?

Bowlero may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We have other favorites, but we understand the arguments that Bowlero isn't a bad business. First off, its revenue growth has been exceptional over the last three years. And while its low free cash flow margins give it little breathing room, its EPS growth over the last three years has been fantastic.

Bowlero's price-to-earnings ratio based on the next 12 months is 32.9x. We don't really see a big opportunity in the stock at the moment, but in the end, beauty is in the eye of the beholder. If you like Bowlero, it seems to be trading at a reasonable price.

Wall Street analysts covering the company had a one-year price target of $19.15 per share right before these results (compared to the current share price of $11.12).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.