Cloud content storage and management platform Box (NYSE:BOX) reported results in line with analysts' expectations in Q4 FY2024, with revenue up 2.5% year on year to $262.9 million. The company expects next quarter's revenue to be around $262 million, in line with analysts' estimates. It made a non-GAAP profit of $0.42 per share, down from its profit of $0.45 per share in the same quarter last year.

Box (BOX) Q4 FY2024 Highlights:

- Revenue: $262.9 million vs analyst estimates of $262.8 million (small beat)

- EPS (non-GAAP): $0.42 vs analyst estimates of $0.38 (9.2% beat)

- Revenue Guidance for Q1 2025 is $262 million at the midpoint, roughly in line with what analysts were expecting (operating margin guidance for the period also roughly in line)

- Management's revenue guidance for the upcoming financial year 2025 is $1.08 billion at the midpoint, in line with analyst expectations and implying 4.3% growth (vs 4.8% in FY2024) (operating margin guidance for the period also roughly in line)

- Free Cash Flow of $81.83 million, up 40.3% from the previous quarter

- Gross Margin (GAAP): 76.1%, in line with the same quarter last year

- Market Capitalization: $4.00 billion

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

The world is shifting away from physical storage and content sharing methods that made it difficult for employees to securely collaborate and share data at work. Box has helped accelerate this shift through its cloud-based content management and collaboration software platform.

For example, when preparing a presentation, employees can use software provided by Box to collaboratively make edits, updates and comments via a user-friendly cloud-based interface. The presentation can be accessed from mobile and desktop devices from any location. Box has also invested in securing the transfer and sharing of sensitive documents which enables it to address highly sensitive verticals such as finance and healthcare.

Box started with offering cloud storage as a simple way for employees to share content more securely, but has since expanded into new functions such as e-signatures, monitoring anomalous behaviour and workflow management.

Document Management

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

As you might have guessed, Box has plenty of competitors, such as DocuSign (NASDAQ:DOCU), Dropbox (NASDAQ:DBX), Google Drive (NASDAQ:GOOG) and Microsoft OneDrive (NASDAQ:MSFT).

Sales Growth

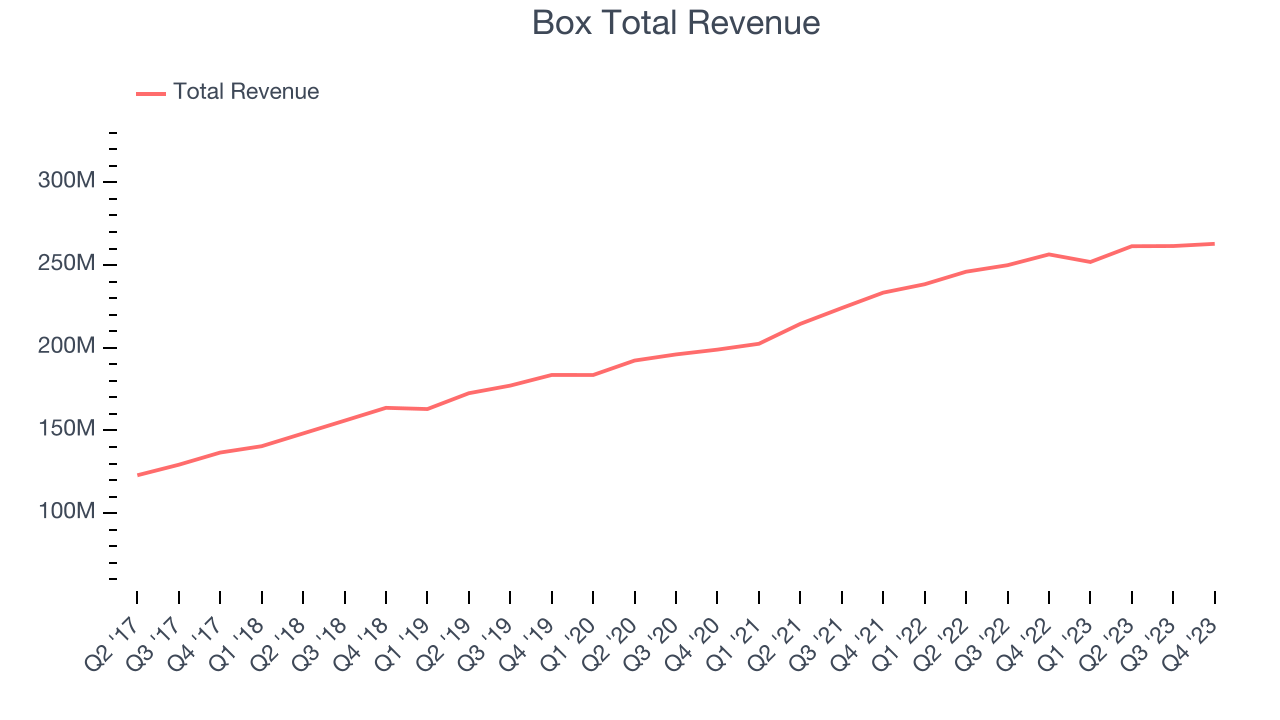

As you can see below, Box's revenue growth has been unremarkable over the last two years, growing from $233.4 million in Q4 FY2022 to $262.9 million this quarter.

Box's quarterly revenue was only up 2.5% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $1.34 million quarter on quarter, accelerating from $109,000 in Q3 2024.

Next quarter's guidance suggests that Box is expecting revenue to grow 4% year on year to $262 million, slowing down from the 5.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.08 billion at the midpoint, growing 4.3% year on year compared to the 4.7% increase in FY2024.

Profitability

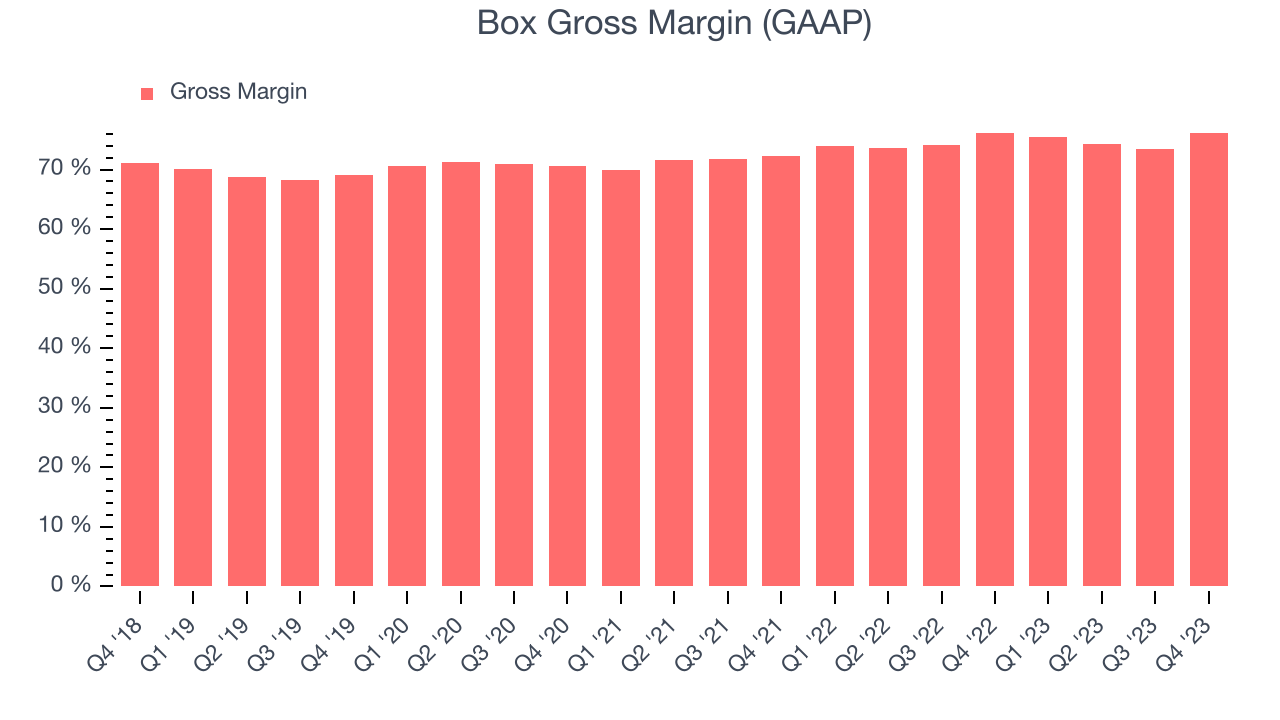

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Box's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 76.1% in Q4.

That means that for every $1 in revenue the company had $0.76 left to spend on developing new products, sales and marketing, and general administrative overhead. Significantly up from the last quarter, Box's impressive gross margin allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

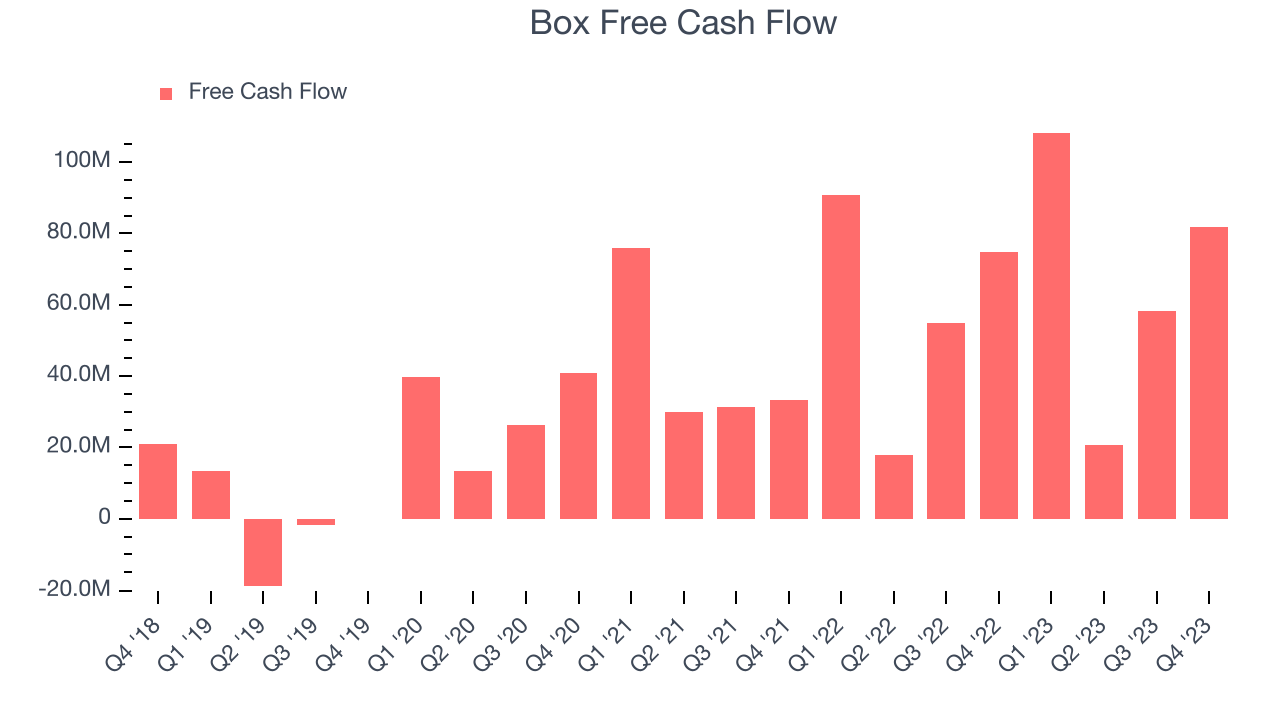

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Box's free cash flow came in at $81.83 million in Q4, up 9.6% year on year.

Box has generated $269 million in free cash flow over the last 12 months, an eye-popping 25.9% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Box's Q4 Results

The results in the quarter were fine, with a small revenue beat and a more convincing EPS beat. Guidance was relatively in line with expectations, showing that the company is staying on track and presenting the market with no major surprises. Box seems excited about the AI potential of its platform, saying “with advancements in AI, companies are accelerating their adoption of the cloud and transforming how they work with their content...Box is at the center of some of the most important trends in technology history as companies look to digitize and automate their businesses." Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Perhaps expectations were low going into the quarter, which could explain why the stock is up 5.1% after reporting and currently trades at $28.6 per share.

Is Now The Time?

When considering an investment in Box, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in case of Box, we'll be cheering from the sidelines. For one, analysts expect growth to deteriorate from here.

Box's price-to-sales ratio based on the next 12 months is 3.7x, suggesting that the market does have lower expectations of the business, relative to the high growth tech stocks. While we have no doubt one can find things to like about the company, we think there might be better opportunities in the market and at the moment don't see many reasons to get involved.

Wall Street analysts covering the company had a one-year price target of $29.88 per share right before these results (compared to the current share price of $28.60).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.