Nutrition products company Bellring Brands (NYSE:BRBR) reported results ahead of analysts' expectations in Q2 CY2024, with revenue up 15.6% year on year to $515.4 million. The company expects the full year's revenue to be around $1.98 billion, in line with analysts' estimates. It made a non-GAAP profit of $0.54 per share, improving from its profit of $0.34 per share in the same quarter last year.

Is now the time to buy BellRing Brands? Find out by accessing our full research report, it's free.

BellRing Brands (BRBR) Q2 CY2024 Highlights:

- Revenue: $515.4 million vs analyst estimates of $505.1 million (2% beat)

- Adjusted EBITDA: $119.5 million vs analyst estimates of $102.5 million (2% beat)

- EPS (non-GAAP): $0.54 vs analyst estimates of $0.44 (23.8% beat)

- The company lifted its revenue guidance for the full year from $1.96 billion to $1.98 billion at the midpoint, a 1% increase (slightly above expectations)

- The company lifted its adjusted EBITDA guidance for the full year from $410 million to $435 million at the midpoint, a 6% increase (above expectations)

- Gross Margin (GAAP): 36.8%, up from 30.5% in the same quarter last year

- Adjusted EBITDA Margin: 23.2%, up from 19.5% in the same quarter last year

- Organic Revenue rose 15.6% year on year (20.3% in the same quarter last year)

- Sales Volumes rose 18.4% year on year (9.3% in the same quarter last year)

- Market Capitalization: $6.48 billion

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Sales Growth

BellRing Brands carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, BellRing Brands can still achieve high growth rates because its revenue base is not yet monstrous.

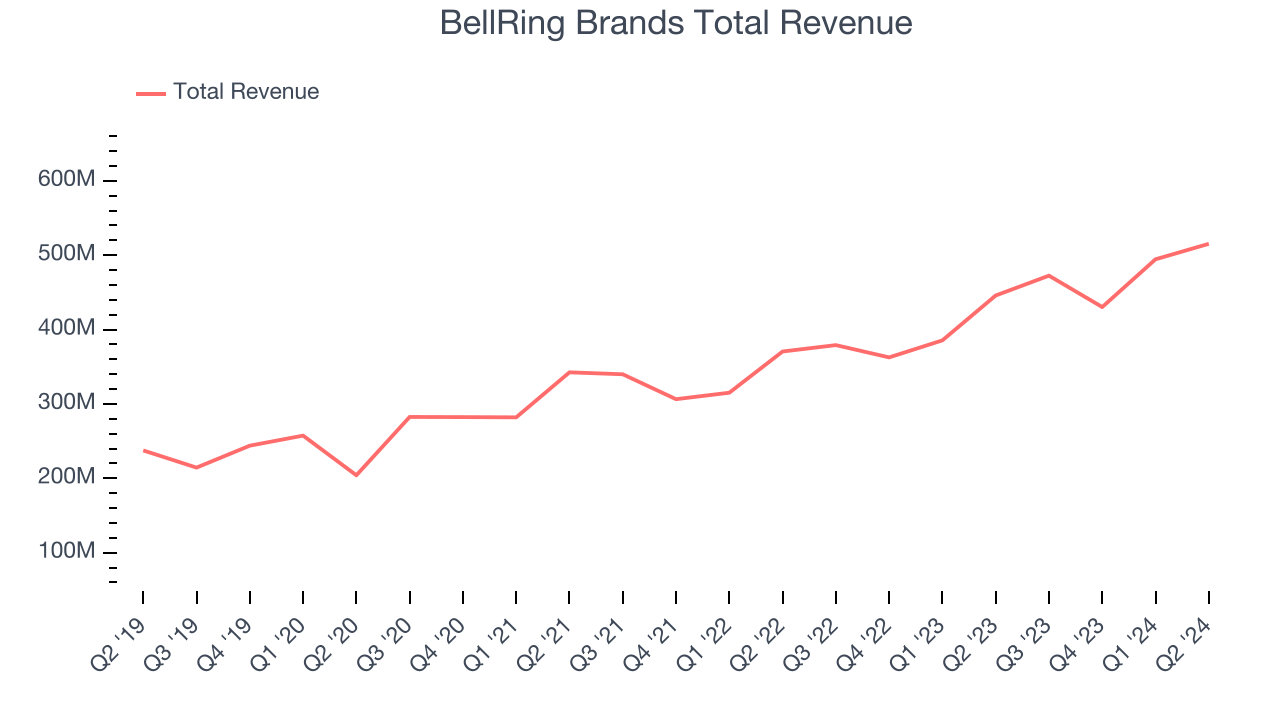

As you can see below, the company's annualized revenue growth rate of 17.2% over the last three years was impressive as consumers bought more of its products.

This quarter, BellRing Brands reported robust year-on-year revenue growth of 15.6%, and its $515.4 million in revenue exceeded Wall Street's estimates by 2%. Looking ahead, Wall Street expects sales to grow 11.3% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

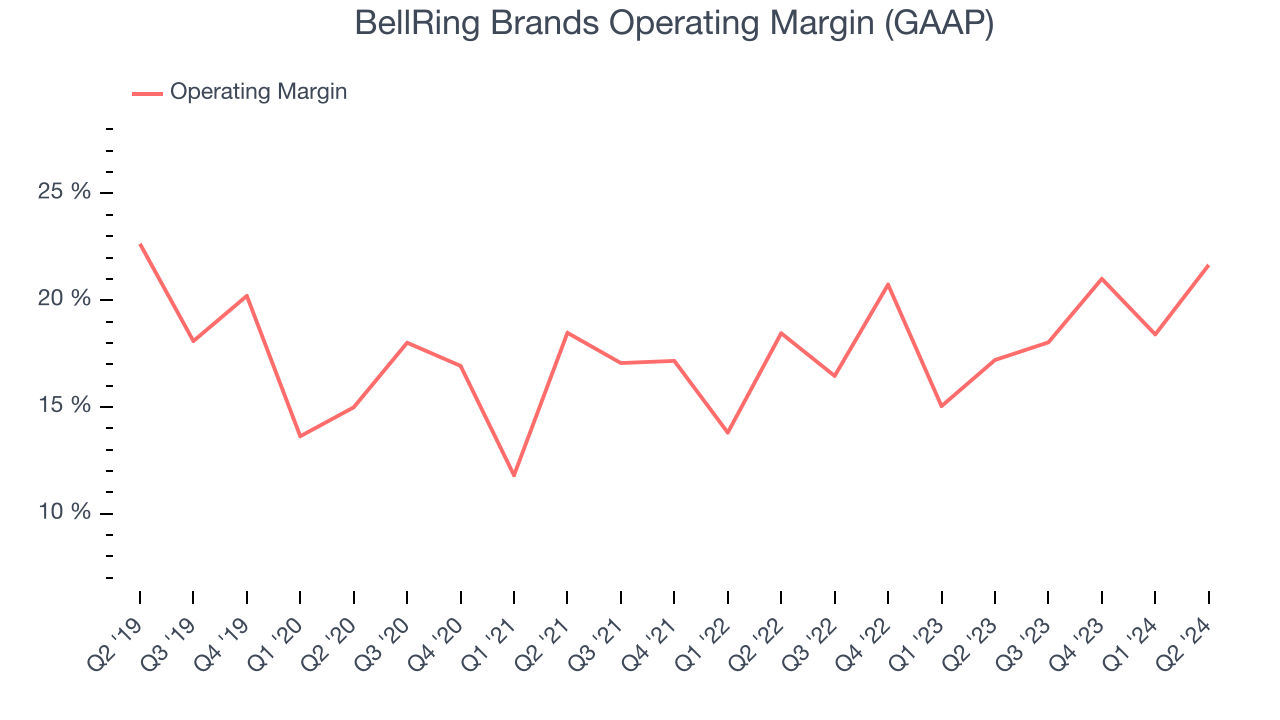

BellRing Brands has been an optimally-run company over the last two years. It was one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.7%.

Analyzing the trend in its profitability, BellRing Brands's annual operating margin rose by 2.5 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q2, BellRing Brands generated an operating profit margin of 21.7%, up 4.5 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Key Takeaways from BellRing Brands's Q2 Results

We were impressed by how significantly BellRing Brands blew past analysts' gross margin expectations this quarter. We were also excited its organic revenue growth outperformed Wall Street's estimates. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock traded up 4.9% to $51.78 immediately after reporting.

BellRing Brands may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.