Nutrition products company Bellring Brands (NYSE:BRBR) reported Q1 CY2024 results topping analysts' expectations, with revenue up 28.3% year on year to $494.6 million. The company's full-year revenue guidance of $1.96 billion at the midpoint also came in 1.9% above analysts' estimates. It made a non-GAAP profit of $0.45 per share, improving from its profit of $0.24 per share in the same quarter last year.

BellRing Brands (BRBR) Q1 CY2024 Highlights:

- Revenue: $494.6 million vs analyst estimates of $466.9 million (5.9% beat)

- EPS (non-GAAP): $0.45 vs analyst estimates of $0.33 (34.5% beat)

- The company lifted its revenue guidance for the full year from $1.91 billion to $1.96 billion at the midpoint, a 2.6% increase

- It also raised its full-year EBITDA guidance from $387.5 million to $410 million at the midpoint, a 5.8% increase

- Gross Margin (GAAP): 33.2%, up from 30.4% in the same quarter last year

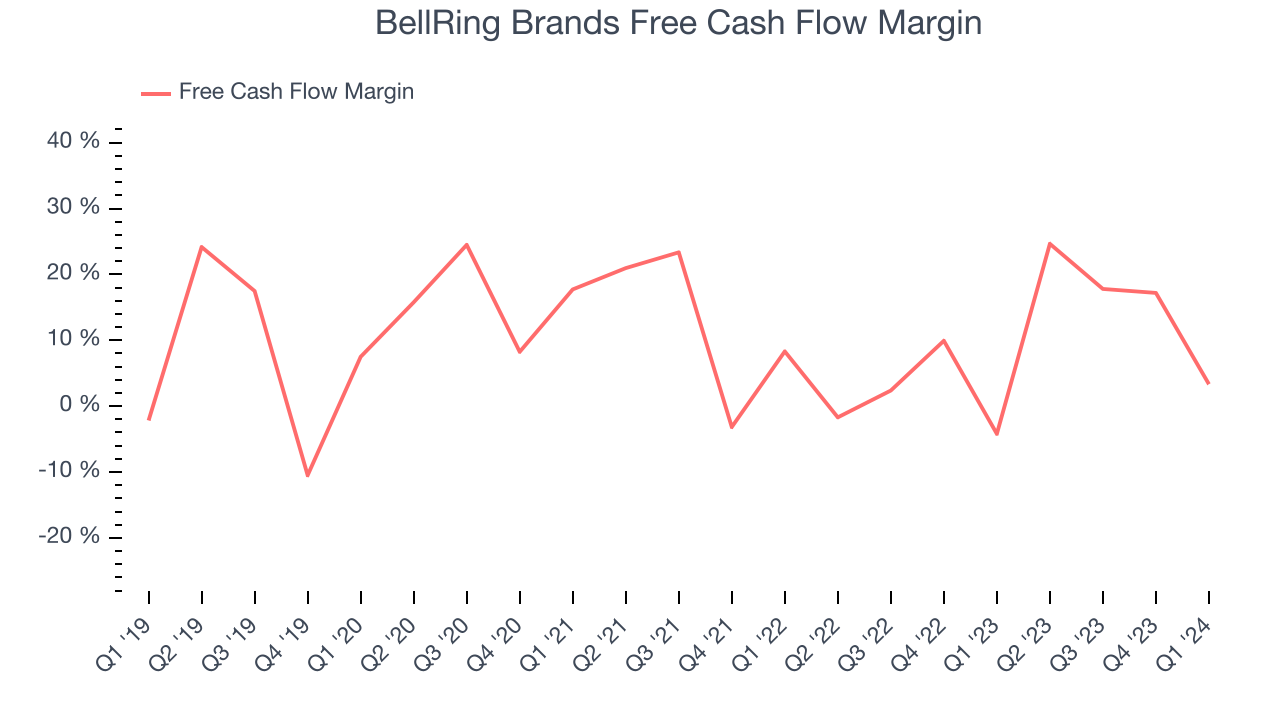

- Free Cash Flow of $16.5 million, down 77.7% from the previous quarter

- Organic Revenue was up 28.3% year on year

- Sales Volumes were up 42.7% year on year

- Market Capitalization: $7.52 billion

Spun out of Post Holdings in 2019, Bellring Brands (NYSE:BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

These products emphasize protein and low-carb or low-sugar content for weight loss and weight management. The Bellring Brands core customer is therefore a health-conscious individual who prioritizes nutritious eating or someone who wants to become that health-conscious person. Some customer archetypes include fitness enthusiasts or people on low-carb or keto diets looking to lose weight.

Bellring Brands’s products are available in general retailers such as grocery stores and club warehouse stores as well as in specialty retailers that cater to fitness and nutrition enthusiasts. Additionally, gyms and fitness centers sometimes carry the company’s products. Lastly, each of the company’s brands has a dedicated website where consumers can browse products, access exclusive deals, and access information on health and fitness.

Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors offering health and wellness supplements and products include The Simply Good Foods Company (NASDAQ:SMPL), Herbalife (NYSE:HLF), and Usana Health Sciences (NYSE:USNA) .Sales Growth

BellRing Brands carries some recognizable brands and products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, BellRing Brands can still achieve high growth rates because its revenue base is not yet monstrous.

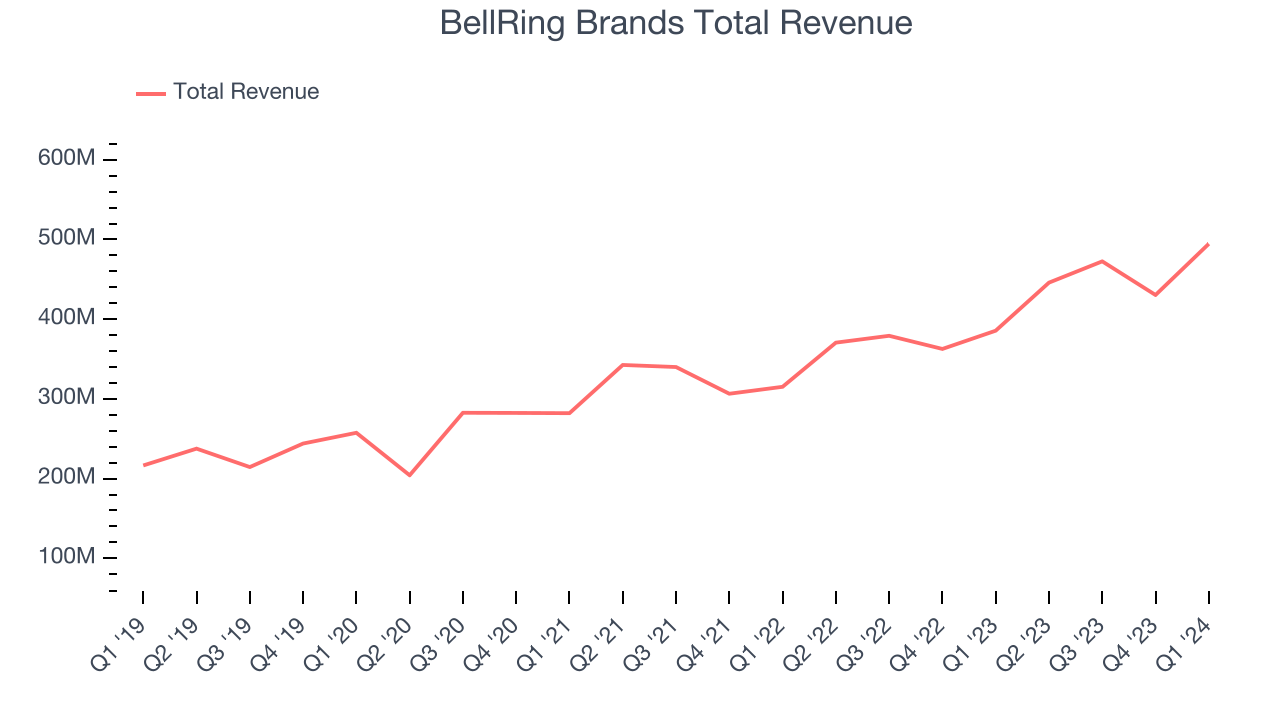

As you can see below, the company's annualized revenue growth rate of 20.6% over the last three years was impressive as consumers bought more of its products.

This quarter, BellRing Brands reported remarkable year-on-year revenue growth of 28.3%, and its $494.6 million in revenue topped Wall Street estimates by 5.9%. Looking ahead, Wall Street expects sales to grow 9.3% over the next 12 months, a deceleration from this quarter.

Gross Margin & Pricing Power

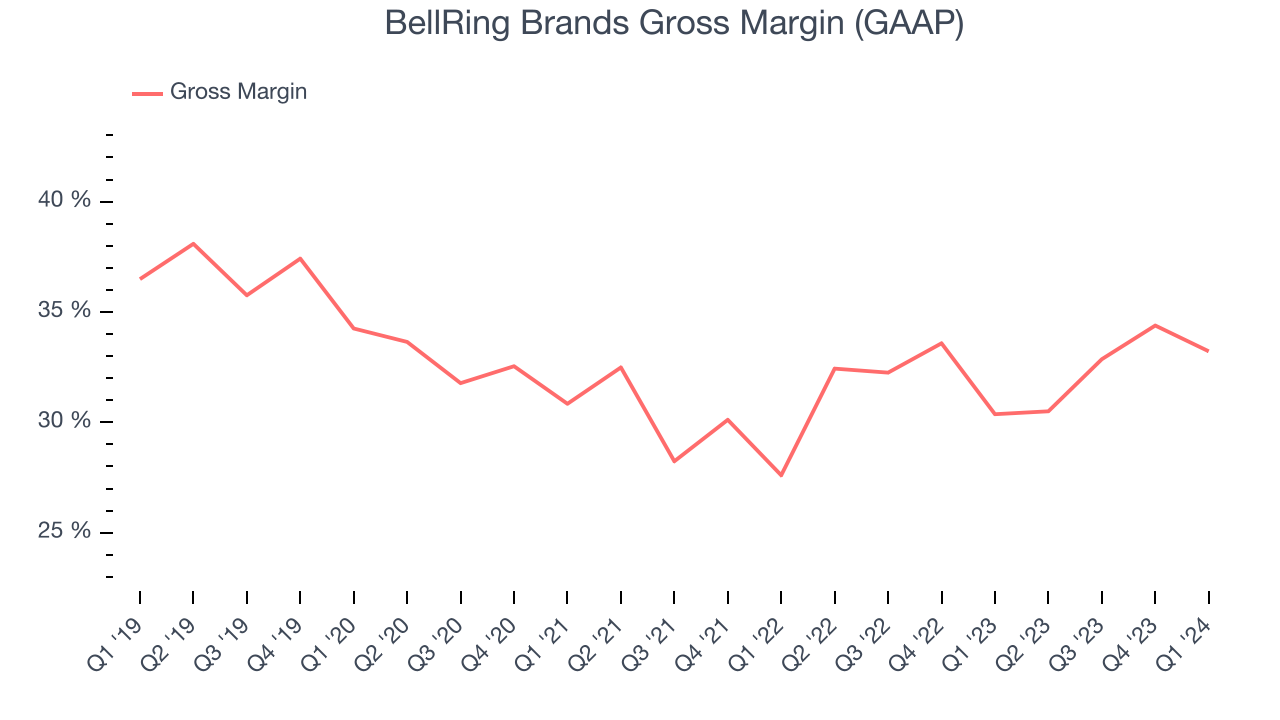

This quarter, BellRing Brands's gross profit margin was 33.2%, up 2.9 percentage points year on year. That means for every $1 in revenue, $0.67 went towards paying for raw materials, production of goods, and distribution expenses.

BellRing Brands's unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see above, it's averaged a decent 32.5% gross margin over the last eight quarters. Its margin has also been trending up over the last 12 months, averaging 1.9% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

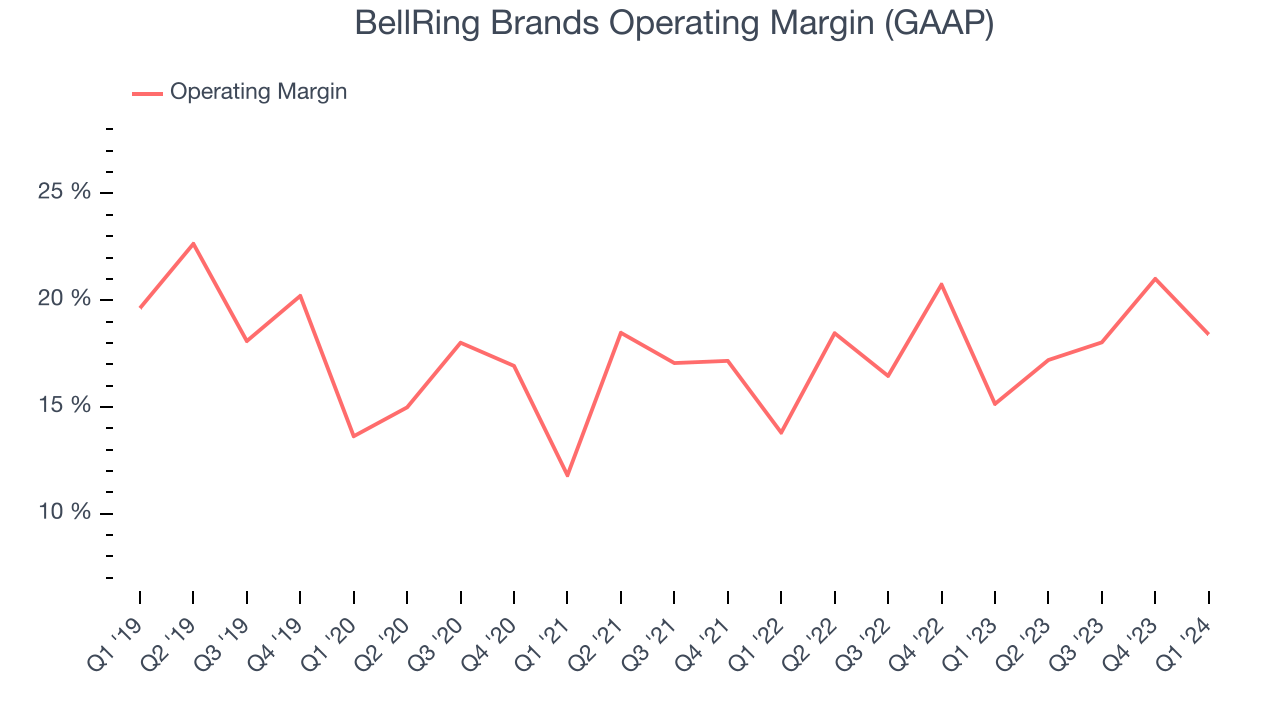

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

This quarter, BellRing Brands generated an operating profit margin of 18.4%, up 3.3 percentage points year on year. This increase was encouraging, and we can infer BellRing Brands was more efficient with its expenses because its operating margin expanded more than its gross margin.

Zooming out, BellRing Brands has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.2%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, BellRing Brands has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer staples sector, boasting an average operating margin of 18.2%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

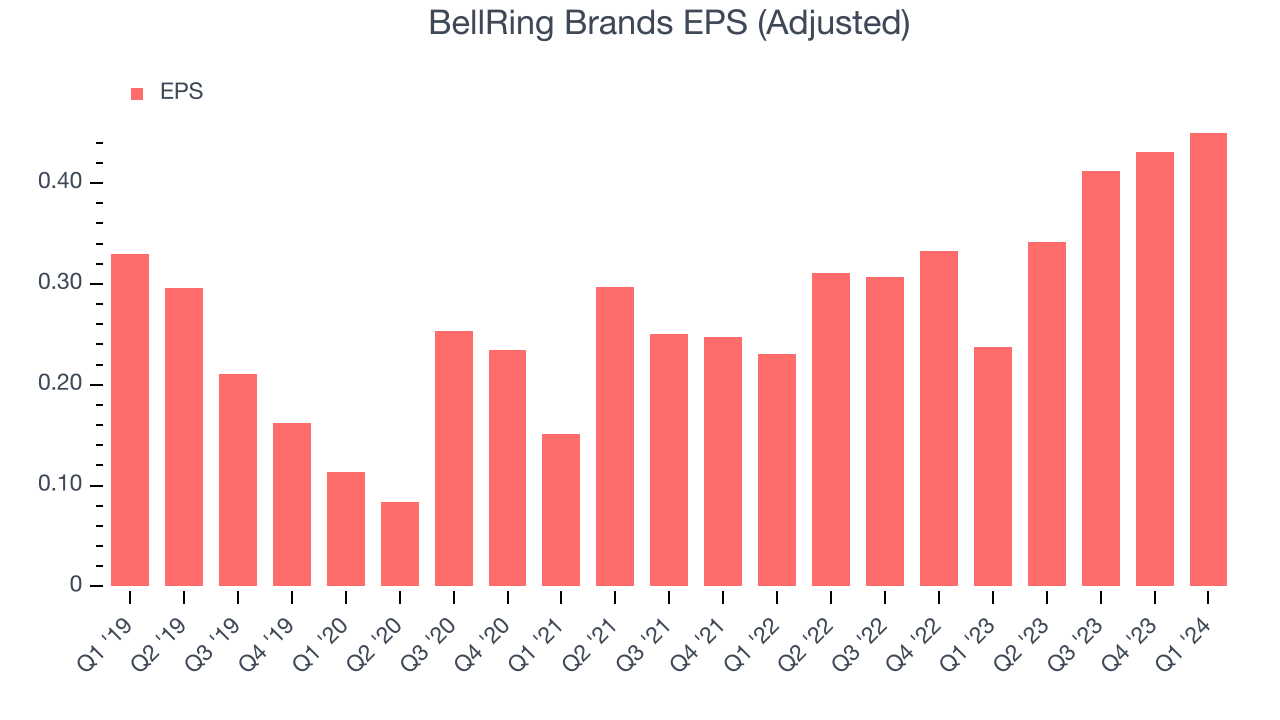

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, BellRing Brands reported EPS at $0.45, up from $0.24 in the same quarter a year ago. This print beat Wall Street's estimates by 34.5%.

Between FY2021 and FY2024, BellRing Brands's EPS grew 126%, translating into an astounding 31.2% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period, showing that BellRing Brands has excelled in managing its expenses.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 7.8% year-on-year increase in EPS.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

BellRing Brands's free cash flow came in at $16.5 million in Q1, representing a 3.3% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

Over the last eight quarters, BellRing Brands has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 9.2%, above the broader consumer staples sector. Furthermore, its margin has averaged year-on-year increases of 13.9 percentage points over the last 12 months. Shareholders should be excited as this will certainly help BellRing Brands achieve its long-term strategic goals.

Return on Invested Capital (ROIC)

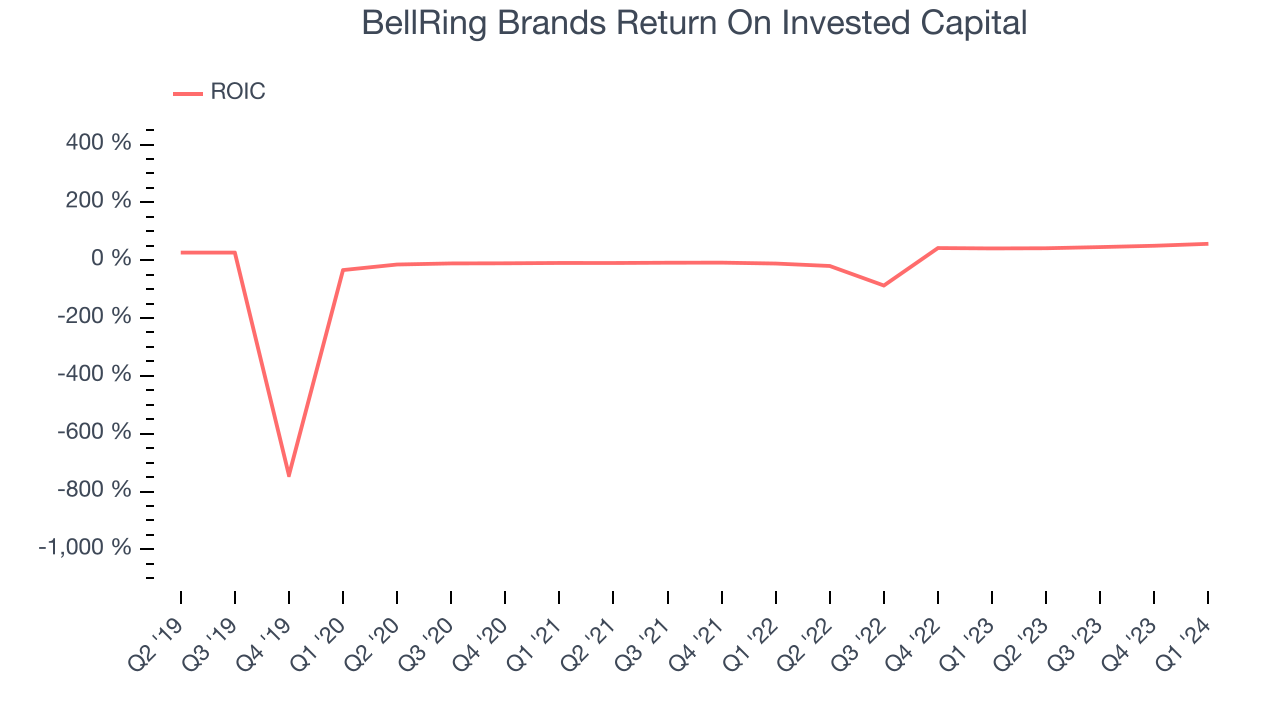

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although BellRing Brands has shown solid business quality lately, it historically did a subpar job investing in profitable business initiatives. Its five-year average ROIC was 8.5%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last few years, BellRing Brands's ROIC has significantly increased. The company's rising ROIC is a good sign and could suggest its competitive advantage or profitable business opportunities are expanding.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

BellRing Brands reported $79.3 million of cash and $832.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $389.6 million of EBITDA over the last 12 months, we view BellRing Brands's 1.9x net-debt-to-EBITDA ratio as safe. We also see its $33.8 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from BellRing Brands's Q1 Results

We were impressed by how significantly BellRing Brands blew past analysts' organic revenue growth and EPS expectations this quarter, driven by a whopping 42.7% increase in its sales volumes - that type of growth is unheard of in the stable consumer staples sector and was led by Premier Protein's outperformance. We were also excited it achieved this growth while expanding its gross margin, which rose 2.9 percentage points year on year to 33.2%.

Because of the strong momentum, the company raised its full-year revenue and EBITDA guidance, topping Wall Street's projections. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 8.6% after reporting and currently trades at $62.1 per share.

Is Now The Time?

BellRing Brands may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think BellRing Brands is a good business. First off, its revenue growth has been impressive over the last three years. And while its brand caters to a niche market, its volume growth has been in a league of its own. On top of that, its EPS growth over the last three years has been fantastic.

BellRing Brands's price-to-earnings ratio based on the next 12 months is 32.5x. There are definitely things to like about BellRing Brands and there's no doubt it's a bit of a market darling, at least for some investors. But when considering the company against the backdrop of the consumer staples landscape, it seems there's a lot of optimism already priced in. We wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $61.80 per share right before these results (compared to the current share price of $62.10).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.