Beer powerhouse Anheuser-Busch InBev (NYSE:BUD) reported results ahead of analysts' expectations in Q1 CY2024, with revenue up 2.3% year on year to $14.55 billion. It made a GAAP profit of $0.54 per share, down from its profit of $0.81 per share in the same quarter last year.

Anheuser-Busch (BUD) Q1 CY2024 Highlights:

- Revenue: $14.55 billion vs analyst estimates of $14.37 billion (1.3% beat)

- Adjusted EBITDA: $4.99 billion vs analyst estimates of $4.80 billion (4.1% beat)

- EPS: $0.54 vs analyst estimates of $0.47 (14.9% beat)

- Gross Margin (GAAP): 54.3%, in line with the same quarter last year

- Organic Revenue was up 2.6% year on year

- Sales Volumes were down 0.6% year on year

- Market Capitalization: $112.1 billion

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch InBev, or ABI as it’s often called, was formed in 2008 when InBev–a Belgian company–acquired Anheuser-Busch for $52 billion. The new company, which at the time was the largest brewer in the world, then bought Grupo Modelo in 2013 and SABMiller in 2016 to strengthen its Latin American and African presences, respectively.

Today, ABI is globally known because of its three largest brands mentioned before, but they also own regional favorites like Brahma in Brazil, Spaten in Germany, and Castle Lager in South Africa. To respond to evolving consumer tastes, the company has also gotten into the craft and specialty market with brands like Goose Island and Four Peaks Brewing Co.

The company's core customer is broad and is generally anyone who enjoys beer. Whether it's a football game or just winding down after work, ABI has a beer to fit the moment. Its products are widely available in grocery stores, liquor shops, pubs, bars, and restaurants around the world. An extensive distribution network ensures that whether you're on a beach in Brazil or a pub in the UK, you're likely to find at least one of their brands on tap or on the shelf.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the beer industry include Heineken (ENXTAM:HEIA), Constellation Brands (NYSE:STZ), Carlsberg (CPSE:CARL B), and numerous regional brewers globally.Sales Growth

Anheuser-Busch is one of the most widely recognized consumer staples companies in the world. Its influence over consumers gives it extremely high negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don't have).

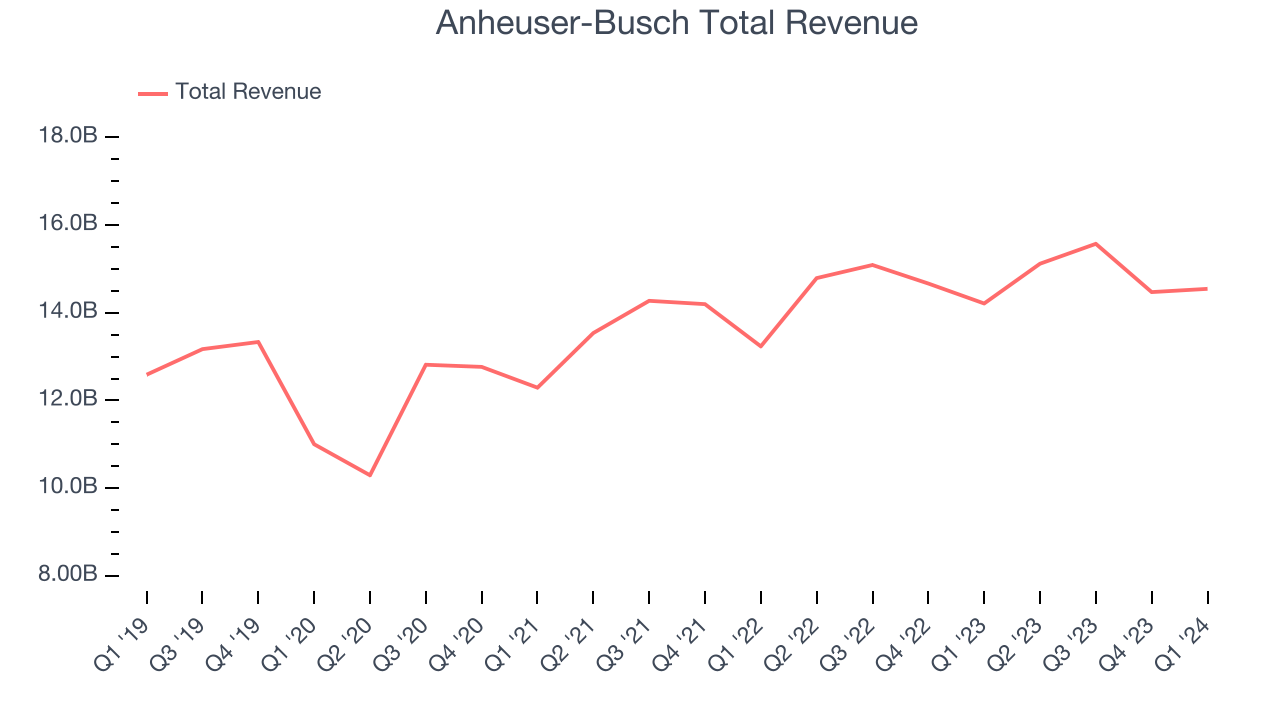

As you can see below, the company's annualized revenue growth rate of 7.4% over the last three years was decent despite selling a similar number of units each year. We'll explore what this means in the "Volume Growth" section.

This quarter, Anheuser-Busch reported decent year-on-year revenue growth of 2.3%, and its $14.55 billion in revenue topped Wall Street's estimates by 1.3%.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

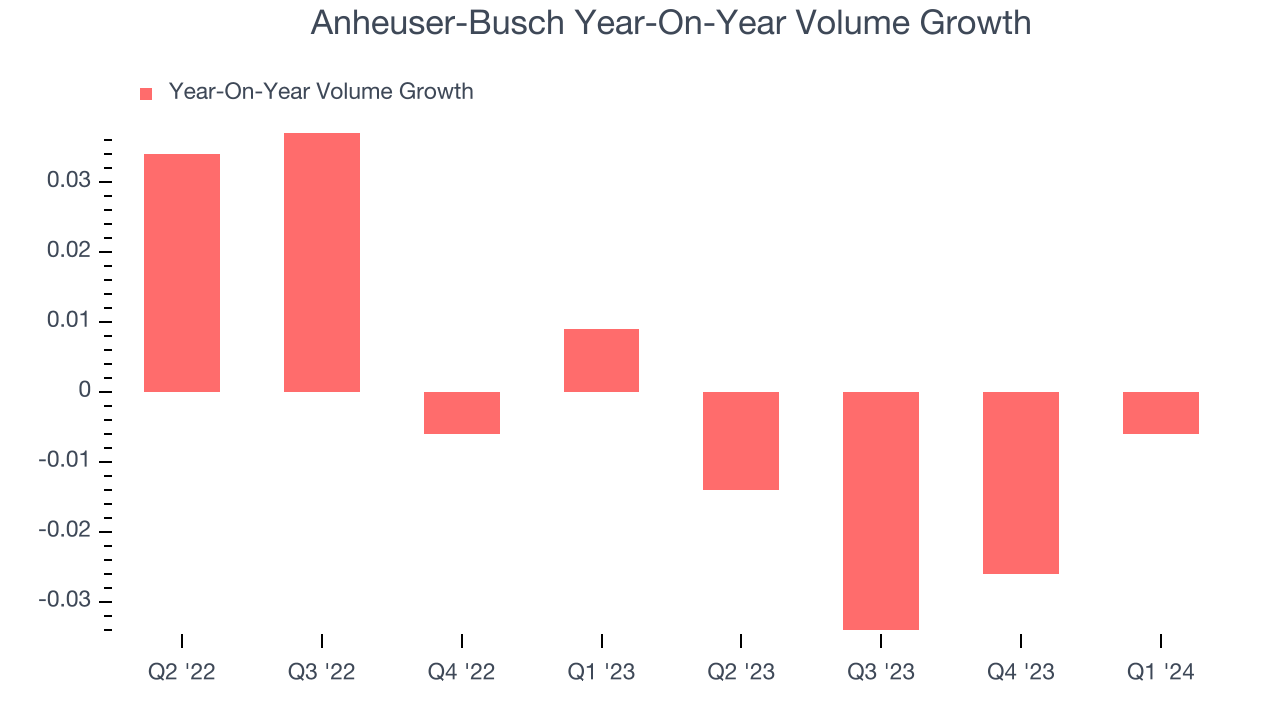

To analyze whether Anheuser-Busch generated its growth from changes in price or volume, we can compare its volume growth to its organic revenue growth, which excludes non-fundamental impacts on company financials like mergers and currency fluctuations.

Over the last two years, Anheuser-Busch's quarterly sales volumes have, on average, stayed about the same. This stability is normal as the quantity demanded for consumer staples products typically doesn't see much volatility. The company's flat volumes also indicate its average organic revenue growth of 8.5% was generated from price increases.

In Anheuser-Busch's Q1 2024, year on year sales volumes were flat. This result was more or less in line with the same quarter last year.

Gross Margin & Pricing Power

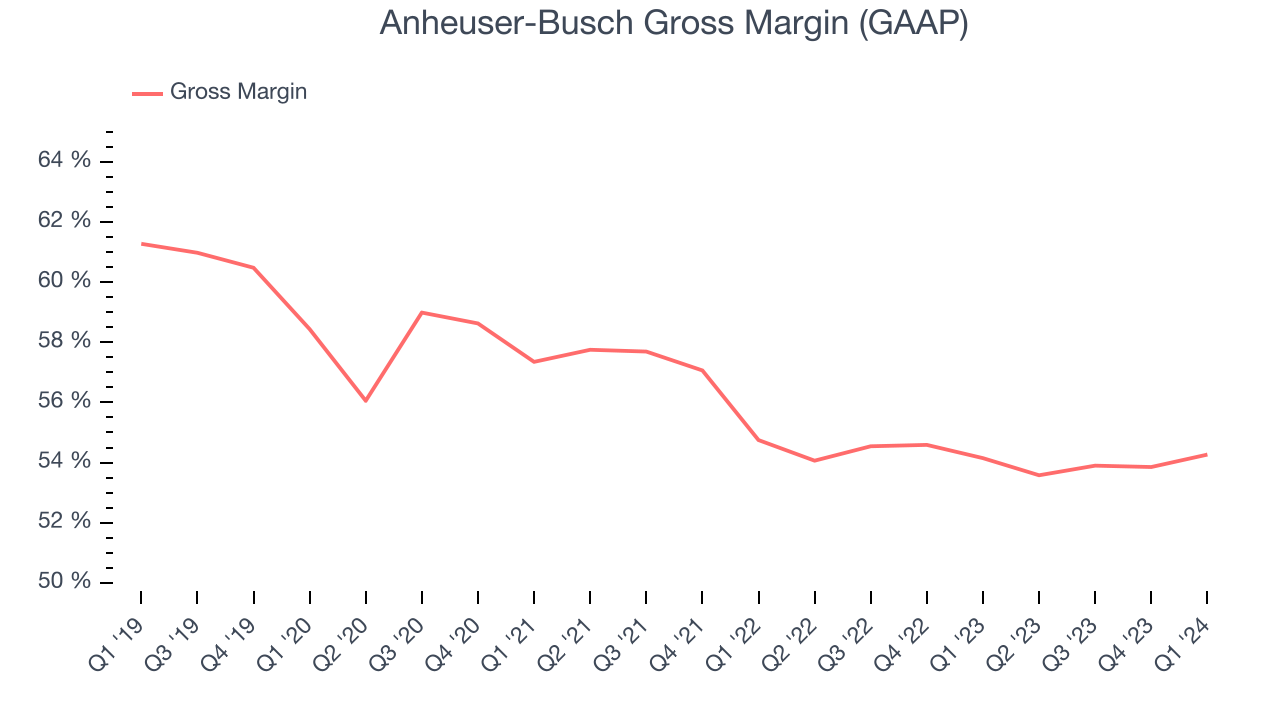

All else equal, we prefer higher gross margins. They usually indicate that a company sells more differentiated products and commands stronger pricing power.

Anheuser-Busch's gross profit margin came in at 54.3% this quarter, in line with the same quarter last year. That means for every $1 in revenue, $0.46 went towards paying for raw materials, production of goods, and distribution expenses.

Anheuser-Busch has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to stay one step ahead of the competition. As you can see above, it's averaged an exceptional 54.1% gross margin over the last two years. Its margin has also been consistent over the last year, suggesting it has stable input costs (such as raw materials).

Operating Margin

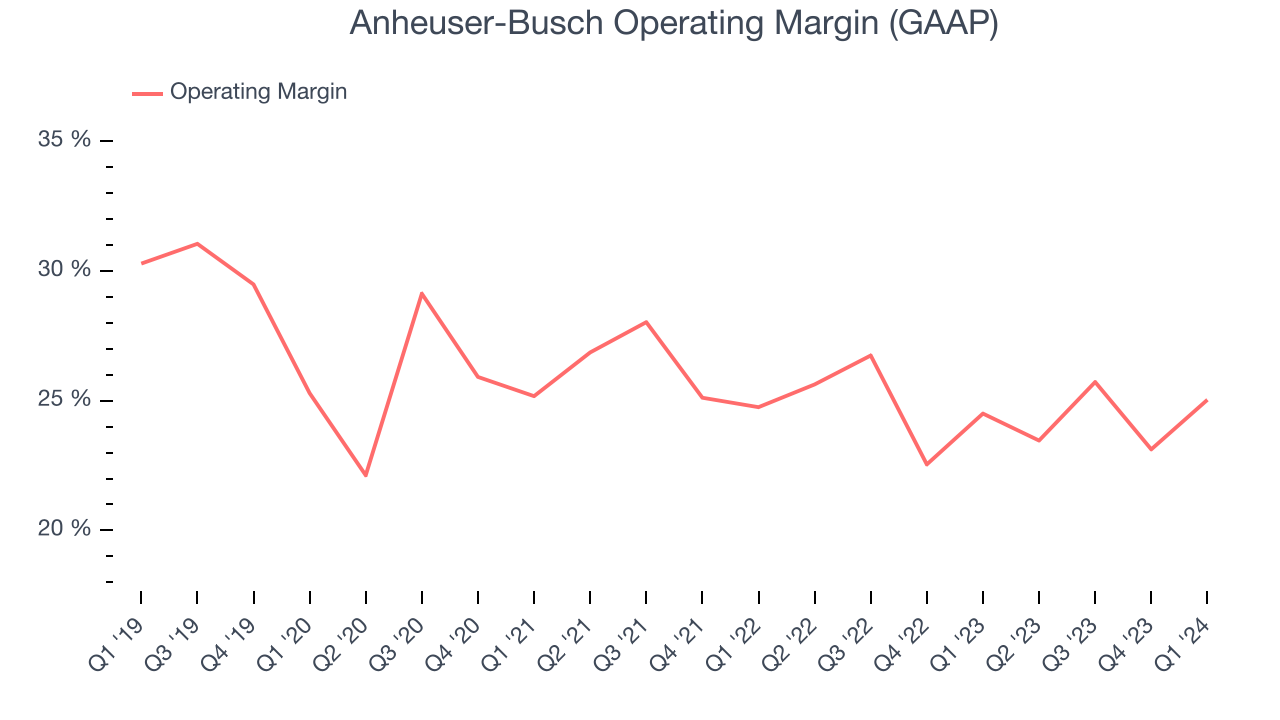

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

In Q1, Anheuser-Busch generated an operating profit margin of 25%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Anheuser-Busch has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 24.6%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business.

Zooming out, Anheuser-Busch has been a well-oiled machine over the last two years. It's demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 24.6%. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. EPS

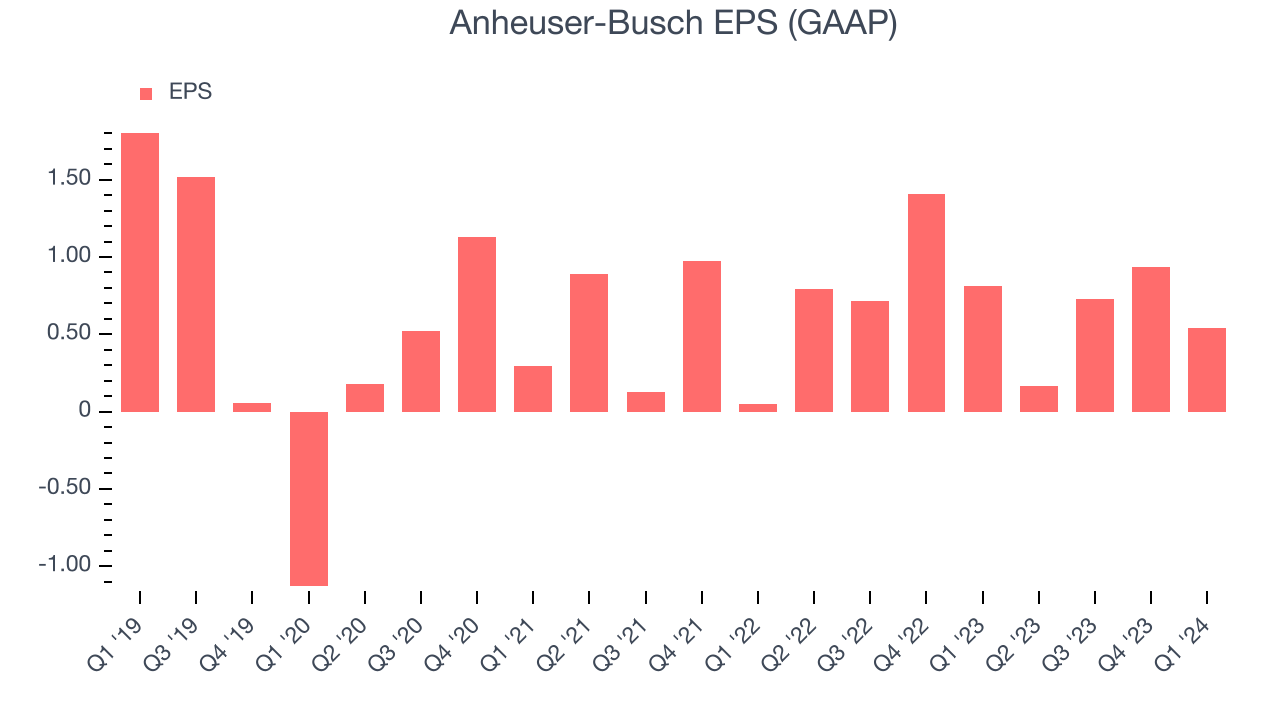

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Anheuser-Busch reported EPS at $0.54, down from $0.81 in the same quarter a year ago. This print beat Wall Street's estimates by 14.9%.

Between FY2021 and FY2024, Anheuser-Busch's EPS grew 11.8%, translating into an unimpressive 3.8% compounded annual growth rate.

Key Takeaways from Anheuser-Busch's Q1 Results

It was good to see Anheuser-Busch beat analysts' adjusted EBITDA and EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 4.7% after reporting and currently trades at $63.42 per share.

Is Now The Time?

Anheuser-Busch may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Anheuser-Busch is a good business. First off, its revenue growth has been decent over the last three years. On top of that, its scale gives it immense negotiating leverage with retailers, and its impressive operating margins show it has a highly efficient business model.

Anheuser-Busch's price-to-earnings ratio based on the next 12 months is 17.4x. There are definitely a lot of things to like about Anheuser-Busch, and looking at the consumer staples landscape right now, it seems to be trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $71.86 per share right before these results (compared to the current share price of $63.42), implying they saw upside in buying Anheuser-Busch in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.